Insight Focus

- The No.11 has traded sideways around 19.5 c/lb this.

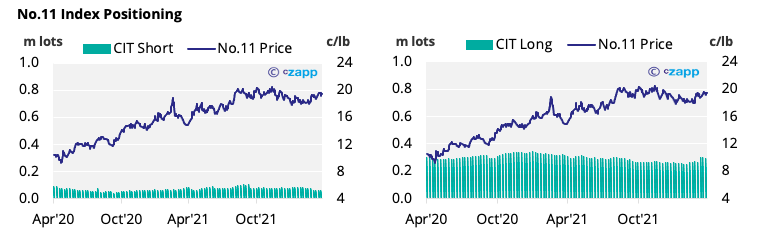

- The raw sugar net speculative position is still gradually increasing.

- The white premium has narrowed by 20 USD/mt.

New York No.11 (Raw Sugar)

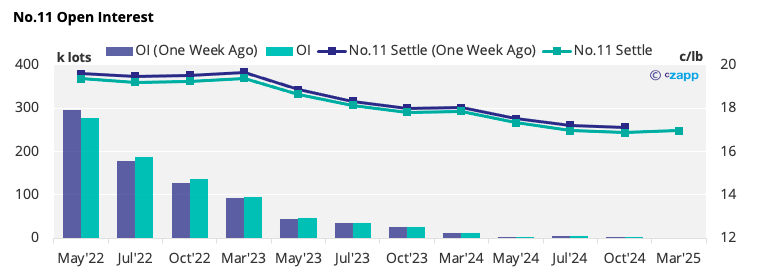

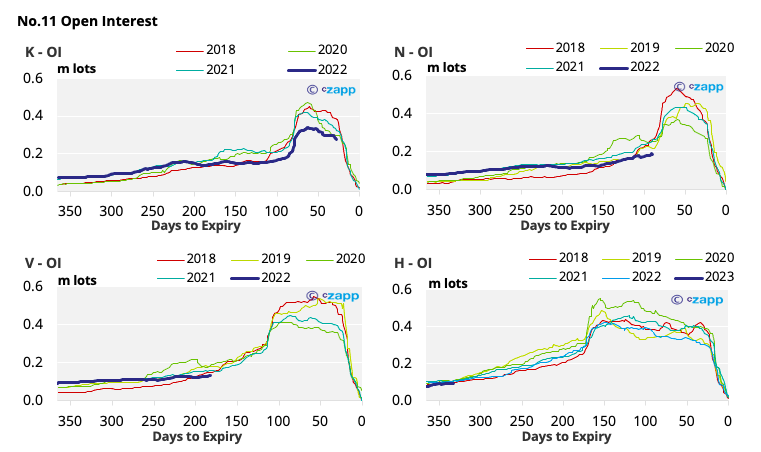

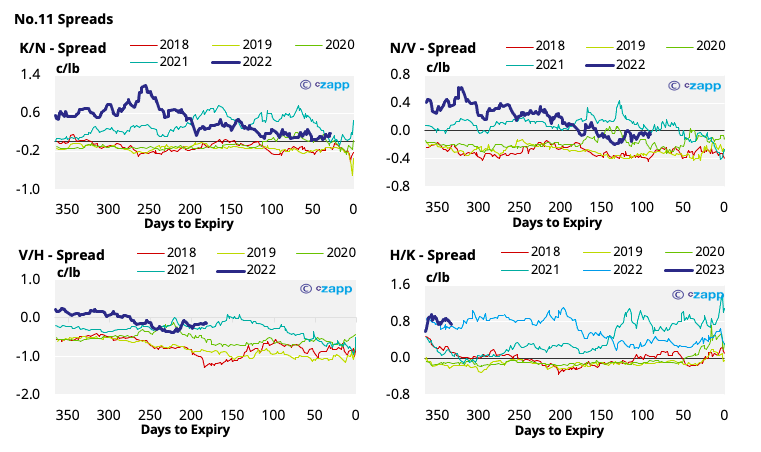

- The No.11 has barely moved this week and remains just below 19.5 c/lb.

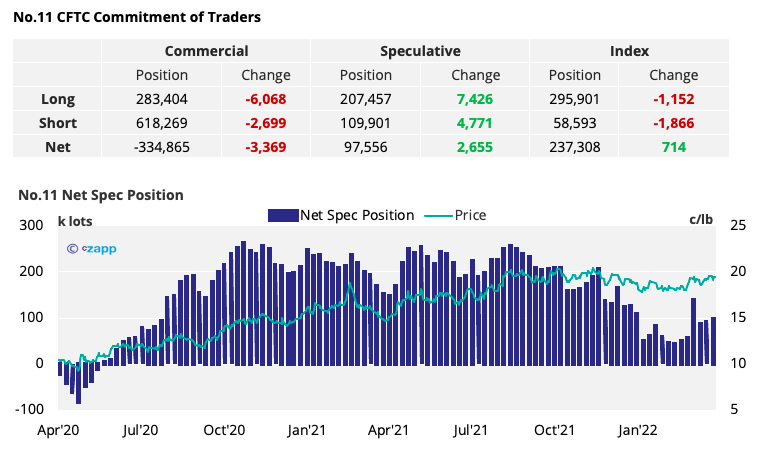

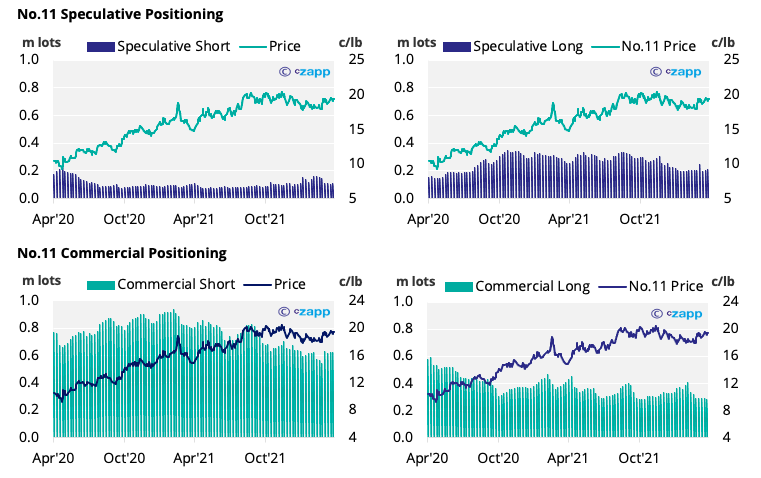

- The speculative long has increased again by just 2.7k lots.

- Interestingly, speculators added to their short and long positions, perhaps indicating a lack of consensus.

- There was also a small decrease in the commercial long and short positions.

- The forward curve remains mostly flat across the rest of 2022.

London No.5 (White Sugar)

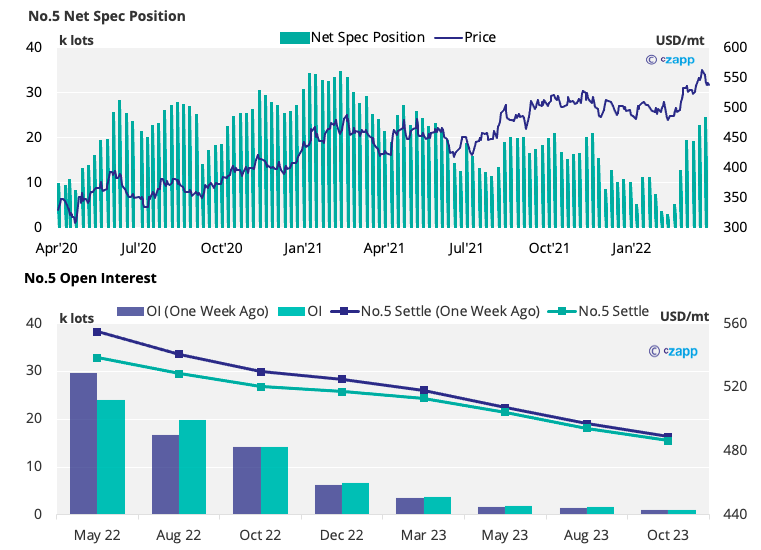

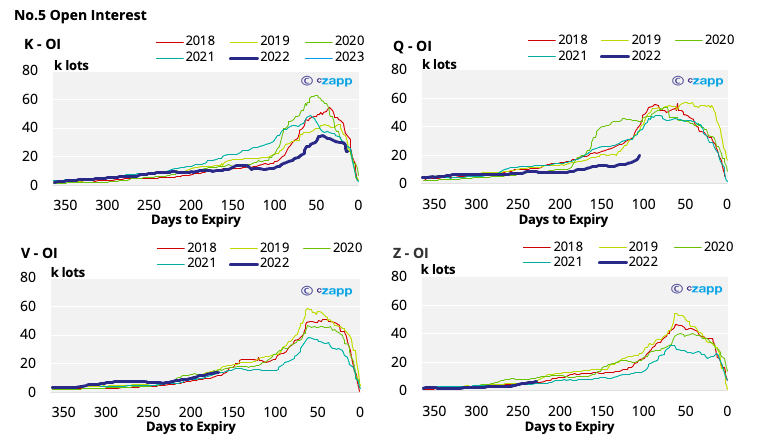

- The No.5 has retreated to 540 USD/mt, reducing the white premium to around 110 USD/mt.

- The forward curve has flattened quite significantly for 2022 but remains backwardated.

- However, the spec long position has continued to climb and, at 24.5 k lots, is now the largest since May 2021.

White Premium (Arbitrage)

- The white premium has fallen by nearly 20 USD/mt as the No.5 drops.

- The K/K now sits at 112 USD/mt.

- With slightly weaker energy prices, we think this is close to fair value for re-export refiners.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

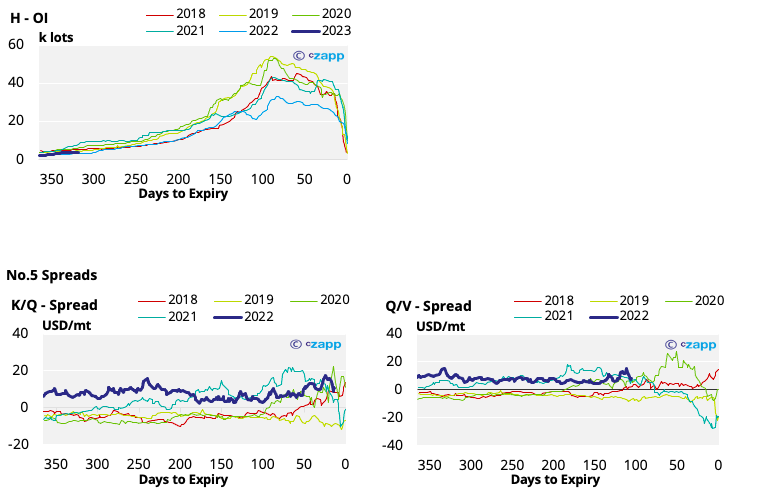

No.11 (Raw Sugar) Appendix

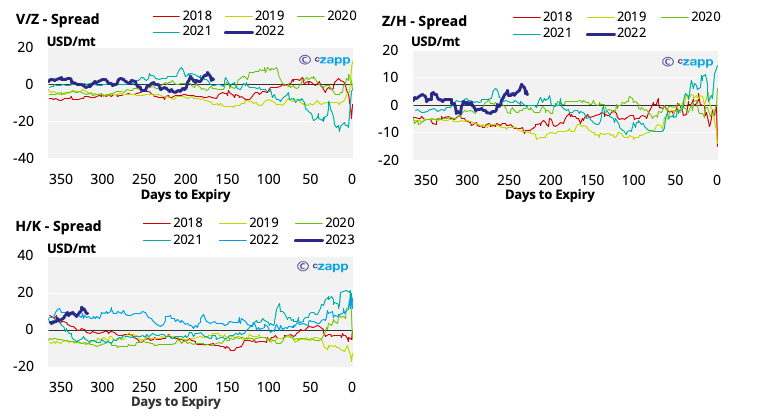

No.5 (White Sugar) Appendix

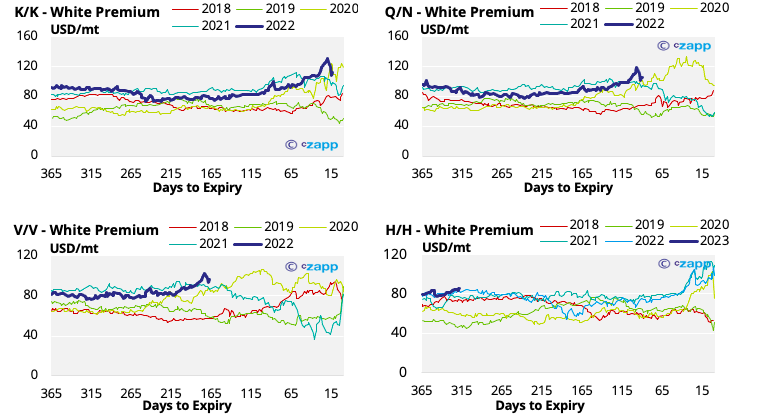

White Premium Appendix

Other Insights That May Be of Interest…