Insight Focus

- The net speculative position moves closer to neutrality.

- White premium drops below 140USD/mt as No.5 also weakens.

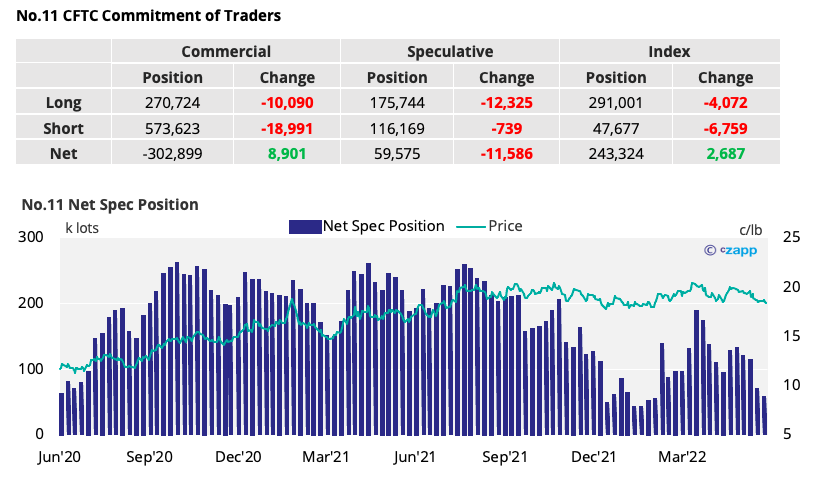

New York No.11 (Raw Sugar)

- The No.11 has fallen below 18.5c/lb by the end of trading last week, drawing closer to the bottom of the 18-20c/lb range prices have been in for the last 10 months.

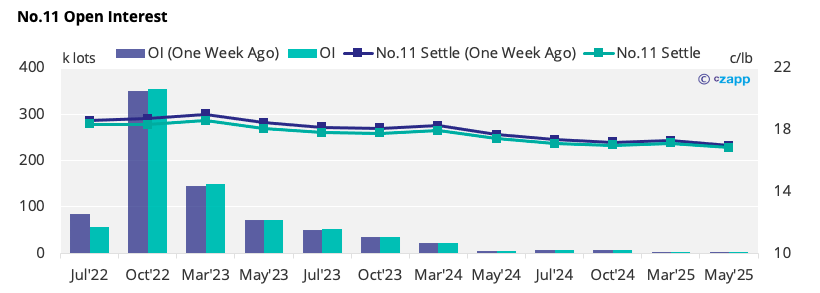

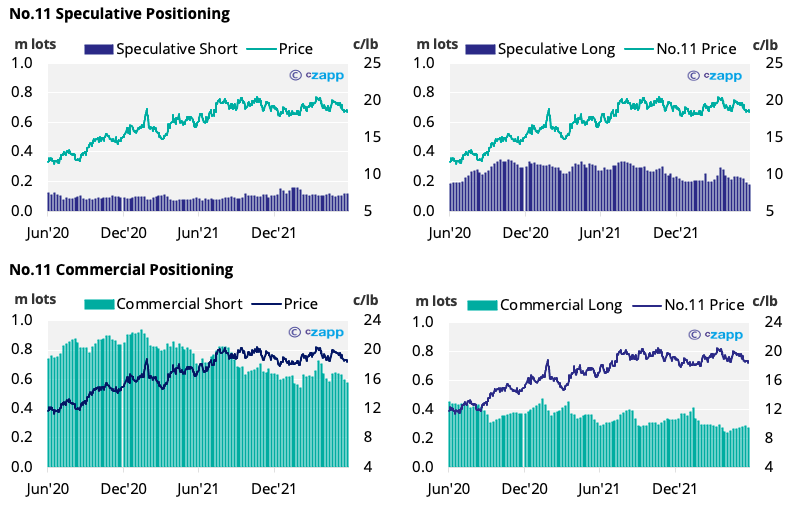

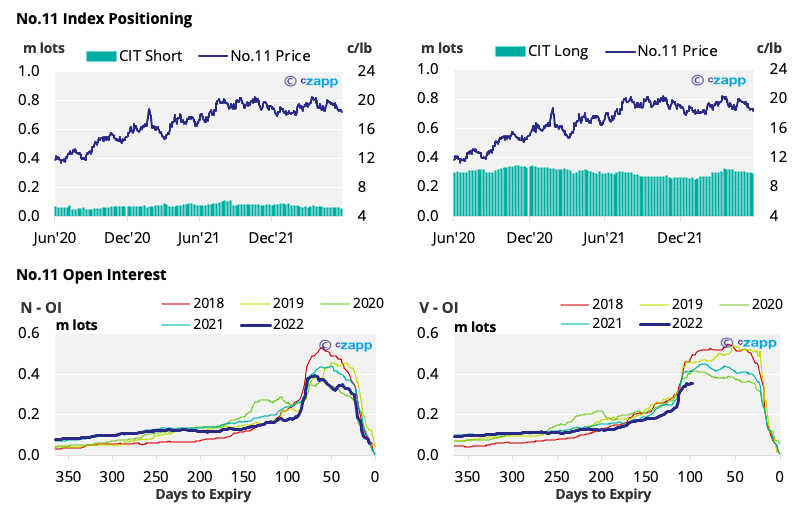

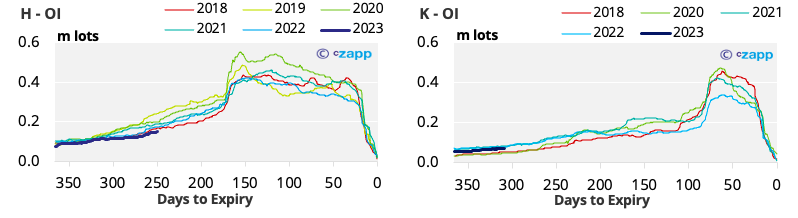

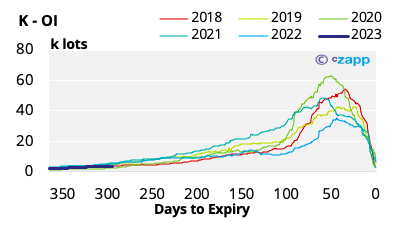

- With the July expiry imminent both commercial and speculative positions have been closing out – only a small number of lots have been rolled to the Oct’22 contract.

- The net spec position has fallen by over 12k lots by the 21st of June, the lowest since Russia’s invasion of Ukraine.

- Equally both commercial short and long positions have rolled off, reducing commercial open interest by around 30k lots.

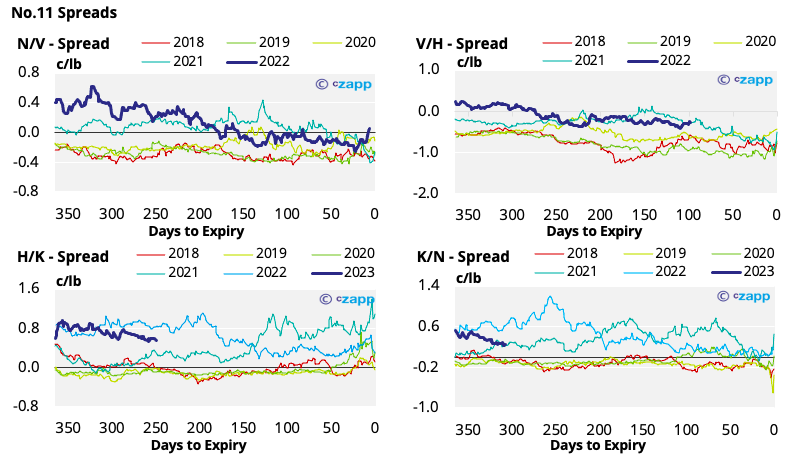

- The No.11 forward curve has flattened slightly but remains in contango for the remainder of 2022.

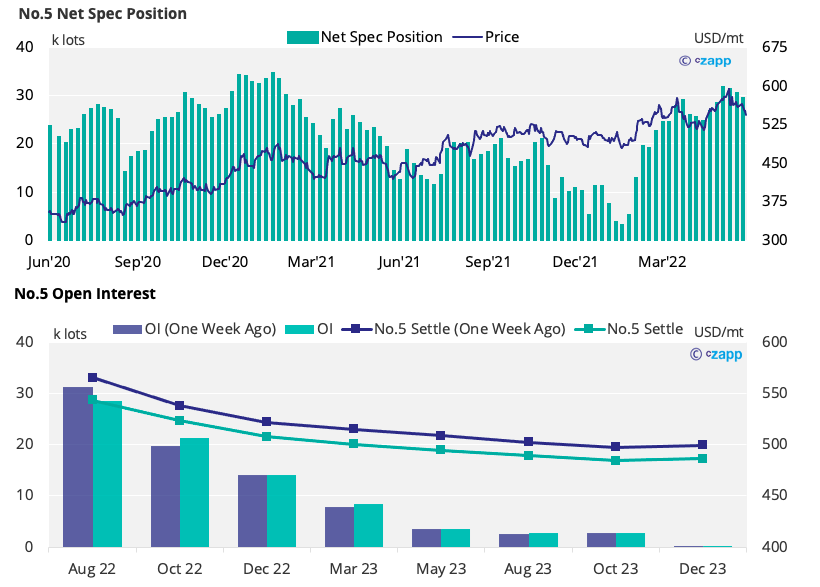

London No.5 (White Sugar)

- After weeks of moving sideways around 560USD/mt, the No.5 has now broken below 540USD/mt.

- Whilst this decline won’t have been accounted for yet in the CFTC COT report, as of the 21st of June the net spec position has fallen by 1k lots to 29.5k lots – this is still h gh by recent standards.

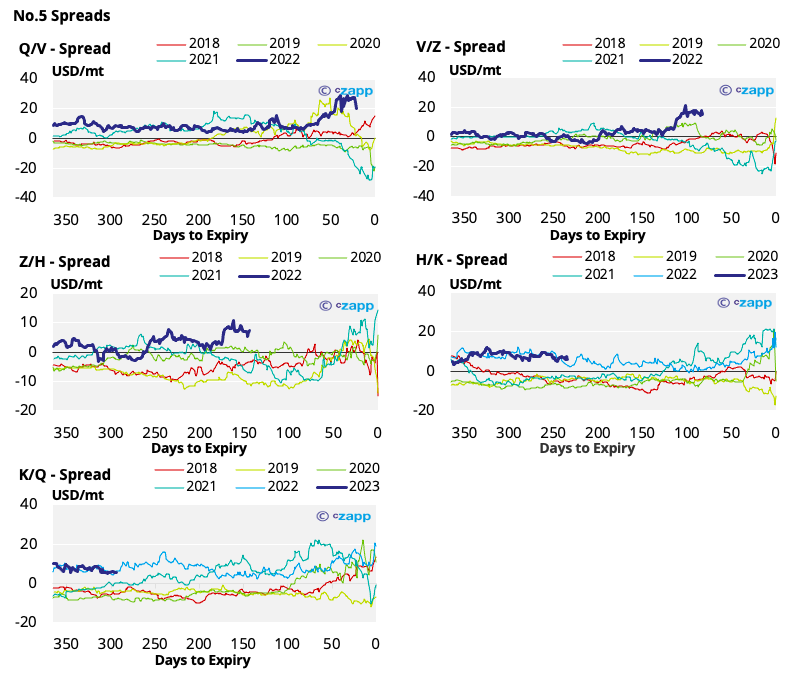

- The white sugar forward curve remains heavily backwardated across 2022 and 2023 – all 2022 spreads are at a strong premium.

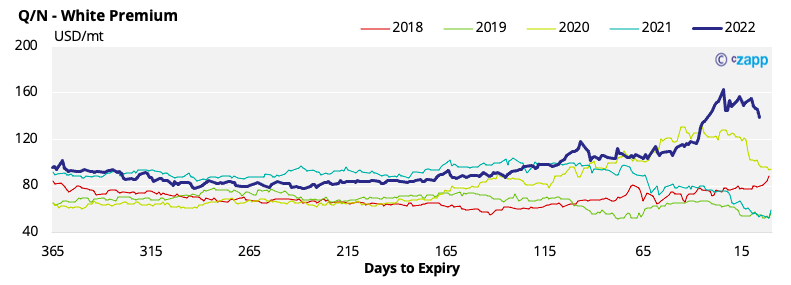

White Premium (Arbitrage)

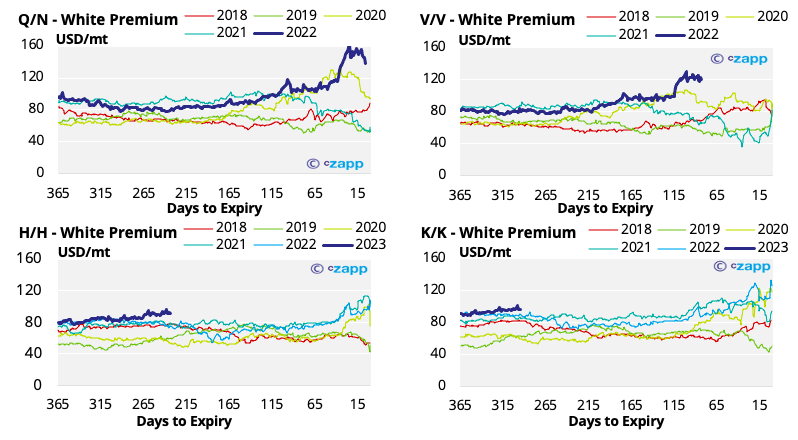

- With No.5 prices falling in the last week the white premium has receded to 138USD/mt by the end of last week.

- At this level re-export refiners should be able to operate profitably, however it is less likely that discretionary refining is possible – this could reduce short term refined sugar supply if this lower white premium persists.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

PET Raw Material Futures Outlook: PET Export Prices Fall Sharply, Attracts Fresh Demand