Insight Focus

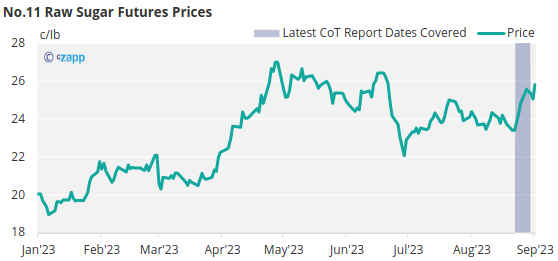

- Both the No.11 and No.5 sugar futures have traded sideways this past week.

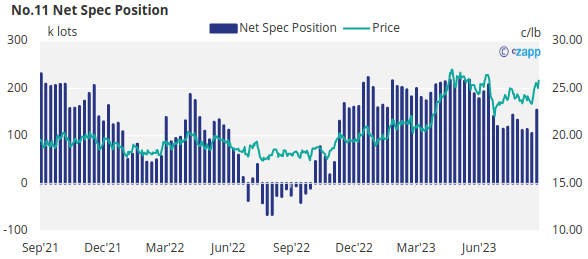

- Speculators have bought back into the raw sugar market.

- Producers were able hedge into higher prices.

New York No.11 Raw Sugar Futures

The No.11 raw sugar futures traded sideways over this past week, hovering around 25c/Ib.

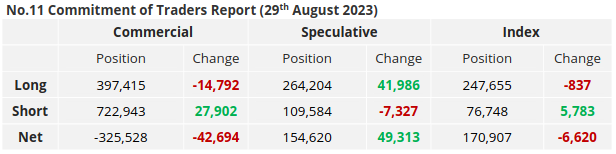

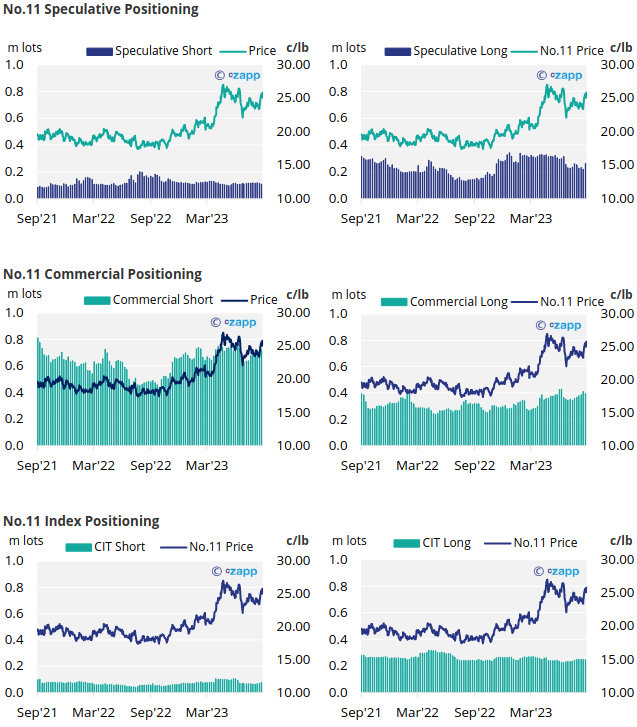

That said, by the 29th of August (latest CFTC CoT report), raw sugar speculators added just under 42k lots of new long positions and cut around 7.3k lots of existing short positions.

This has resulted in the net spec position to extending by over 49k lots; the first notable increase in the past few weeks.

On the commercial side, consumers have closed around 14.7k lots of their long positions, while producers, on the other hand, have opted to capitalize on the higher prices by adding approximately 27.9k lots of new hedges.

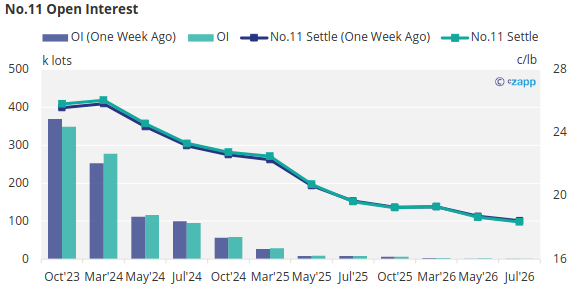

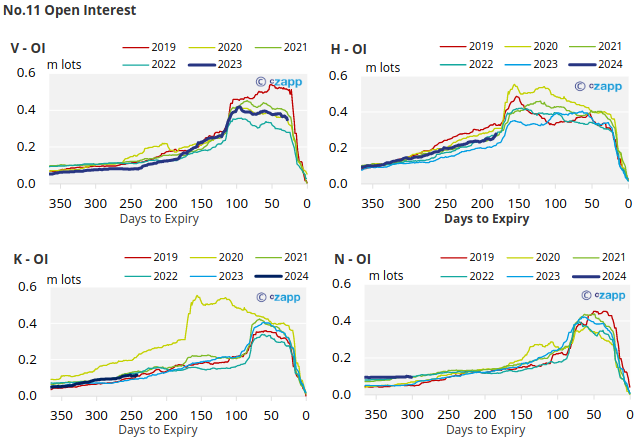

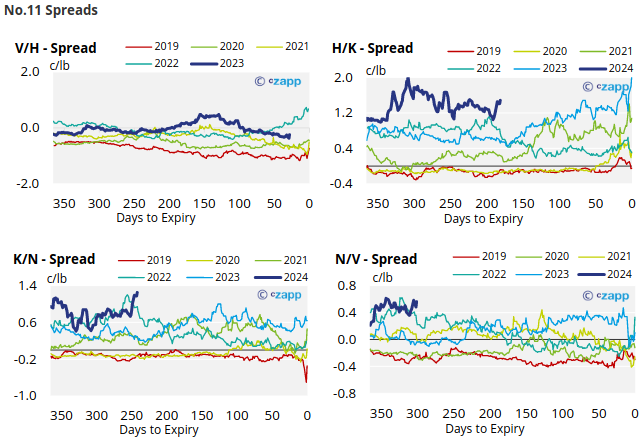

The No.11 forward curve remains inverted from Mar’24 until Mar’26.

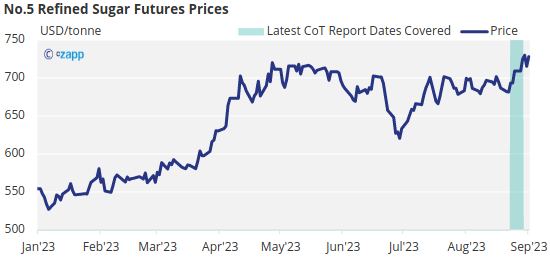

London No.5 Refined Sugar Futures

Similar to the No.11, the No.5 raw sugar futures also moved sideways, before settling at 738USD/mt by Friday’s close.

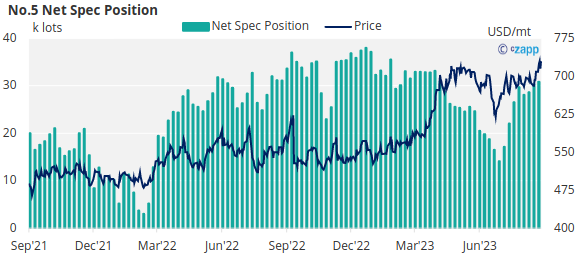

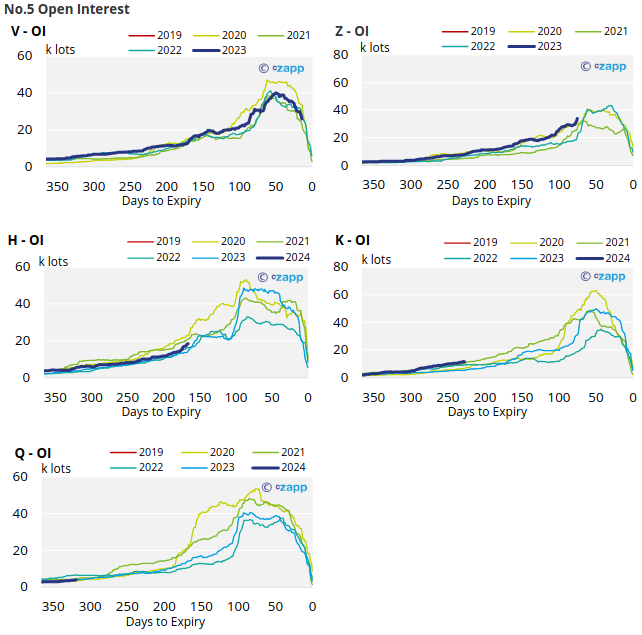

During this timeframe, refined sugar speculators increased their net spec position by approximately 0.5k lots, bringing the total net spec position to 30.8k lots.

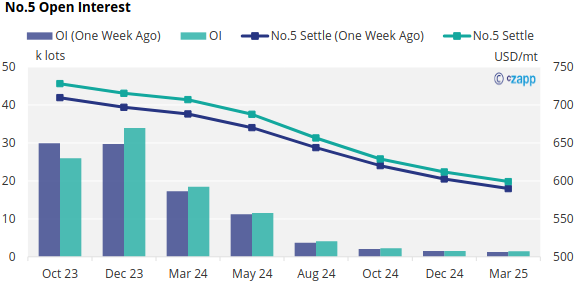

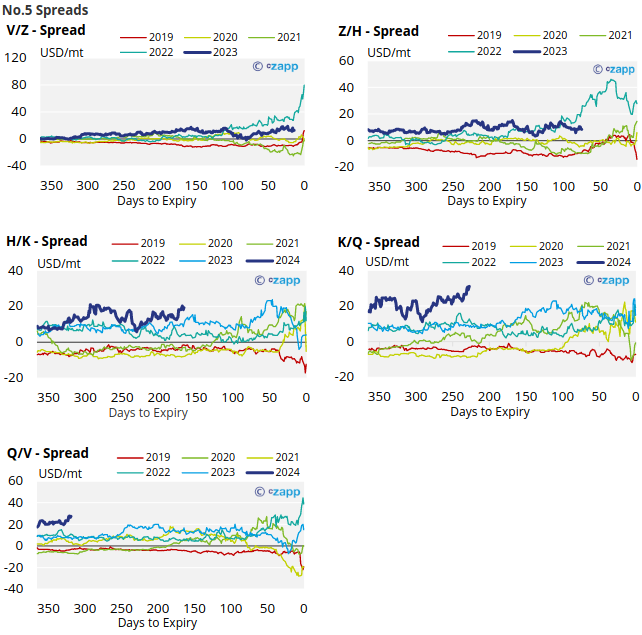

With contracts strengthening slightly across the board, the No.5 forward curve remains inverted through to March 2025.

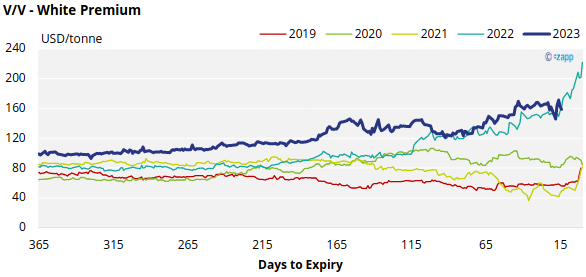

White Premium (Arbitrage)

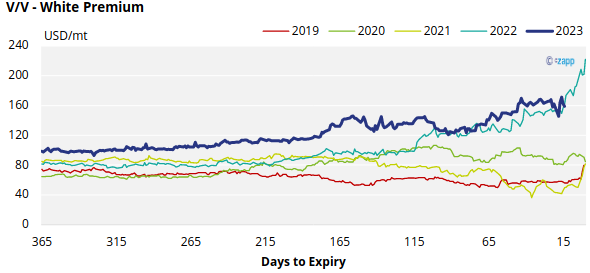

The V/V sugar white premium has strengthened to 159USD/mt.

We believe that many re-export refiners require at least 85-100USD/tonne over the No.11 to be profitable, which means that the spot white premium provides comfortably enough for these refiners to maximize their throughput.

At this level, higher-cost or discretionary refiners may begin to consider re-exporting in addition to serving their domestic markets.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

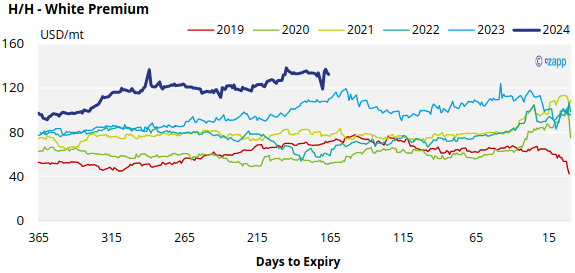

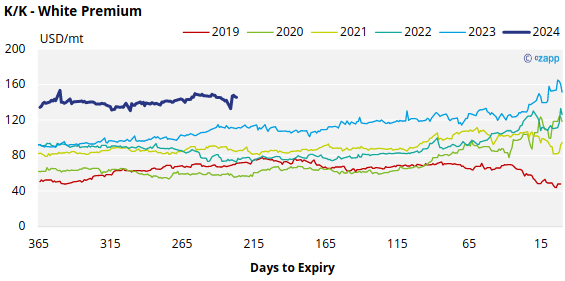

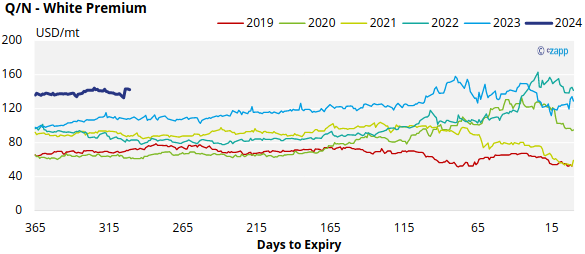

White Premium Appendix