Insight Focus

- The index long position in raw sugar has fallen to the lowest level in 6 years.

- This may indicate indices are rebalancing away from sugar/commodities.

- Sugar has been in a bull market for 43 months, one of the longest on record.

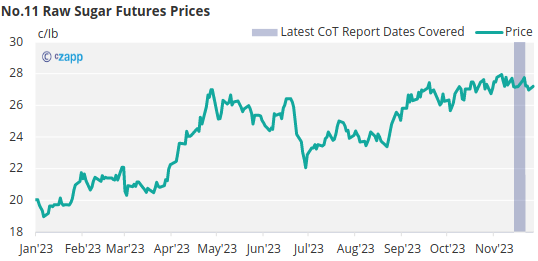

New York No.11 Raw Sugar Futures

Raw sugar futures remain close to 12-year highs at around 28c/lb.

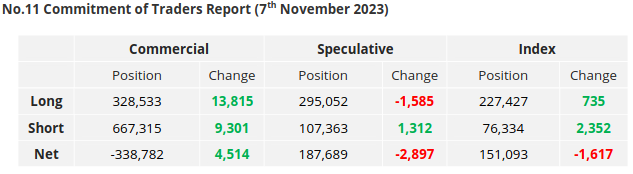

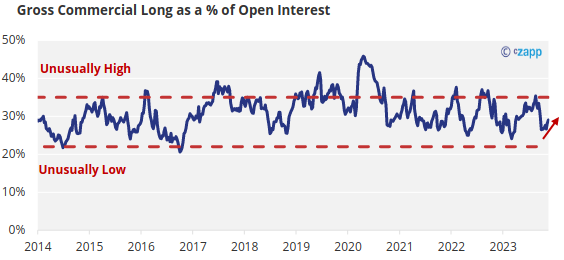

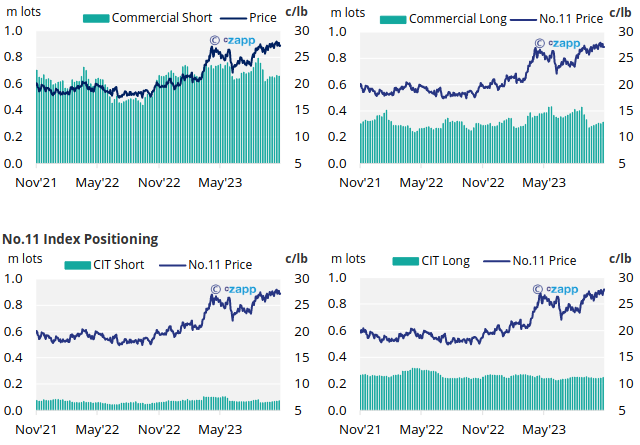

It’s therefore surprising to see that the week leading up to 21st November had the largest one-week increase in the consumer long since the build up to the October’23 futures expiry. Raw sugar end-users bought nearly 14k lots of long hedges. The commercial long position has grown by 7% in the past month.

It’s unusual to see this kind of activity with prices so high, which suggests that consumers have been waiting for a pull back before placing their hedges but have now run out of time. It’s possible that some consumers need to have a certain level of cover in place before year-end.

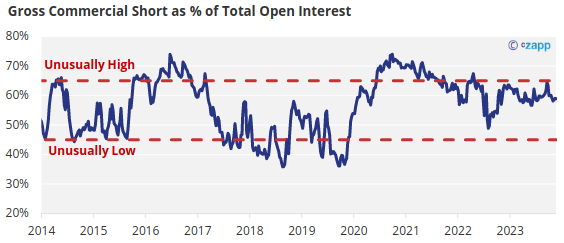

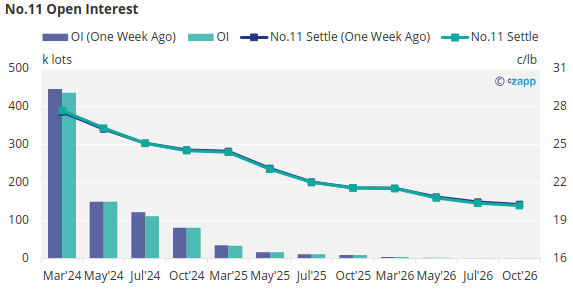

The commercial short has also increased in the week to the 21st November, showing that producers continue to drip-feed their hedges into market strength. As a result, market open interest has risen to its highest level since mid-September, at 1.13m lots.

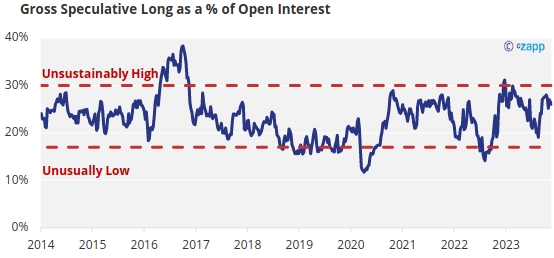

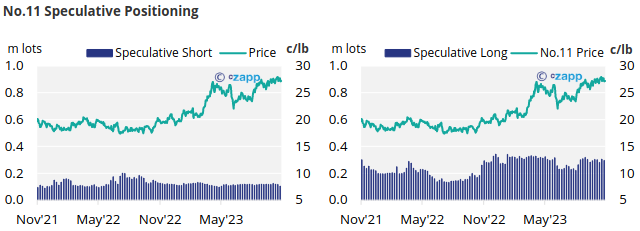

Rising open interest could give speculators room to increase their long positions in sugar without becoming too crowded. However, the net speculative position has barely changed in November and remains close to 190k lots long. The speculative long of around 300k lots accounts for around 26% of open interest; in the past speculative positions have become unwieldy at around 30% of open interest.

The only catch is that speculators have been heavily long the raw sugar market since mid-September, yet price momentum has faded since this time. Only catch is how long-lived this long position has been; sugar hasn’t had much momentum recently. It’s not clear if speculators will continue to add to their long into year-end, especially as commodity indices have been trimming their long.

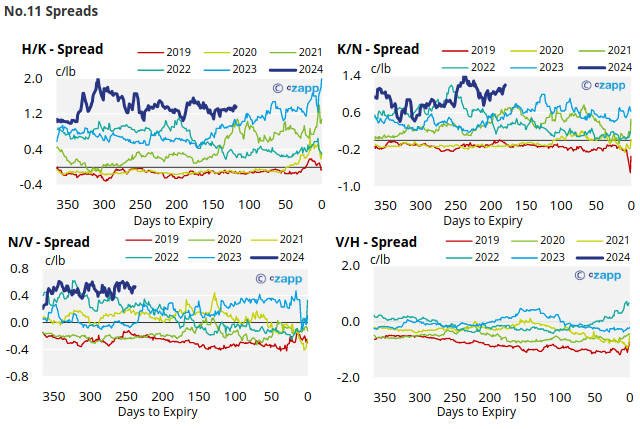

The raw sugar futures curve remains backwardated through to the end of 2026.

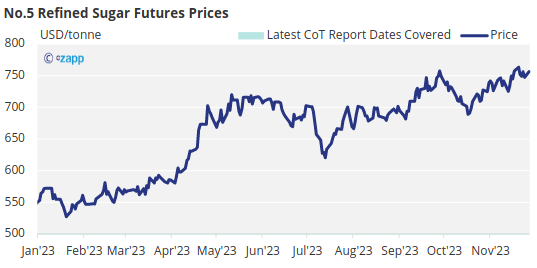

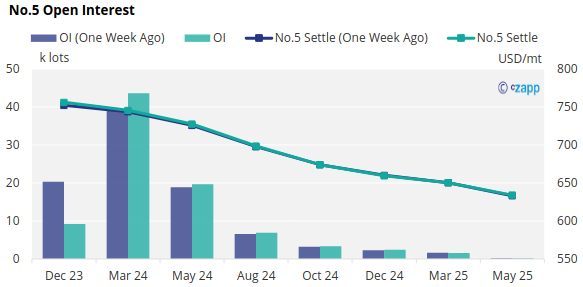

London No.5 Refined Sugar Futures

The refined sugar futures remain in an uptrend.

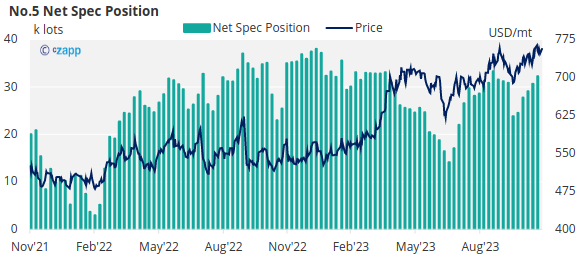

Speculators remain heavily long the refined sugar futures.

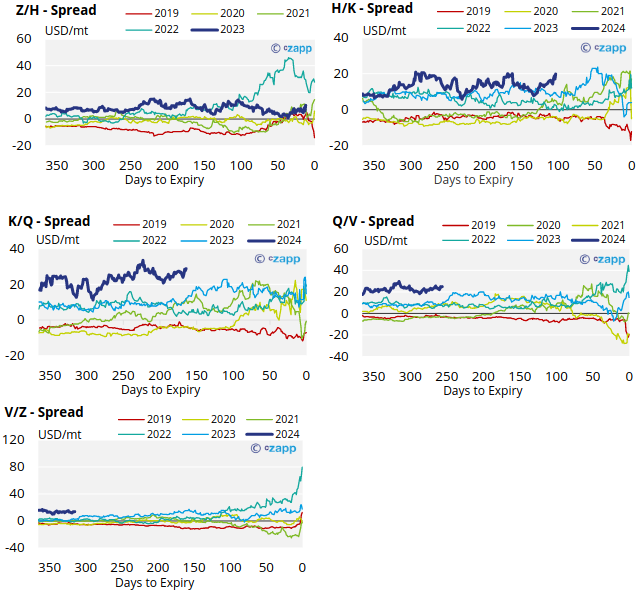

The refined sugar futures curve remains heavily backwardated.

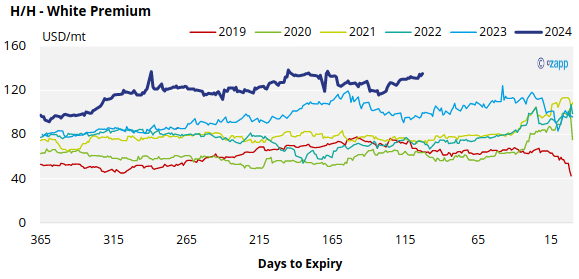

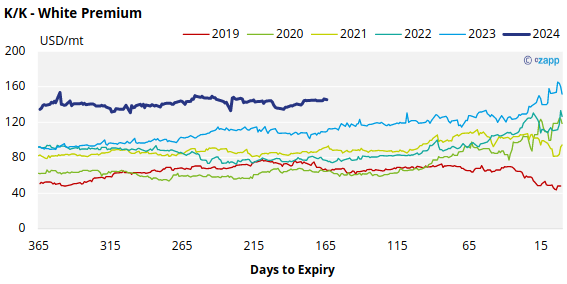

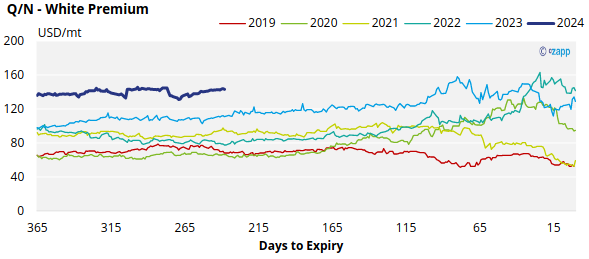

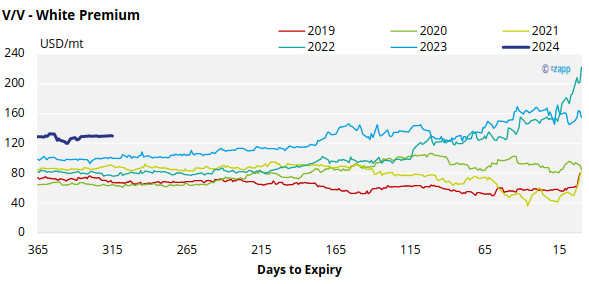

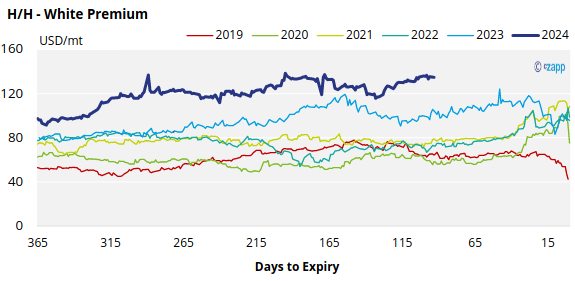

White Premium (Arbitrage)

The 2024 white premiums remain strong. We’ve not seen this kind of strength in the H/H white premium at this stage in the cycle in at least 5 years.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.11 Commercial Positioning

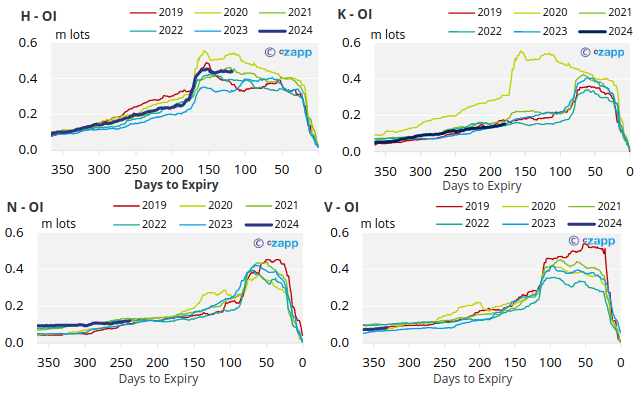

No.11 Open Interest

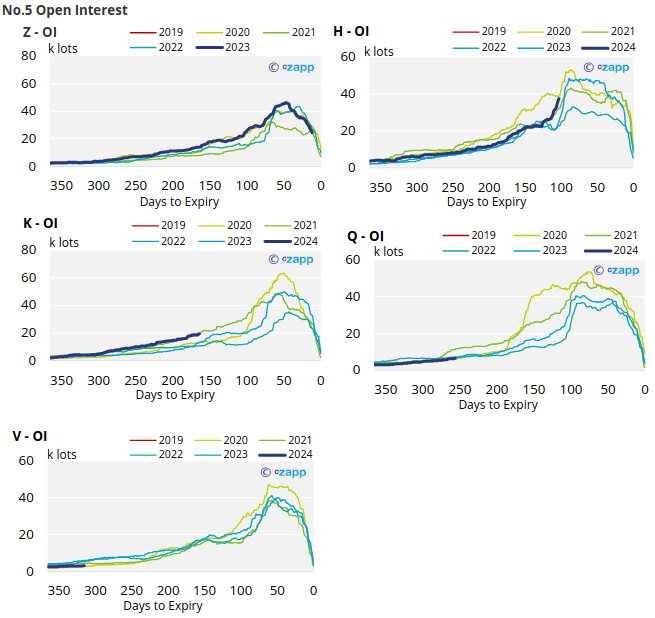

No.5 (White Sugar) Appendix

No.5 Spreads

White Premium Appendix