Insight Focus

Raw sugar futures traded between 18-19c/lb over the past week. Speculators have added heavily to their short position. Producers reduced their position by 64.4k lots.

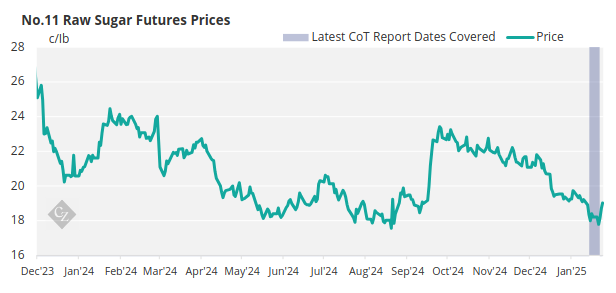

New York No.11 Raw Sugar Futures

The raw sugar futures market traded between 18-19c/lb over the past week as it rebounded from lows of just under 18c/lb. These lows coincided with levels last seen between 2022-2024.

Since then, the market has rallied by 100 points, an interesting move considering we are in a bear market.

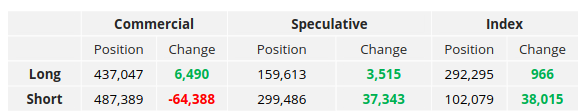

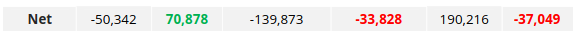

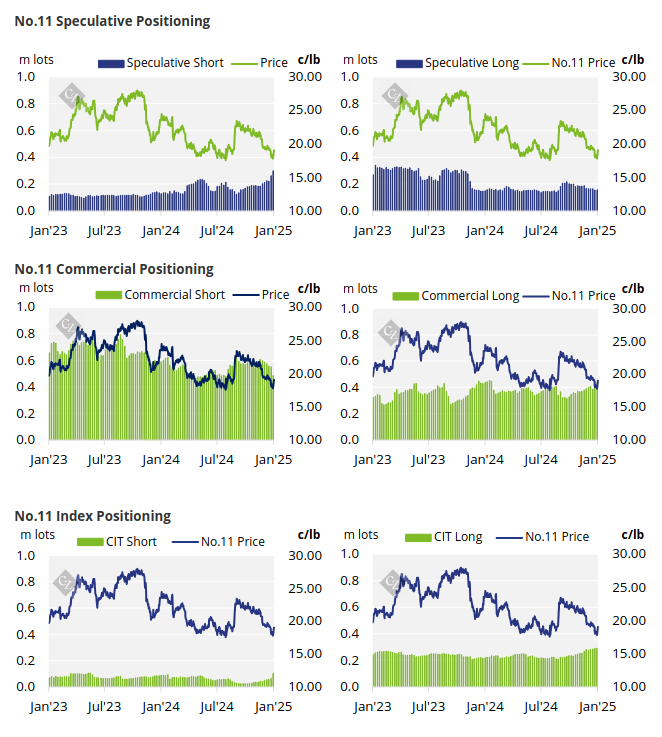

There was significant speculative selling over the past week as speculators have added heavily to their short position by 37.3k lots. Speculators are now net-short in the raw sugar market by -139.9k lots – the largest net-short position since the market broke below the highs of the 2020-2023 bull market.

No.11 Commitment of Traders Report (21 January 2025)

Looking over to the commercial participants, producers have closed out a significant number of short positions at 64.4k lots of shorts. End-users have continued adding to their positions, opening 6.5k lots of long positions.

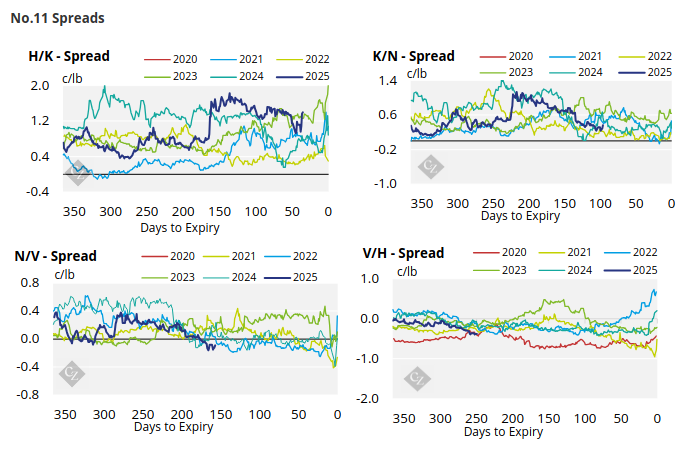

The No. 11 forward curve has strengthened across the board.

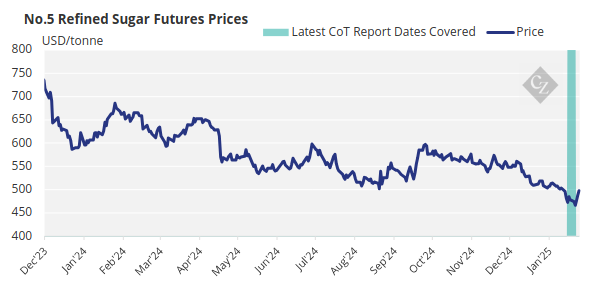

London No.5 Refined Sugar Futures

The No. 5 refined sugar futures traded higher over the past week between USD 466-498.2/tonne.

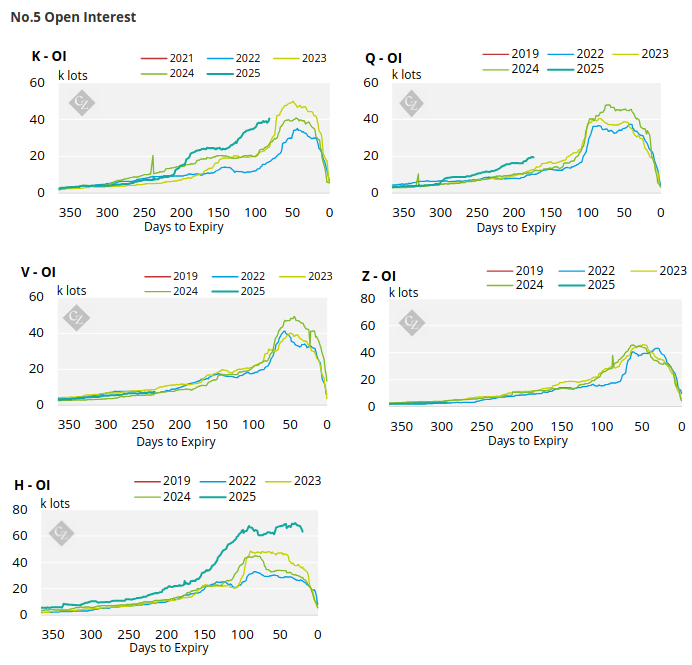

No.5 Open Interest

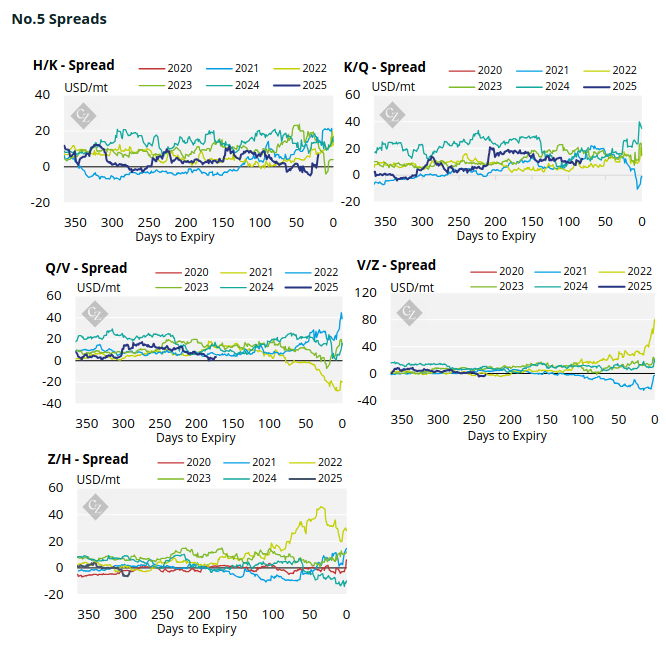

Following a similar trajectory to the No.11 raw sugar futures curve, the No.5 refined sugar futures curve has also strengthened across the board.

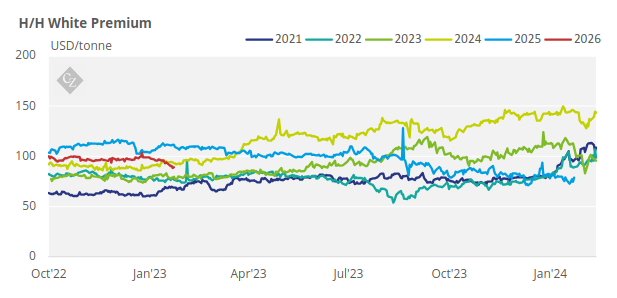

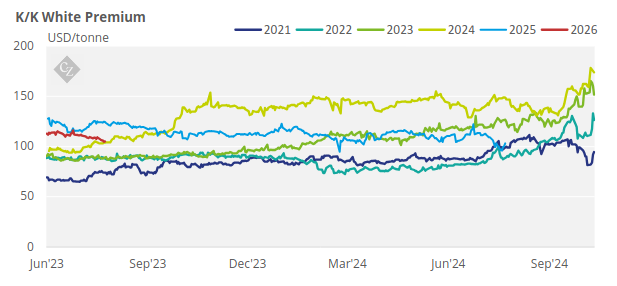

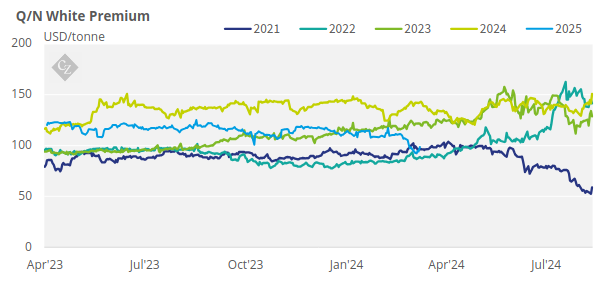

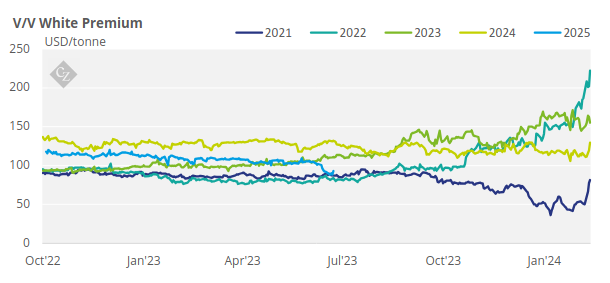

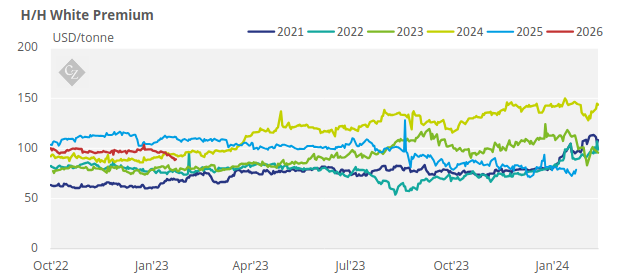

White Premium (Arbitrage)

The H/H white premium traded lower between USD 72-78.9/tonne.

This is below the level at which many of the world’s re-export refiners can operate profitably.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

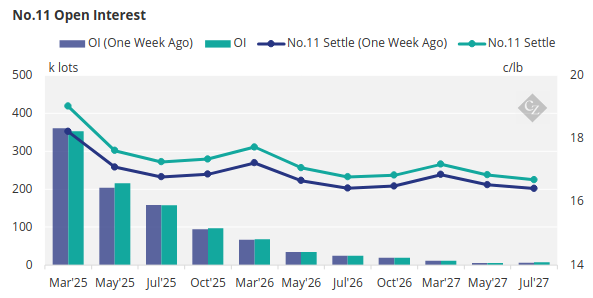

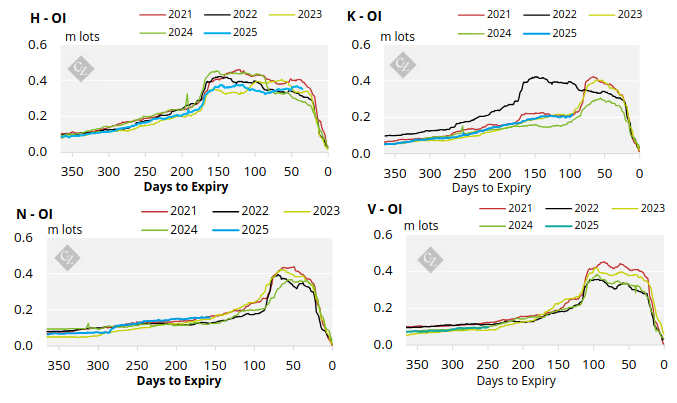

No.11 Open Interest

No.5 (White Sugar) Appendix

White Premium Appendix