Insight Focus

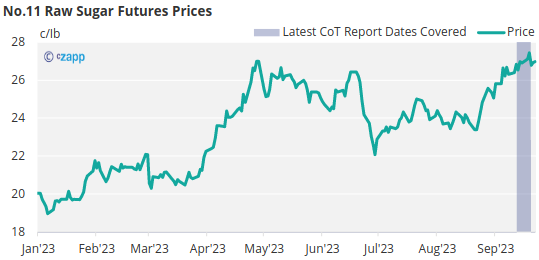

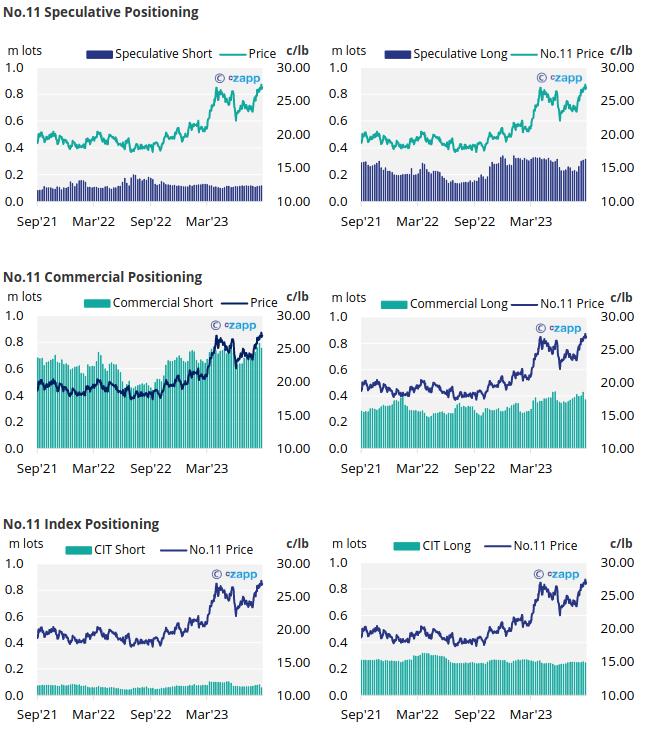

- The No.11 sugar futures have traded sideways for a second week in a row.

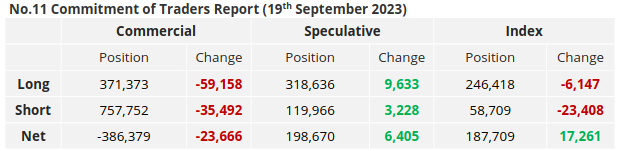

- Commercial participants have closed out a significant number of positions.

- The H/H white premium continues to stand at 125USD/mt.

New York No.11 Raw Sugar Futures

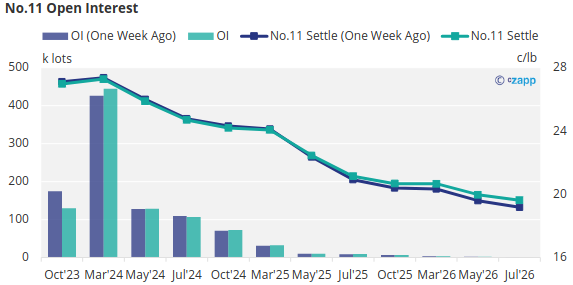

With only 5 trading days until the Oct’23 expiry, the No.11 raw sugar futures have been trading sideways around 27c/Ib.

Both producers and consumers have chosen to close out their positions ahead of the October expiry, trimming by 59k and 35.4k lots respectively.

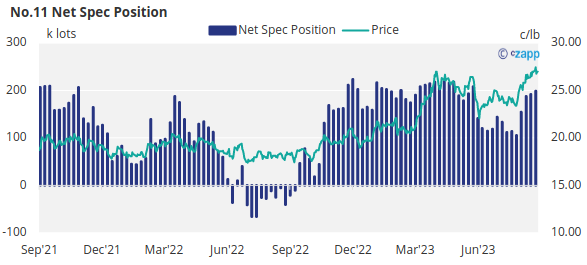

Looking over to the speculators, they have added 9.6k lots of long positions and 3.2k lots of short positions, bringing the overall net spec position to 198k lots.

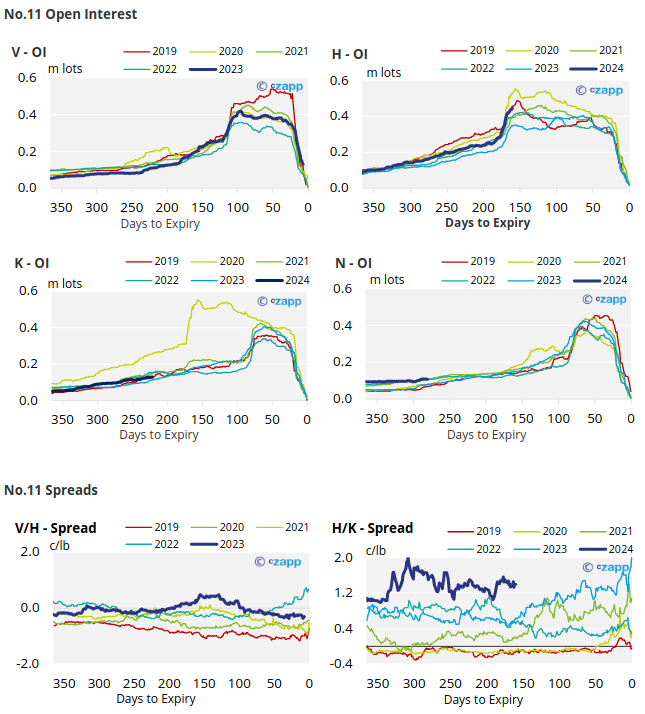

The No.11 forward curve remains inverted until Mar’26.

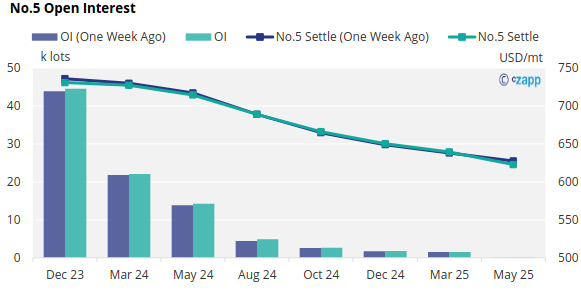

London No.5 Refined Sugar Futures

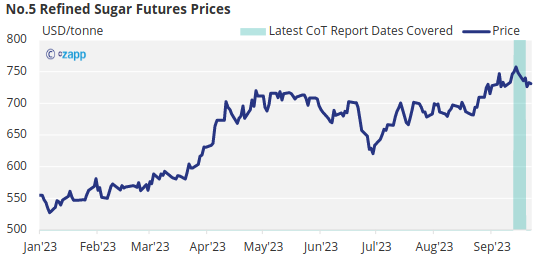

Following the expiry of the No.5 futures contract, refined sugar prices have weakened slightly, falling from a high of 744USD/mt at the start of the week to 730USD/mt by Friday’s close.

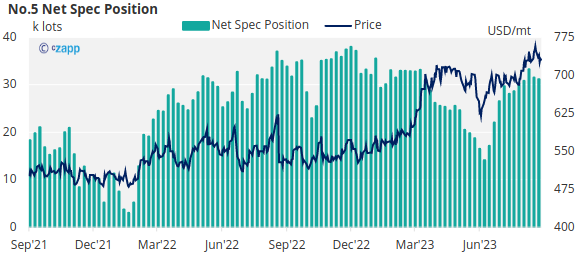

With the net spec position falling by 0.3k lots, the overall net spec position has decreased slightly to 31.2k lots.

The No.5 forward curve has become backwardated until May’25.

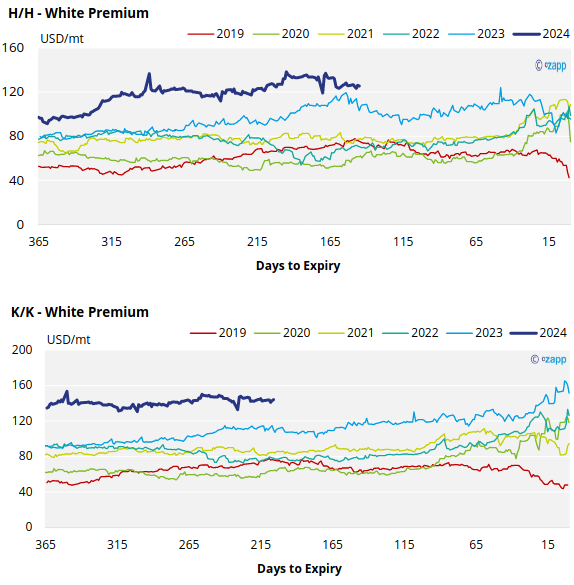

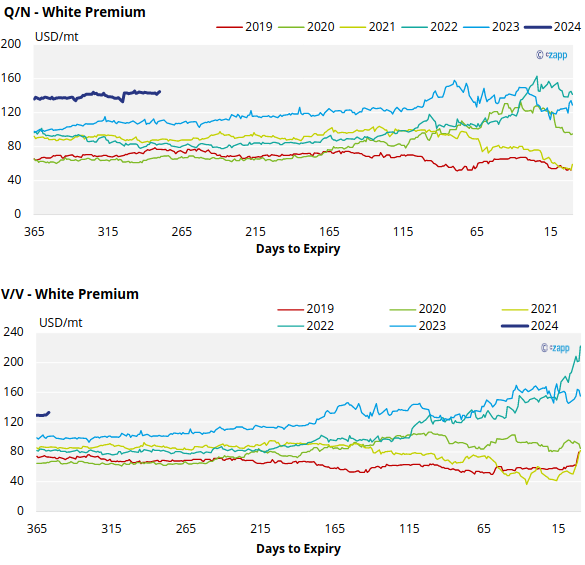

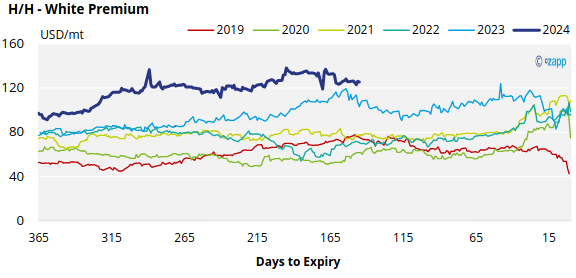

White Premium (Arbitrage)

Over the past few weeks, the H/H white premium has been trading sideways hovering around 125USD/mt.

The refined sugar market is expected to be slightly undersupplied for the remainder of 2023 and the majority of 2024, as evidenced by comparatively strong K/K and Q/N white premiums, both of which are currently standing at 144USD/mt.

We believe that many re-export refiners require at least 90-105USD/tonne over the No.11 to be profitable, which means that the spot white premium provides comfortably enough for these refiners to maximize their throughput.

At this level, higher-cost or discretionary refiners may begin to consider re-exporting in addition to serving their domestic markets.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

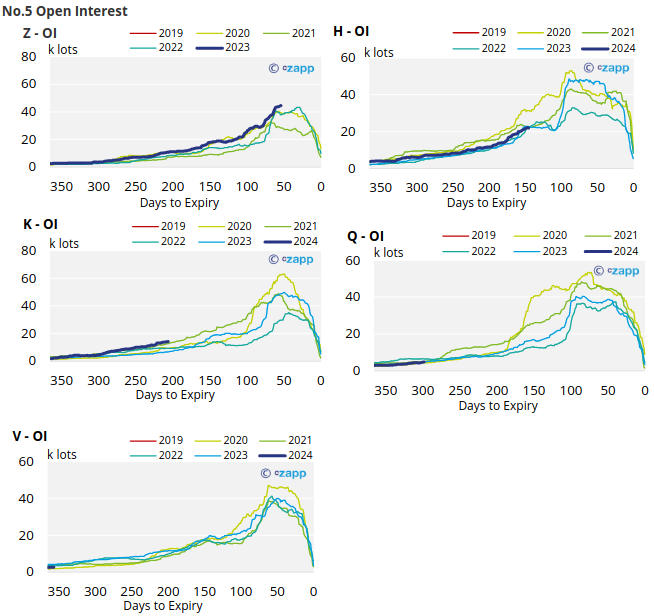

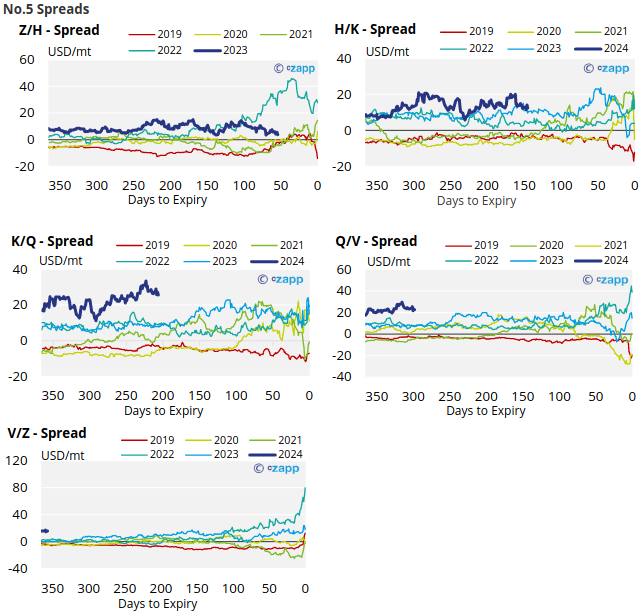

No.5 (White Sugar) Appendix

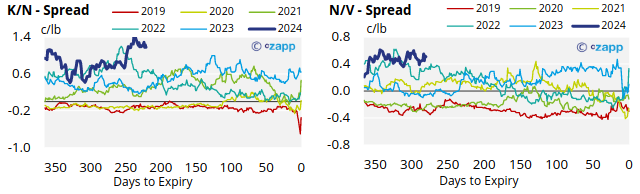

White Premium Appendix