Insight Focus

- No.11 prices fall below 19c/lb.

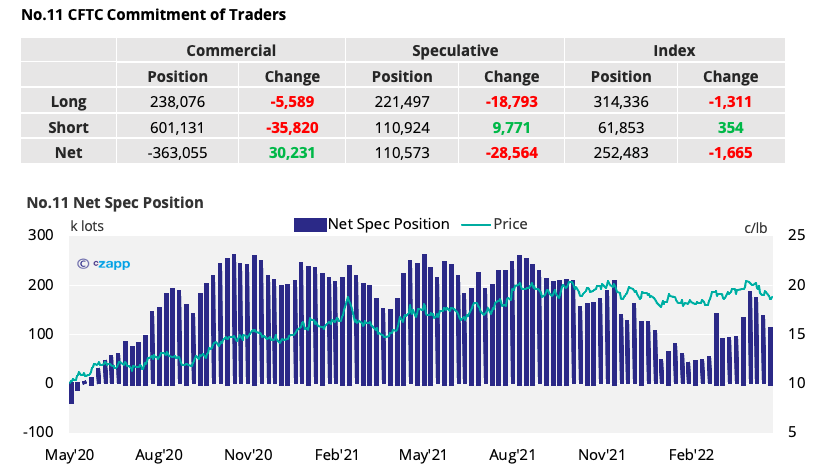

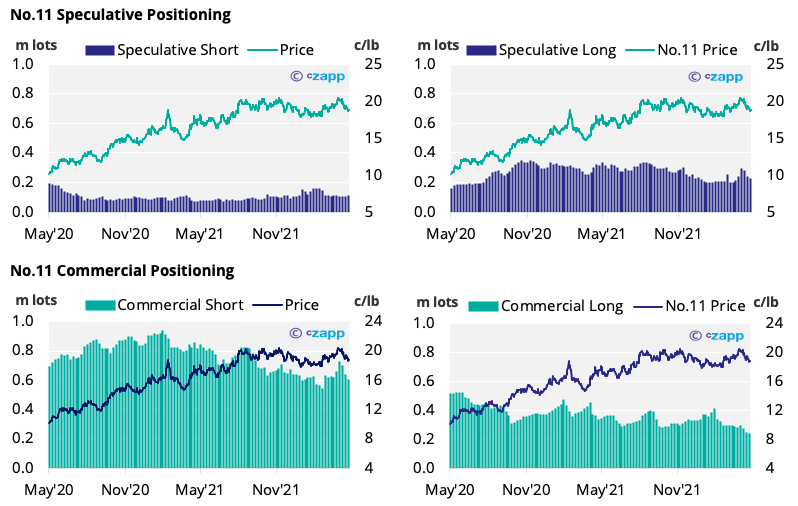

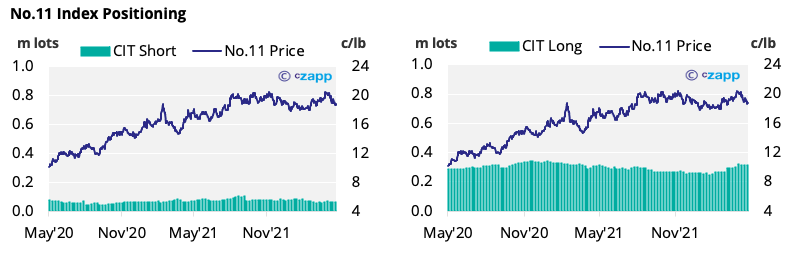

- Raw sugar speculators continue to exit long positions.

- Commercial short positions are rolling off faster than they are added.

New York No.11 (Raw Sugar)

- Raw sugar prices have continued their decline over last week, settling at 18.8c/lb by Friday.

- Prices had been helped downwards by 18k lots of spec long positions being removed by the 3rd of May.

- A modest increase in the spec short means that the net spec position is now the lowest in 6 weeks.

- Consumers continue to be poorly hedged with the commercial long position reducing by over 5k lots.

- Additionally, almost 36k lots of commercial short positions have been removed – indicating producers have paused further hedging in light of lower prices.

