Insight Focus

- Raw sugar futures have fallen sharply in the last week.

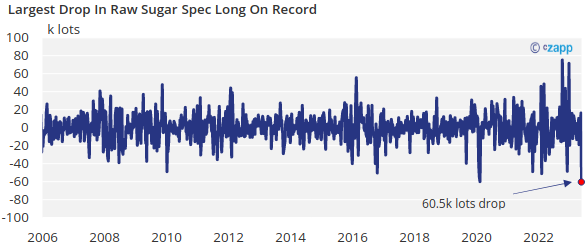

- Speculators have closed a record number of long positions.

- The July futures expired last week at a 10pt premium to the October.

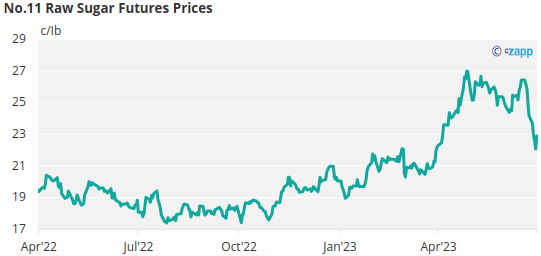

New York No.11 Raw Sugar Futures

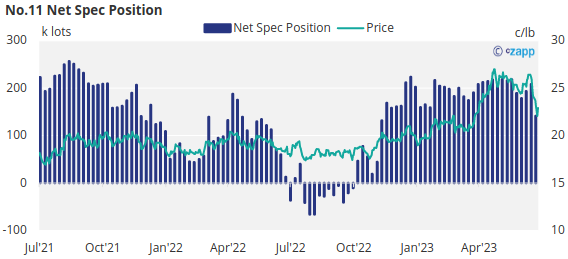

Raw sugar futures weakened significantly over the last 7 trading days leading up to the Jul’23 expiry, falling from 25.9c/Ib to 22.8c/Ib last Friday.

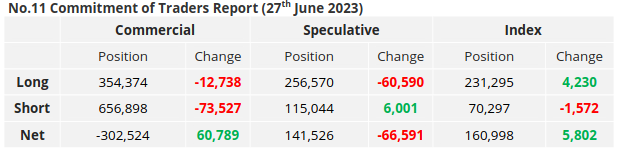

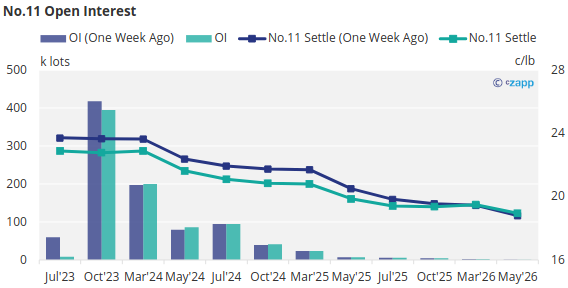

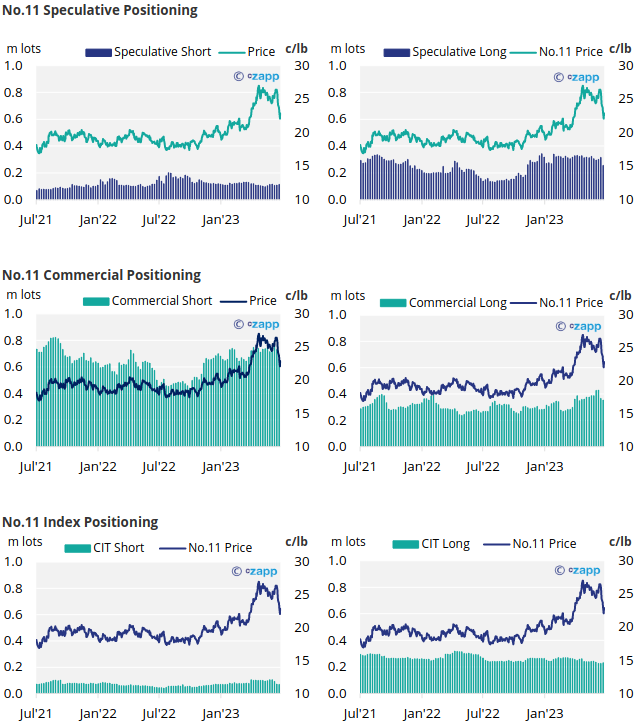

As a result, by the 27th of June (the most recent CoT CFTC report), both raw sugar producers and consumers had closed a significant number of positions, 73.5k and 12.7k lots, respectively; these were most likely hedges being closed before the expiry.

Turning our attention to the speculators, they have closed the largest number of long positions on record in the last week.

The spec short position has increased slightly (6k lots), meaning the overall net spec position has decreased by over 66.5k lots.

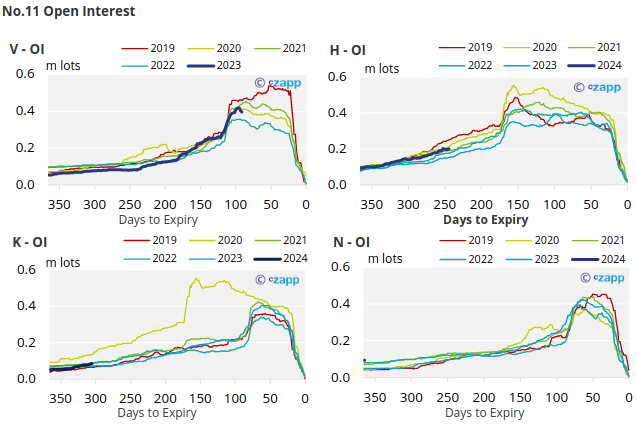

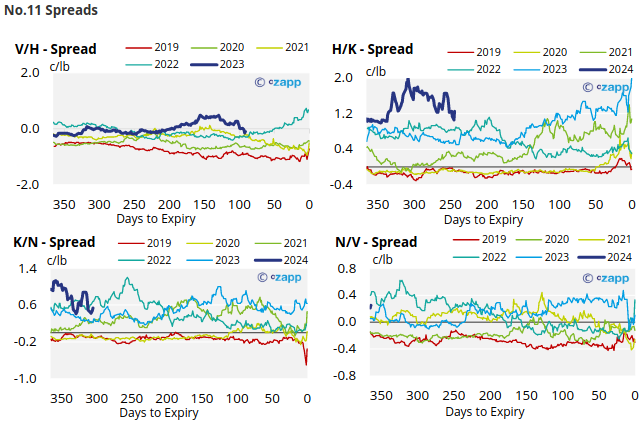

The No.11 forward curve is flat to Mar’24 before becoming fully backwardated from Mar’24 to May’26.

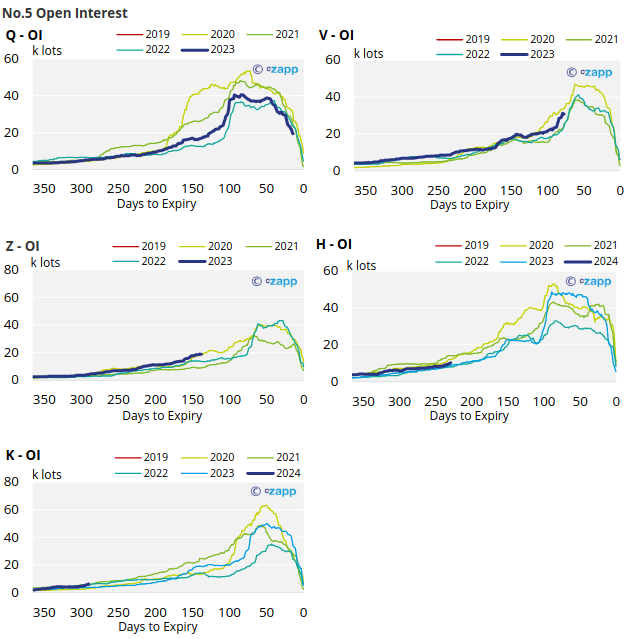

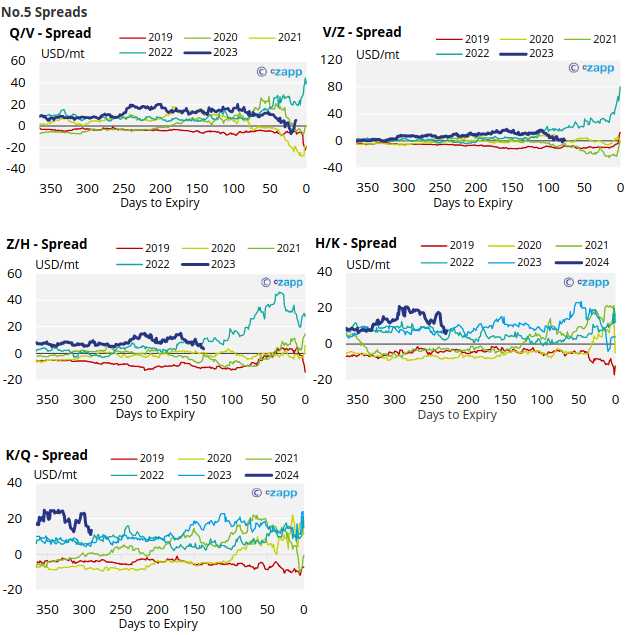

London No.5 Refined Sugar Futures

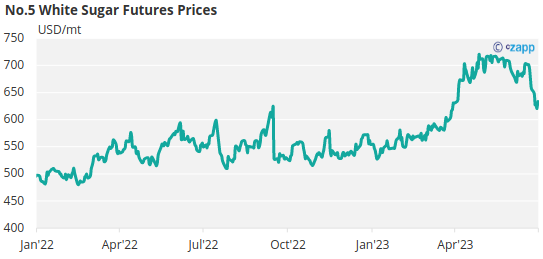

Similar to the No.11, the No.5 refined sugar price has also weakened significantly over the past week, falling from 648USD/mt at the start of the week to 633USD/mt last Friday.

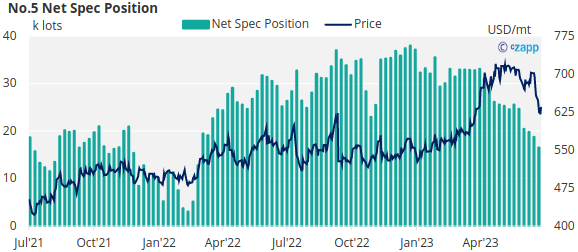

Refined sugar speculators, who have been steadily reducing their long position for several weeks, have closed over 2.3k lots of positions in the last week. As a result, the net spec position has shrunk to just under 16.5k lots.

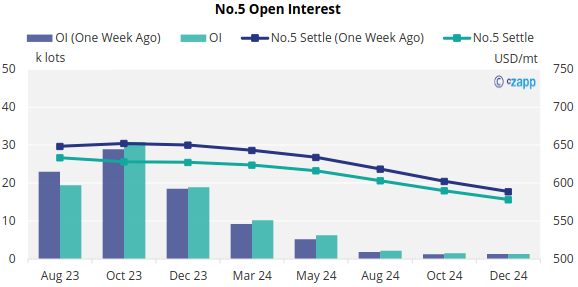

The No.5 forward curve remains inverted through to December 2024.

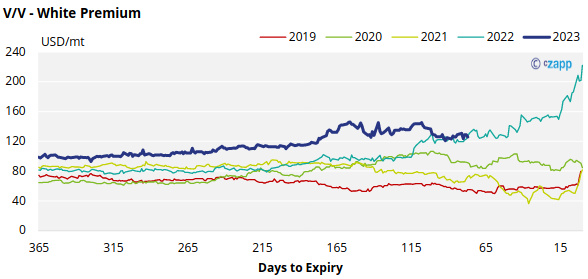

White Premium (Arbitrage)

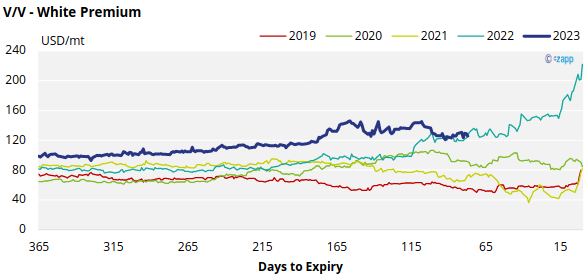

The V/V sugar white premium has strengthened slightly over the past week, now trading at 126USD/mt.

Many re-exports refiners need around 110-120USD/mt above No.11 to produce refined sugar, so the current white premium is just enough to encourage this.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

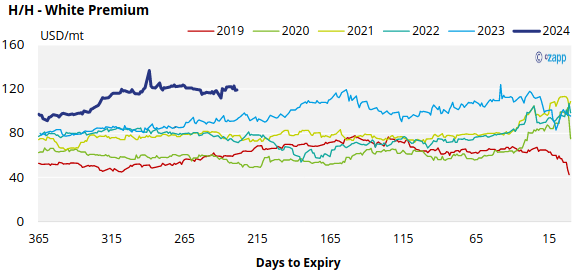

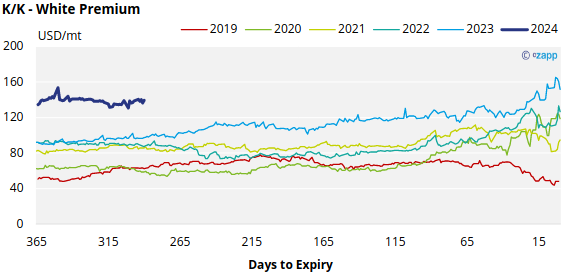

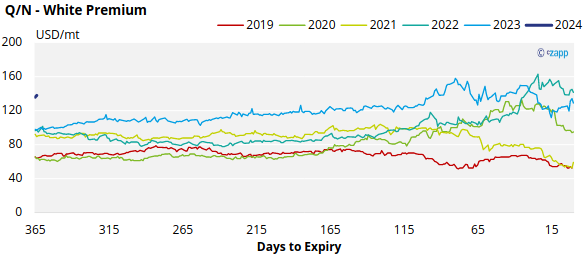

White Premium Appendix