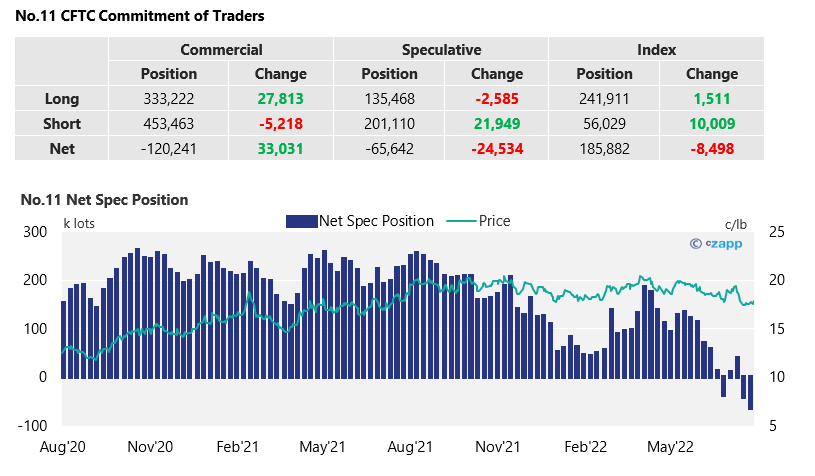

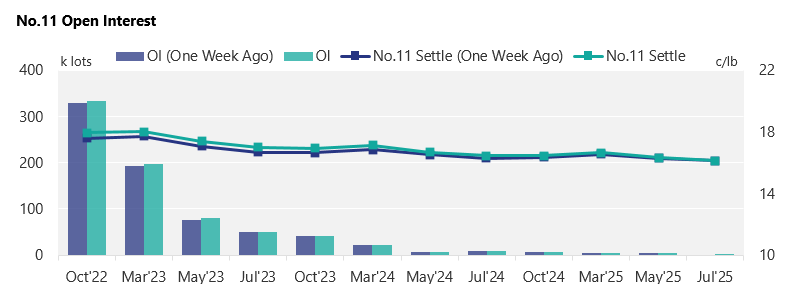

New York No.11 (Raw Sugar)

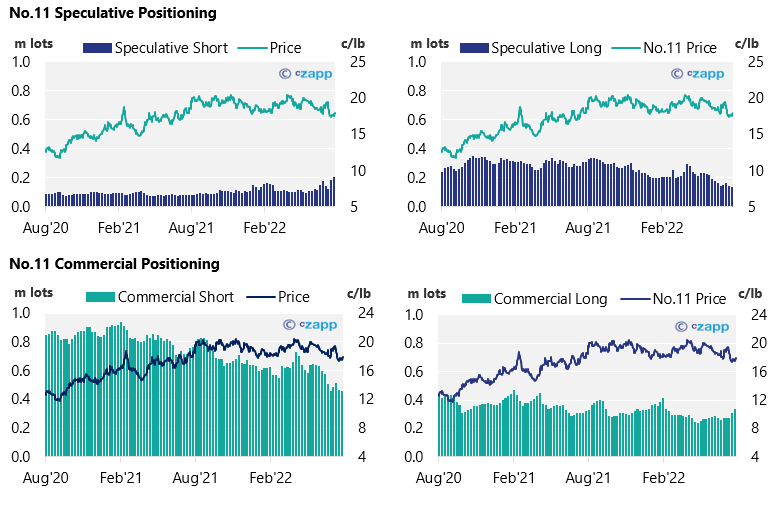

- The No.11 has slowly climbed back towards 18c/lb by the end of last week.

- Raw sugar consumers have furthered their hedging programs whilst the market is weaker and have added a further 28k of long positions as of the 2nd of August.

- Commercial short positions continue to roll off as producers are not willing to hedge with the No.11 at this level.

- Raw sugar speculators are solidifying their bearish view, adding almost 22k more short positions to the 2nd of August – the net spec position now sits at -65k lots.

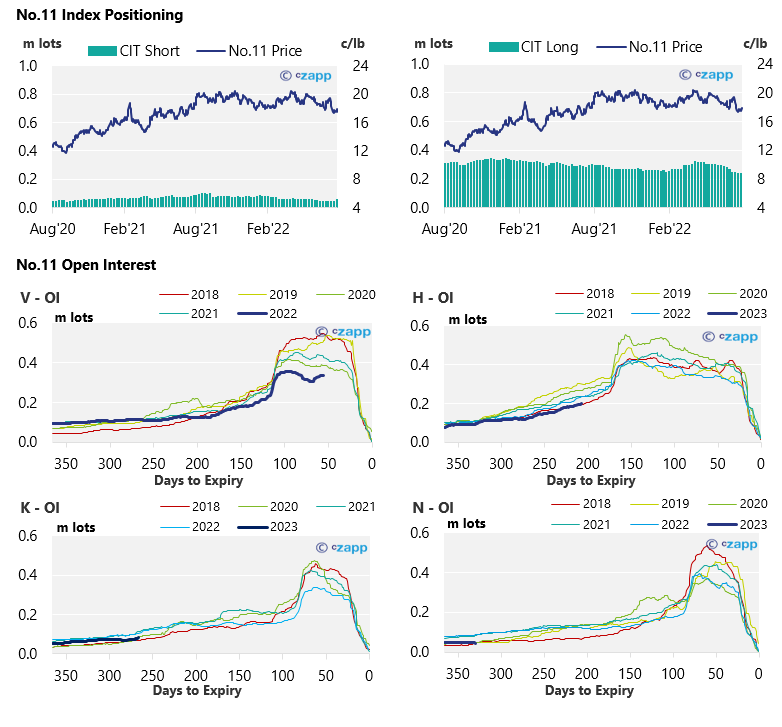

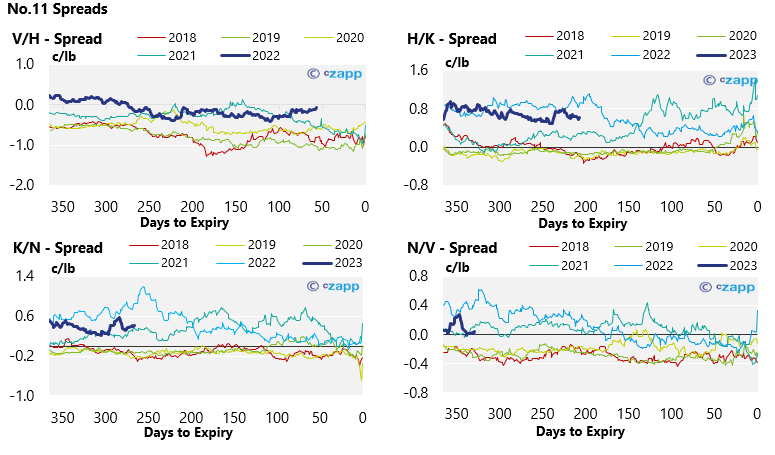

- The No.11 forward curve is flat into Mar’23, falling into backwardation for the rest of 2023.

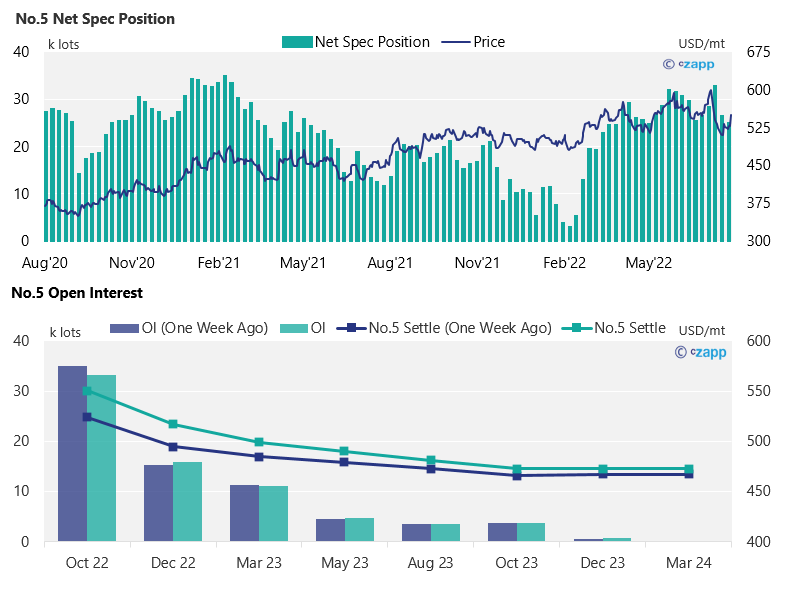

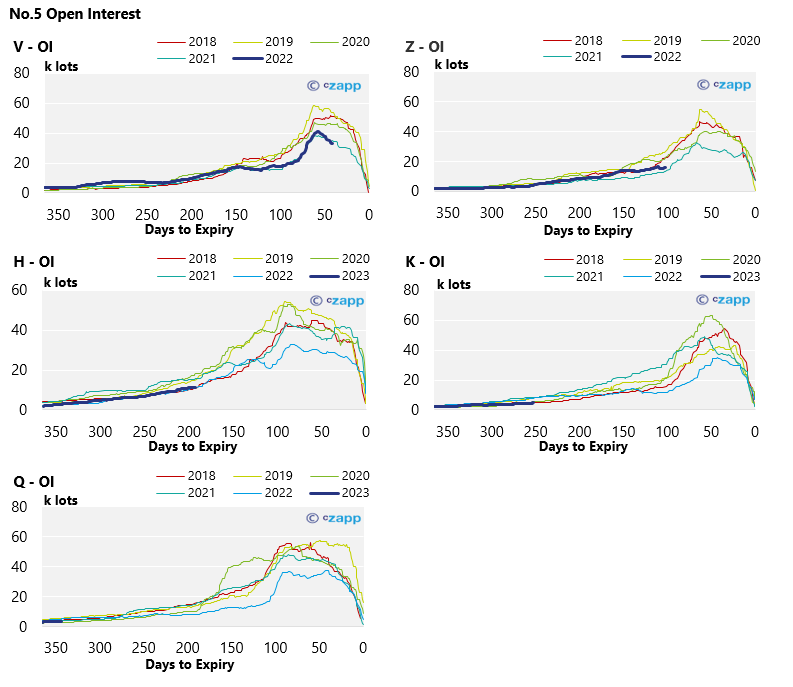

London No.5 (White Sugar)

- No.5 prices have recovered towards 550USD/mt by the end of last week.

- By the 2nd of August the net spec position has fallen slightly to 25k lots. Compared to much of 2021 this is still fairly high which could indicate that specs are still positive for white sugar prices.

- The No.5 forward curve has steepened further, with the V/Z spread widening to over 30USD/mt. This is unusually higher by this point in the year.

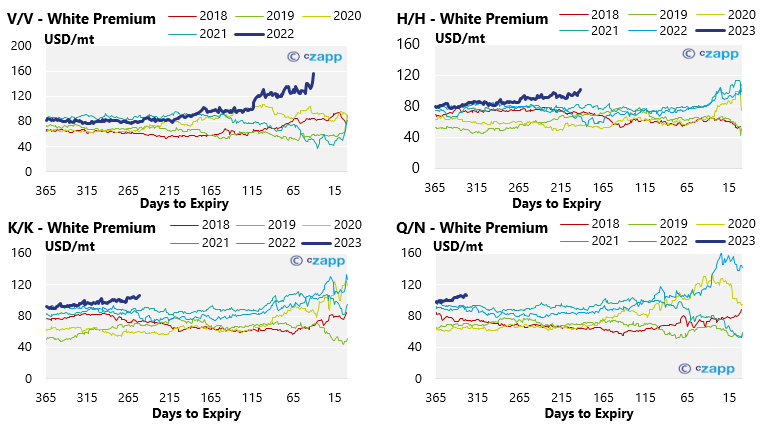

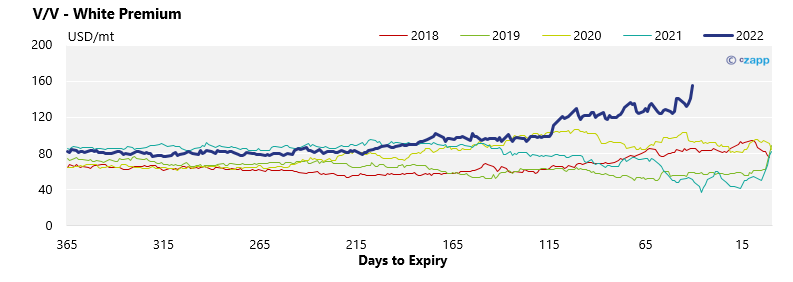

White Premium (Arbitrage)

- The white premium quickly moved close to 160USD/mt on Friday following a strong one day rise in the No.5.

- However, by the time of writing it has retreated back towards 140USD/mt.

- At this level we should see re-export refiners operating profitably and maximising their throughput.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix