Insight Focus

- Raw sugar speculators have attempted to build another short position, will it sustain?

- White sugar speculators reduce long position with No.5 moving sideways.

- Sugar white premium softens in light of small No.11 upward move relative to No.5.

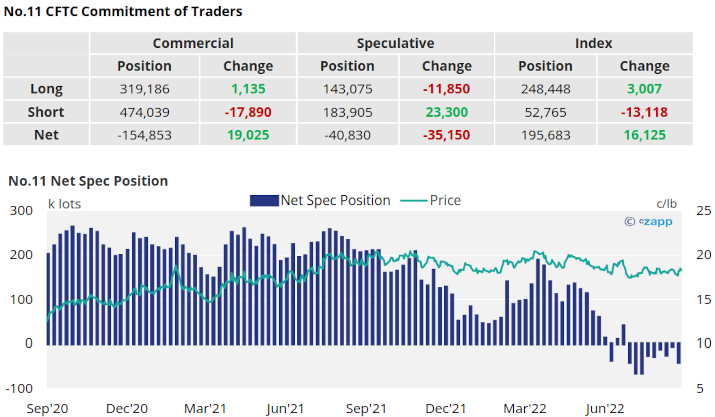

New York No.11 (Raw Sugar)

No.11 prices have recovered toward 18.5c/lb from 17.5c by the end of last week – this is yet to be reflected in the CFTC COT data.

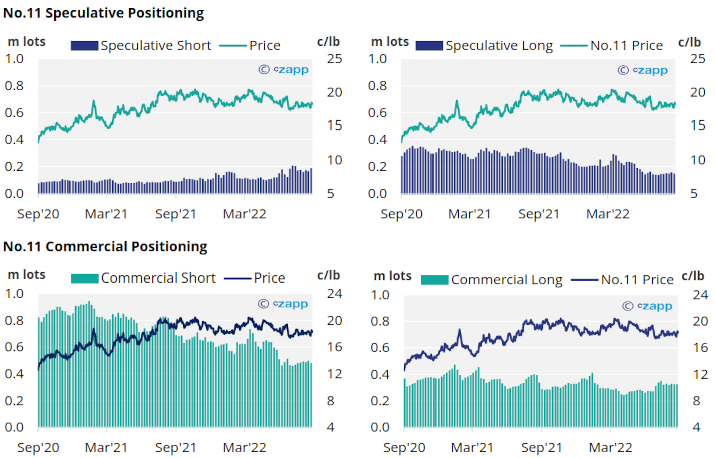

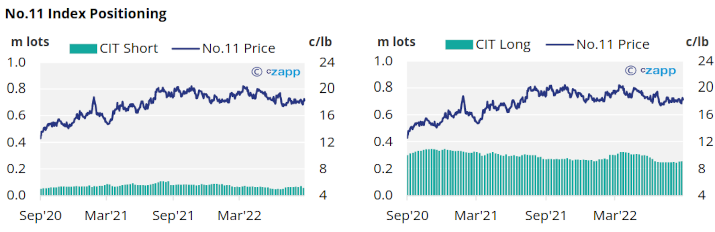

As such, by the 20th of September, raw sugar speculators added over 23k lots of fresh short positions and closed 12k long positions in a further attempt to sustain downward pressure on the market. This means the net spec position is now the most negative since the start of August.

Raw sugar producers closed out a net 18k lots with lower prices not offering opportunity to hedge, conversely consumers added over 1k new hedges.

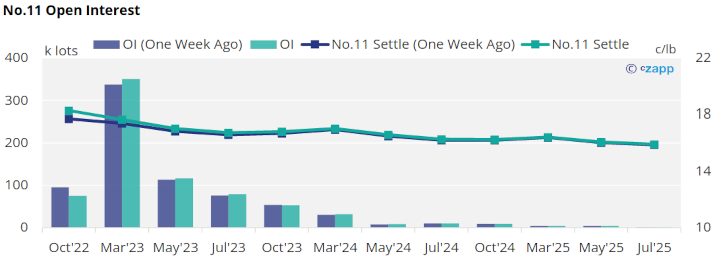

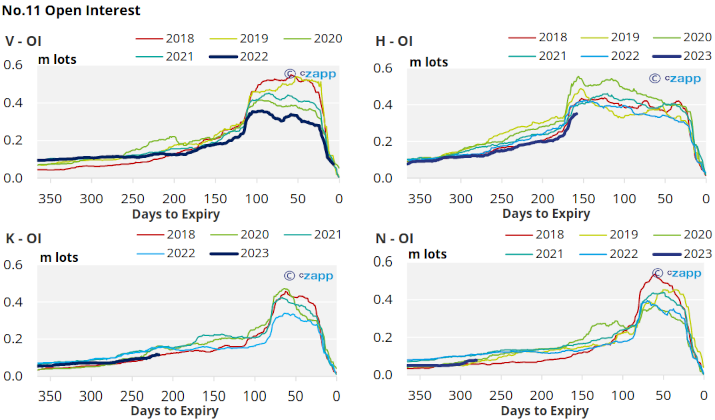

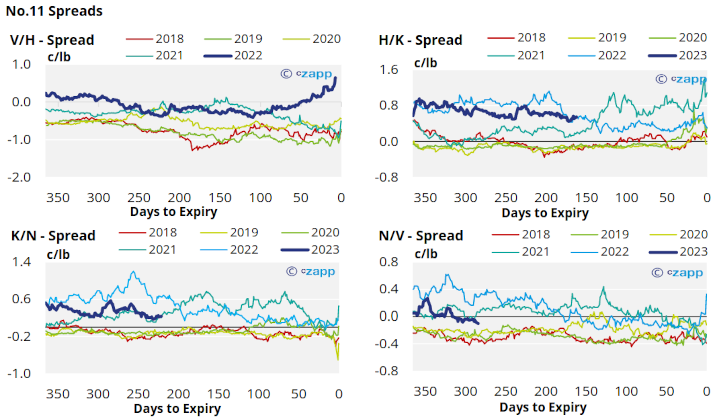

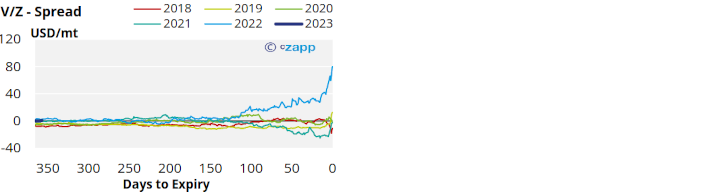

With the Oct’22 contract close to expiry the V/H spread has widened to over 60 points. This leaves the No.11 forward curve further backwardated for the next 12 months.

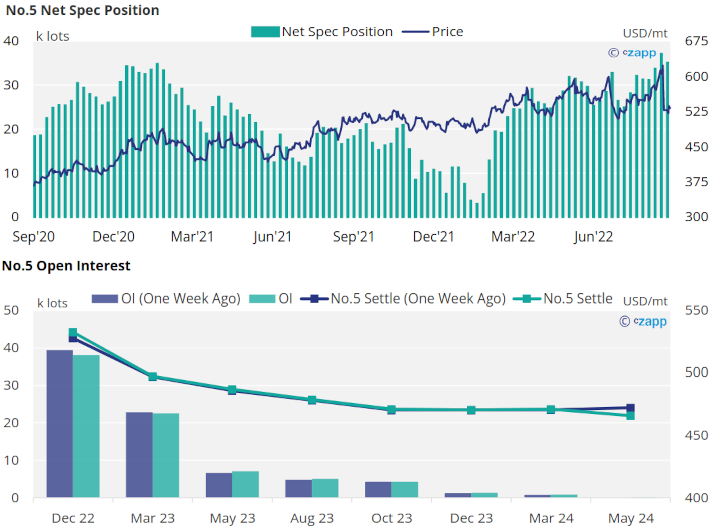

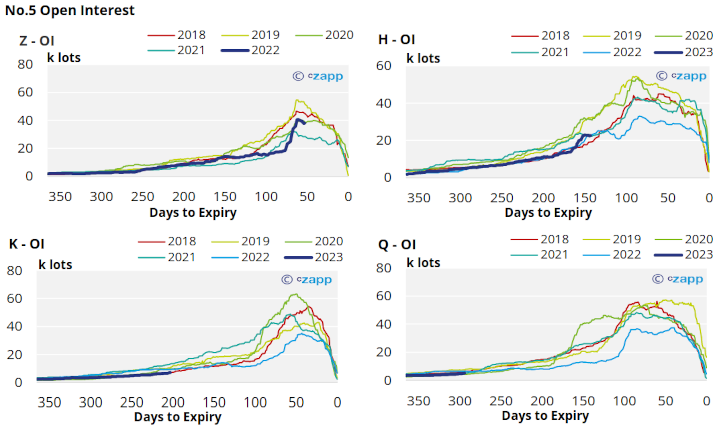

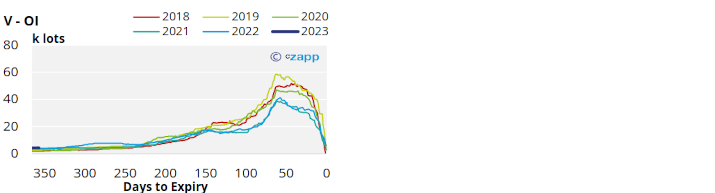

London No.5 (Refined Sugar)

The Dec’22 contract has moved sideways between 520 and 540USD/mt following the Oct’22 No.5 expiry.

With No.5 prices out of the uptrend channel for the moment speculators have reduced their net long position in refined sugar – as of the 20th of September the net spec position has fallen by 2k lots to 35k lots. However, this is still the second highest in 2022 so far.

The No.5 forwards curve remains heavily backwardated for the next 12 months, highlighting the severe short-term tightness in the market.

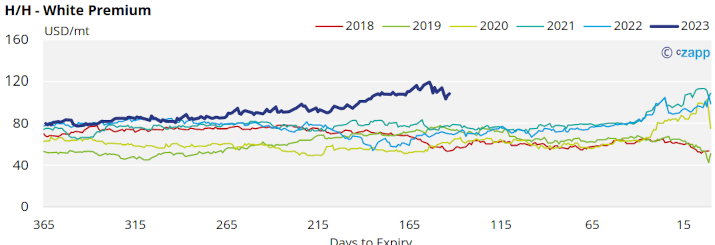

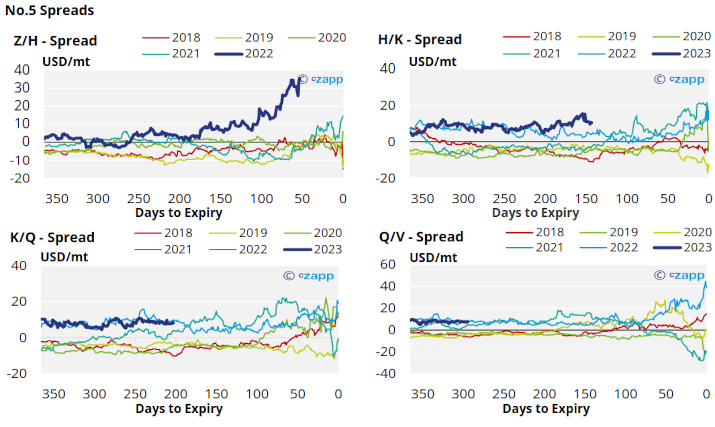

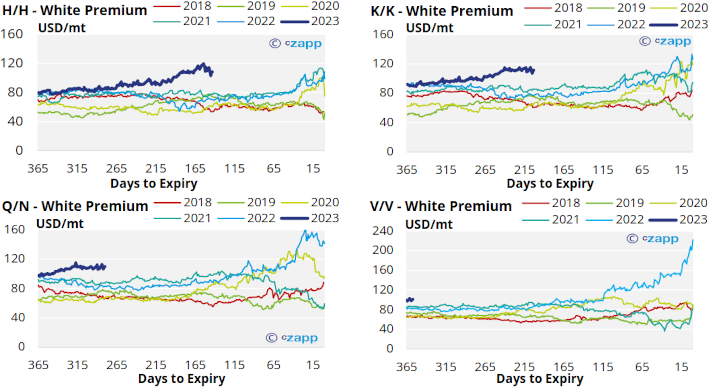

White Premium (Arbitrage)

Upwards movement in the No.11 this last week has allowed H’23/H’23 white premium values to soften below 110USD/mt – this is well below the level prior to the Oct’22 No.5 expiry.

Despite the severe tightness in the refined sugar market, we think many re-export refiners will struggle to operate profitably at this level.

However, the proceeding K/K and Q/N white premiums are both trading above 110USD/mt, unusually high this far in advance of their expiries.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

Thai Ethanol Prices set to Rise

Ask the Analyst: Why are the Sugar Markets Tight when there is a Production Surplus?