Insight Focus

- Raw and refined sugar futures prices weakened last week, following two weeks of gains.

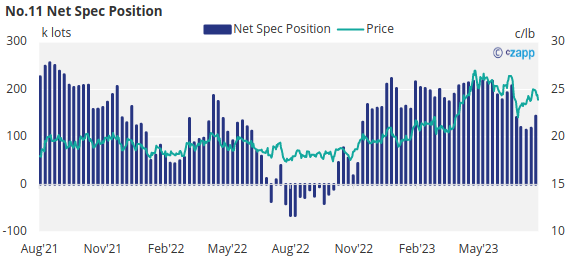

- Sugar speculators extended their long positions in the week until July 25th.

- The refined sugar net spec position is now the highest since April.

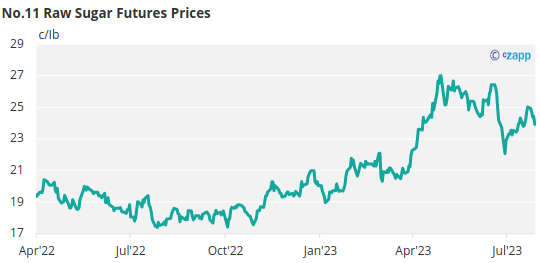

New York No.11 Raw Sugar Futures

No.11 raw sugar futures price fell away around 100 points to just under 24c/lb over the course of the last week of trading.

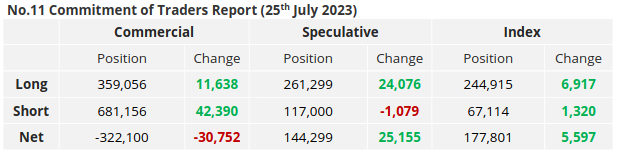

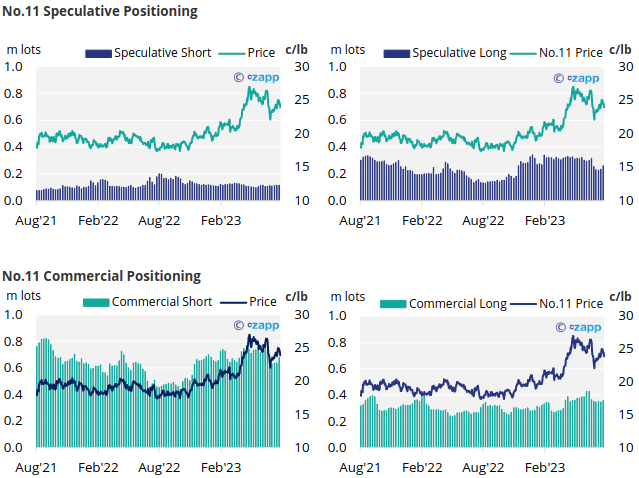

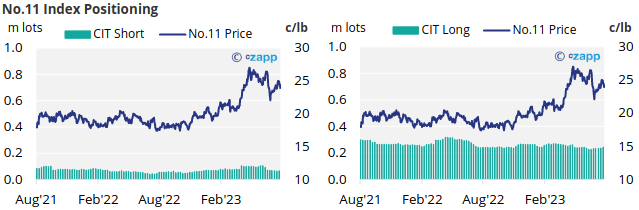

Prior to this, by the 25th of July (most recent CFTC CoT report), raw sugar speculators added 24k lots of new long positions and cut 1k lots of existing short positions.

This means the net spec position has extended by over 25k lots, the first meaningful increase since specs liquidated around half of their long position at the end of June.

Meanwhile the market offered opportunities for both raw sugar producers and consumers to advance their hedging, adding 42k and 12k lots of new hedges respectively.

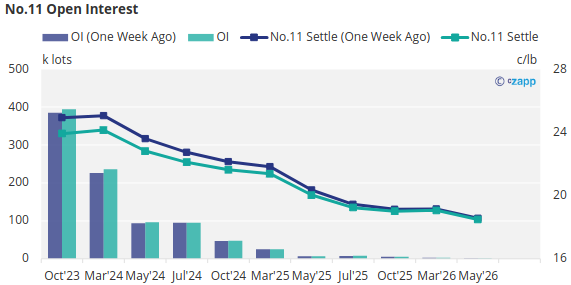

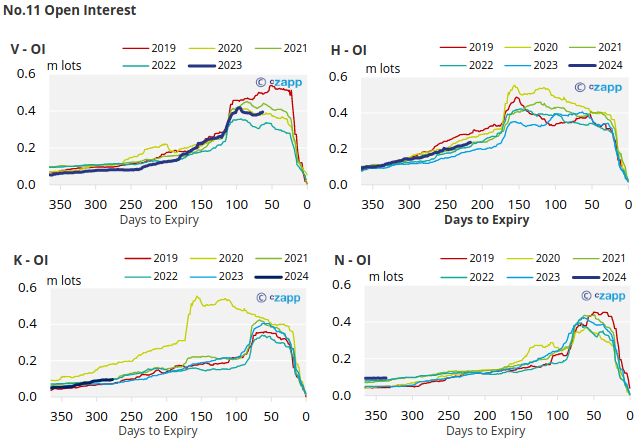

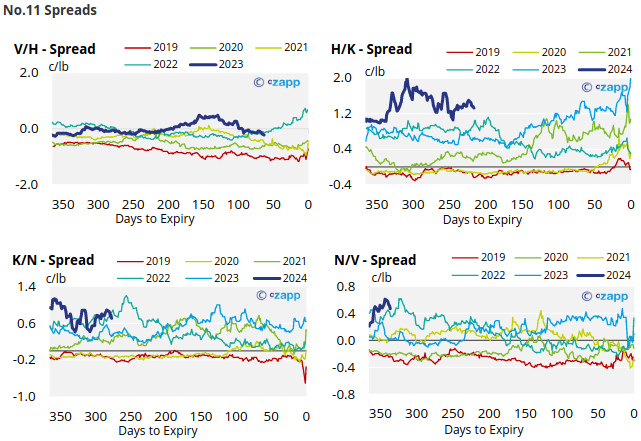

Whilst futures contracts weakened slightly all down the board over the last week, the V/H spread remains in carry, whilst the rest of the forward curve is still strongly backwardated.

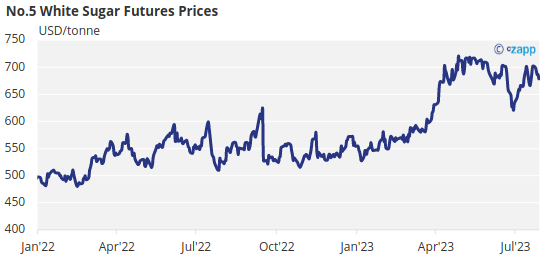

London No.5 Refined Sugar Futures

No.5 refined sugar futures prices similarly retreated over the previous week of trading, closing on Friday just below 680USD/tonne.

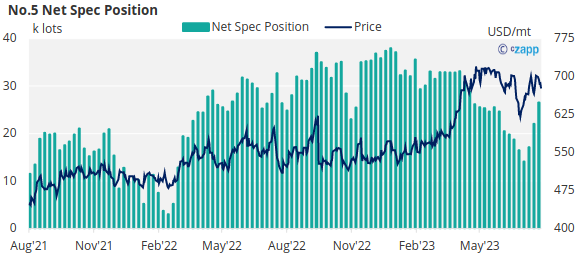

As can now be seen from the latest CoT report (covering the week leading to the 25th of July), the sharp gains made in that week may have been driven by refined sugar speculators who added 4.5k lots of new long positions.

This brings the refined sugar net spec position back to its highest since April.

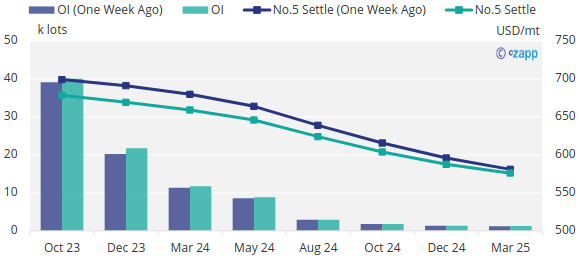

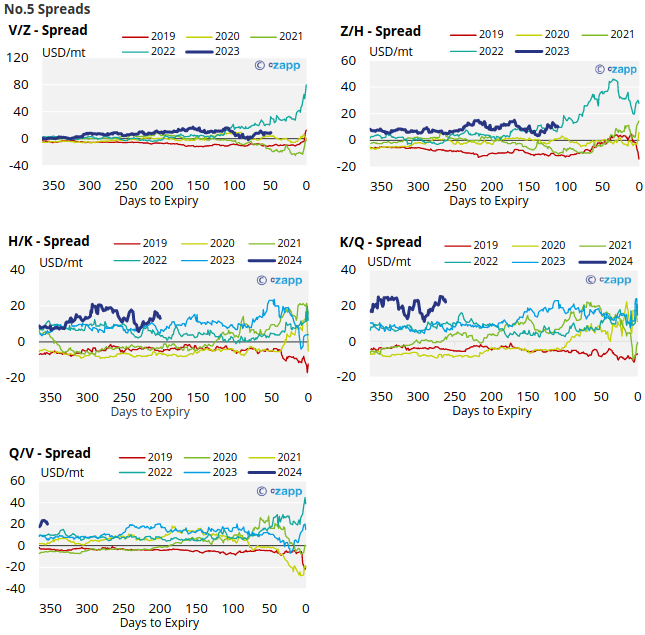

The refined sugar futures forward curve remains strongly backwardated out until at least March 2025.

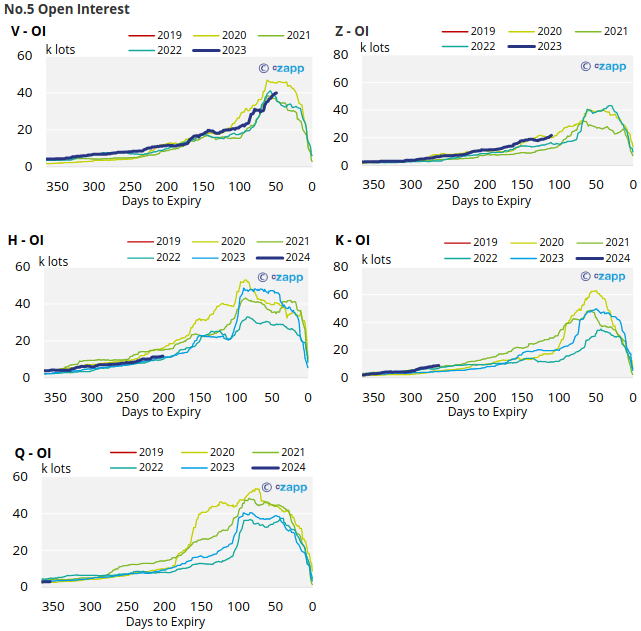

No.5 Open Interest

White Premium (Arbitrage)

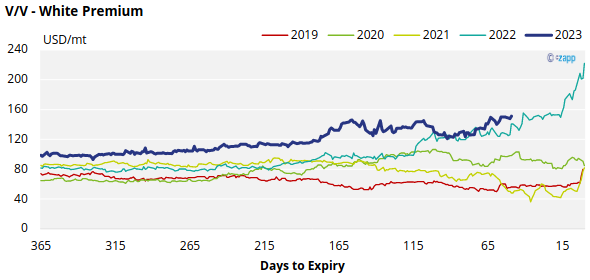

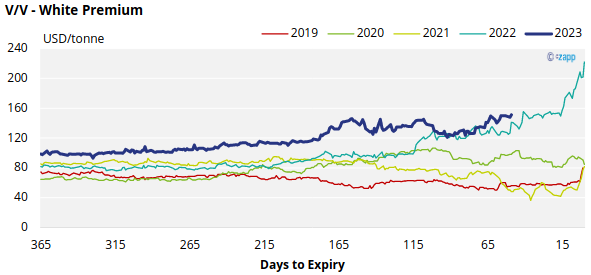

With both raw and refined sugar prices making similar moves over the last week, the V/V sugar white premium has remained stable at around 150USD/tonne.

We think many re-export refiners require at least 105-115USD/tonne over the No.11 to operate profitably meaning the white premium comfortably offer more than this for the moment.

The V/V white premium may also offer enough to incentivise discretionary refiners to re-export.

These are higher-cost refiners that usually only service their domestic markets but can re-export if the white premium is particularly strong. This reflects the current undersupply in the refined sugar market.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

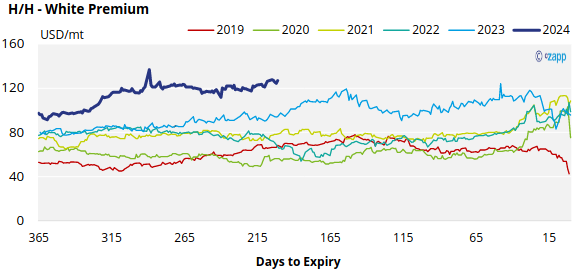

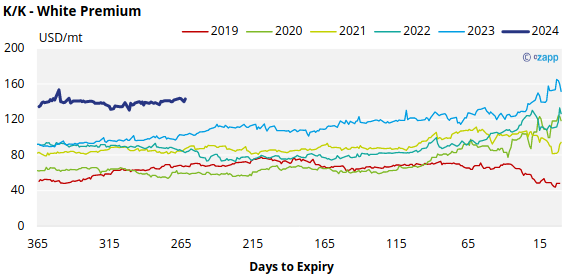

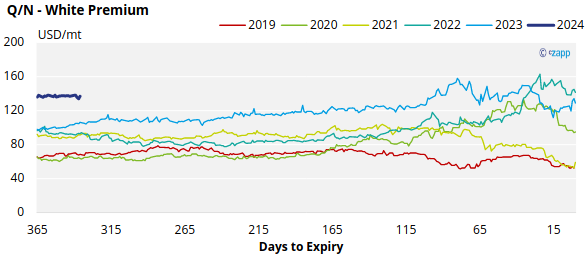

White Premium Appendix