Insight Focus

- Raw and refined sugar futures have declined so far in 2023.

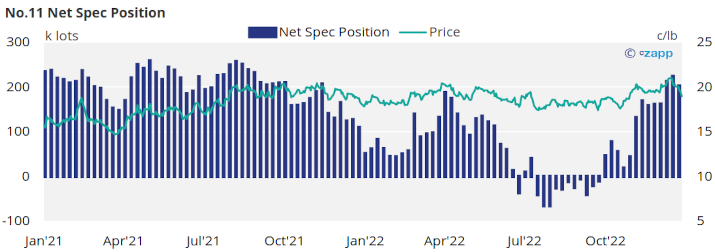

- As such, No.11 speculators have closed some of their long positions.

- Raw sugar producers have paused their hedging activities.

New York No.11 (Raw Sugar)

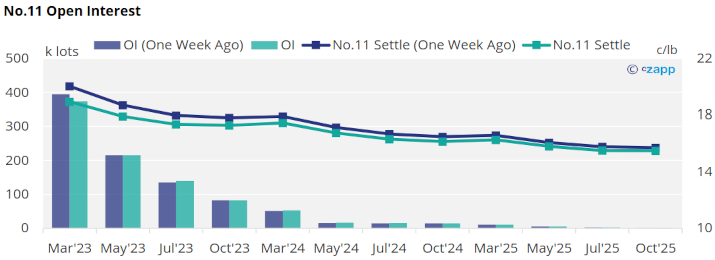

No.11 futures experienced a sharp decline during the first week of 2023, below 19c/lb by Friday close.

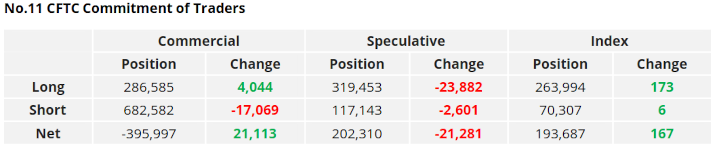

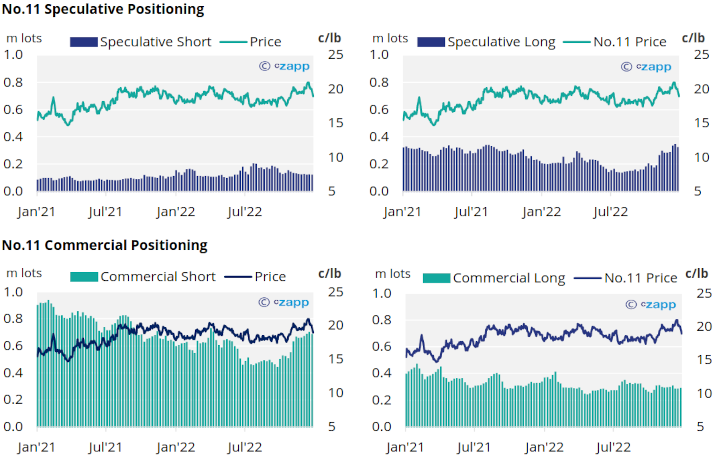

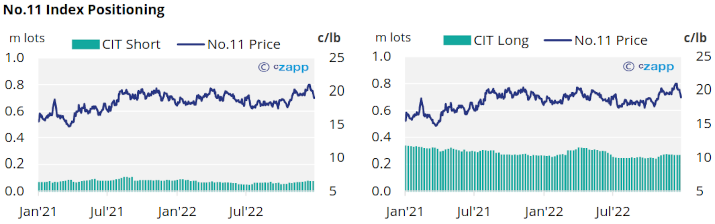

By the 3rd of January (latest CoT CFTC), with the market retreating, many recently opened spec long positions have come under pressure. As such, speculators have closed over 23k lots of long positions.

With some spec short positions closed too, the net spec position has fallen by 21k lots to 202k lots.

On the commercial side, raw sugar producers closed 17k lots of short positions, whilst consumers were able to capitalise on weaker prices, with the commercial long position increasing by 4k lots.

If the market continues to retreat toward the lower end of the 18-20c/lb range, this may incentivise raw sugar consumers to resume greater hedging activity.

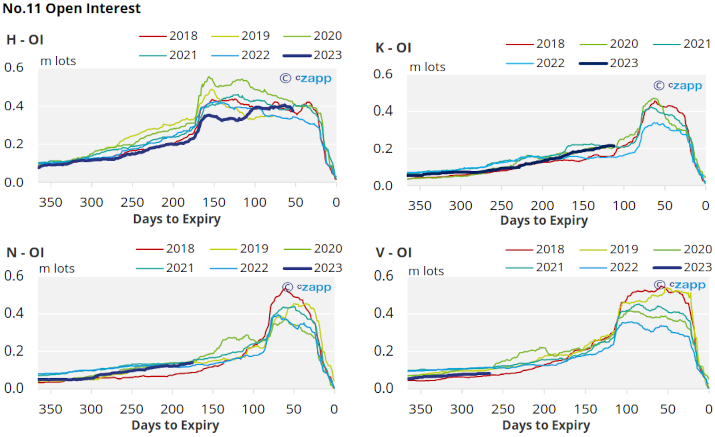

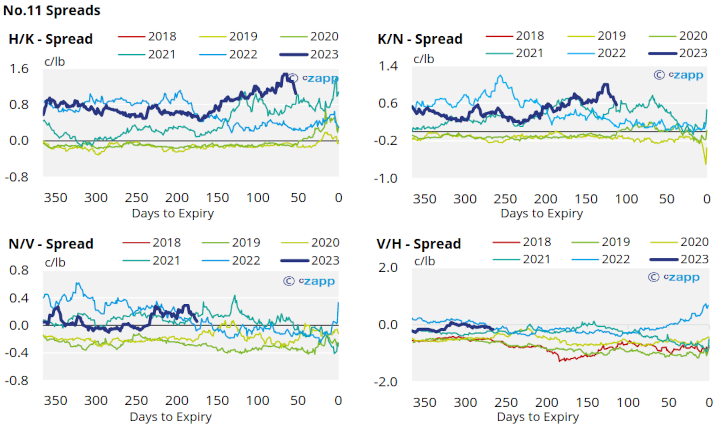

The No.11 forward curve has flattened in the nearby contracts, remaining inverted until Oct’23 moving into contango to Mar’24.

London No.5 (Refined Sugar)

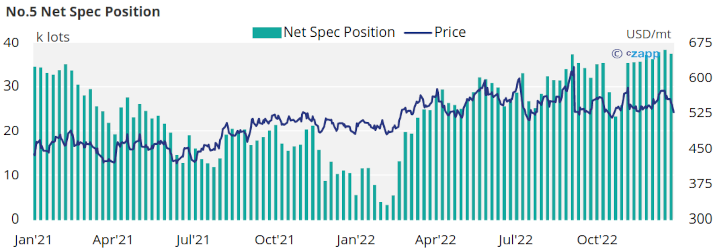

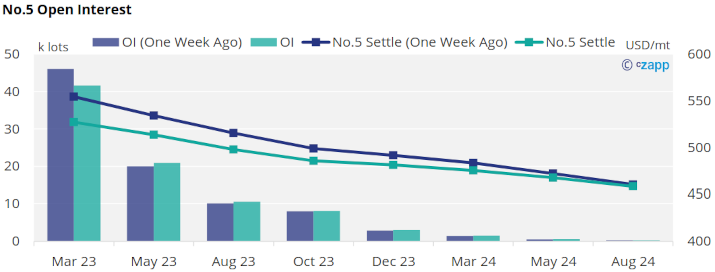

No.5 refined sugar futures also fell sharply over last week, closing at 528USD/mt by Friday.

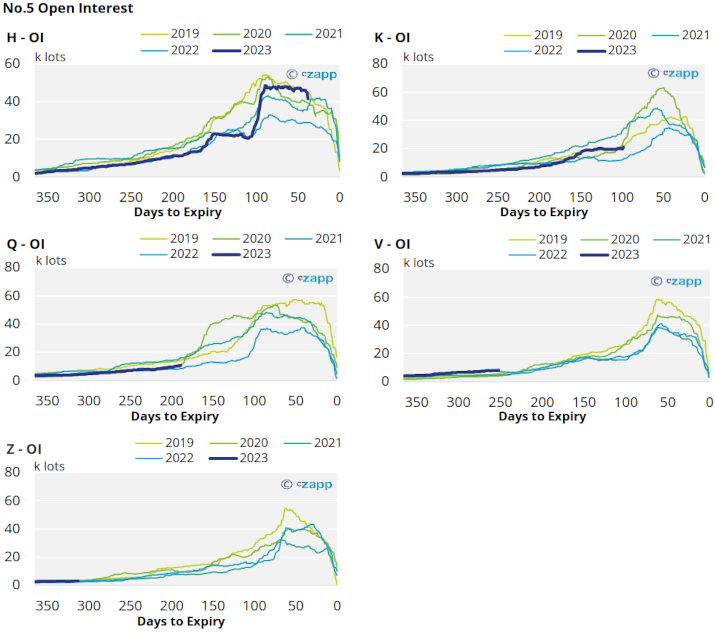

By the 3rd of January with prices in decline, the net spec position retreated slightly but remains close to 2022 highs.

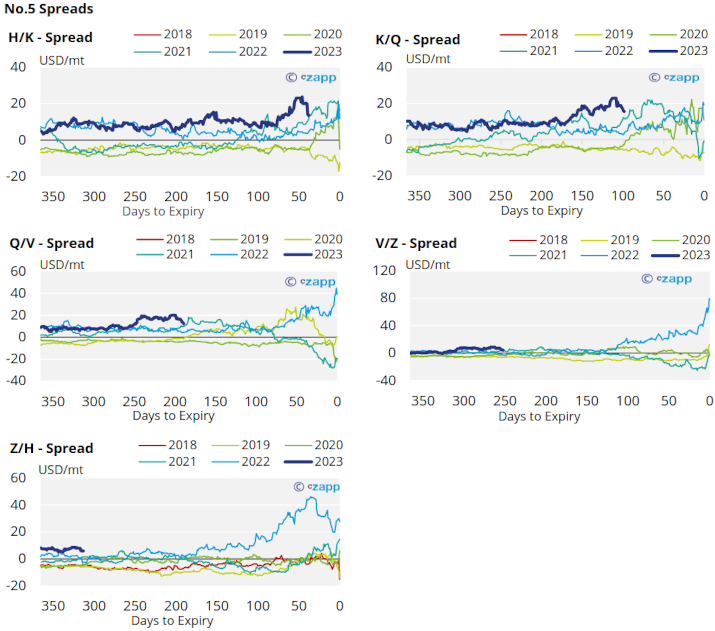

The No.5 forward curve continues to flatten particularly in the nearby contracts, suggesting easing market tightness.

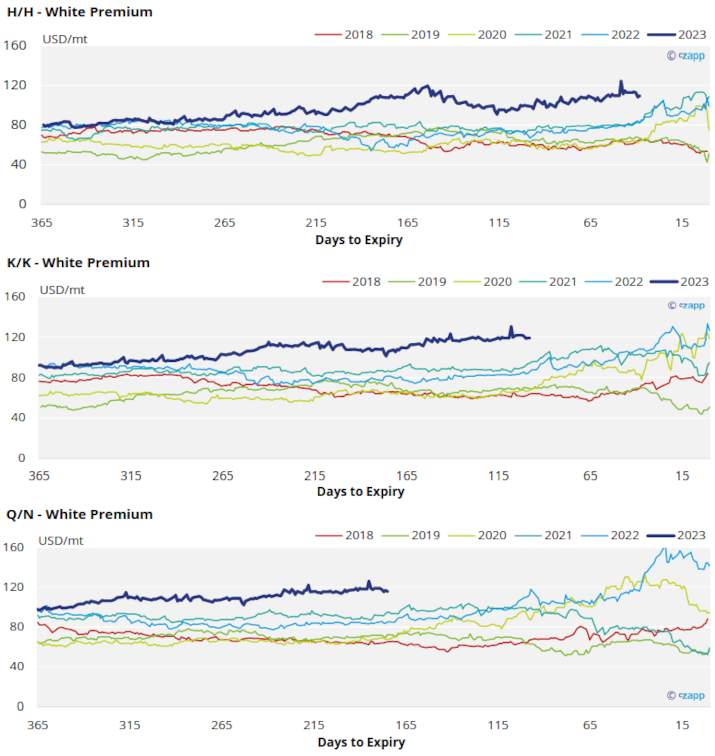

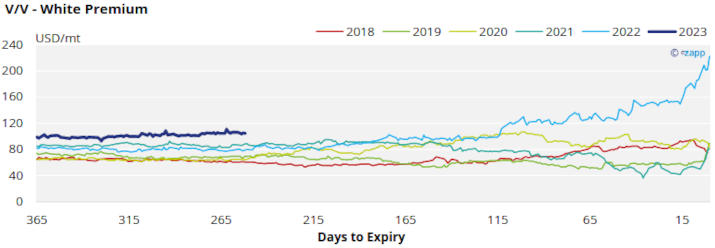

White Premium (Arbitrage)

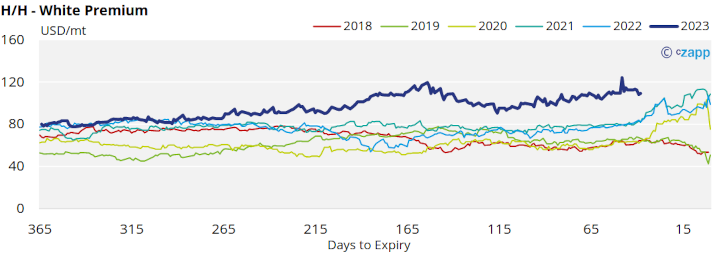

The H/H sugar white premium continues to weaken, falling to 109USD/mt by close of trading last week.

We think re-exports refiners need around 120-130USD/mt above the No.11 to profitably produce refined sugar without physical premiums, therefore the current white premium is not strong enough to incentivise this.

The refined sugar market is likely to be slightly undersupplied for the majority of 2023 and this is reflected in comparatively stronger K/K and Q/N white premiums which have slightly weakened below 120USD/mt.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix