Insight Focus

- The No.11 continues to test the bottom of the 18-20c/lb range.

- White premium falls as Q/N arbitrage comes off the board.

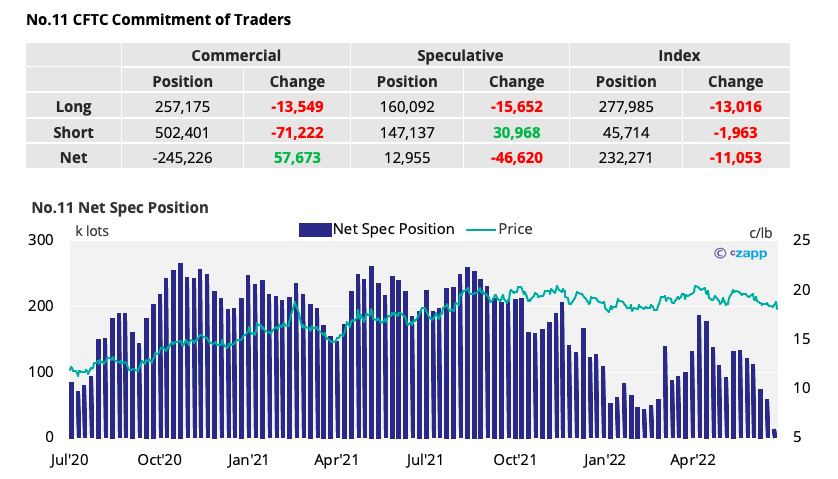

New York No.11 (Raw Sugar)

- Following the July expiry on Thursday last week the raw sugar market fell close to 18c as we move to the Oct’22 contract.

- This is right at the bottom of the current range, and the lowest the No.11 has been since before the Russian invasion of Ukraine.

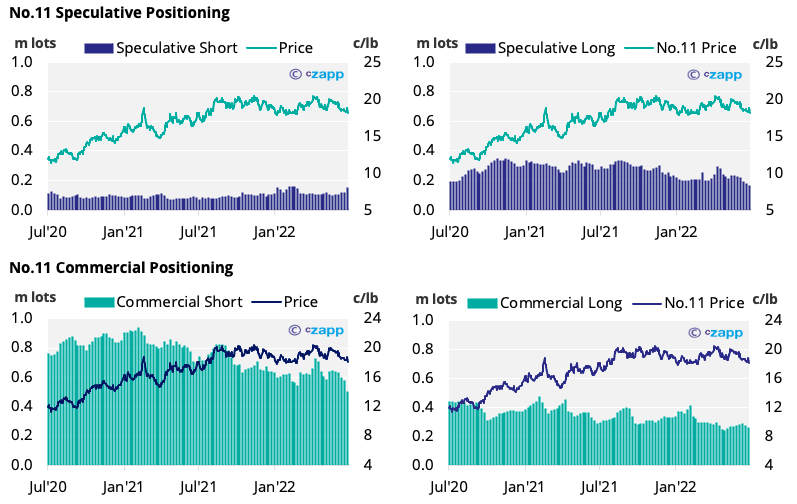

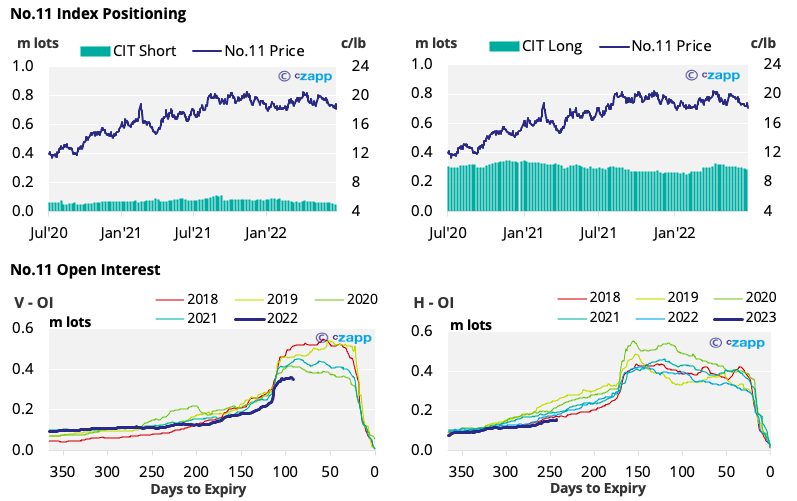

- Whilst this further drop will not yet be reflected in the CFTC COT report, as of the previous week (28th of June) almost 31k lots of speculative short positions were opened, along with the closure of over 15k spec long positions.

- This move indicates a continuation in the shift towards a more negative speculative outlook for sugar and leaves the net spec position at 12k lots, the lowest since June 2020 when the No.11 was near 10c.

