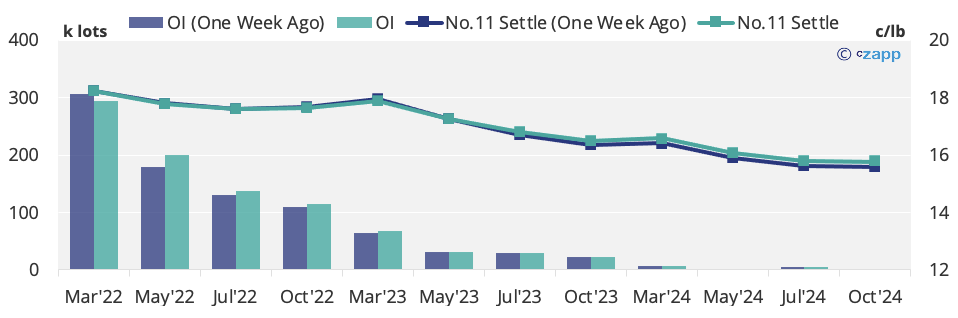

- The No.11 has hovered around 18-18.5c/lb over the last week.

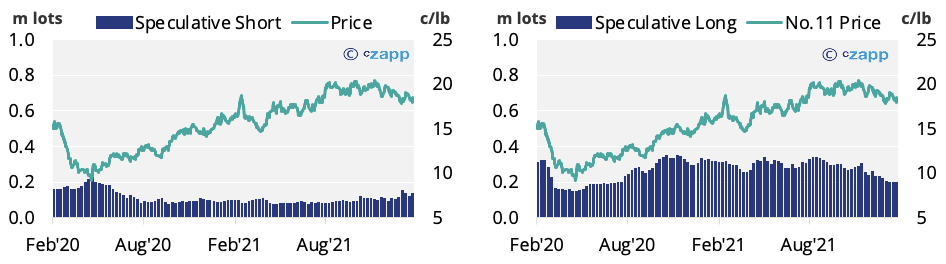

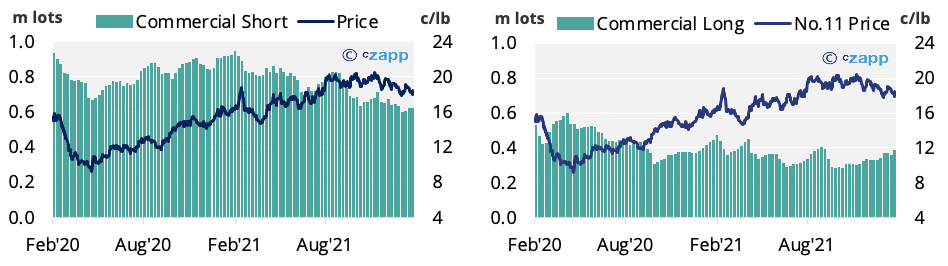

- Consumers continue to add to their position, taking further advantage of the price weakness.

- Re-export refiners have benefited as the white premium has strengthened since the previous update.

New York No.11 (Raw Sugar)

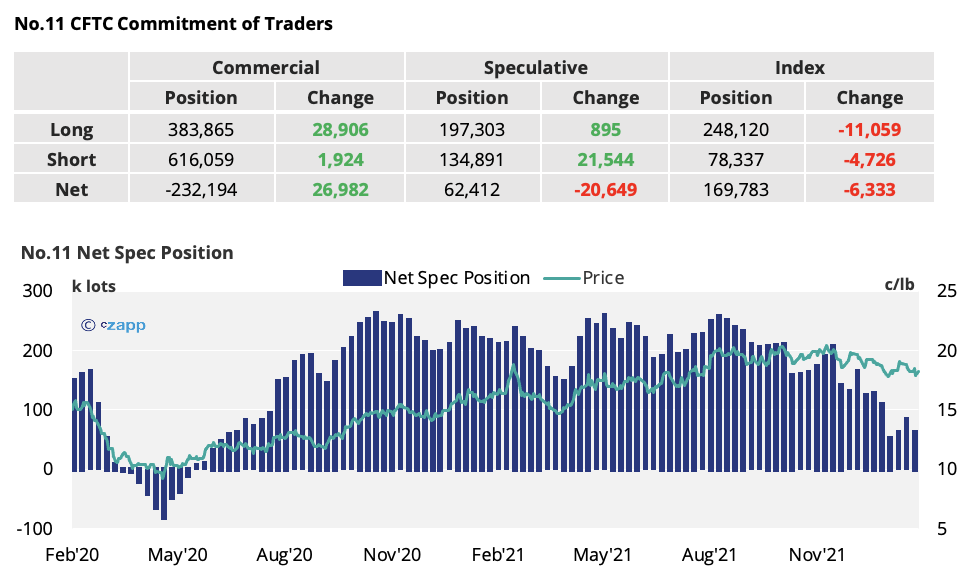

- As specs open 22k new short positions, the net spec position returns to the level seen a fortnight ago.

- This supports the sentiment that there’s currently a lack of clear momentum in the market.

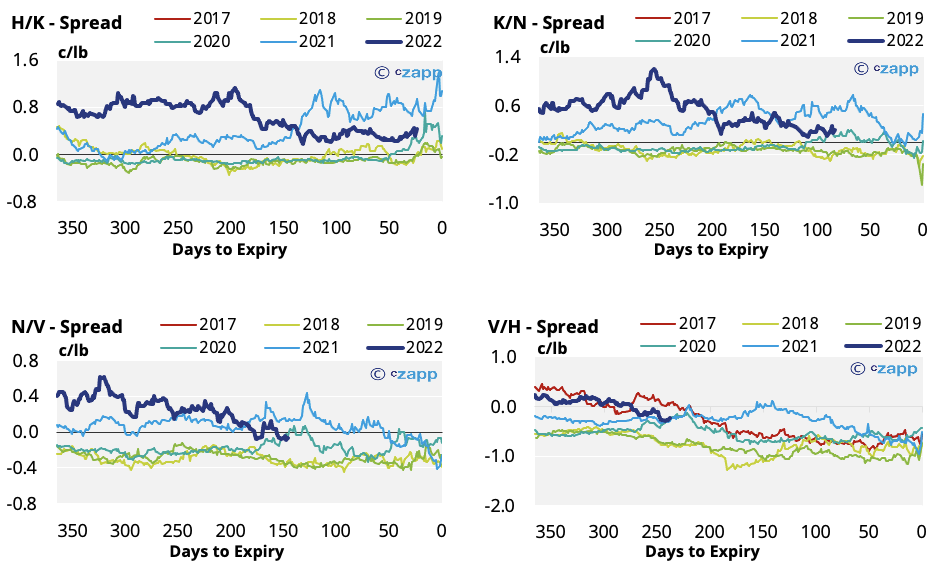

- The forward curve remains close to flat for the next 12 months, making forward buying attractive.

No.11 Speculative Positioning

No.11 Commercial Positioning

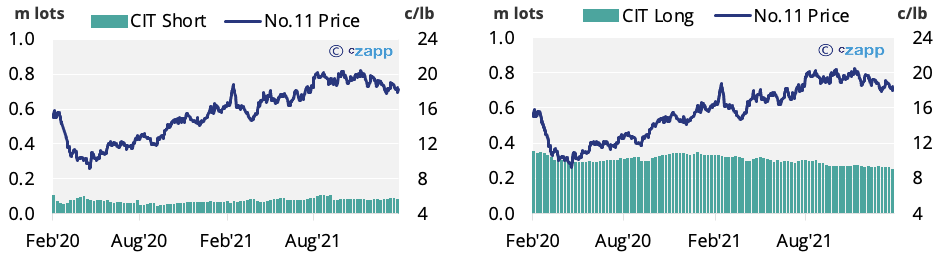

No.11 Index Positioning

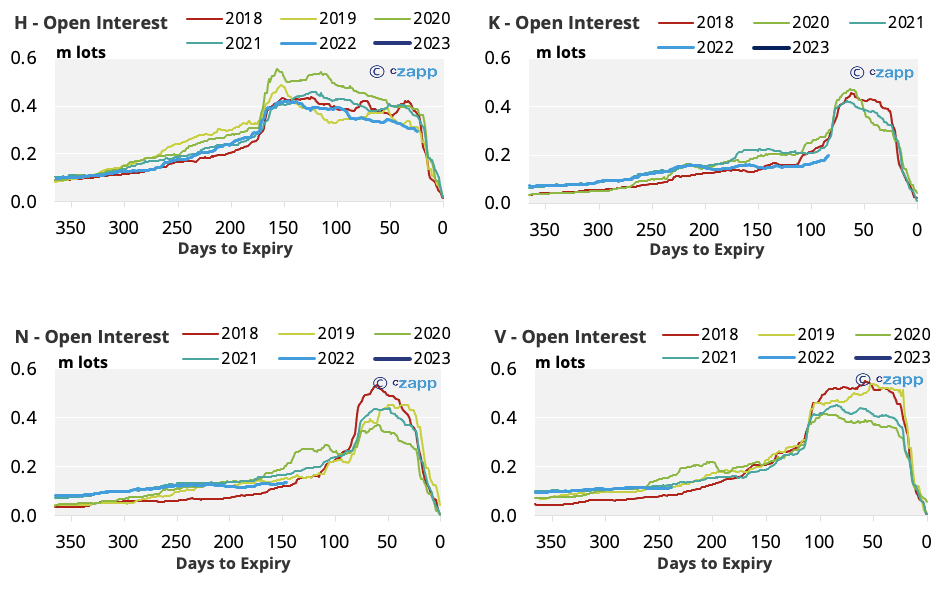

No.11 Open Interest

No.11 Spreads

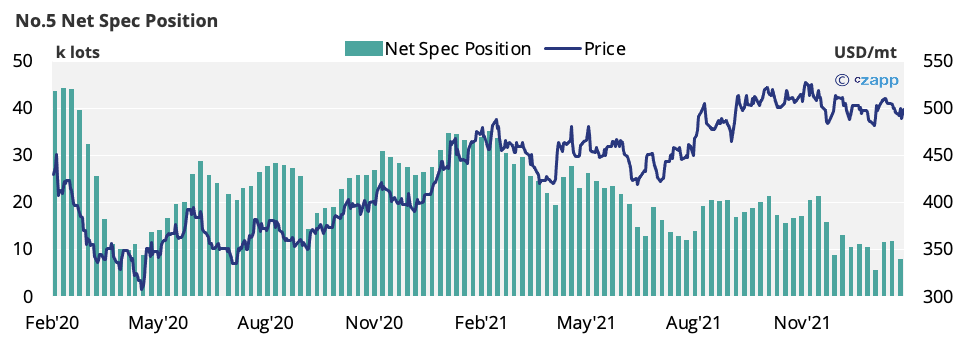

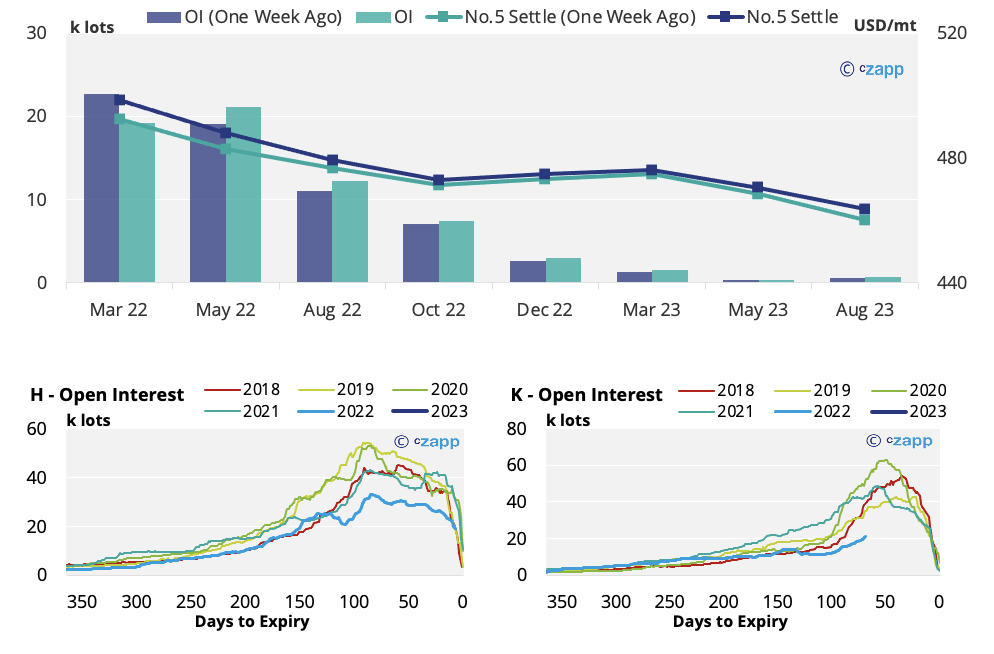

No.5 London (White Sugar)

- Notwithstanding a brief dip under 490 USD/mt, the No.5 continues to sit just below 500 USD/mt.

- The open interest for the K’22 and Q’22 contracts remains below historic levels.

- The whites forward curve has flattened over the last week, which is good for forward buying.

No.5 Open Interest

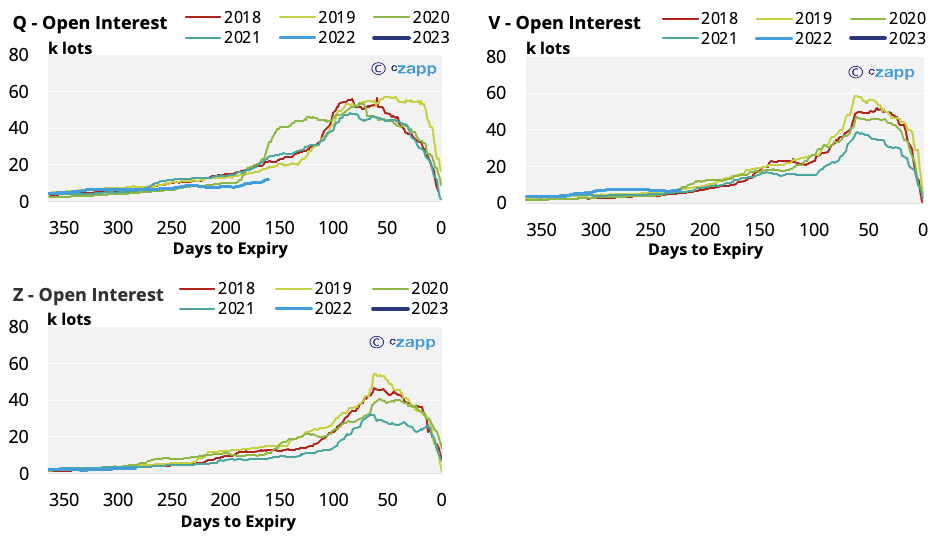

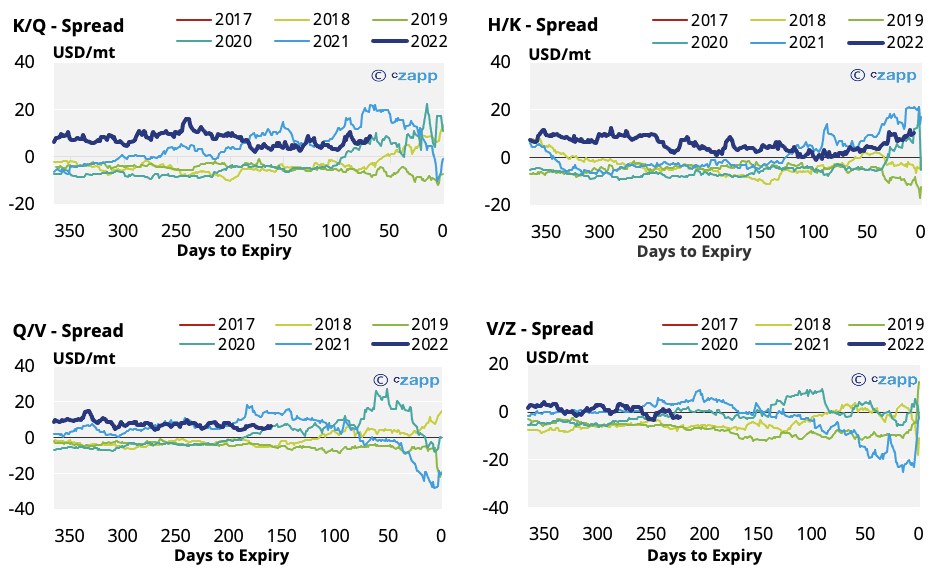

No.5 Spreads

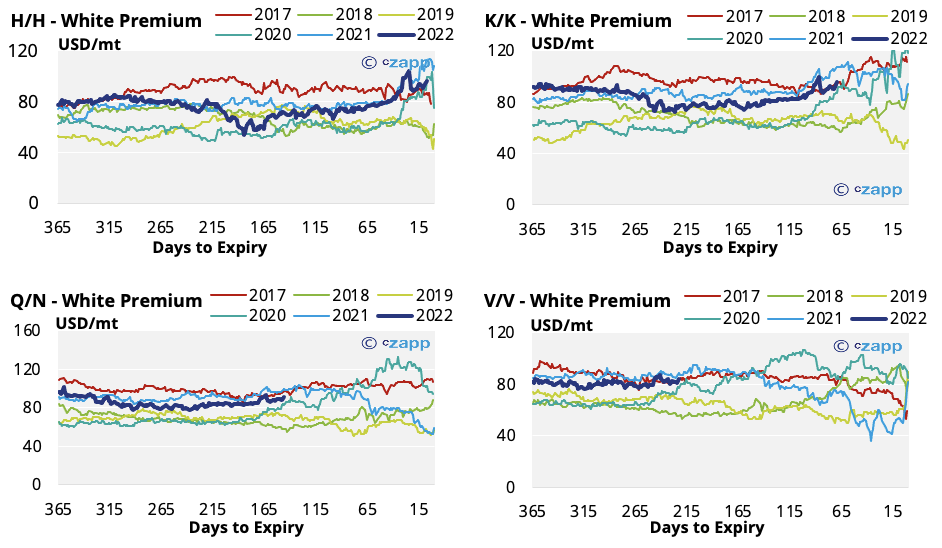

White Premium (Arbitrage)

- The H/H and K/K 2022 white premiums have edged closer to the top end of their historical ranges as the No.11 has dipped slightly.

- With cash values or discounted raws spreads, this could overcome the level needed for re-export refiners to operate profitably.

Other Insights That May Be of Interest…