Insight Focus

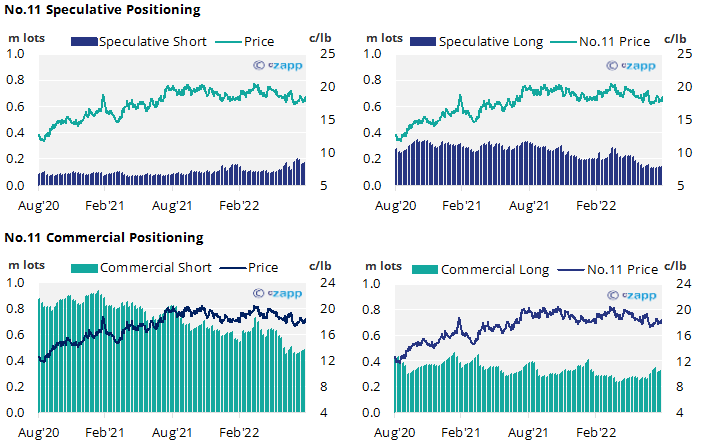

- Raw sugar producers and consumers have both been able to advance their hedging regimes.

- Speculative sentiment in raw sugar looks uncertain as both the spec long and spec short positions rise.

- Strength in the white premium persists.

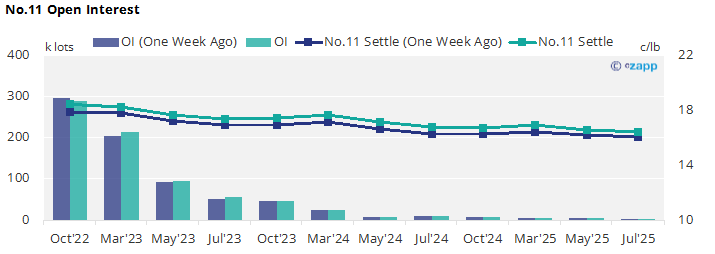

New York No.11 (Raw Sugar)

- The Oct’22 No.11 contract lurched back to 18.5c/lb on Friday last week, following a week trading sideways around 18c/lb.

- By the latest CFTC COT report on the 23rd August, movement in the No.11 allowed both raw sugar producers and consumers opportunity to add hedges, increasing their cover by 8k and 6k lots respectively.

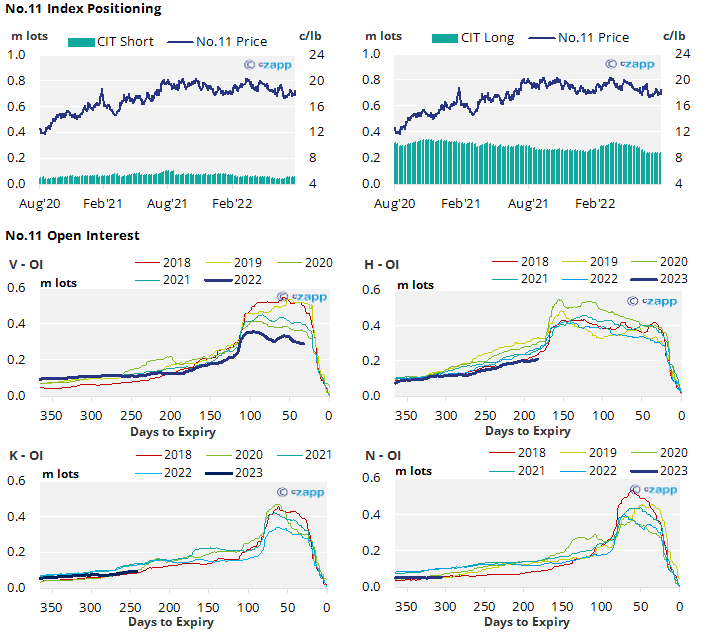

- Activity by speculators was more muted, seeing the spec long rise by over 1k lots and the spec short increase by 4k lots.

- Whilst this has meant the net spec position has become more negative, it remains fairly neutral by the standards of the last two years.

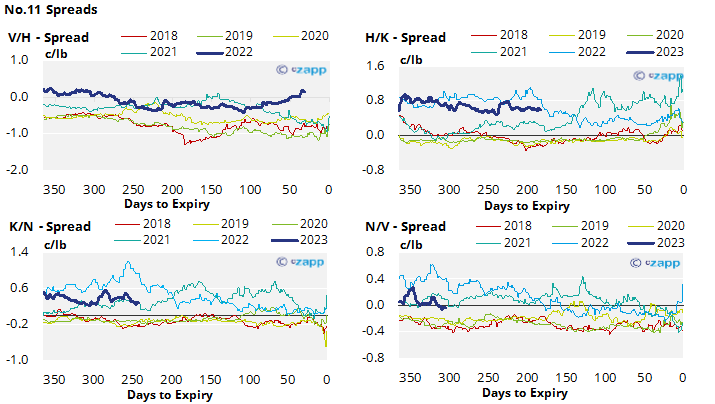

- The nearby V/H spread is now trading at a 16-point premium, moving the No.11 forward curve into backwardation through to July next year.

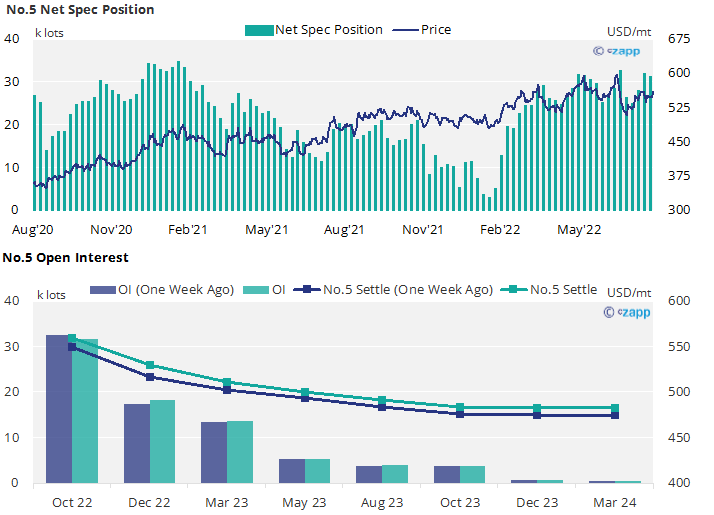

London No.5 (White Sugar)

- No.5 prices have floated between 550 and 560USD/mt over the last week.

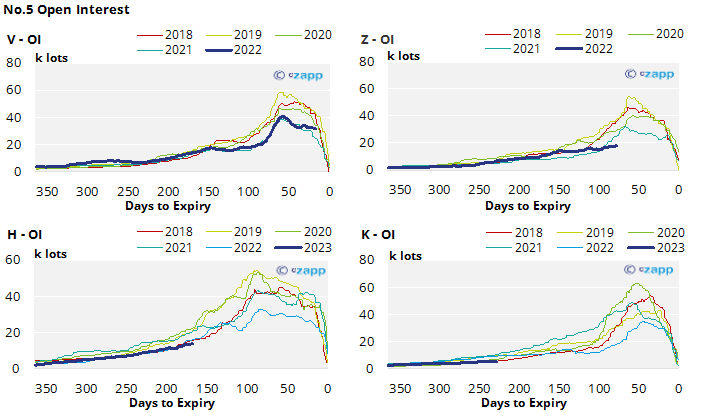

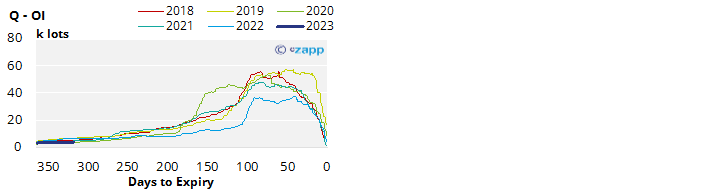

- By the 23rd of August white sugar speculators have slightly weakened their long position as the No.5 uptrend appears to have stalled – the net spec position now stands at just over 31k lots.

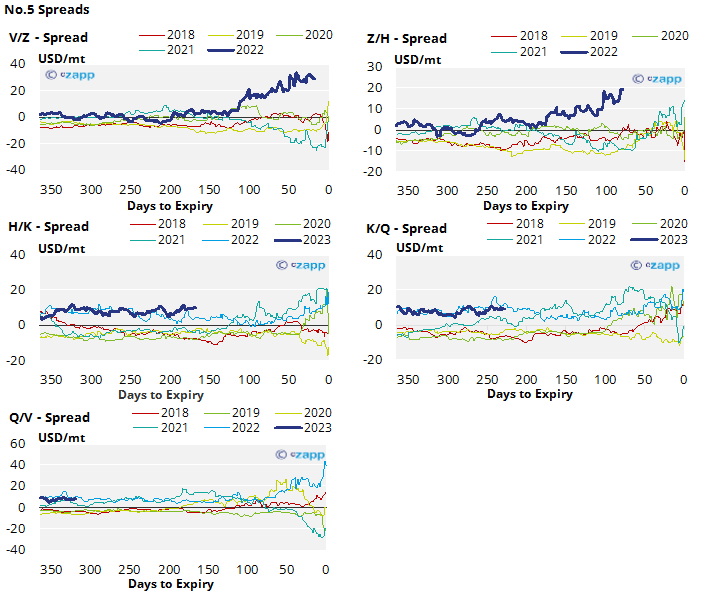

- The No.5 forward curve remains heavily backwardated into 2024, with spreads to May’23 each the widest in at least the last 5 years.

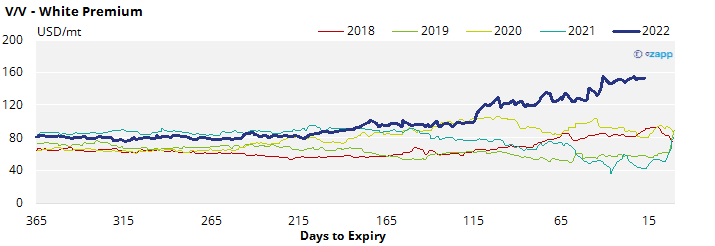

White Premium (Arbitrage)

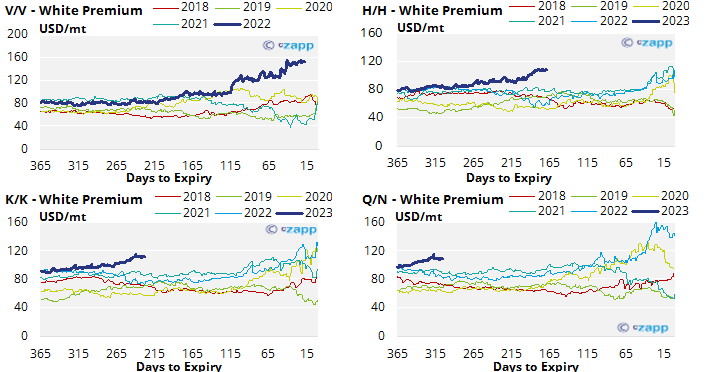

- The sugar white premium has moved sideways around 150USD/mt over the last week – this is reflective of current tightness in the refined sugar market.

- At this level we should see re-export refiners operating profitably and maximising their throughput.

- We think discretionary refiners will need upwards of 160USD/mt to start buying extra raws cargoes for re-export.

- Additionally the next H/H, K/K, and Q/N white premiums are all trading above 100USD/mt, these are unusually high this far in advance of their expiry.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…