Insight Focus

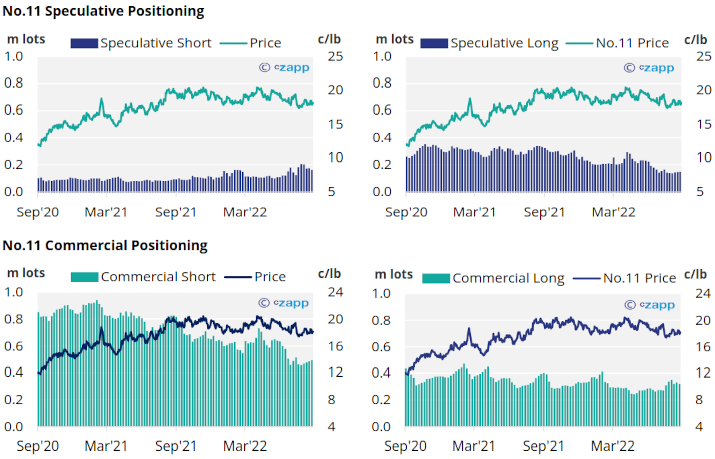

- Raw sugar speculators cut short position for the 3rd time in as many months.

- The nearby No.5 contract jumped above 575USD/mt by close of trading last week.

- Sugar white premium now sits above 170USD/mt, will this be sustainable?

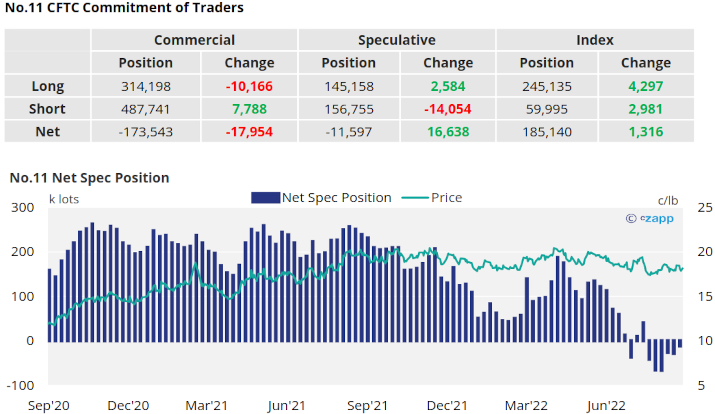

New York No.11 (Raw Sugar)

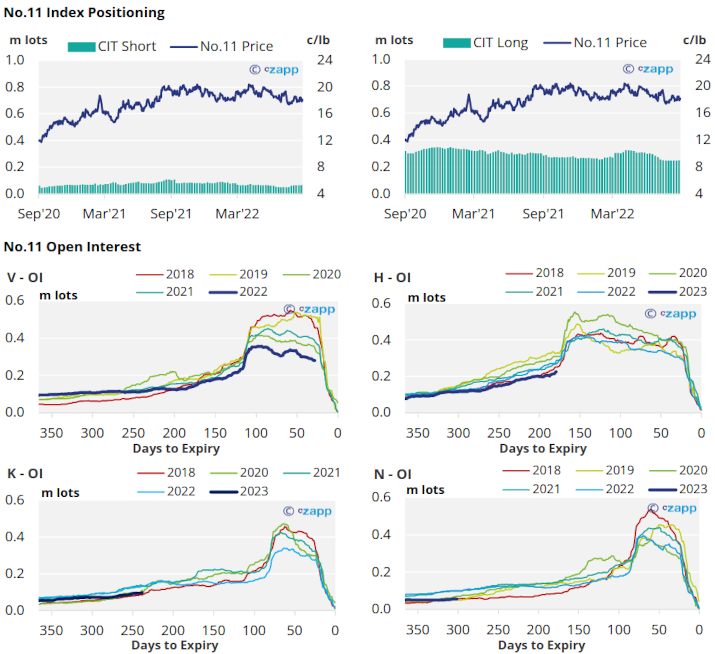

- No.11 prices have spent another week moving between 18 and 18.5c/lb, closing at 18.2c/lb on Friday.

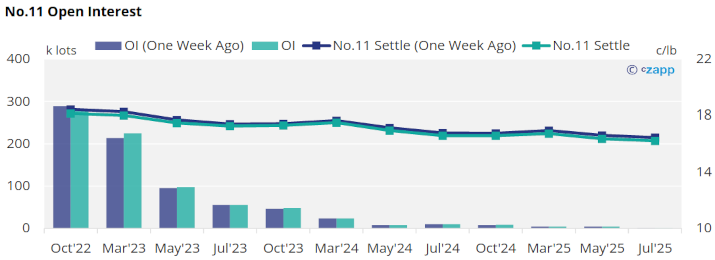

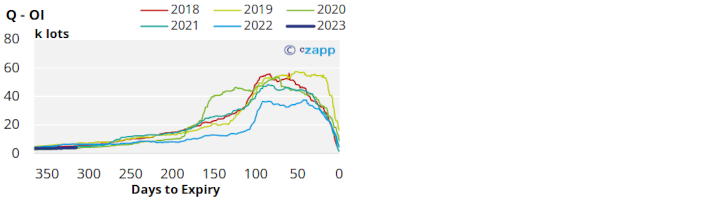

- With the Oct’22 expiry approaching, open interest in the contract has been in decline as positions close out or roll to the Mar’23 contract.

- As of the 30th of August, raw sugar consumers closed over 10k lots of long positions whilst producers added 8k lots as prices moved towards 18.5c/lb.

- In the same period the net spec position moved over 16k lots back towards neutrality as a significant volume of recently opened short positions were closed – this is the 3rd time a short position has been blown up in recent months.

- The No.11 forward curve remains inverted to Jul’23 moving into contango to Mar’24.

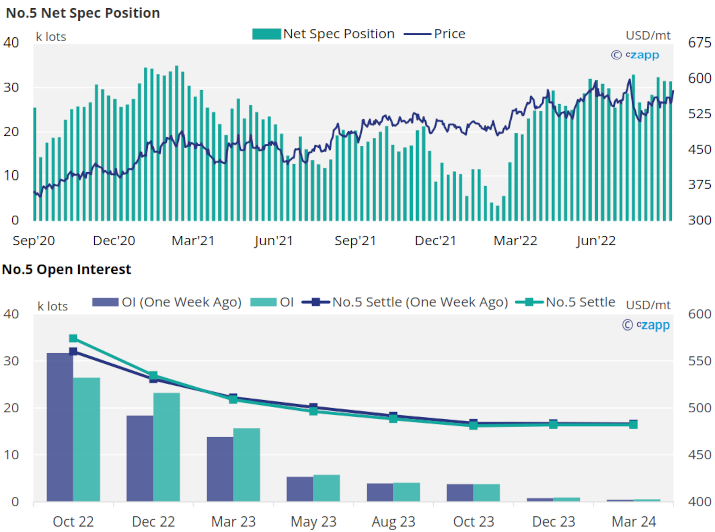

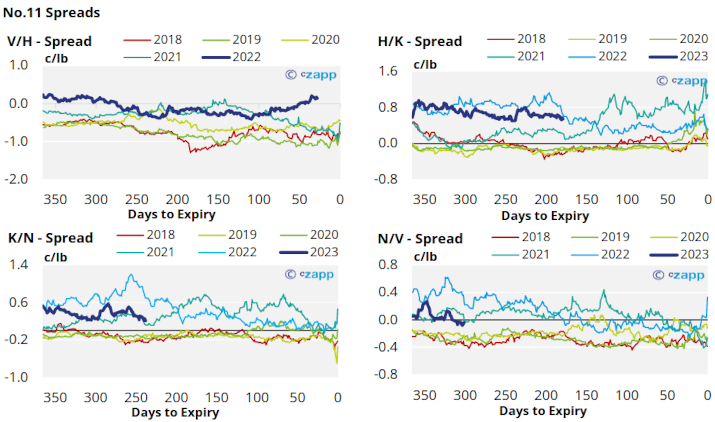

London No.5 (White Sugar)

- The No.5 spiked above 575USD/mt on Friday last week following a further week trading between 550 and 560USD/mt.

- With prices broadly moving sideways through much of August, by the 30th the net spec position remained at 31k lots, this is still close to the high of 2022.

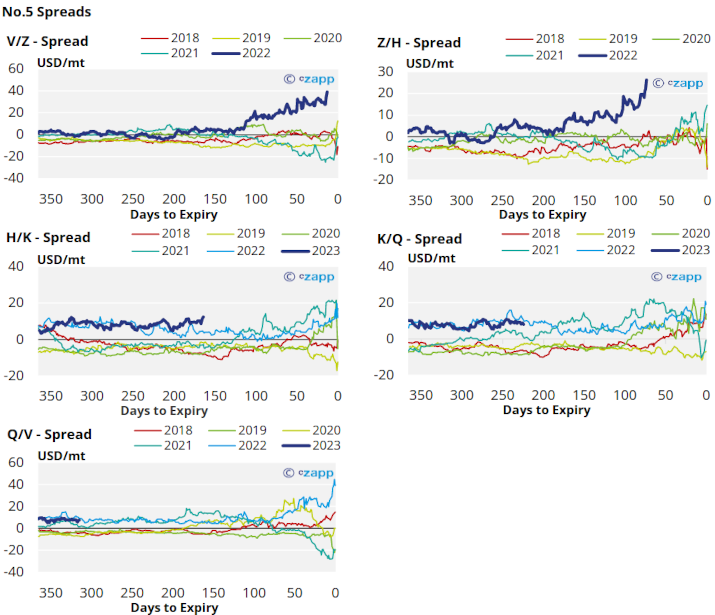

- Friday’s sharp upward movement was mostly contained to the Oct’22 contract with the V/Z spread moving to 40USD, this leaves the forward curve heavily backwardated to the end of 2023.

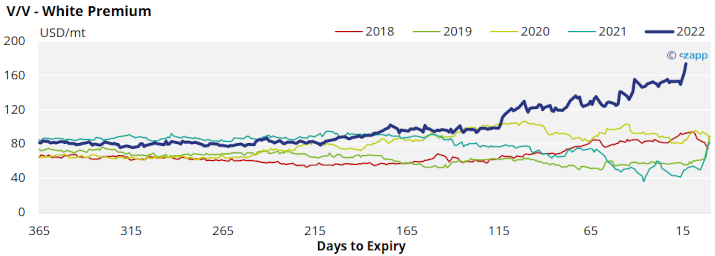

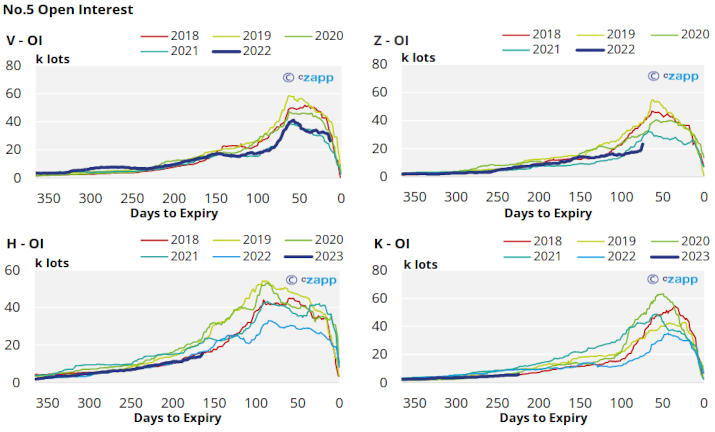

White Premium (Arbitrage)

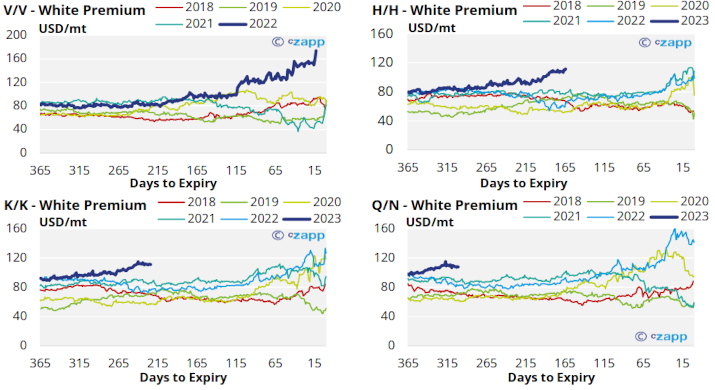

- The white premium has moved above 170USD/mt following Friday’s upwards movement in the No.5 – before this it had been stable around 150USD/mt.

- If this level can be sustained, we could start to see discretionary refiners increase their raw sugar demand and re-export refined sugar, traditional re-export refiners will also be maximising their throughput.

- Additionally the next H/H, K/K, and Q/N white premiums are all trading above 110USD/mt, these are unusually high this far in advance of their expiry.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…