Insight Focus

- Sugar speculators have been put under pressure.

- Consumers are still very poorly hedged.

- The white sugar net spec position has reduced after months of increase.

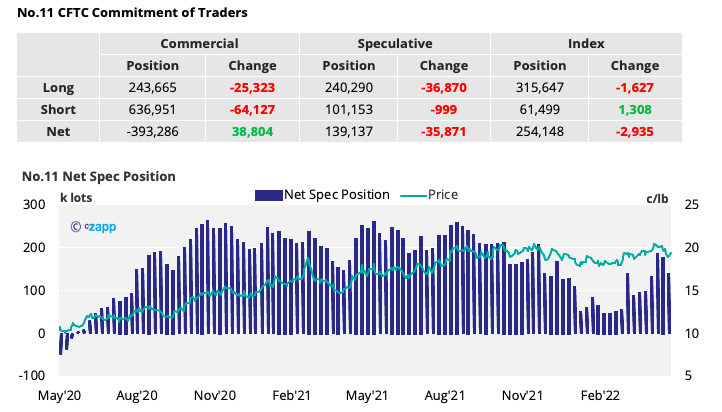

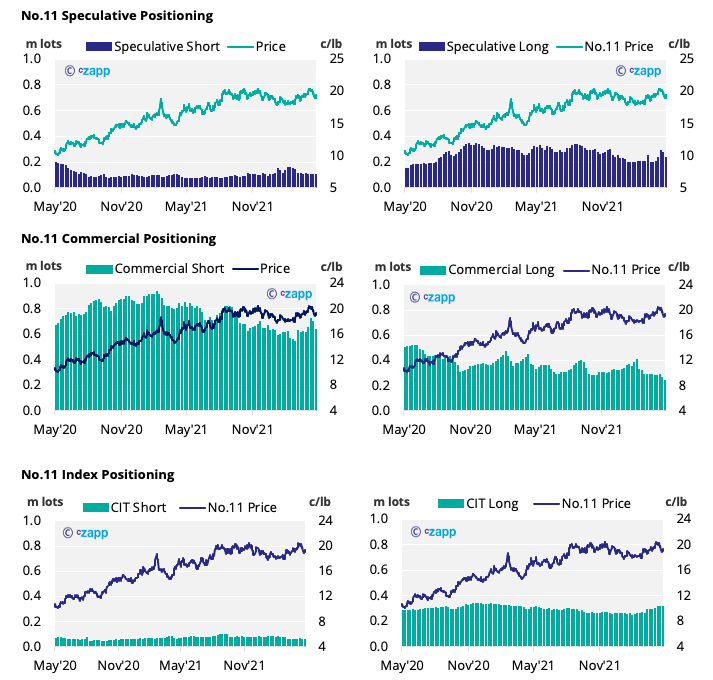

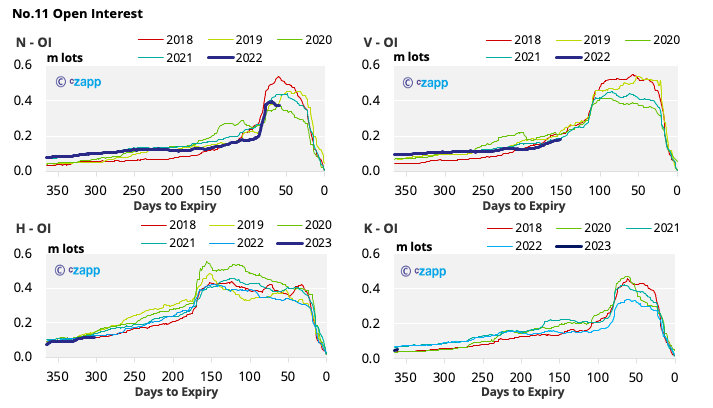

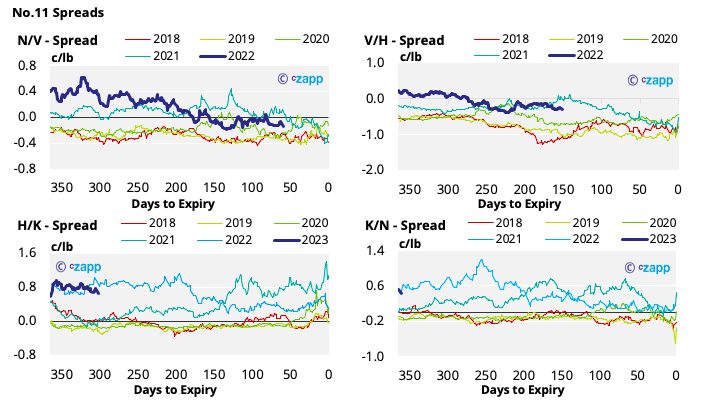

New York No.11 (Raw Sugar)

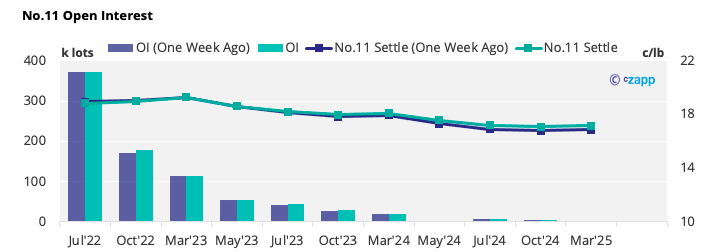

- As of April 26, the total commercial position has reduced by almost 90k lots ahead of the May’22 expiry.

- Sugar consumers now hold the lowest share of open interest since 2016, thus remain very poorly hedged.

- Falling prices have seen many recent spec long positions challenged, with nearly 37k lots closed by April 26, fuelling further decline in the No.11.

- Raw sugar prices have now stabilised just below 19c/lb following a retreat through the second half of April.

- The No.11 forward curve is still slightly contango towards H’23, then backwardated across 2023.

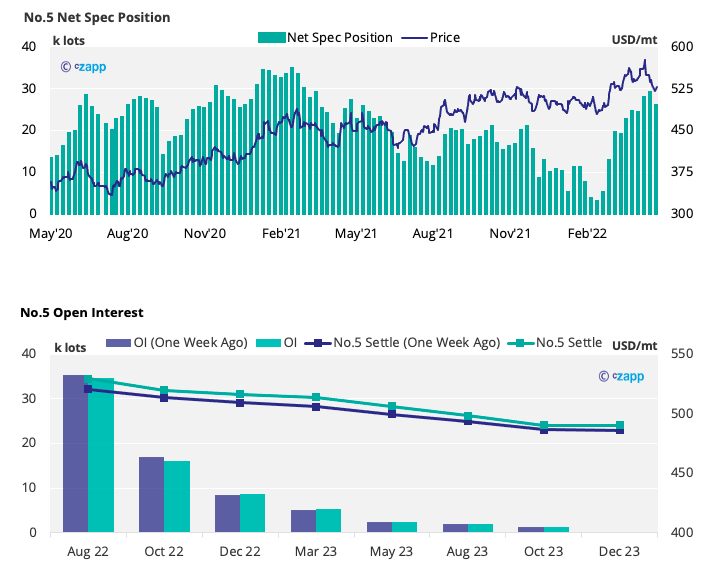

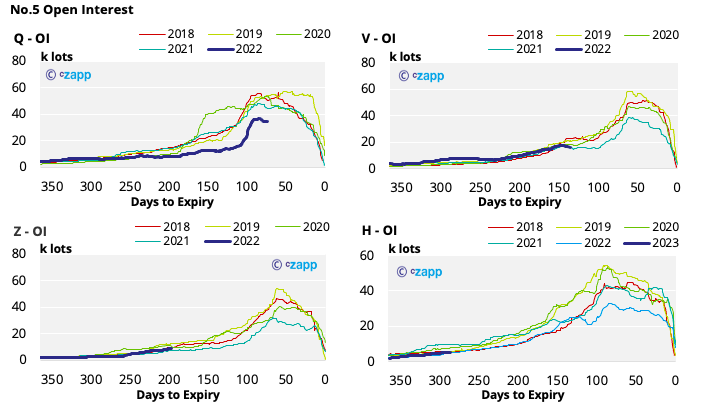

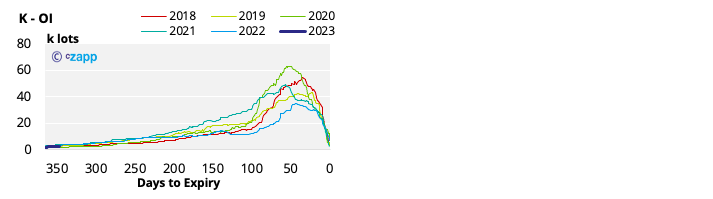

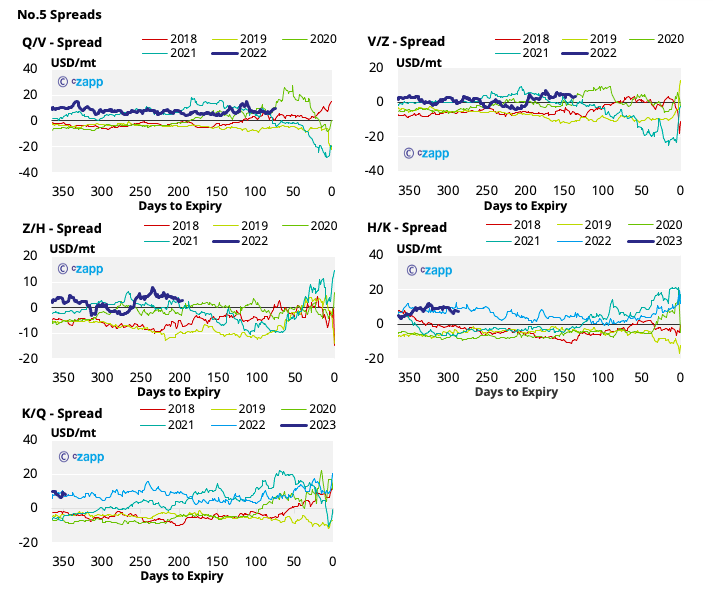

London No.5 (White Sugar)

- By April 26, the white sugar net spec position fell by 3k lots, the largest drop since January.

- This has helped move the No.5 downwards, which now sits above 520 USD/mt.

- White sugar prices have fallen all down the board, leaving the futures curve similarly backwardated across 2022 and 2023.

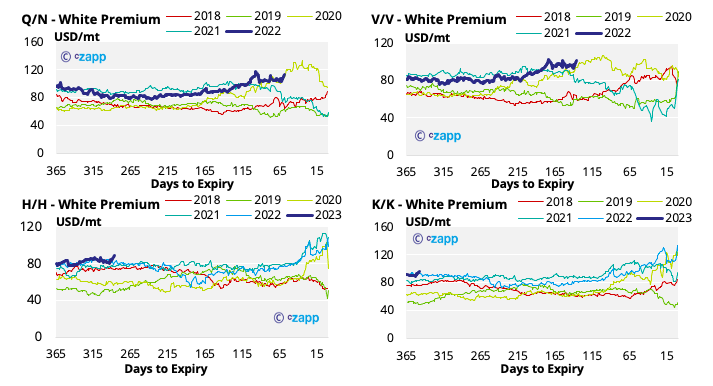

White Premium (Arbitrage)

- With both the No.11 and No.5 weakening in recent weeks, the Q/N white premium is currently around 110USD/mt.

- We think some re-export refiners may struggle to operate profitably at this level.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…