- The white premium now trades above 150USD/mt – should encourage more refined sugar.

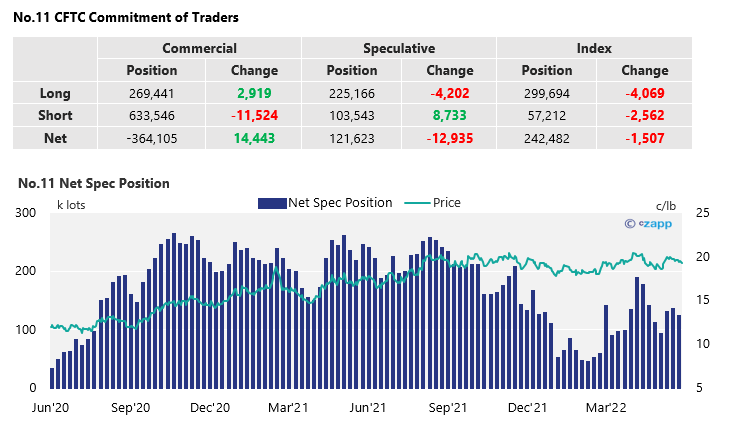

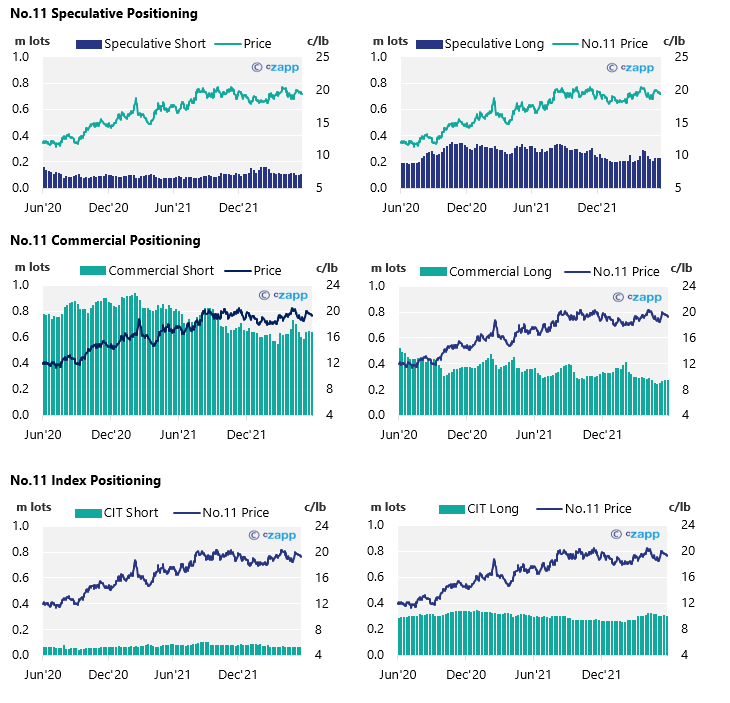

- Raw sugar speculators add to short positions.

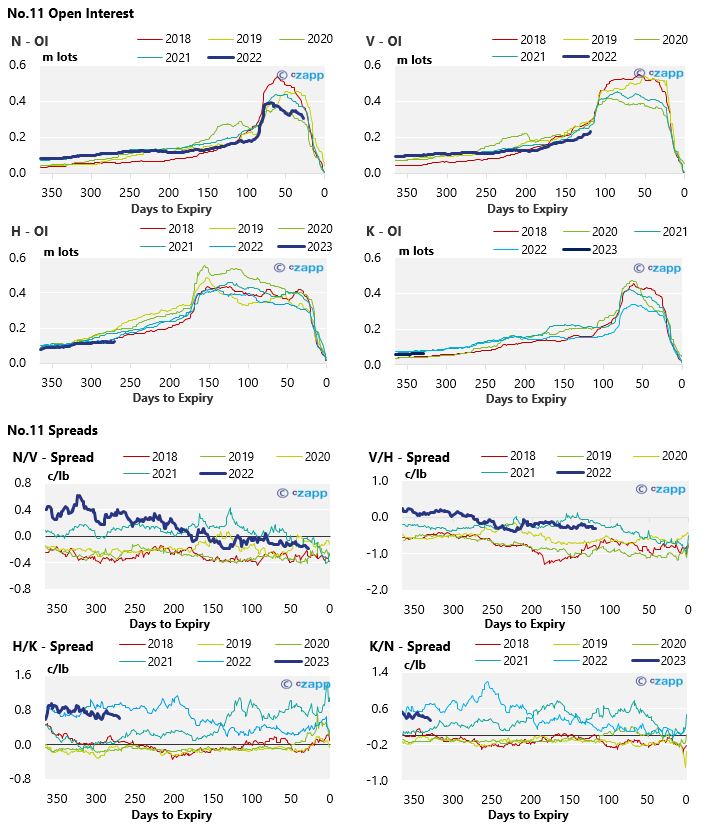

New York No.11 (Raw Sugar)

- The No.11 has weakened below 19.5c/lb by the end of trading last week.

- As of the latest CFTC COT report, the net spec position shrank by almost 13k lots as long positions are lifted and new short positions added – this has helped move prices downwards.

- Commercial short positions are rolling off faster than new positions are added as the No.11 drifts away from the top of the 18-20c/lb range.

- Consumers continue to hedge in small volumes, though are still poorly covered by historical standards.

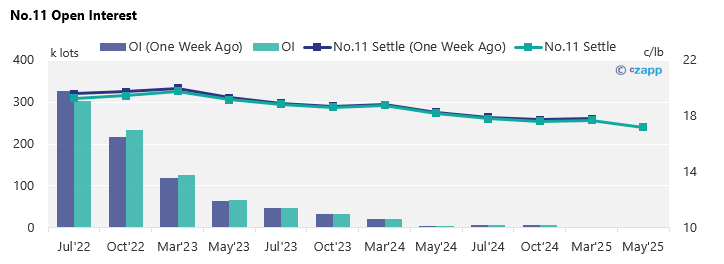

- The No.11 forward curve is still slightly contango towards H’23, then backwardated across 2023.

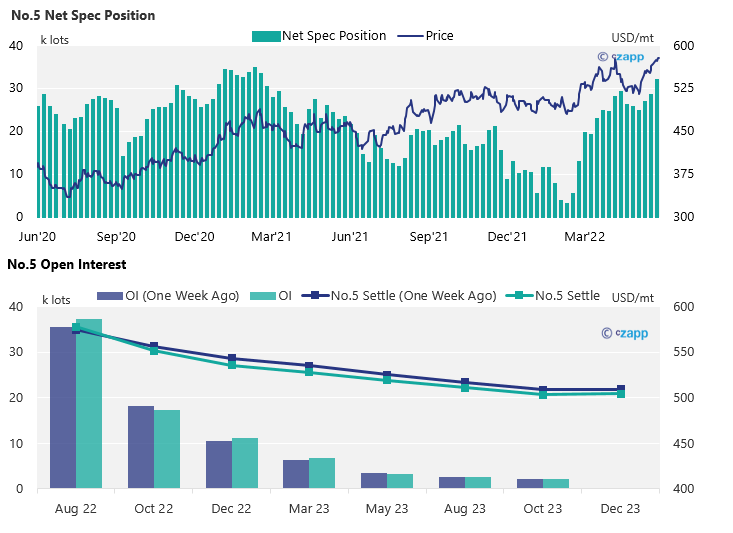

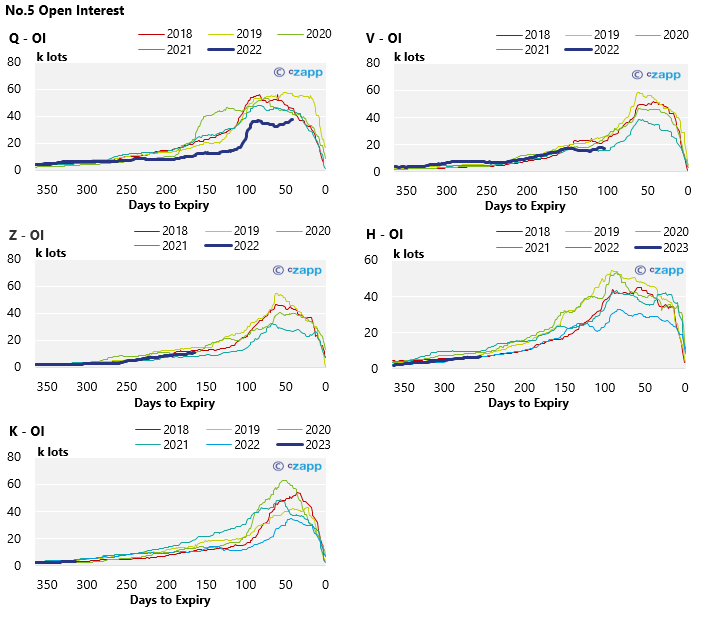

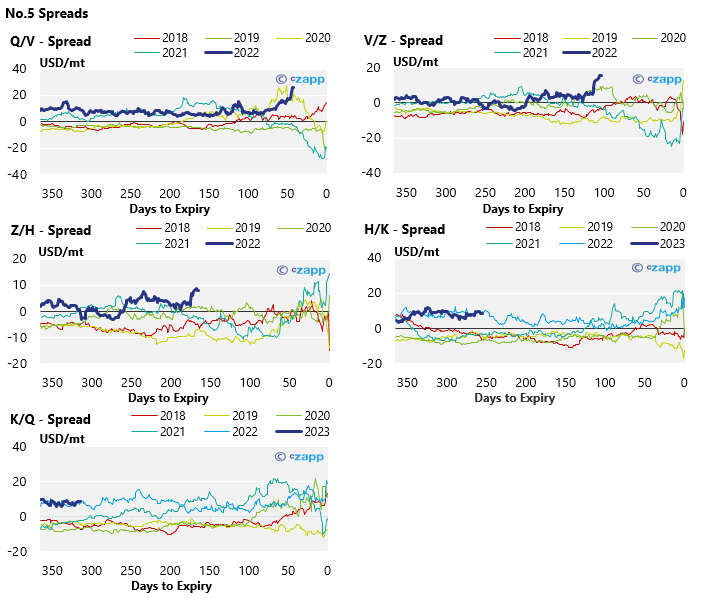

London No.5 (White Sugar)

- The No.5 continues to move upwards reaching highs above 585USD/mt, before settling close to 580USD/mt.

- White sugar speculators help drive prices higher as the net spec position grew by close to 4k lots by the latest CFTC COT report to 32k lots, the highest in over a year.

- The Q’22 contract has seen the most buying, helping backwardate the futures curve further across 2022 and 2023 – all 2022 spreads are at a strong premium.

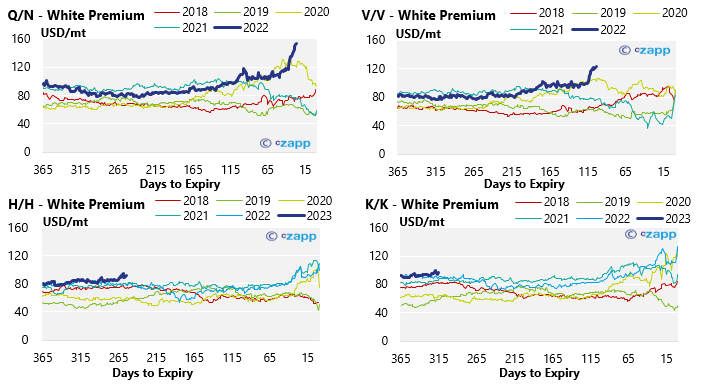

White Premium (Arbitrage)

- Since the No.11 continues to weaken as the No.5 pushes higher the Q/N white premium widens further.

- Now at over 150USD/mt, this should encourage extra refined supply onto the world market.

- At this level re-export refiners should be able to comfortably operate profitably as well.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix