Insight Focus

The May’25 raw sugar futures expire this week. Both commercial participants and speculators have closed out their positions. The No.11 and No.5 forward curves have strengthened across the board.

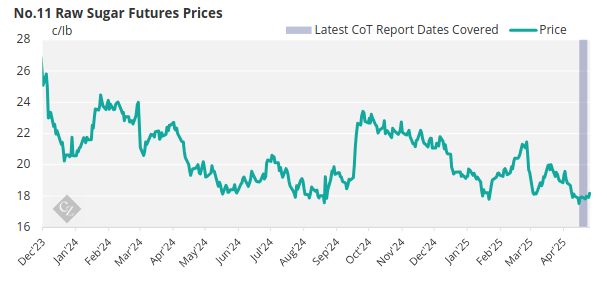

New York No.11 Raw Sugar Futures

The raw sugar futures traded between 17.8-18c/lb until Thursday, before closing at 18.2c/lb on Friday.

The May’25 raw sugar futures expire on Wednesday; expiries are often consequential events in the sugar market, as this is when the futures and physical markets align. Raw sugar prices are currently trading below 18c/lb, and we have previously seen heavy buying, particularly from the Chinese refiners at the 17.5c/lb level. We are intrigued to see if the expiry brings a change of character to the price action.

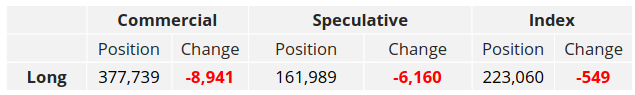

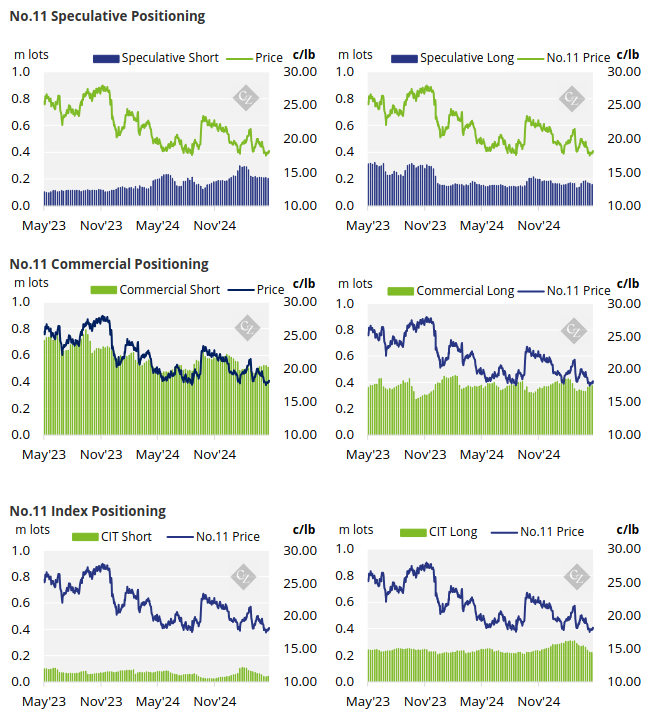

According to the latest CFTC data, both producers and end-users have closed out their positions as producers reduced their short position by 13k lots of shorts and end-users have closed out just under 9k lots of longs.

No.11 Commitment of Traders Report (April 22, 2025)

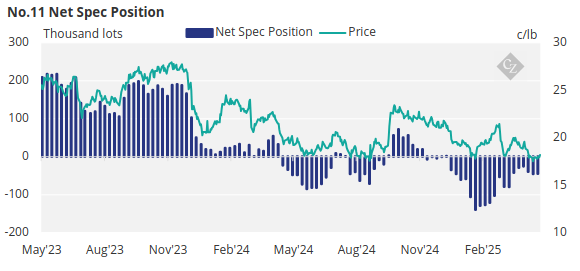

Speculators have taken similar action, closing out both their long and short positions by 6.2k lots of long positions and 7.1k lots of short positions. The net-short position now stands at -44.8k lots.

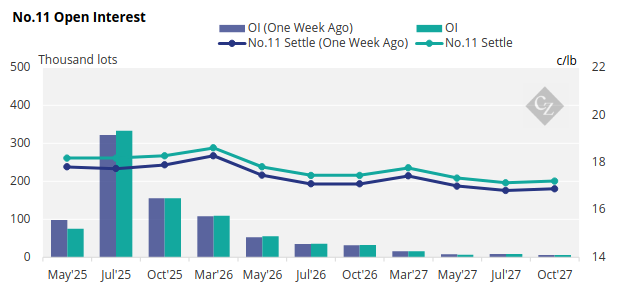

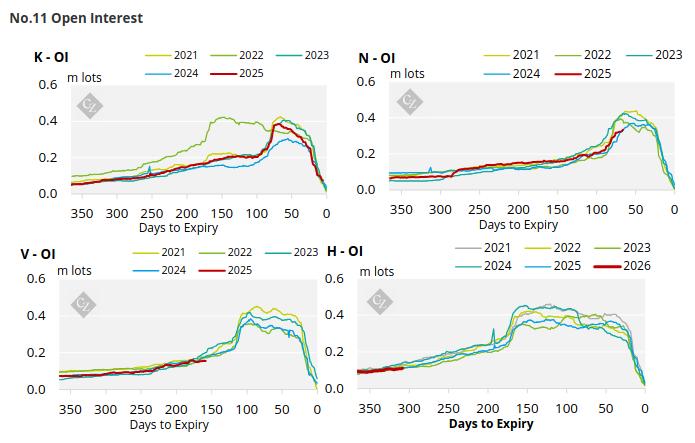

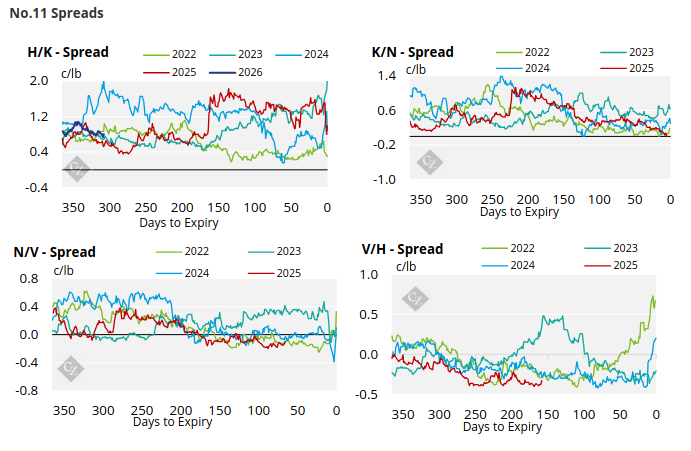

No.11 Open interest

The No. 11 forward curve has strengthened across the board.

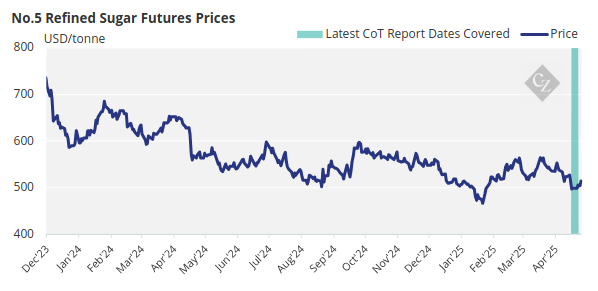

London No.5 Refined Sugar Futures

The refined sugar futures started trading at USD 498.9/tonne on Monday before trading above USD 500/tonne for the rest of the week. The refined sugar futures closed at USD 514/tonne on Friday.

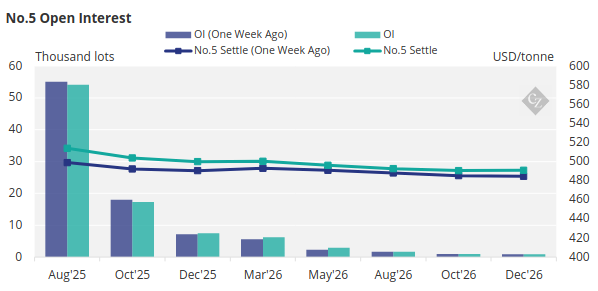

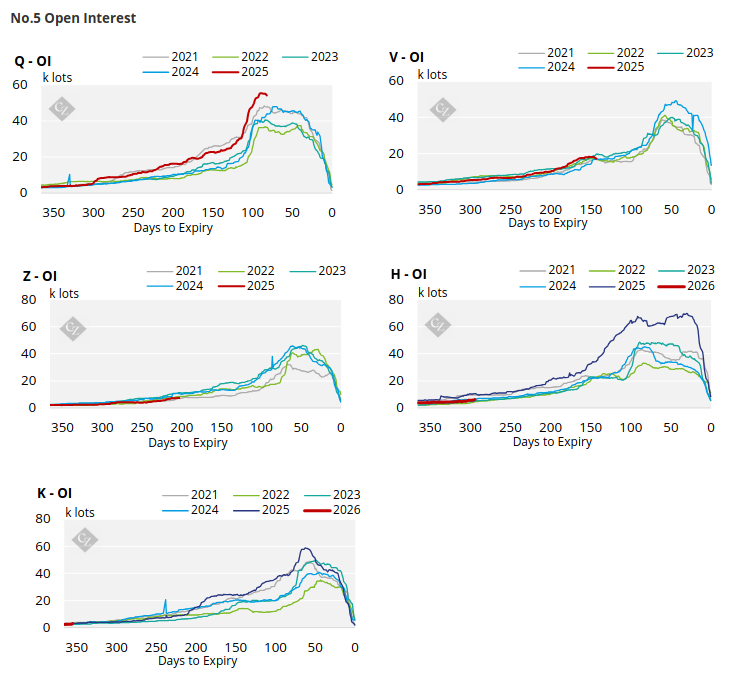

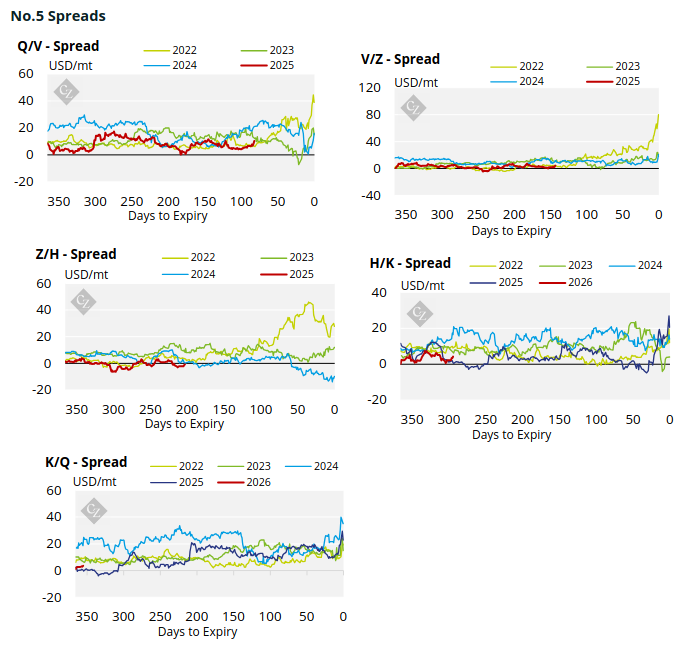

No.5 Open Interest

The No.5 refined sugar futures curve has strengthened across the board.

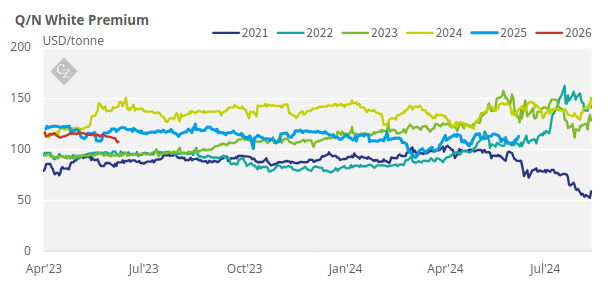

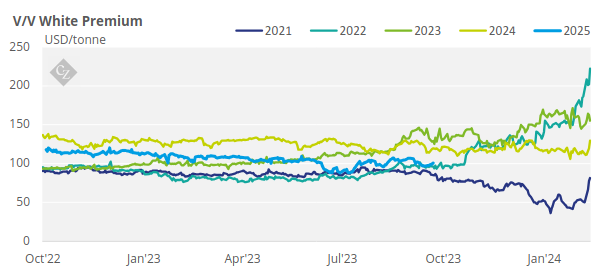

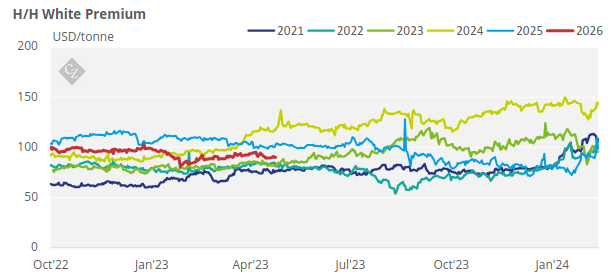

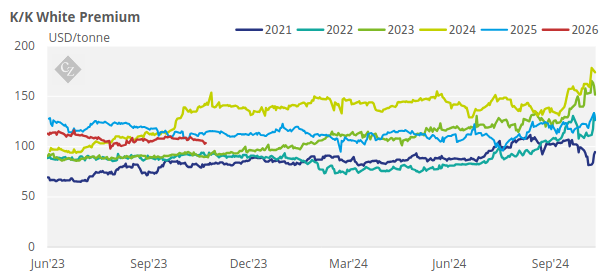

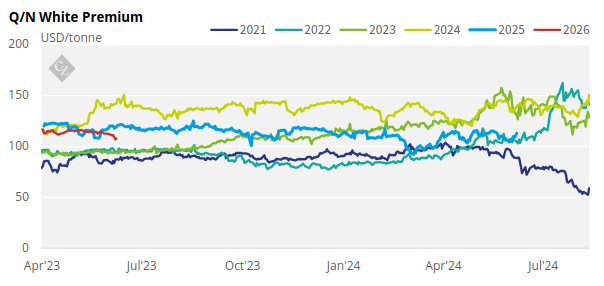

White Premium (Arbitrage)

The Q/N white premium traded between USD 107.8-111/tonne until Thursday, and hit USD 113.2/tonne by Friday’s close.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix