Insight Focus

Raw sugar futures traded above 20c/lb. Speculators are no longer net short in the market. End-users closed a large number of positions.

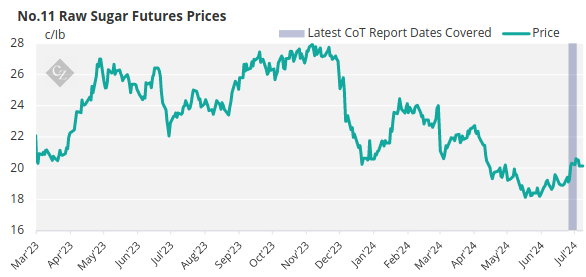

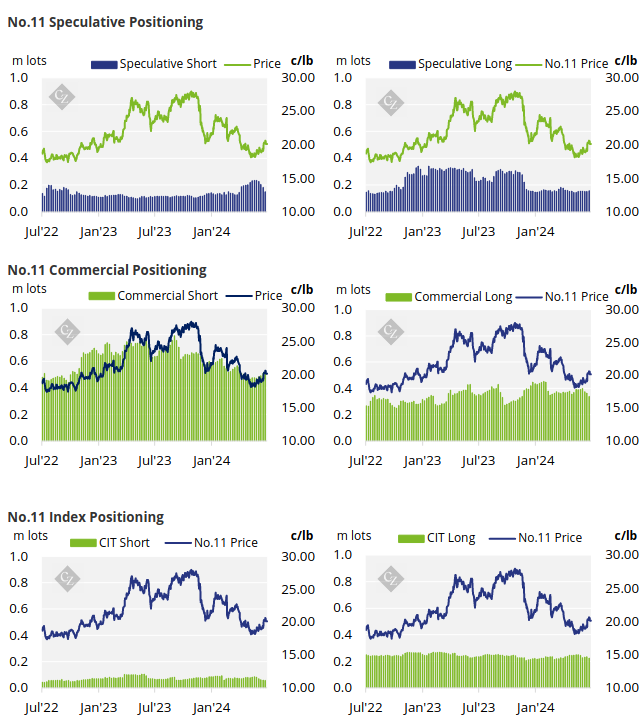

New York No.11 Raw Sugar Futures

The raw sugar futures market traded above 20c/lb last week, hitting 20.1c/lb by Friday’s close.

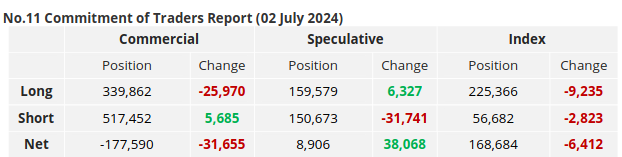

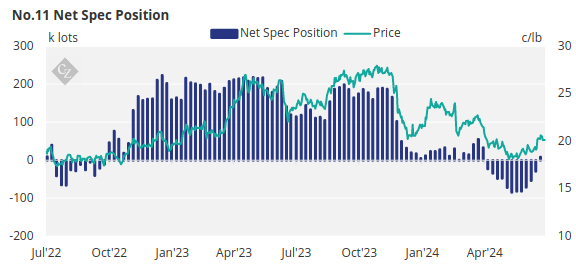

Speculative action is likely the reason prices were pushed up following the expiry just over a week ago, as they continued with their streak of not adding to their shorts, closing out 31.7k lots of short positions.

Speculators have not added a significant amount to their long positions, opening just 6.3k lots of longs. However, speculators are no longer net short in the market as their net spec position now stands at 8.9k lots, returning to a more neutral position.

Looking at the commercial participants, end-users have closed out a significant number of positions, closing out 26k lots of long positions. While producers have opened a minimal number of positions, opening just 5.7k lots of short positions, despite the raw sugar futures having traded above 20c/lb.

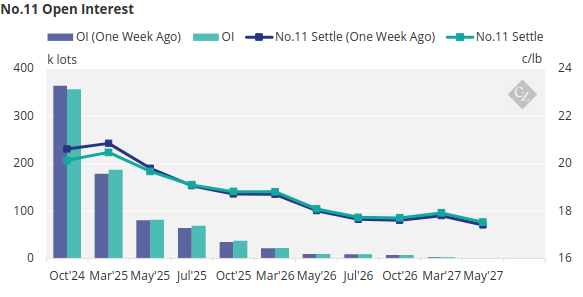

The No.11 futures curve has weakened towards the front of the curve but remains flat across the board.

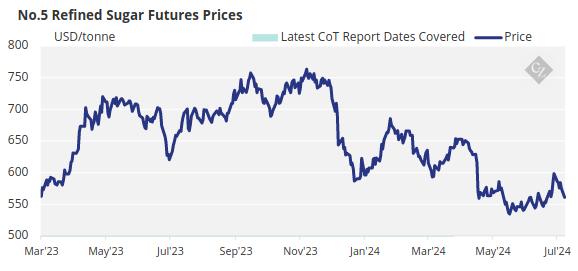

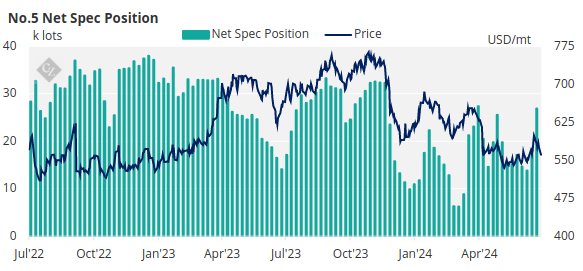

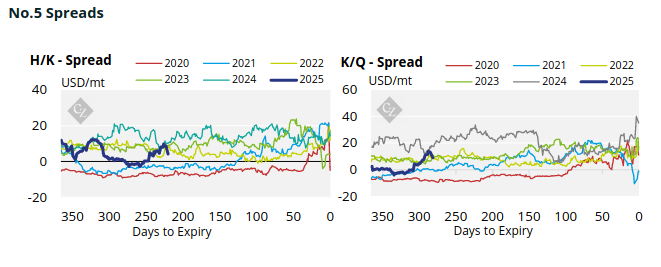

London No.5 Refined Sugar Future

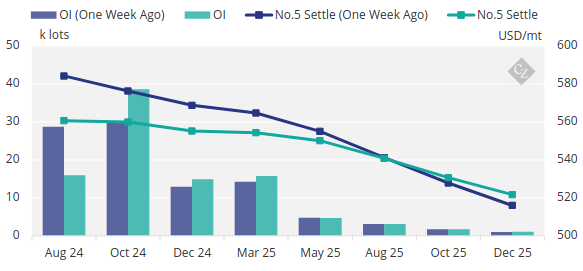

The No.5 refined sugar futures traded between 575-585 USD/mt in the past week, before closing at 575 USD/mt on Friday.

Speculators opened 9.7k lots of longs bringing the net spec position up to 26.8k lots, which is the highest net spec we have seen since May.

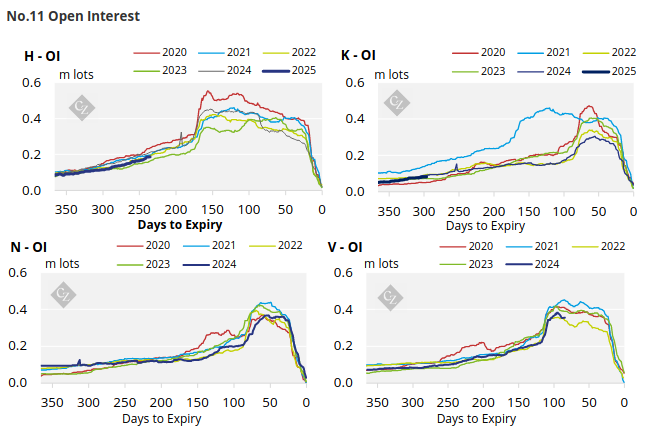

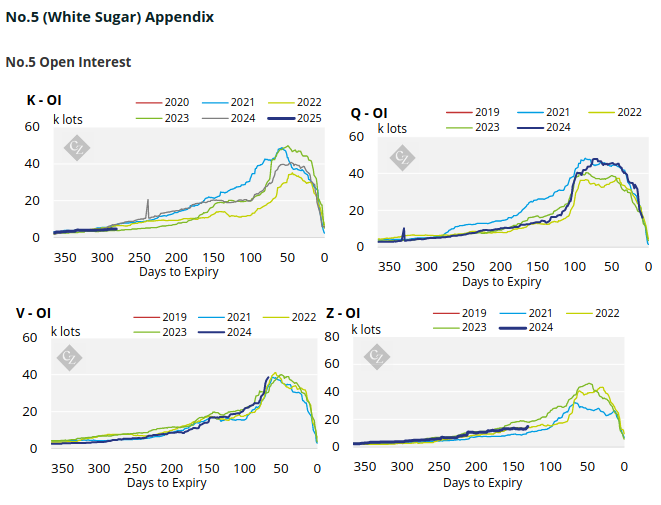

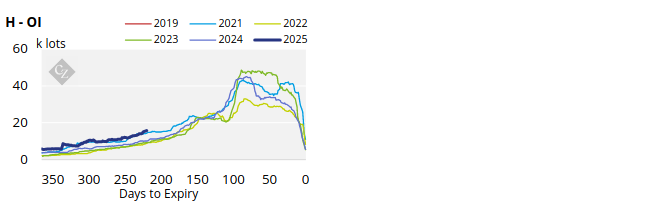

No.5 Open Interest

The No.5 refined sugar futures curve has flattened towards the front of the curve but remains in backwardation from May 2025 onwards.

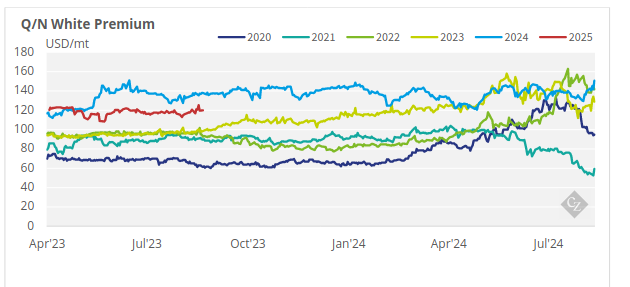

White Premium (Arbitrage)

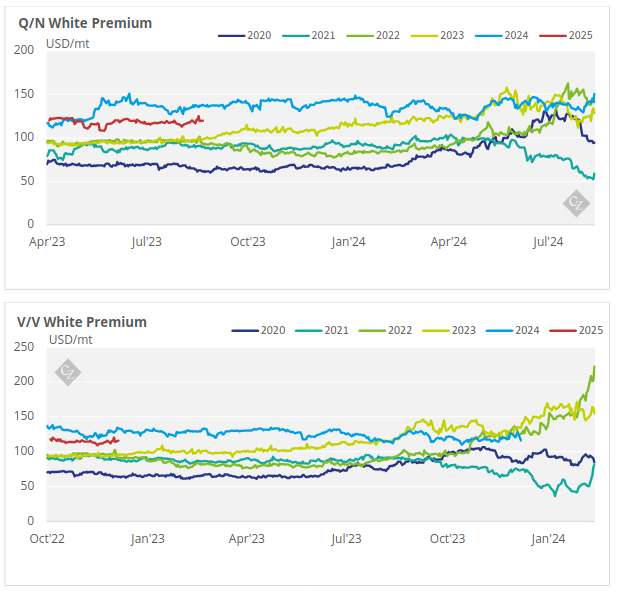

The Q/N 2025 white premium traded lower last week, closing at 120 USD/mt on Friday.

Many re-exports refiners need around 105-115USD/mt above the No.11 to profitably produce refined sugar. The current white premium is well above this level, which means we should theoretically see a pick-up in demand soon.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

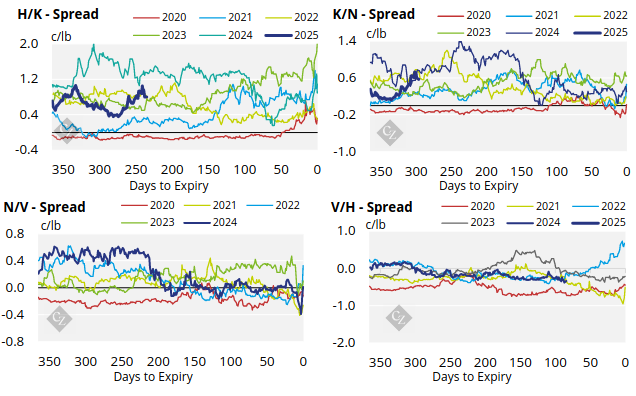

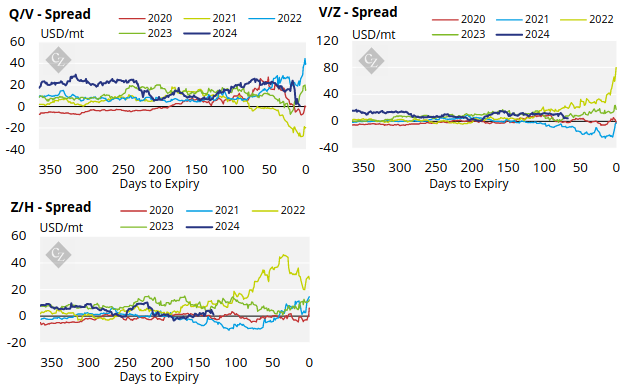

No.11 Spreads

4

4

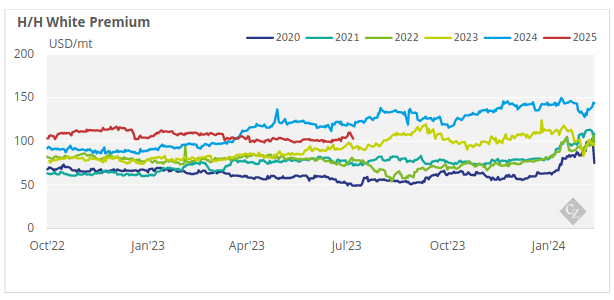

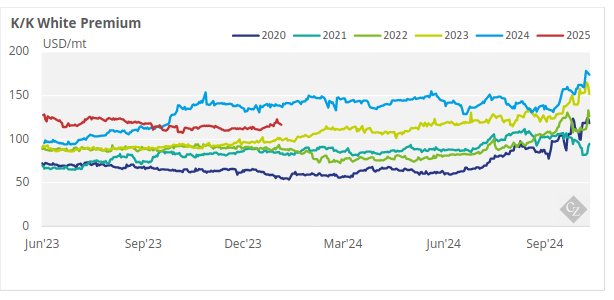

White Premium Appendix