Insight Focus

Raw sugar futures prices traded between 21.9-22.8c/lb over the past week. Both producers and end-users have added to their positions. Both the No.11 and No.5 futures curves remain in backwardation.

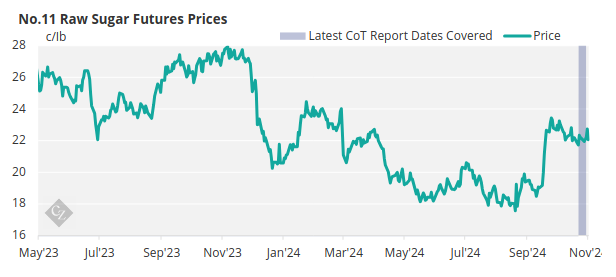

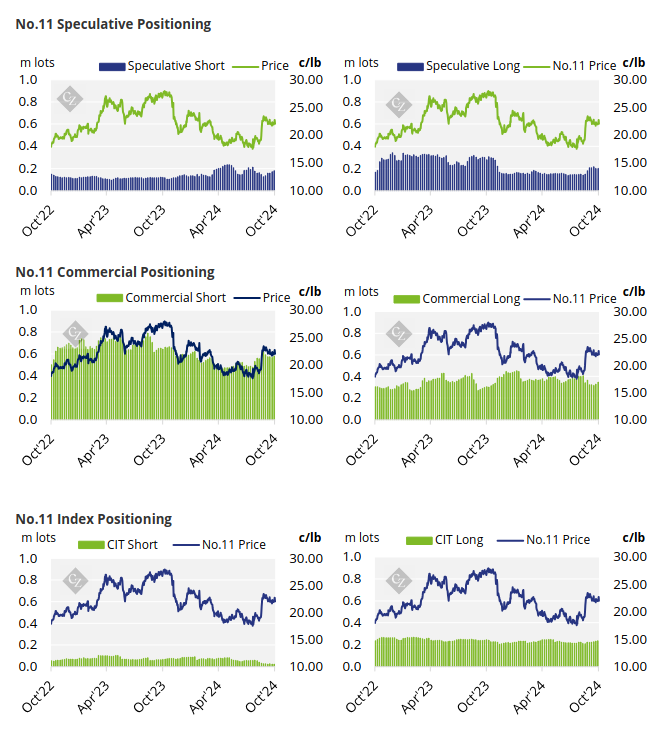

New York No.11 Raw Sugar Futures

The raw sugar futures market traded between 21.9-22.8c/lb over the past week and closed at 22.1c/lb on Friday.

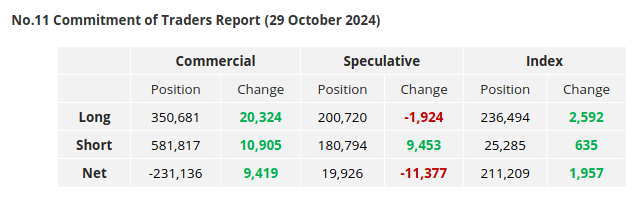

Both producers and end-users have added to their positions as producers opened 10,900 lots of shorts, while end-users added 20,300 lots of long positions. Overall, commercial participants are relatively well-covered in the raw sugar market today.

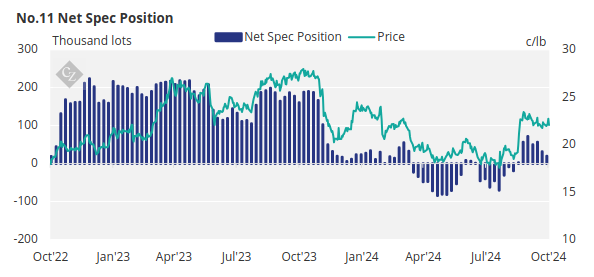

Speculators have reduced their long position by just under 2,000 lots and further opened 9,500 lots of short positions.

The net spec position currently stands at 19,900 lots long.

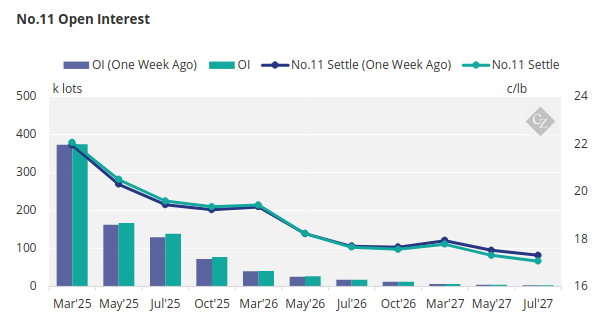

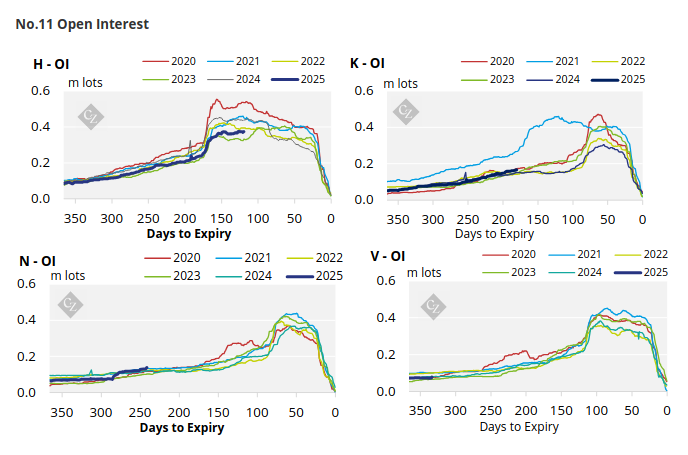

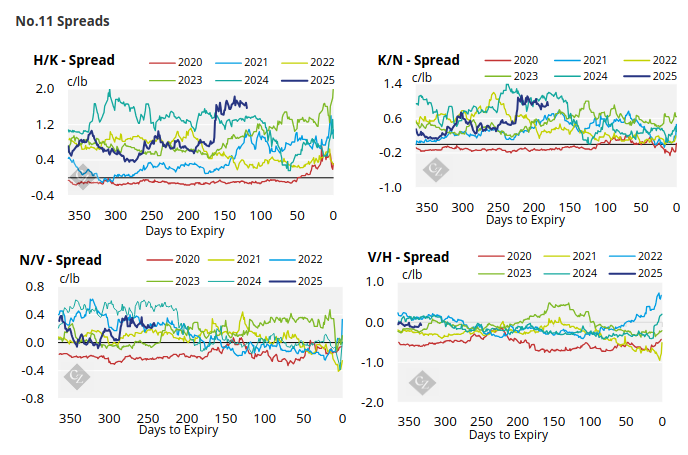

The No.11 futures curve remains in backwardation and has weakened slightly between March and July 2027.

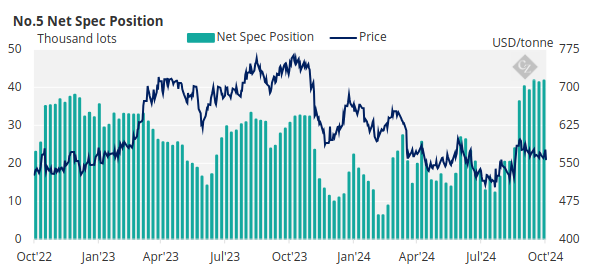

London No.5 Refined Sugar Futures

The No.5 refined sugar futures traded between USD 558-576.5/tonne, closing at USD 558/tonne on Friday.

Speculators have opened 429 lots of long positions, bringing the net spec position up to 41,800 lots.

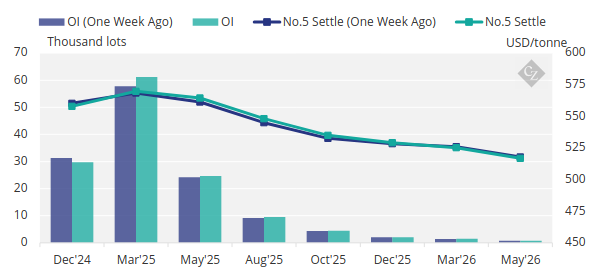

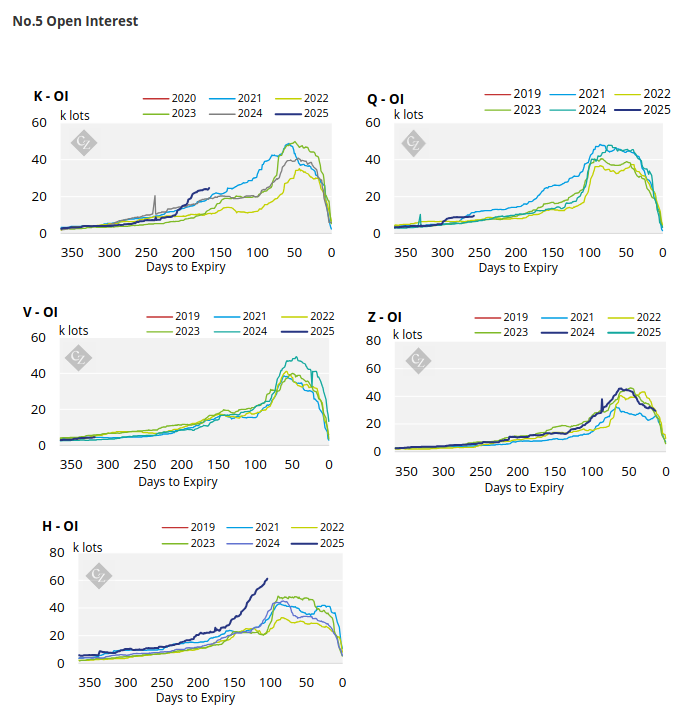

No.5 Open Interest

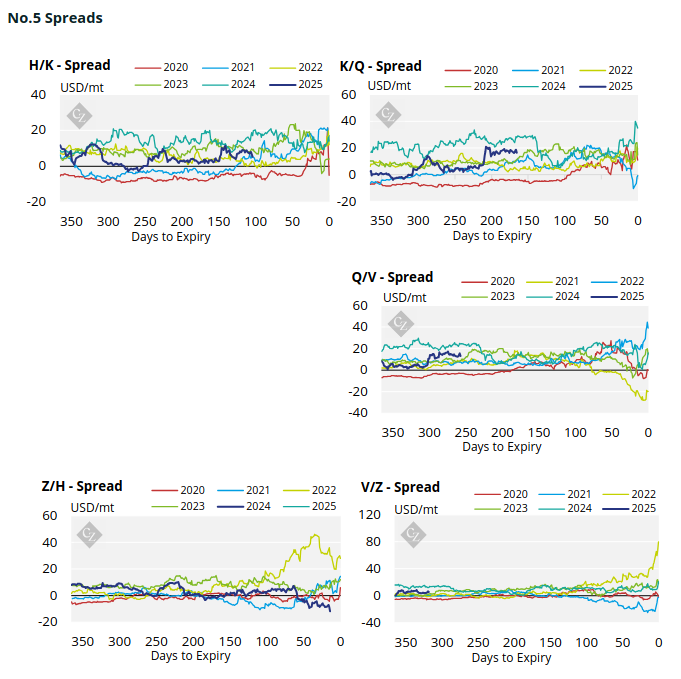

The No.5 refined sugar futures curve has flattened across majority of the board.

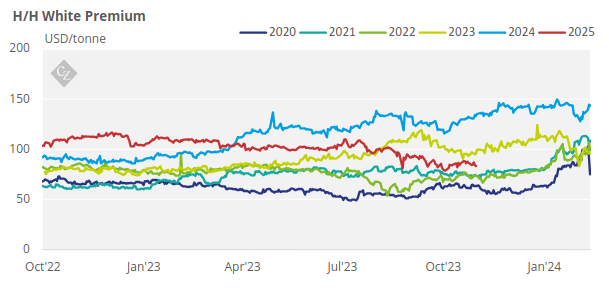

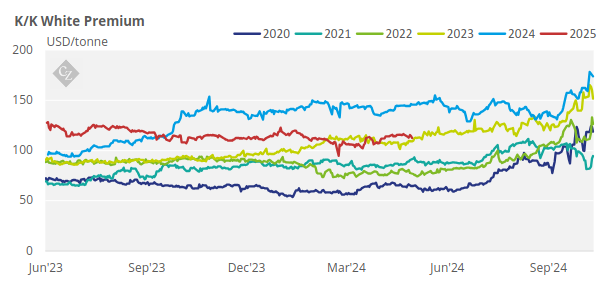

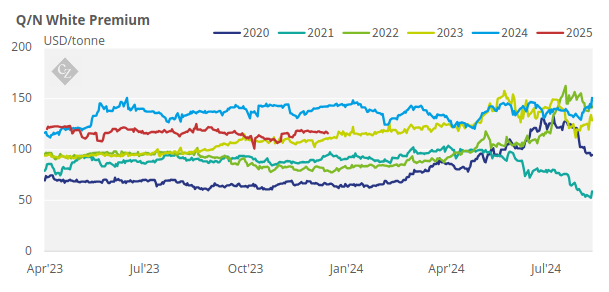

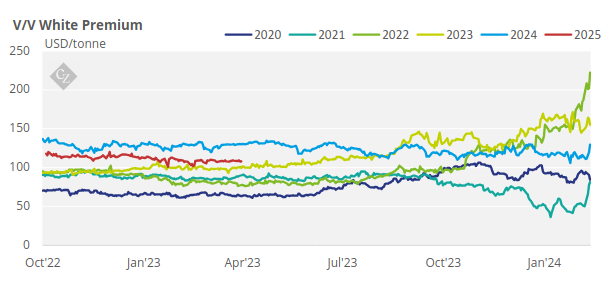

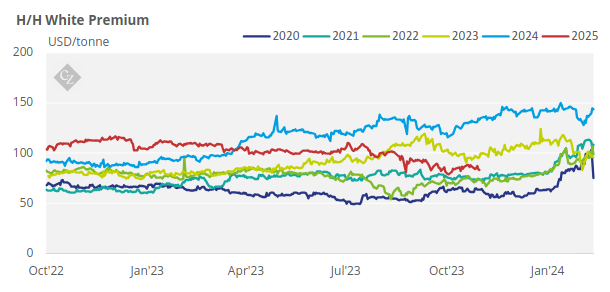

White Premium (Arbitrage)

The H/H white premium traded between USD 83-87/tonne and closed at USD 83.2/tonne on Friday.

Many re-export refiners need around USD 105-115/tonne above the No.11 to profitably produce refined sugar. The current white premium is below this level, signalling to toll refiners to slow their operations.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix