Insight Focus

- The No.11 raw sugar futures remain in their recent range.

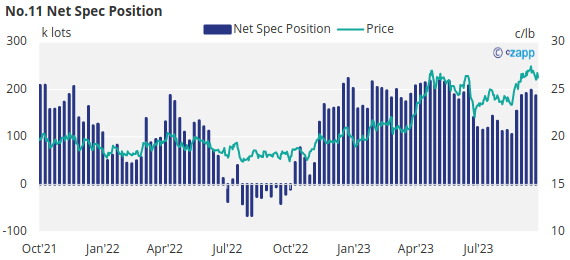

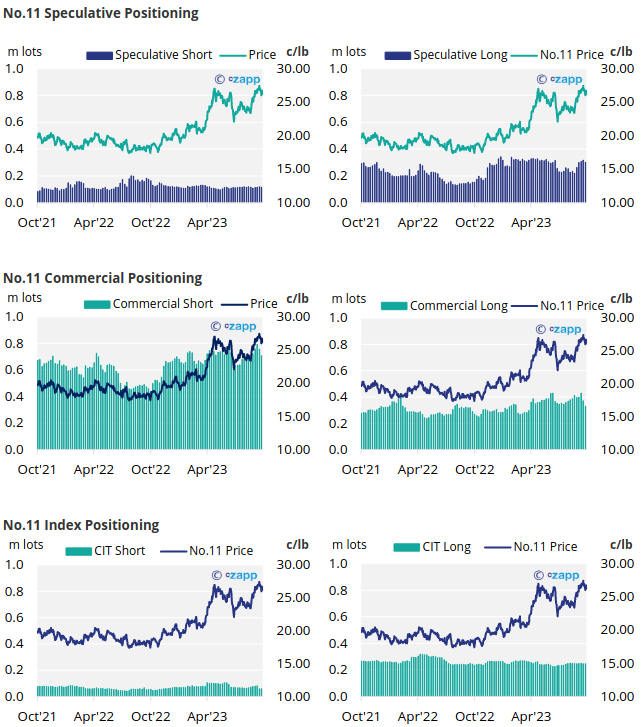

- Speculators remain heavily net long of raw sugar.

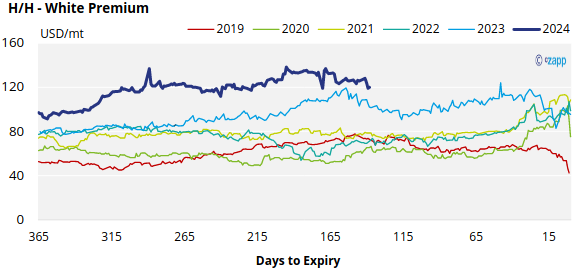

- The H/H white premium has weakened, now standing at 120USD/mt.

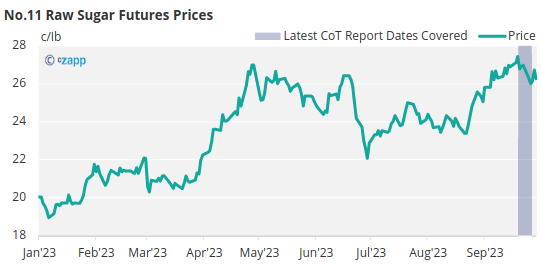

New York No.11 Raw Sugar Futures

The No.11 sugar futures remain in their recent range between 22c and 27c/lb.

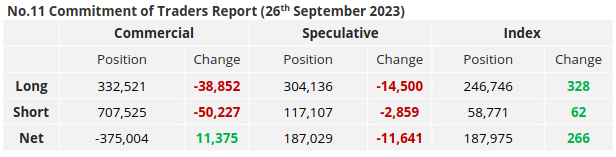

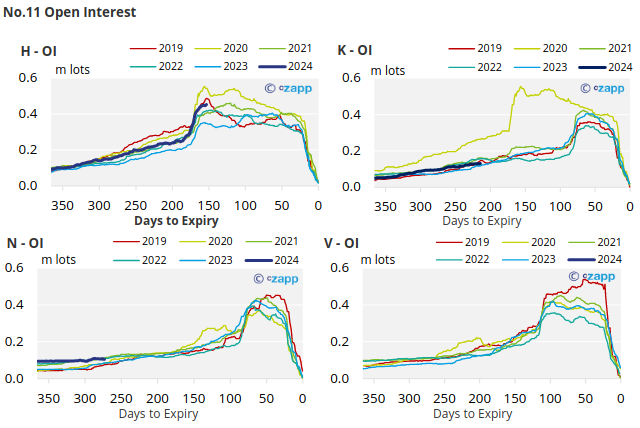

We have seen commercial participants close out their positions in the days leading up to the Oct’23 expiry, with producers closing out around 50k lots and consumers closing out just under 39k lots of commercial long positions.

Turning to the speculators, they have also chosen to exit both their spec short and spec long positions, reducing the overall net spec position to 187k lots.

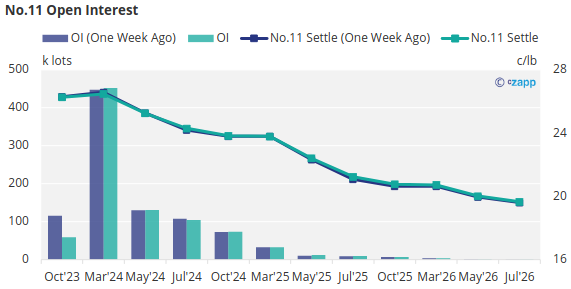

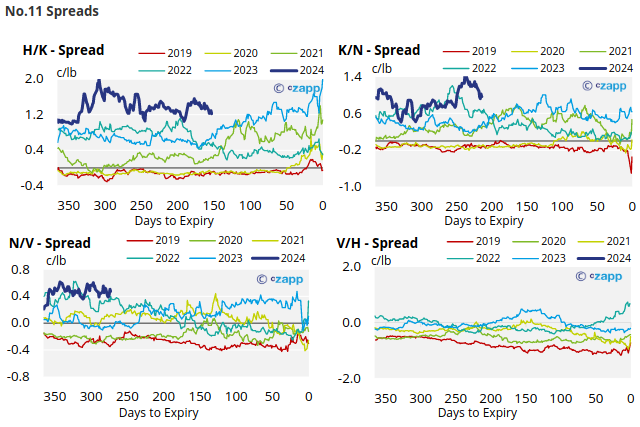

The No.11 forwards curve has remained relatively unchanged since last week and remains inverted through Mar’26.

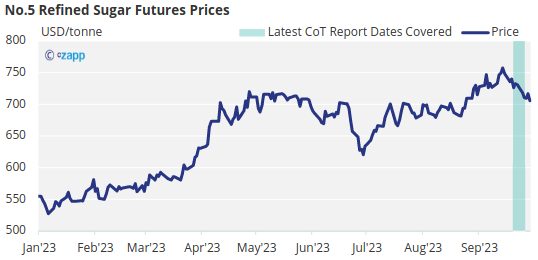

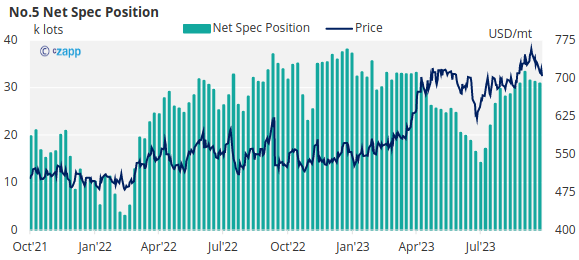

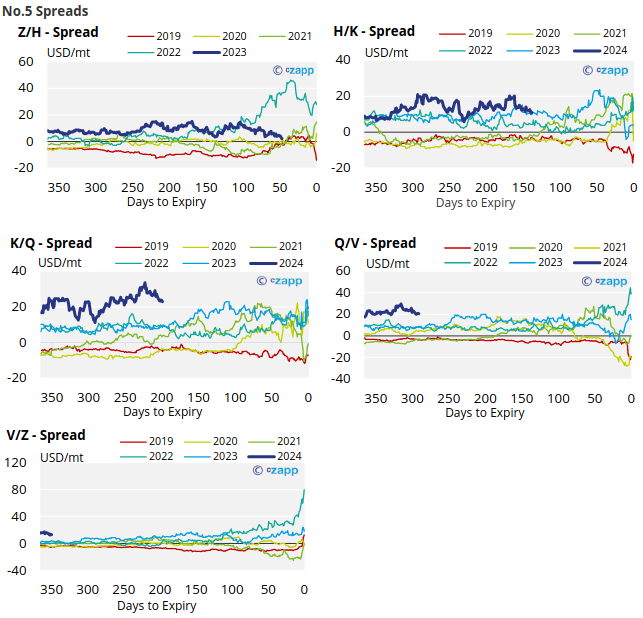

London No.5 Refined Sugar Futures

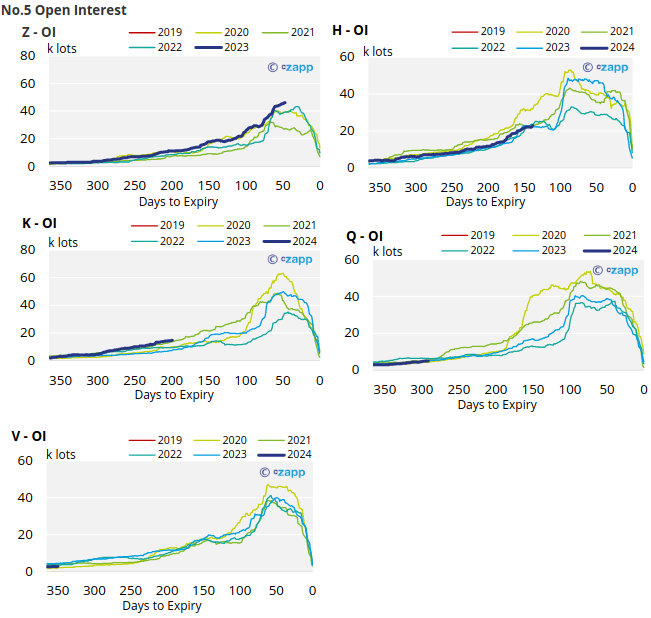

Unlike the No.11, the No.5 refined sugar futures weakened for a second week in a row, falling from 718USD/mt at the start of the week to 705USD/mt by Friday’s close.

As a result, the overall net spec position has fallen slightly to 30.9k lots.

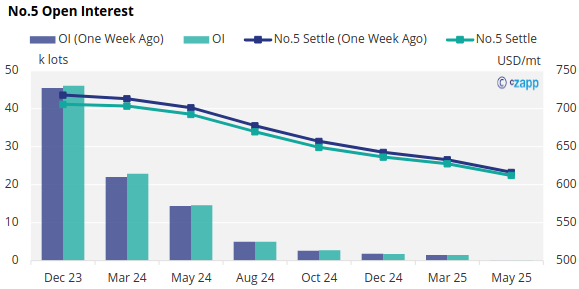

The No.5 forward curve remains backwardated until May’25.

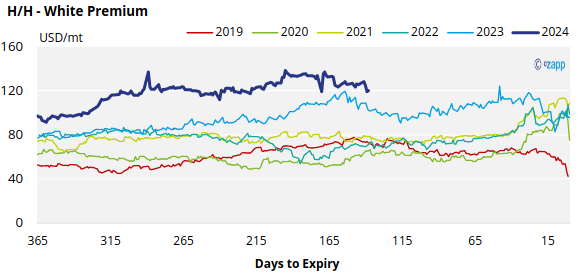

White Premium (Arbitrage)

The H/H white premium has weakened over the past week to 120USD/mt.

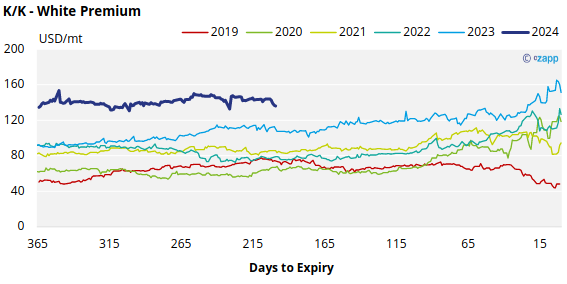

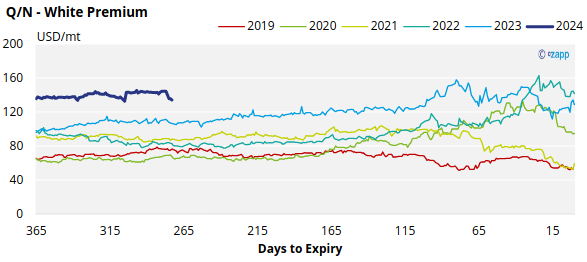

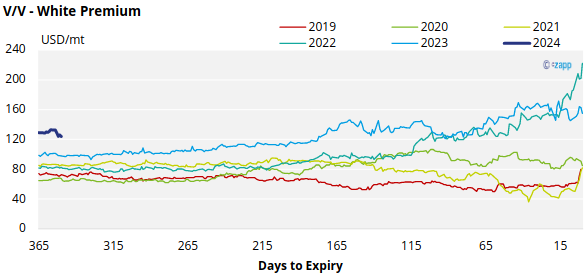

The refined sugar market is expected to be undersupplied for the rest of 2023 and the majority of 2024, as evidenced by a strong K/K and Q/N white premiums.

We believe that many re-export refiners require at least 90-105USD/tonne over the No.11 to be profitable, which means that the spot white premium provides comfortably enough for these refiners to maximize their throughput.

At this level, higher-cost or discretionary refiners may begin to consider re-exporting in addition to serving their domestic markets.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix