Insight Focus

- No.11 prices have strengthened back above 19c.

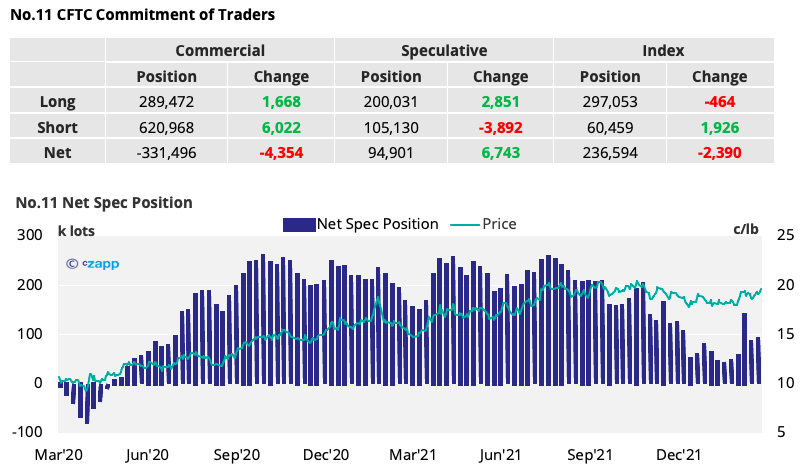

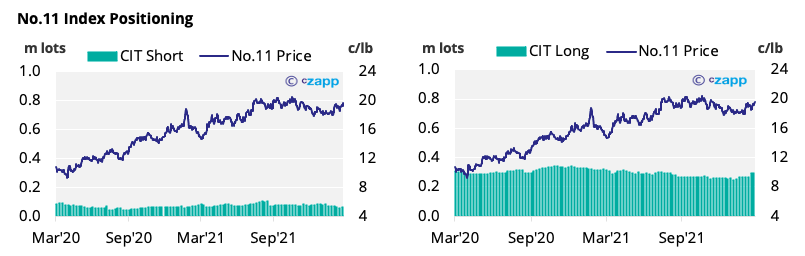

- The raw sugar net spec position has grown slightly since the last update.

- The white premium has widened further as No.5 prices climb higher.

New York No.11 (Raw Sugar)

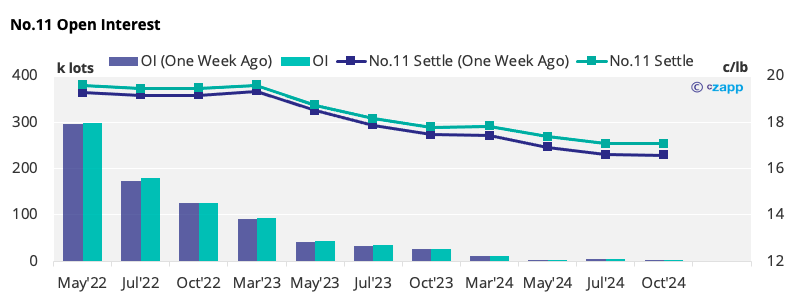

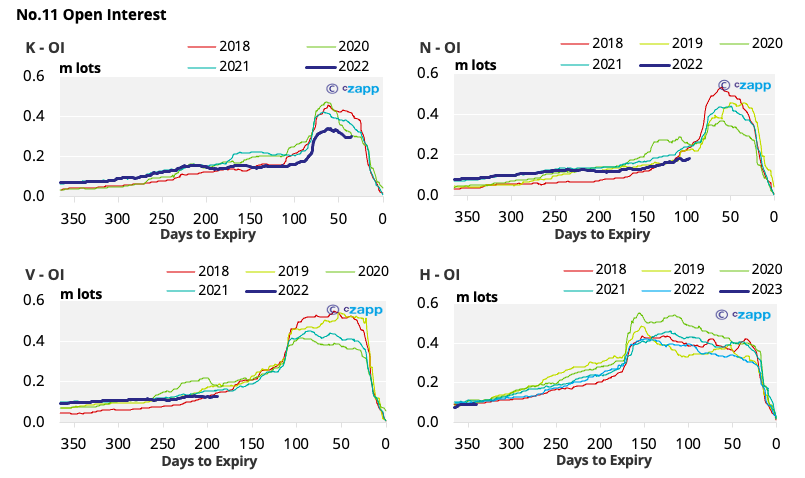

- No.11 prices have recovered above 19c, and now sit around 19.5c/lb.

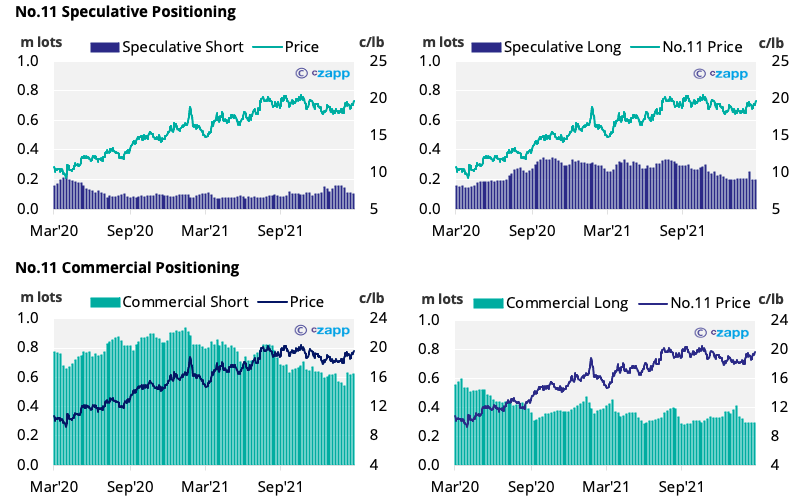

- This follows minor spec buying, increasing the net spec position by around 7k lots by the 22nd March.

- Sugar producers have taken advantage of price recovery, adding 6k lots of hedges – this selling pressure may have limited the No.11 rise.

- The forward curve remains mostly flat across the rest of 2022.

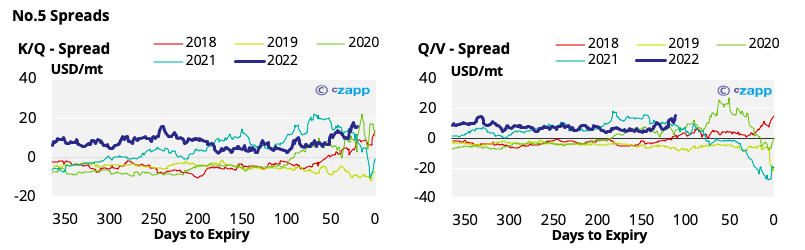

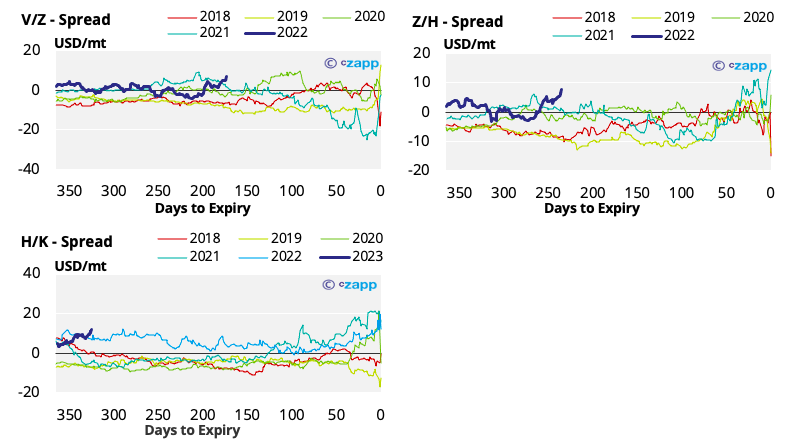

London No.5 (White Sugar)

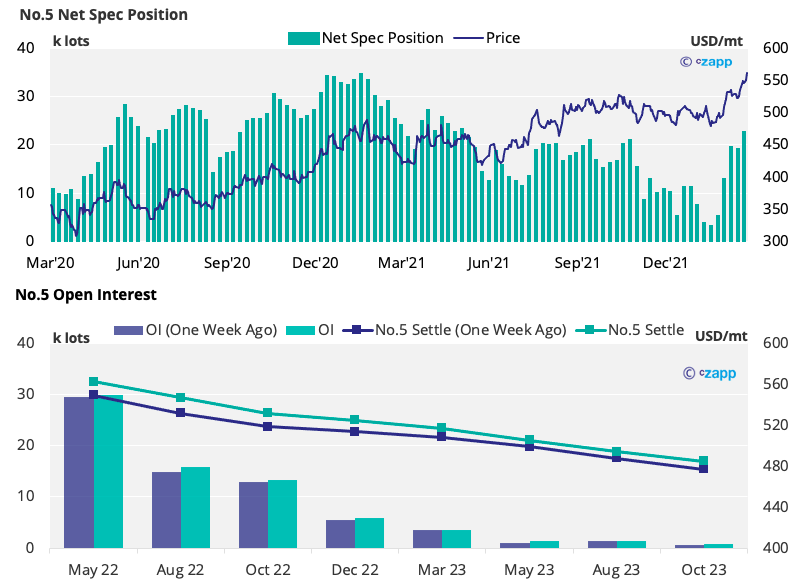

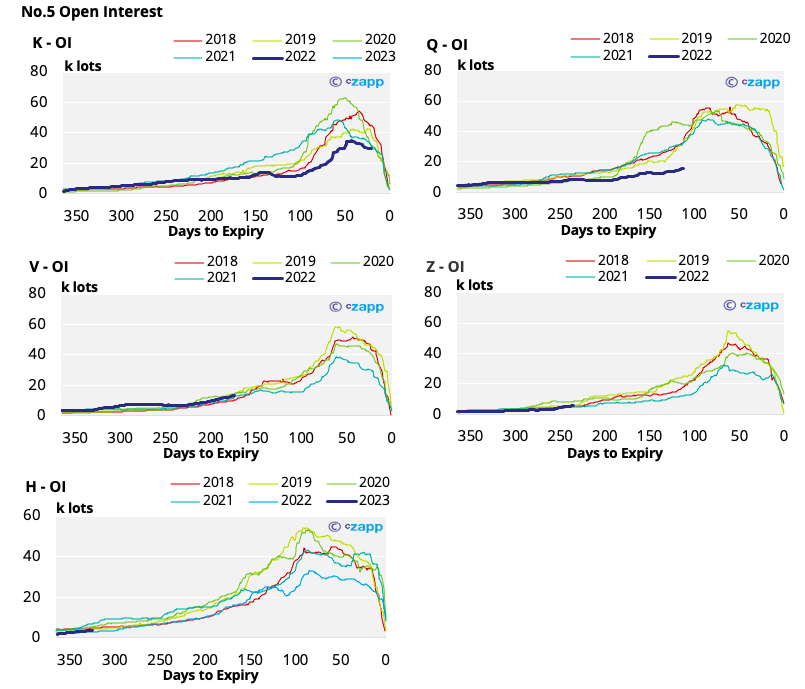

- The No.5 continues to move upwards, reaching over 560 USD/mt by the end of last week.

- Speculators have increased their long positions by 4k lots and the net spec position moves 2.5k lots higher.

- The white sugar futures curve remains heavily backwardated through 2022.

- Q’22 open interest is still low by recent standards as more K’22 positions are being closed out rather than rolled into August.

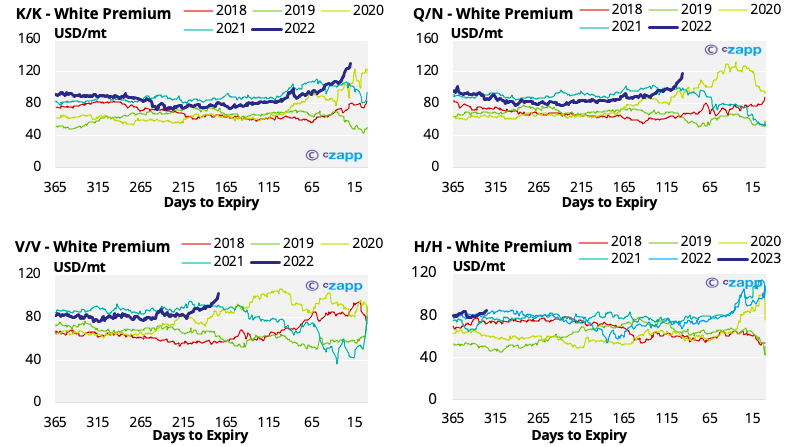

White Premium (Arbitrage)

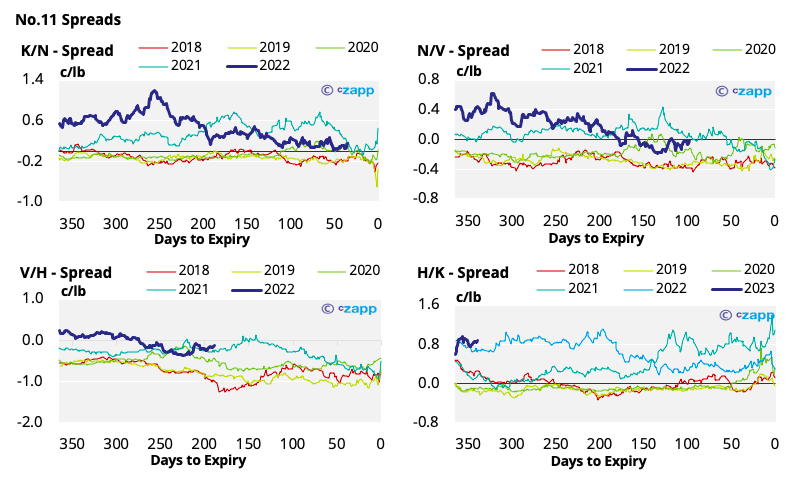

- Despite No.11 prices strengthening, the white premium broke 130 USD/mt by the end of last week.

- This is the largest the K/K arbitrage has been in the last five years.

- After accounting for increased energy prices, we think this is a fair value for re-export refiners.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…