Insight Focus

- No.11 prices have fallen slightly, yet No.5 values have continued strengthening.

- This means the white premium now trades above 130USD/mt, the highest in 9 years.

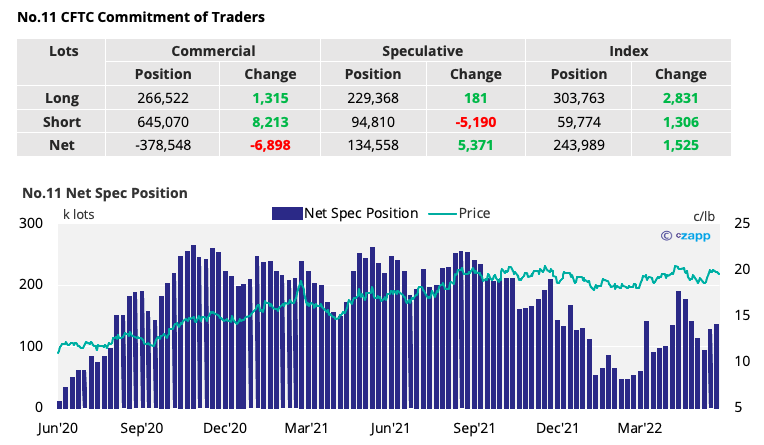

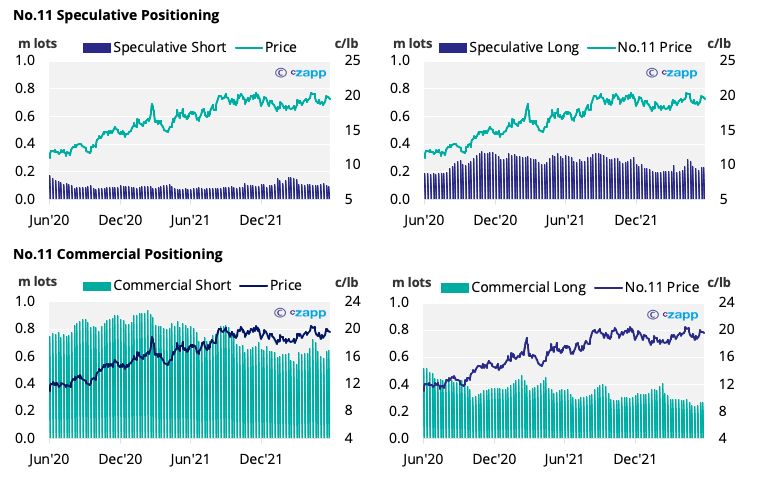

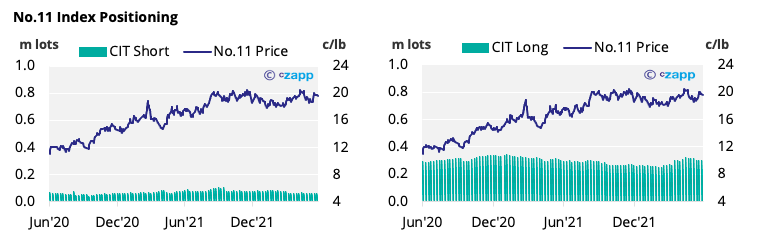

- Commercial and speculative positions have not changed drastically since the previous update.

New York No.11 (Raw Sugar)

- No.11 prices continue a gradual decline back below 20c and now sit above 19.5c/lb.

- As of the 23rd of May, despite falling prices, speculators closed 5k lots of their short positions –meaning the net spec position increased.

- Sugar producers continued to hedge, adding over 8k lots of cover with prices still nearer the top of the 18-20c/lb range.

- Consumers remain very poorly hedged, only increasing their position by around 1k lots.

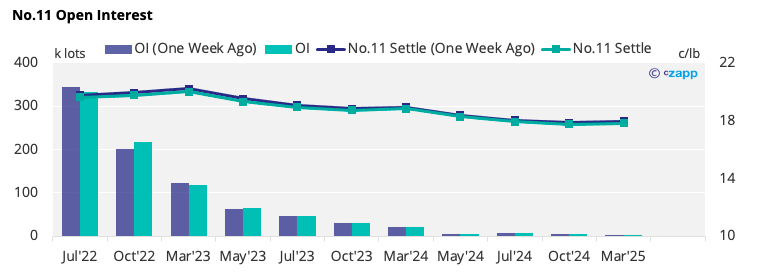

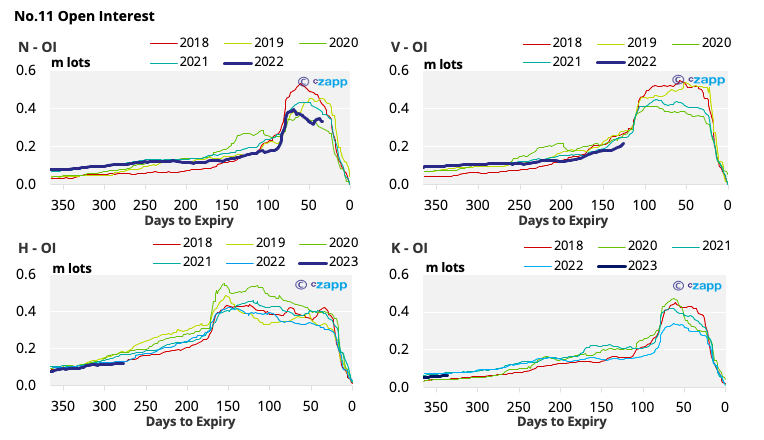

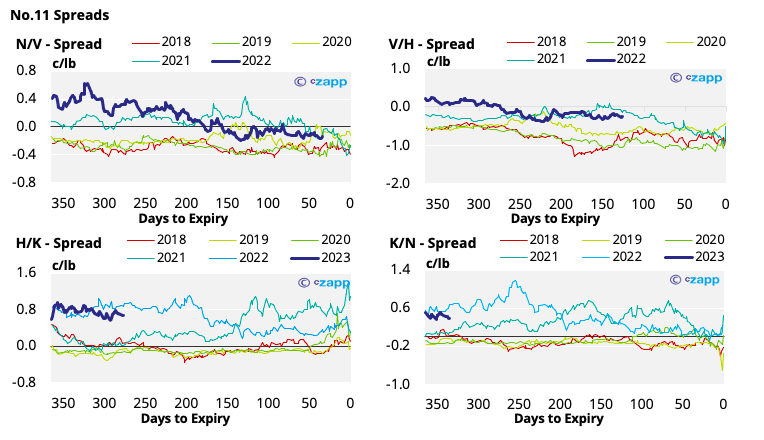

- The No.11 forward curve is still slightly contango towards H’23, then backwardated across 2023.

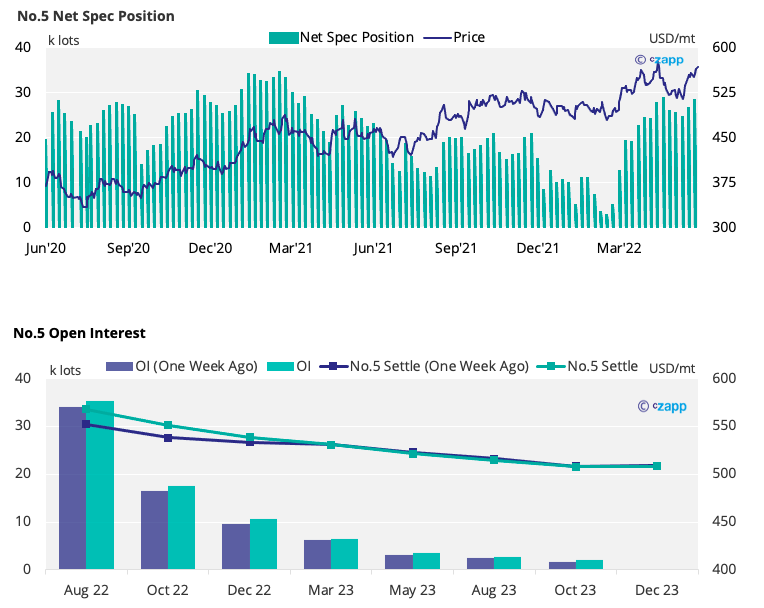

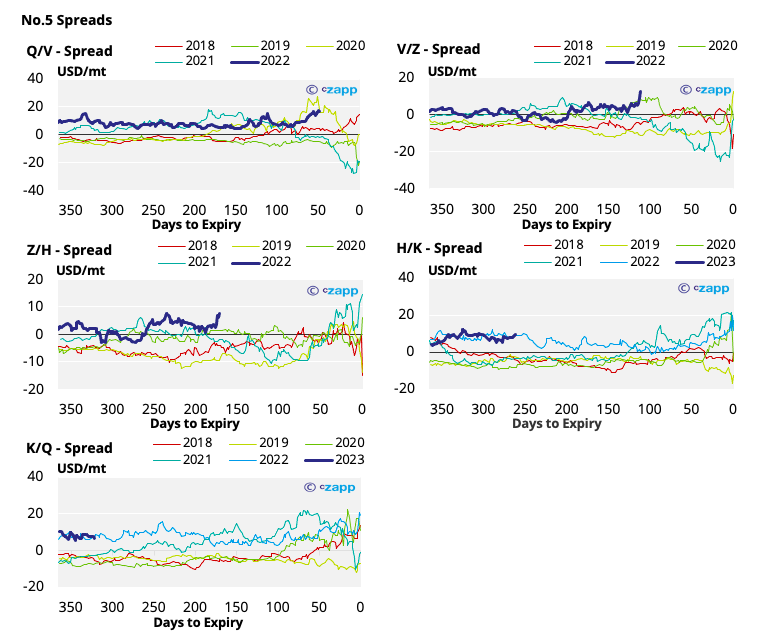

London No.5 (White Sugar)

- No.5 prices continue to rally, and have passed 570USD/mt.

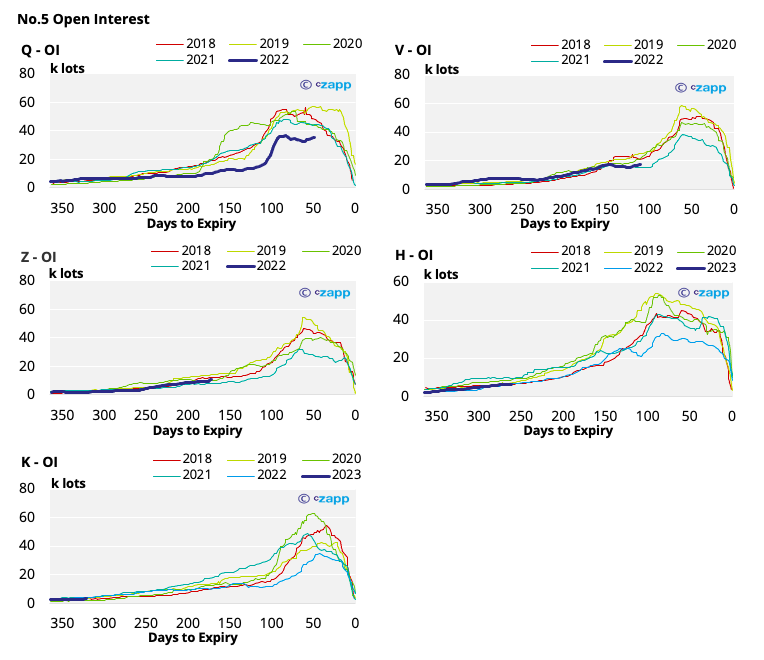

- By the latest CFTC COT update on the 23rd of May, the spec long rose by almost 2k lots, bringing the net spec position close to the 2022 high mark in April.

- The near month contracts have seen the most upwards pressure, significantly increasing the level of backwardation through to March 2023.

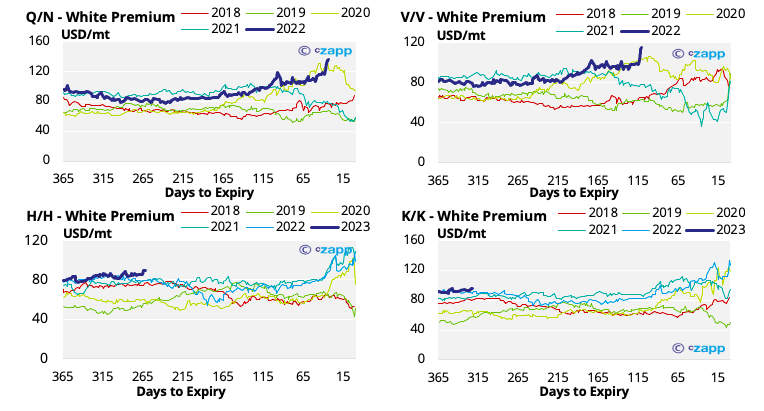

White Premium (Arbitrage)

- With the No.5 outperforming the No.11, the white premium has surged above 135USD/mt by close of trading last week. This is the highest level since June 2013.

- At this level re-export refiners should be able to comfortably operate profitably.

- With strong No.5 buying in the V’22 contract too, the V/V 22 arbitrage has rallied above 115USD/mt, the highest in at least the last 5 years.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…