Insight Focus

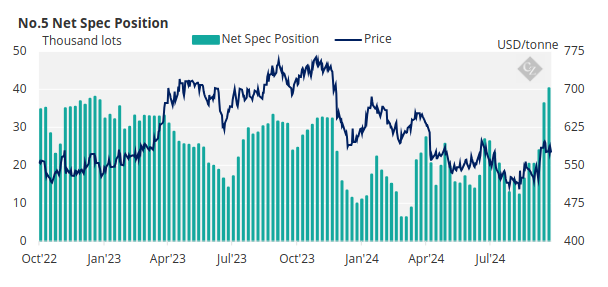

The Oct’24 raw sugar futures contract expired last Monday. Raw sugar futures prices traded between 22-23.3c/lb following the expiry. The No.5 net spec position is the highest seen since December 2022.

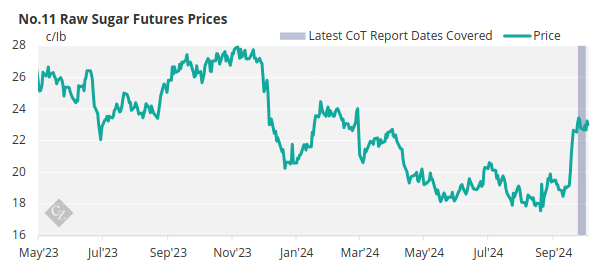

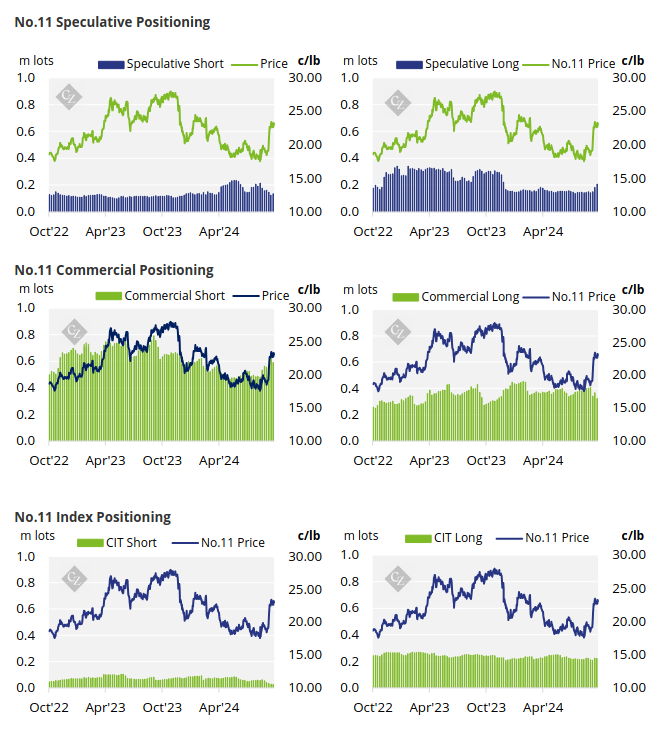

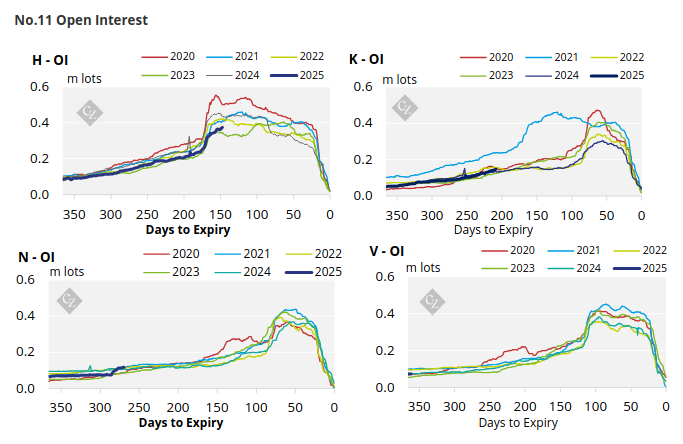

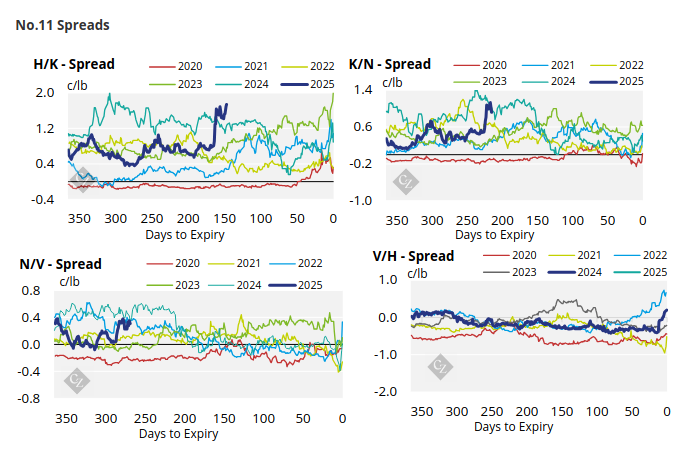

New York No.11 Raw Sugar Futures

The Oct’24 raw sugar futures contract expired last Monday at 22.67c/lb. Following the expiry the raw sugar futures market traded between 22-23.3c/lb, before closing at 23c/lb on Friday.

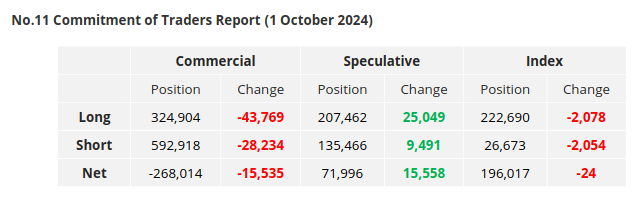

Looking at the commercial side, both producers and end-users have closed out their positions. Producers closed out 28,200 lots of short positions while end-users reduced their position by 43,800 lots of longs.

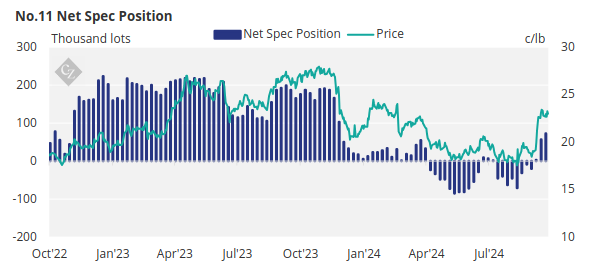

By contrast, speculators have added to both their long and short positions as they opened 25,000 lots of long positions and 9,500 lots of short positions.

The net spec position now stands higher at 72,000 lots.

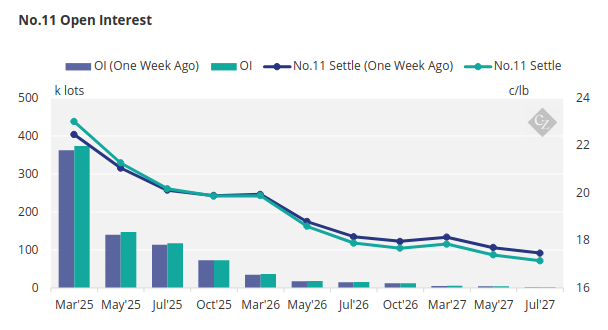

The No.11 futures curve has strengthened at the front of the curve while having weakened from Mar’26 to Jul’27. Nonetheless the curve remains in backwardation across the board.

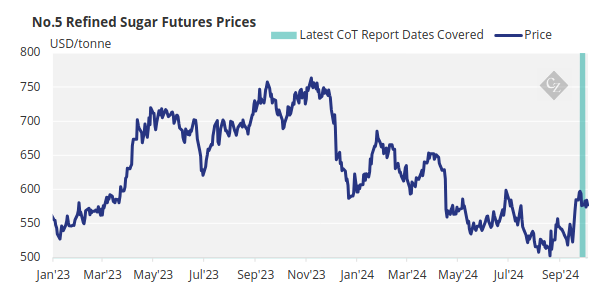

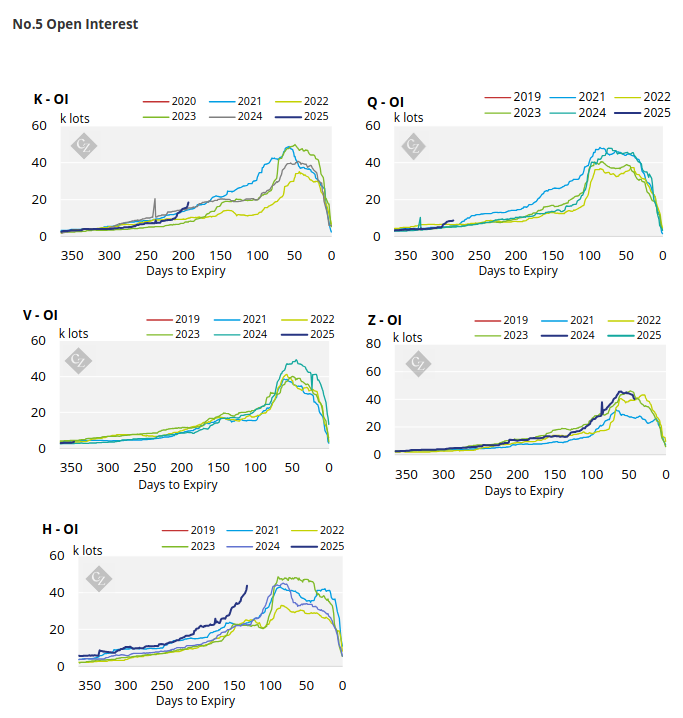

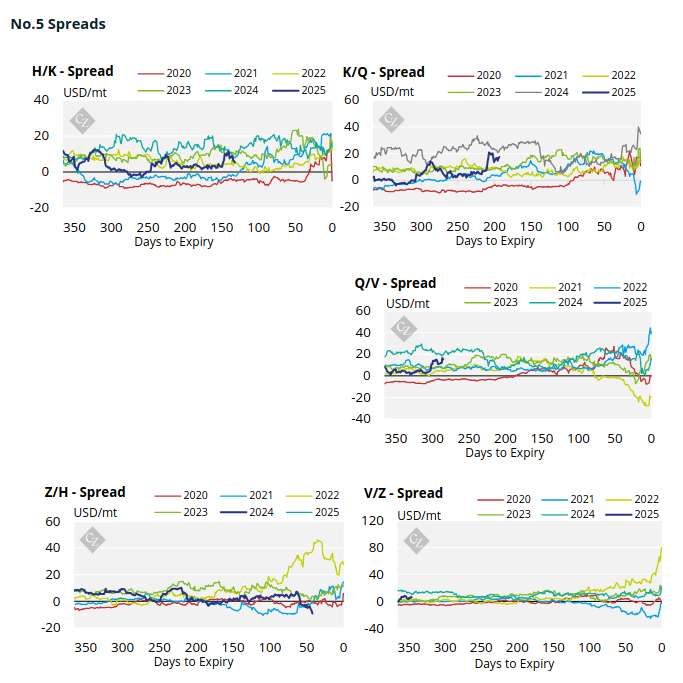

London No.5 Refined Sugar Futures

The No.5 refined sugar futures traded between USD 574-584/tonne and closed at USD 576.9/tonne on Friday.

Speculators opened 4,000 lots of long positions, bringing the net spec position up to 40,200 lots.

This is the highest net spec position to date since December 2022, when the net spec position was at 38,000 lots.

No.5 Open Interest

The No.5 refined sugar futures curve has strengthened between Dec’24 and Dec’25.

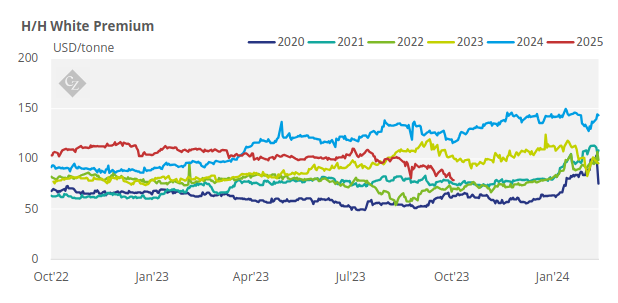

White Premium (Arbitrage)

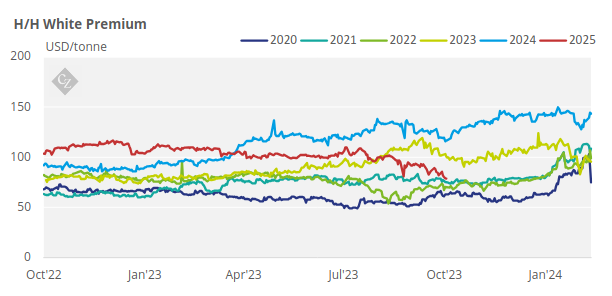

The H/H white premium traded between USD 78.8-85.8/tonne and closed at USD 78.8/tonne on Friday.

Many re-export refiners need around USD 105-115/tonne above the No.11 to profitably produce refined sugar. The current white premium is below this level, signalling to toll refiners to slow their operations.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

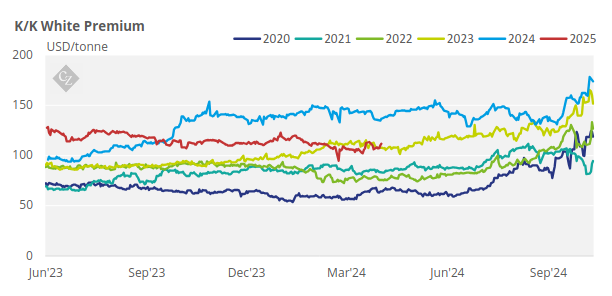

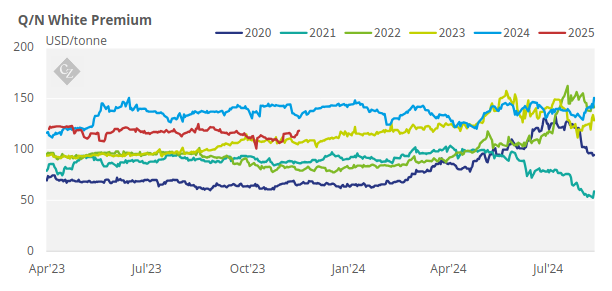

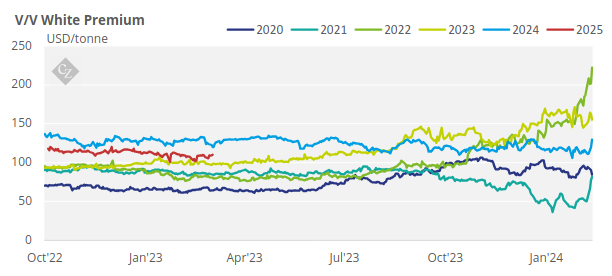

White Premium Appendix