Insight Focus

Raw sugar futures continued trading above 19c/lb over the past week. Speculators have reduced their net-short position. Producers took advantage of the price strength.

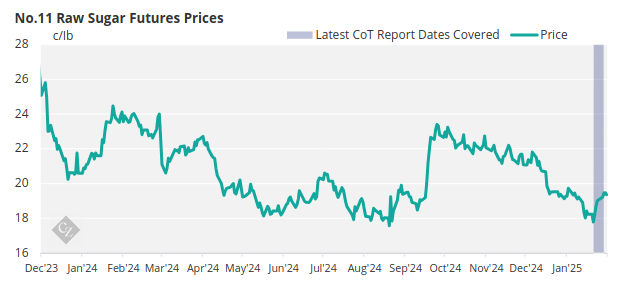

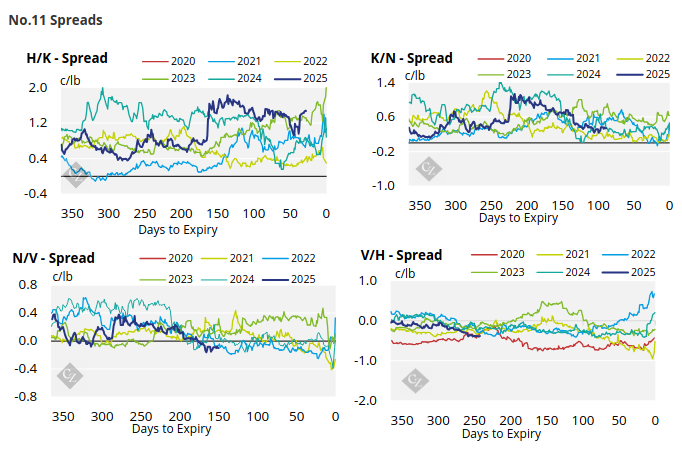

New York No.11 Raw Sugar Futures

The No.11 raw sugar futures continued trading above 19c/lb over the past week.

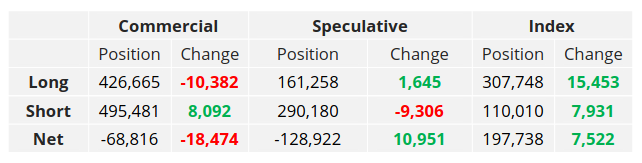

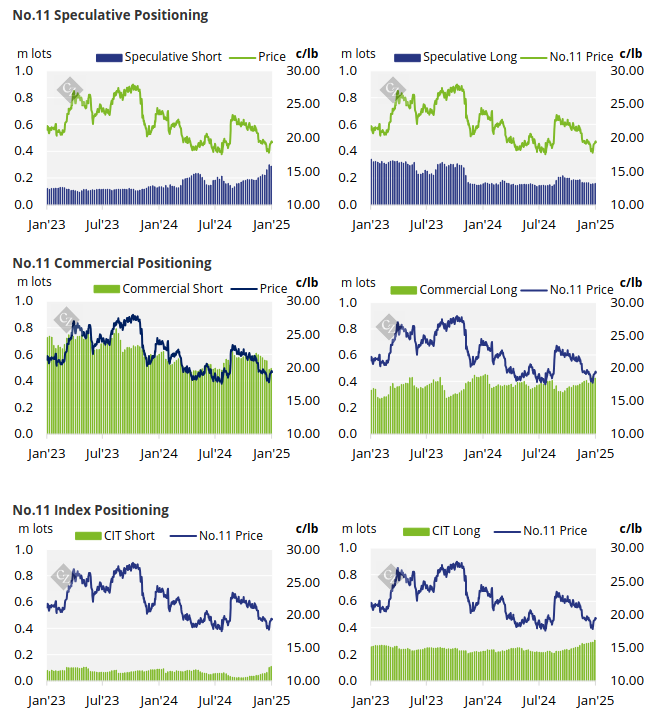

Producers took advantage of the higher prices, opening 8.1k lots of short positions. End-users, on the other hand, have closed out 10.4k lots of long positions bringing the net commercial position down 18.5k to 68.8k lots.

No.11 Commitment of Traders Report (28 January 2025)

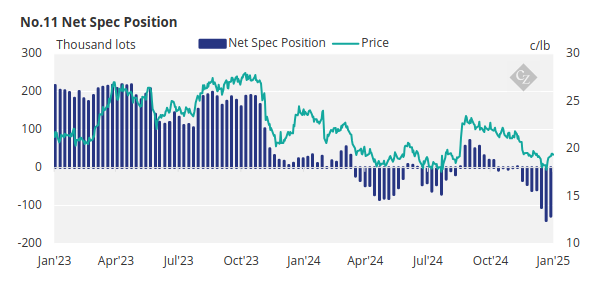

Turning our attention to the speculators, they have closed out 9.3k lots of short positions reducing their net short position to -128.9k lots.

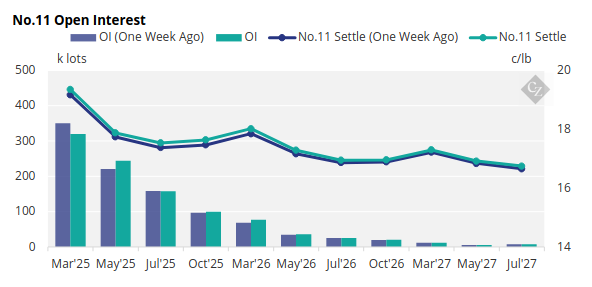

The No. 11 forward curve has strengthened across the board.

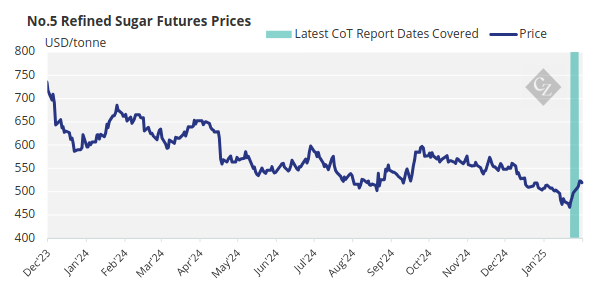

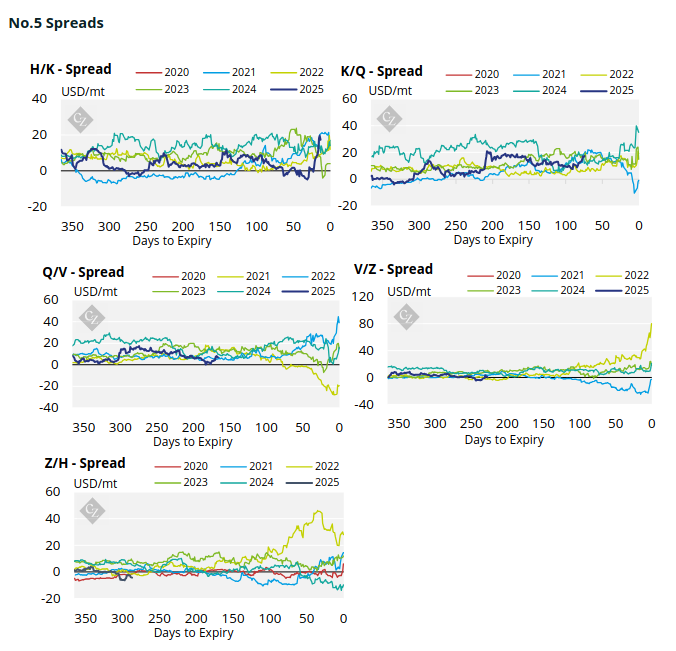

London No.5 Refined Sugar Futures

The No. 5 refined sugar futures climbed higher throughout the week, starting at USD 507/tonne on Monday before closing at USD 519.5/tonne.

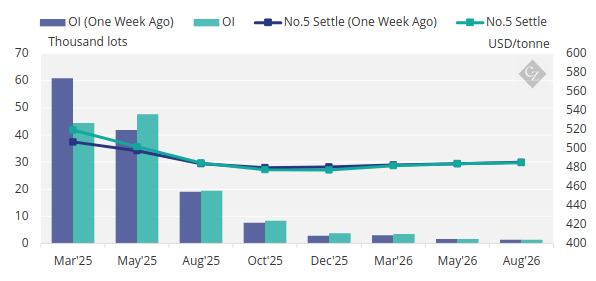

No.5 Open Interest

The No.5 refined sugar futures curve has strengthened towards the front of the curve.

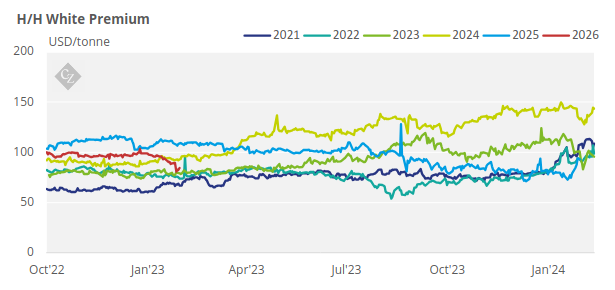

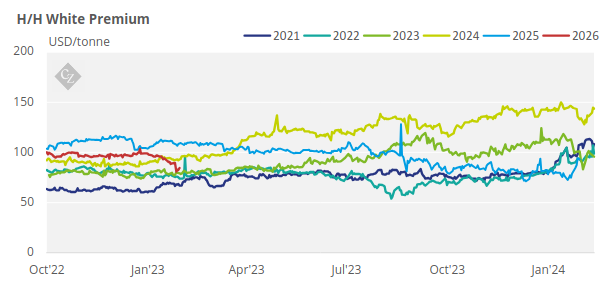

White Premium (Arbitrage)

The H/H white premium traded higher over the past week between USD 84-93/tonne.

This is below the level at which many of the world’s re-export refiners can operate profitably.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

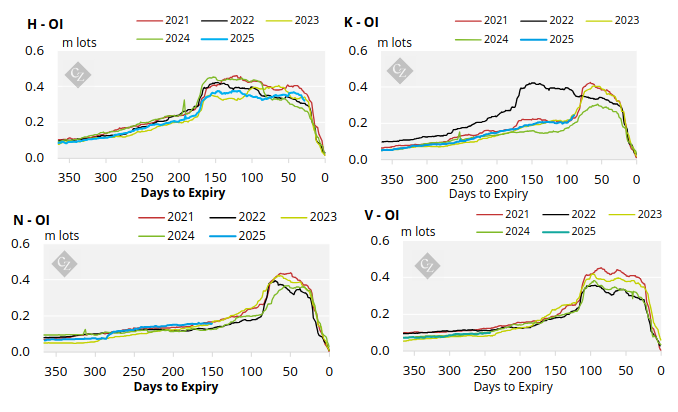

No.11 Open Interest

No.5 (White Sugar) Appendix

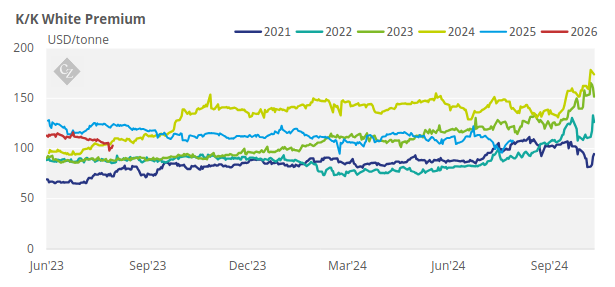

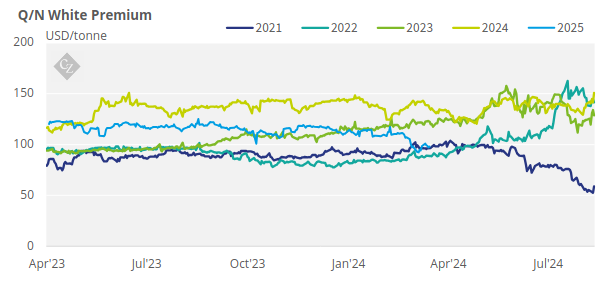

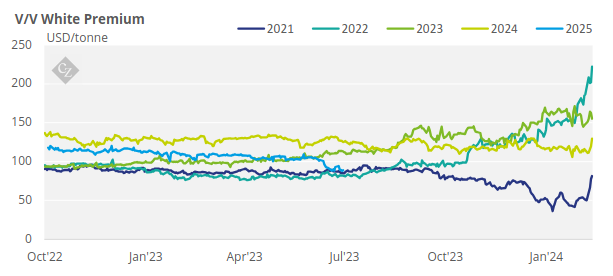

White Premium Appendix