Insight Focus

- Both the No.11 and No.5 sugar futures have weakened over the past week.

- Producers consumers have closed positions ahead of July’s futures expiry.

- Speculators have increased their net long.

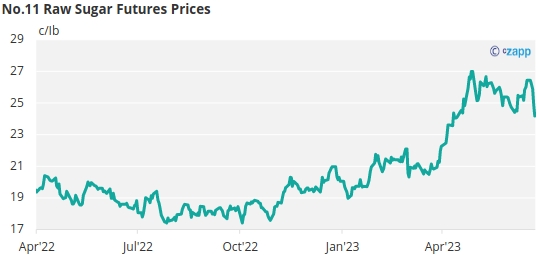

New York No.11 Raw Sugar Futures

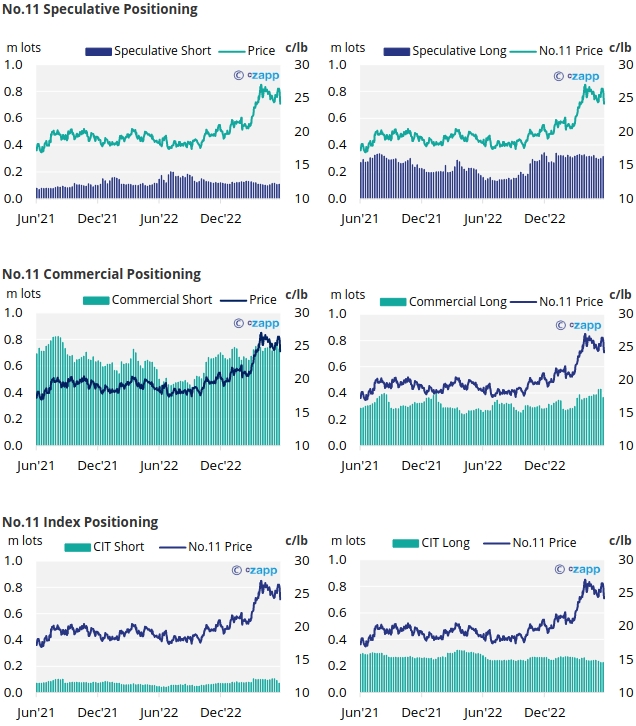

The No.11 sugar futures weakened over the past week, going from 26.4c/Ib at the start of the week to 24.1c/Ib by Friday’s close.

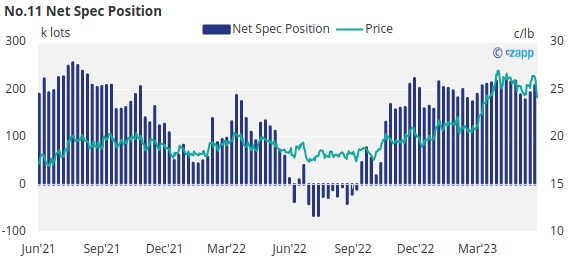

Raw sugar speculators have opened over 16k lots of long and 1.5k lots of short positions after weeks of little activity. As a result, the net spec position has grown by 14.7k lots to 208k lots.

On the commercial side, both producers and consumers of raw sugar have closed a large number of positions. By the 20th of June (latest CoT CFTC report) a couple days before the Jul’23 expiry, the commercial open interest fell by over 35k with long positions making up the majority.

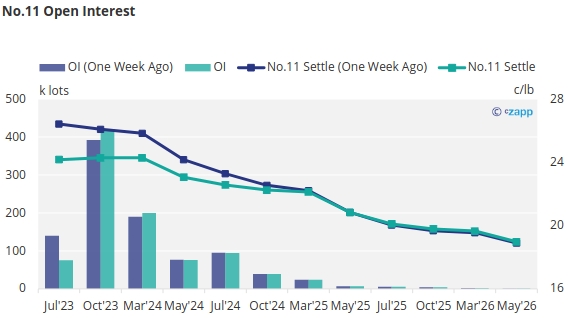

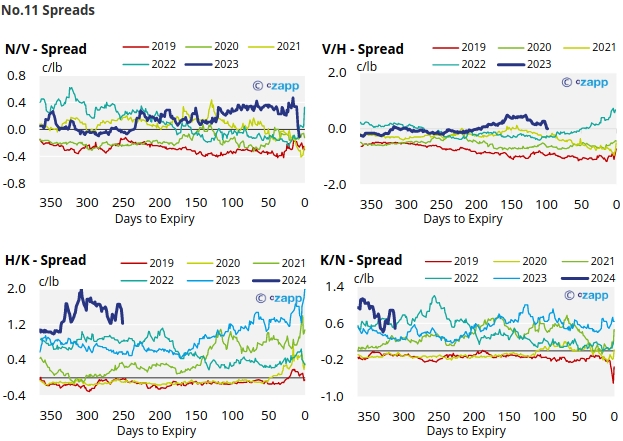

The No.11 forward curve is flat to Mar’24 before becoming backwardated from Mar’24 to May’26.

London No.5 Refined Sugar Futures

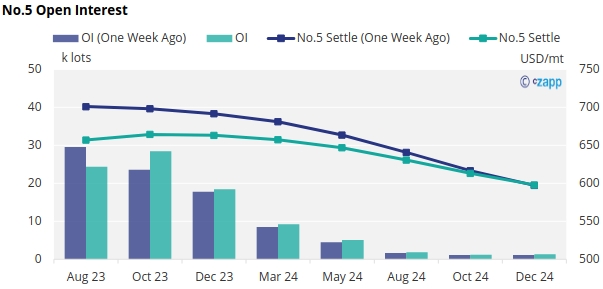

The No.5 refined sugar price has weakened over the last week, falling from 701.2 USD/mt at the start of the week to 657.3 USD/mt by Friday’s close. This represents a 44 USD/mt drop in the last week.

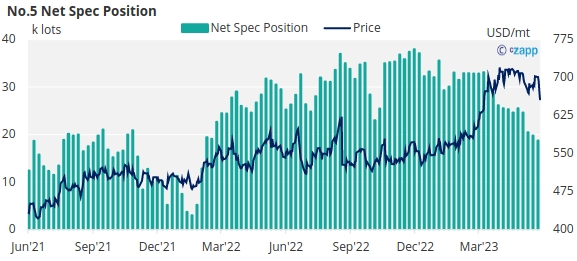

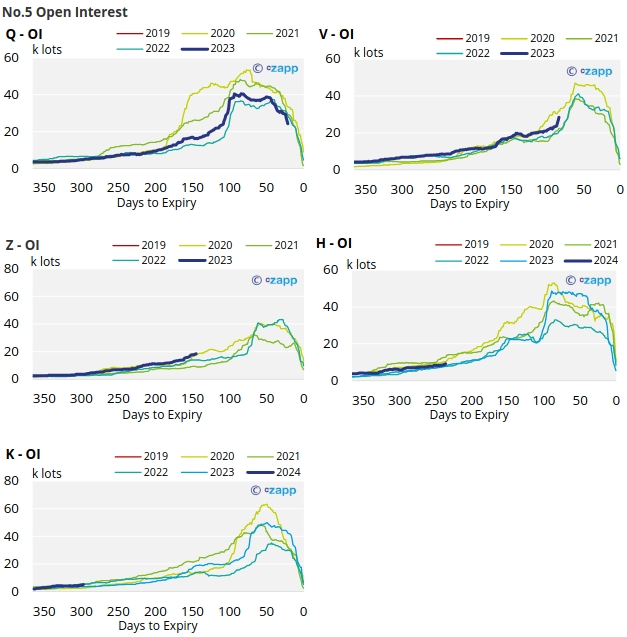

By the 20th of June (latest CoT report), refined sugar speculators continue to reduce their long position, closing over 1k lots. This is the lowest number of positions held since the start of 2022.

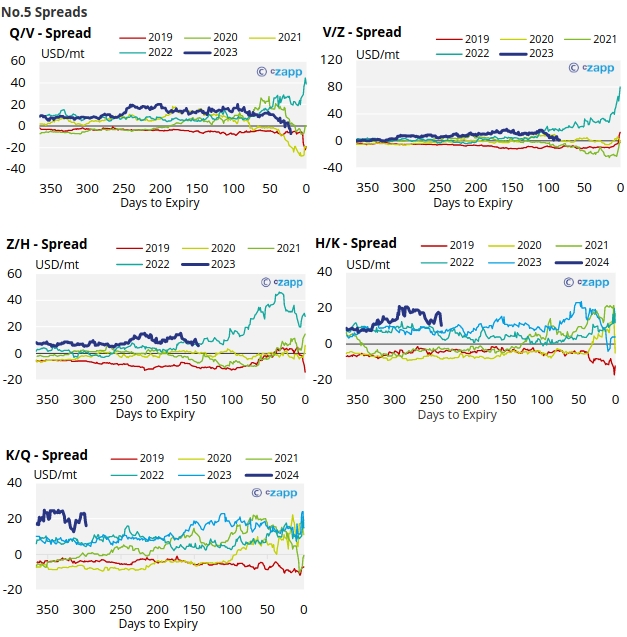

With contracts strengthening slightly across the board, the No.5 forward curve remains inverted through to December 2024.

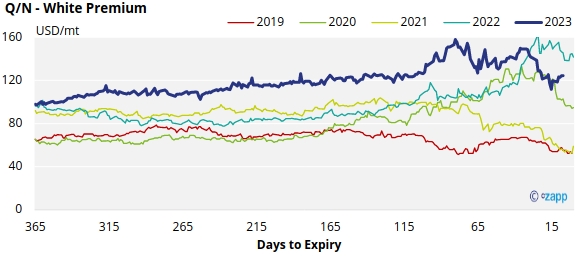

White Premium (Arbitrage)

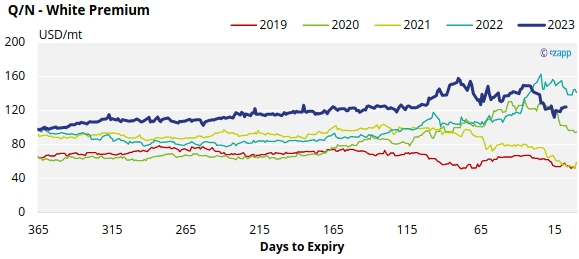

The Q/N sugar white premium has increased slightly reaching 124.2 USD/mt by Friday.

Many re-exports refiners need around 110-120USD/mt above No.11 to produce refined sugar, so the current white premium is just enough to encourage this.

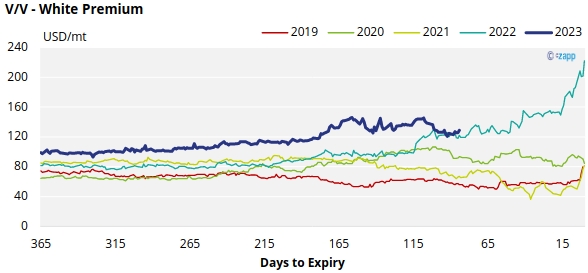

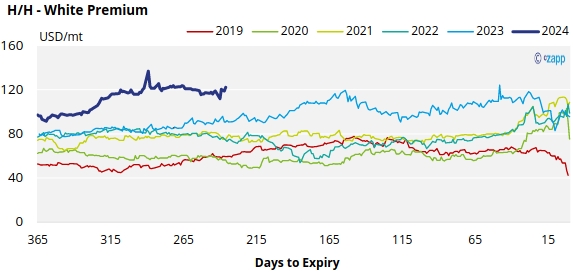

The refined sugar market is likely to be slightly undersupplied for the majority of 2023, and this is reflected in comparatively strong V/V and H/H white premiums, which has also weakened slightly over the past week and now approach 129USD/mt and 122USD/mt, respectively.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

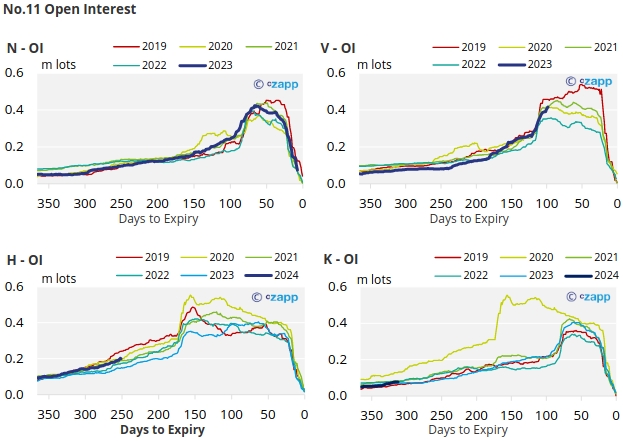

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

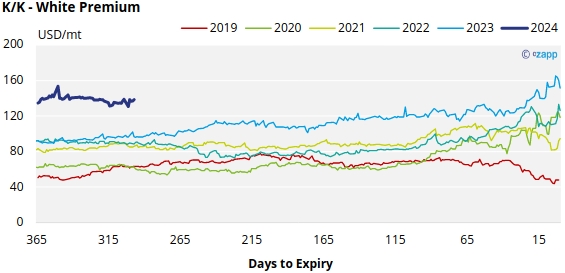

White Premium Appendix