- Equally the commercial short position fell by over 71k lots as hedges are rolling off quickly.

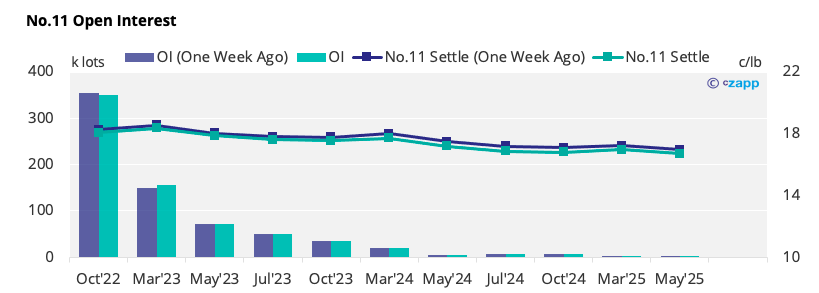

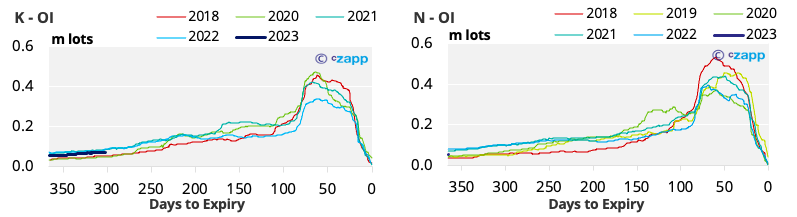

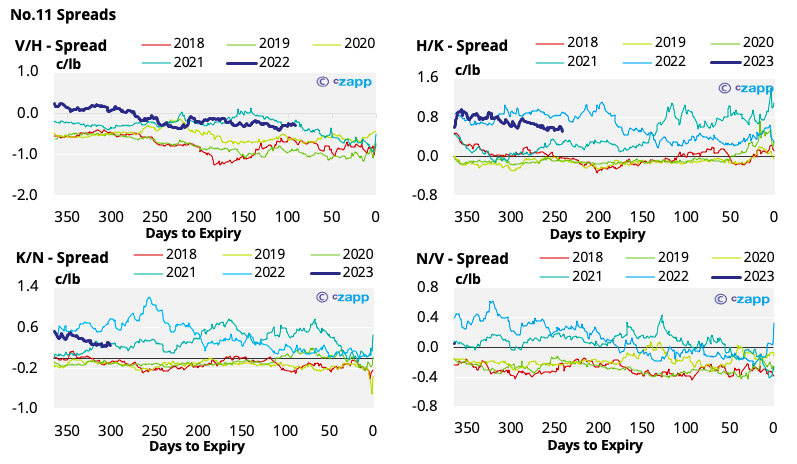

- The No.11 forward curve is now fairly flat across the rest of 2022 and into 2023.

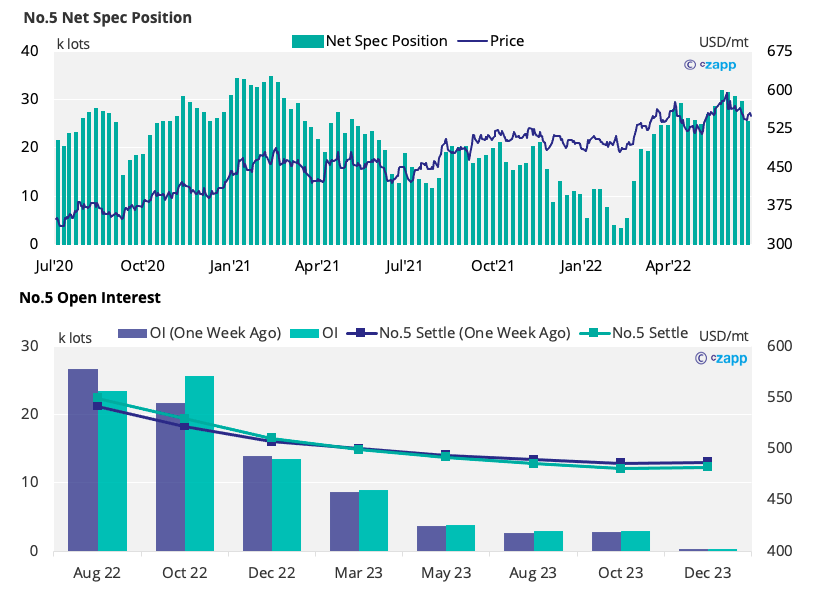

London No.5 (White Sugar)

- The No.5 continues to move around 550USD/mt.

- By the 28th of June when prices were weakening the white sugar net spec position reduced by 4k lots to 25k, this is still quite high in the context of the last 12 months.

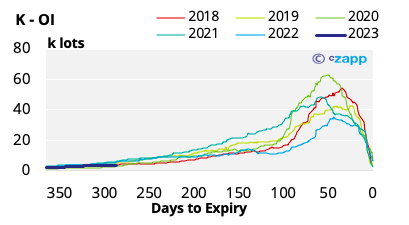

- The white sugar forward curve is increasingly backwardated across 2022 and 2023 – all 2022 spreads are at a strong premium.

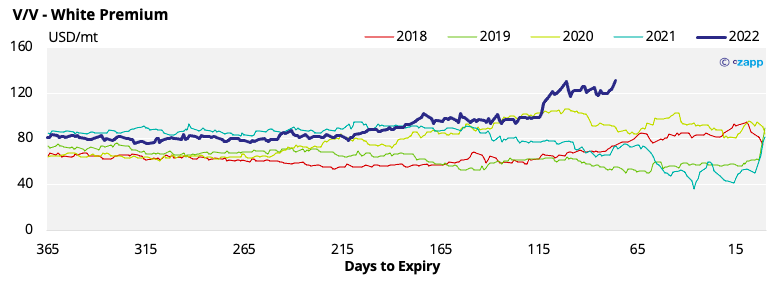

White Premium (Arbitrage)

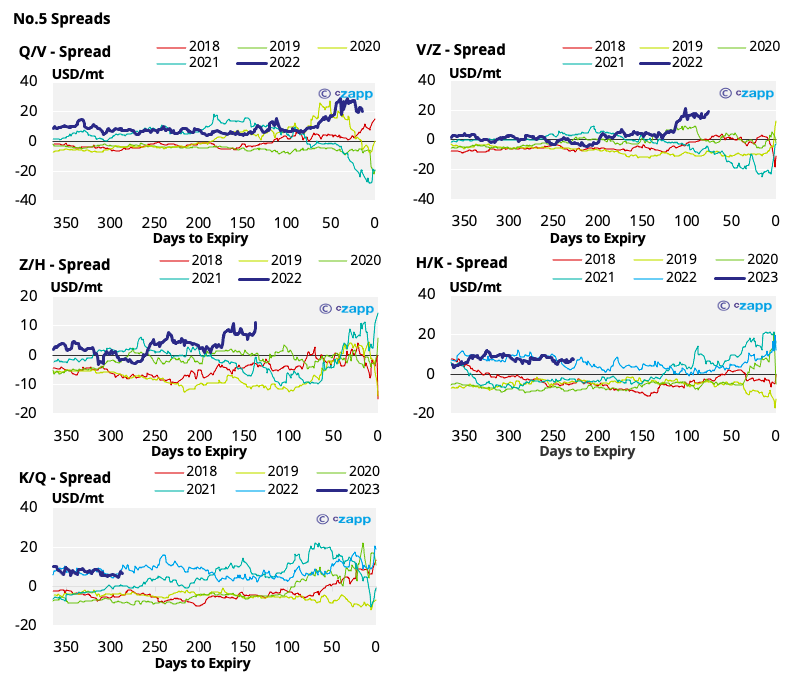

- Falling the No.11 July expiry, the V’22/V’22 white premium has strengthened to above 130USD/mt as the No.11 weakens further – this is around 10USD/mt lower than the outgoing Q’22/N’22 white premium before it expired.

- At this level re-export refiners should still be able to operate profitably, however it is not likely that discretionary refining is possible – this could reduce short term refined sugar supply if this lower white premium persists.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

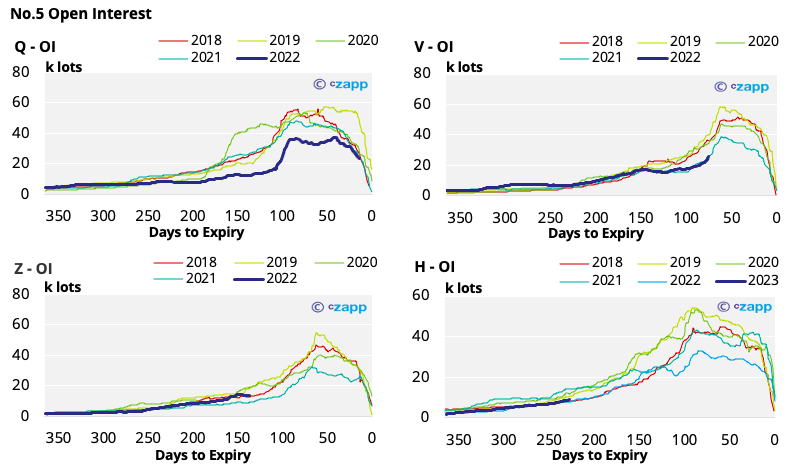

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

PET Raw Material Futures Outlook: PET Export Prices Fall Sharply, Attracts Fresh Demand