Insight Focus

- As the Mar’23 expiry approaches, No.11 futures remain close yearlong highs.

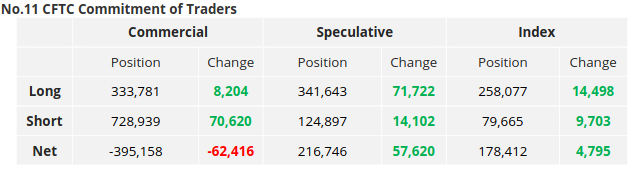

- The CFTC has begun to publish the missing reports, following disruption in early February.

- Refined sugar speculators add over 3k new long positions amid market strength.

New York No.11 (Raw Sugar)

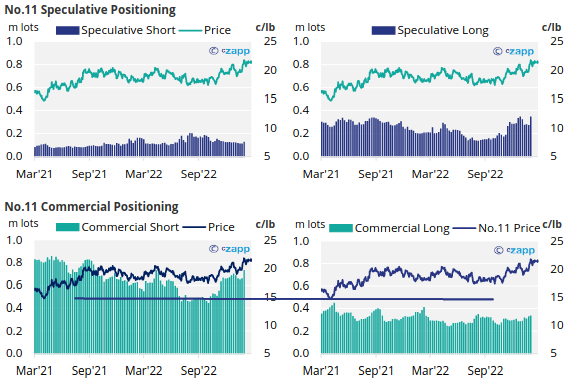

With the CFTC now able to resume publishing, we can now comment on their latest released data up to the 31st January 2023. More up to date data should become available in the coming weeks.

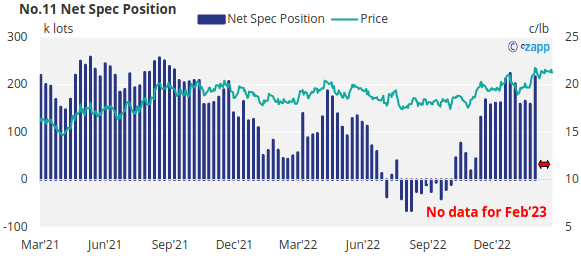

This said, by the 31st of January (latest CoT CFTC), speculators aggressively added over 70k lots of new long positions as the market strengthened.

As such, the net spec position reached close to its highest since 2021 at over 216k lots.

In the weeks since then, No.11 raw sugar futures prices have broadly remained above 21c/lb (closing last Friday at 21.5clb). This in mind, we think it’s likely that speculators will still be holding a large long position in raw sugar.

On the commercial side, as per the newly released delayed report up to the 31st of January, both raw sugar producers and consumers were able to add new hedges, 70k and 8k lots respectively.

Producers were likely capitalising on market strength whilst consumers were likely buying hand-to-mouth in advance of the March expiry.

With prices remaining strong into February, we expected to see more producer hedging and potentially more hand-to-mouth buying from consumers. We will be able to comment for sure once the CFTC is able to release the remaining delayed reports and bring us back up to date.

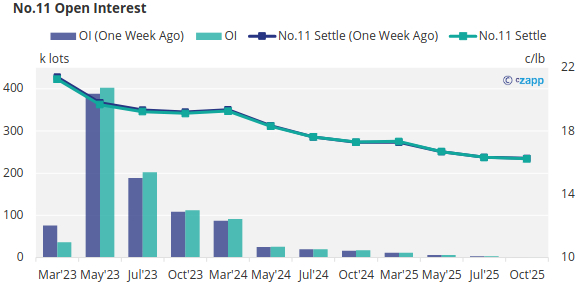

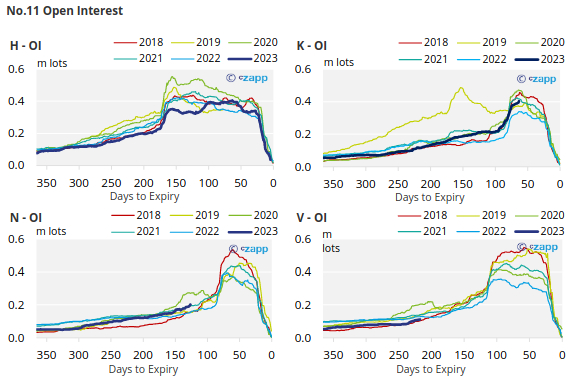

With the Mar’23 contract close to expiry; attention has moved toward May’23 which better represents whether prices will finally break out of the long held 18-20c/lb range. For the moment the May’23 is still trading toward the top of this range.

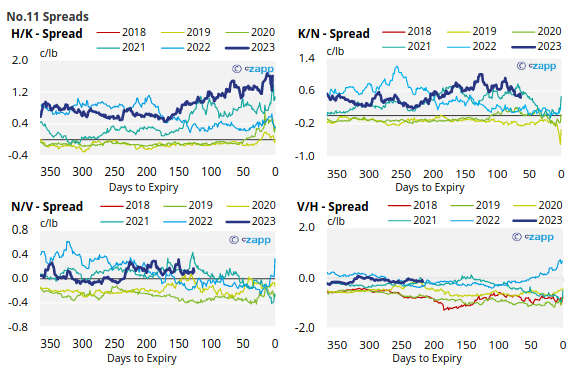

The No.11 forward curve remains inverted until Oct’23, moving into contango into Mar’24.

London No.5 (Refined)

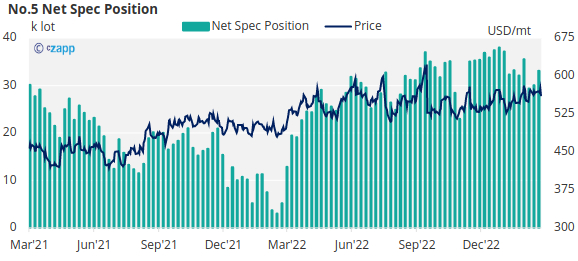

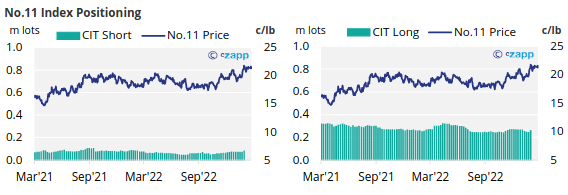

No.5 CoT data has been unaffected by the hack impacting the CFTC. As such, data regarding the No5 net spec position is up to date.

No.5 refined sugar futures have broadly traded sideways over the last week, only dropping toward 560USD/mt by Friday close.

By the 24th of February (latest ICE CoT), the net spec position extended back above 33k lots after gradual declining since January.

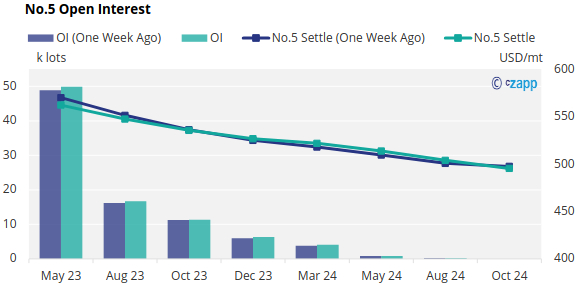

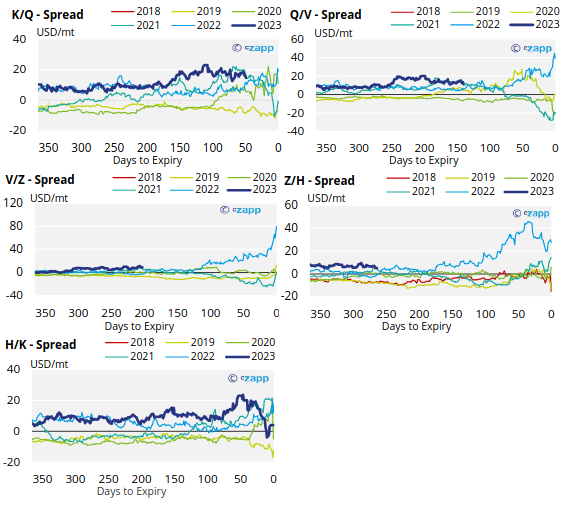

The No.5 forward curve nearby contracts have fallen slightly while contracts further down the board have increased slightly. Overall, the No.5 forward curve remains backwardated.

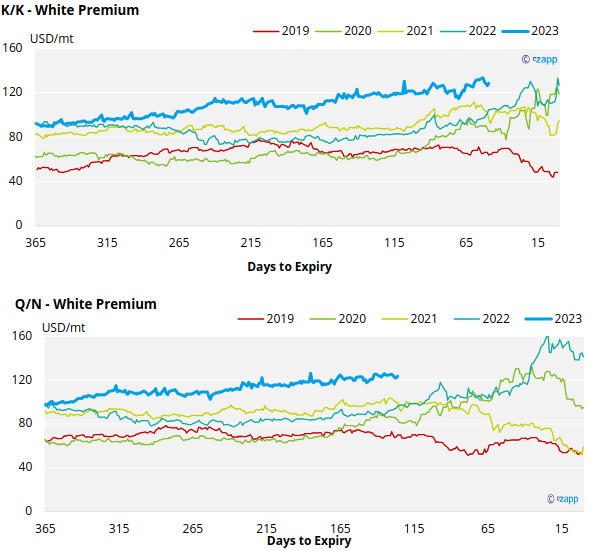

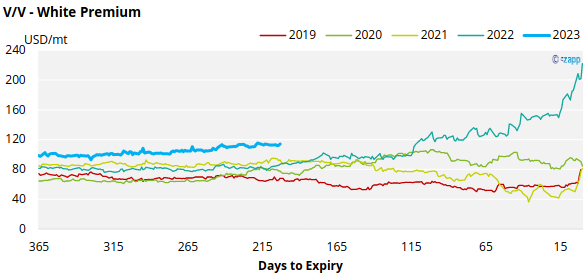

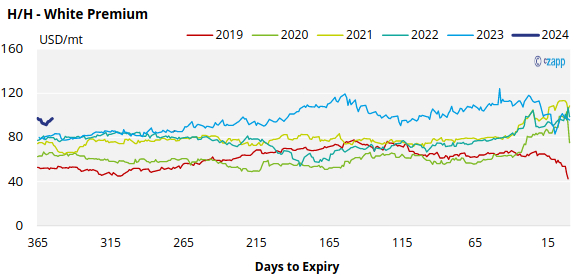

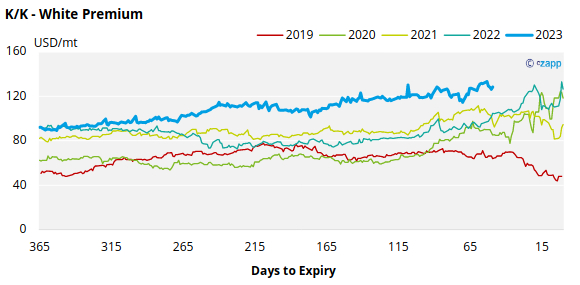

White Premium (Arbitrage)

The K/K sugar white premium dropped to 126USD/mt by the end of last week.

With world energy prices falling, we think re-exports refiners need around 115-125USD/mt above the No.11 to profitably produce refined sugar.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

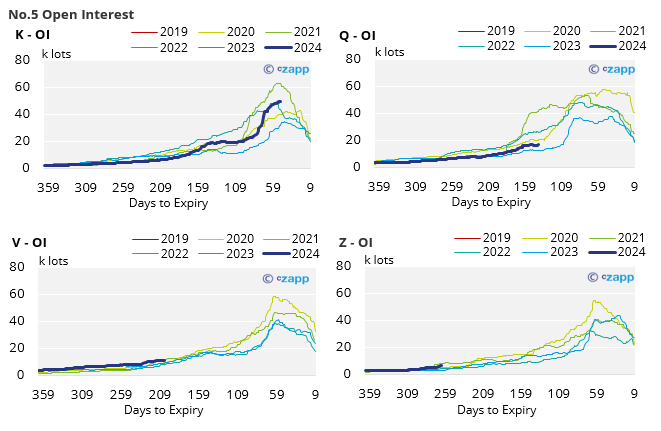

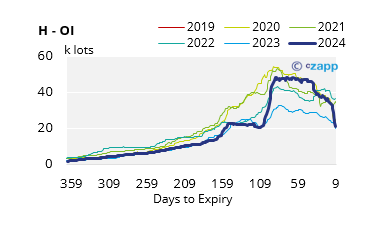

No.5 (White Sugar) Appendix

No.5 Spreads

White Premium Appendix