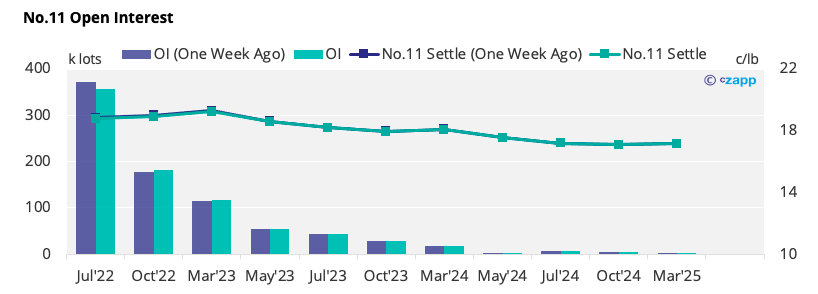

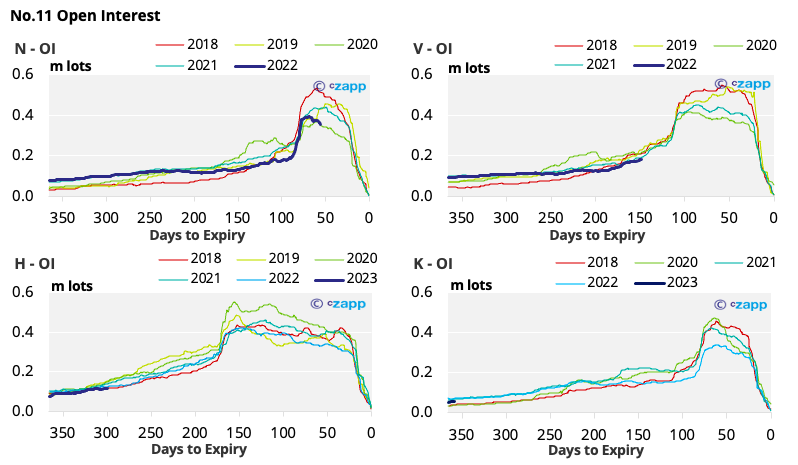

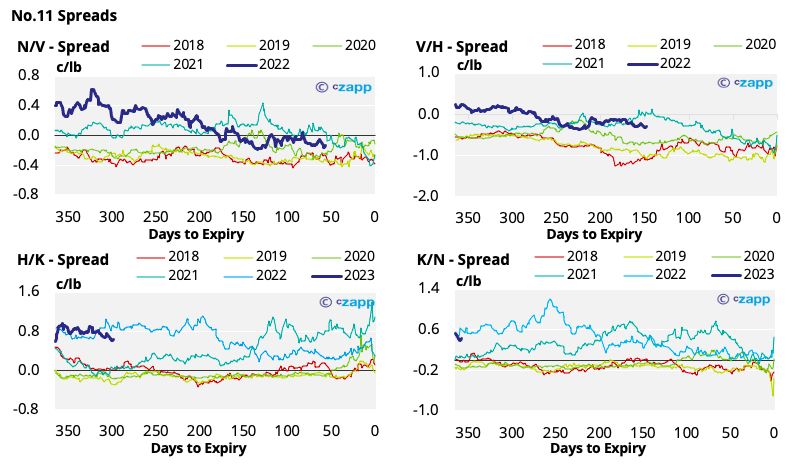

- The No.11 forward curve is still slightly contango towards H’23, then backwardated across 2023.

London No.5 (White Sugar)

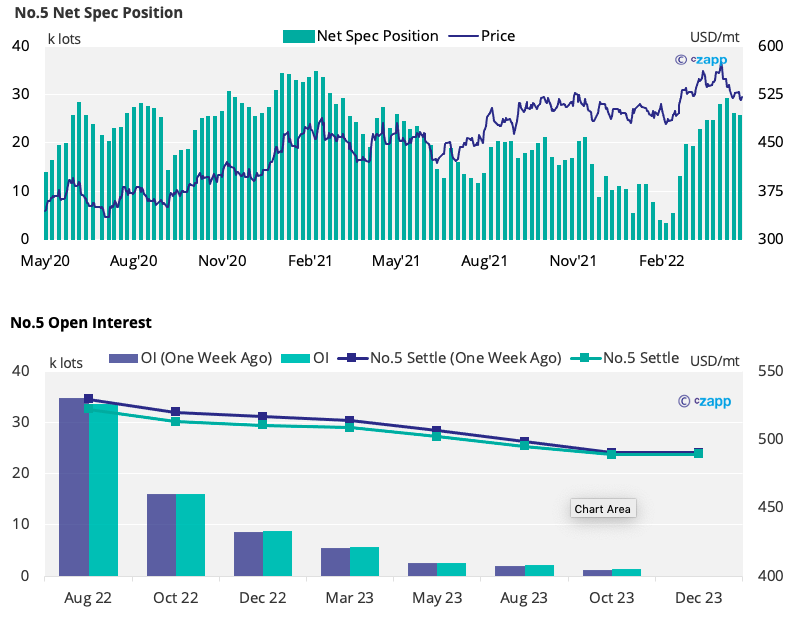

- No.5 prices have hovered around 520USD/mt for the second week in a row.

- The net spec position is largely unchanged, and remains close to the highest level since May 2021.

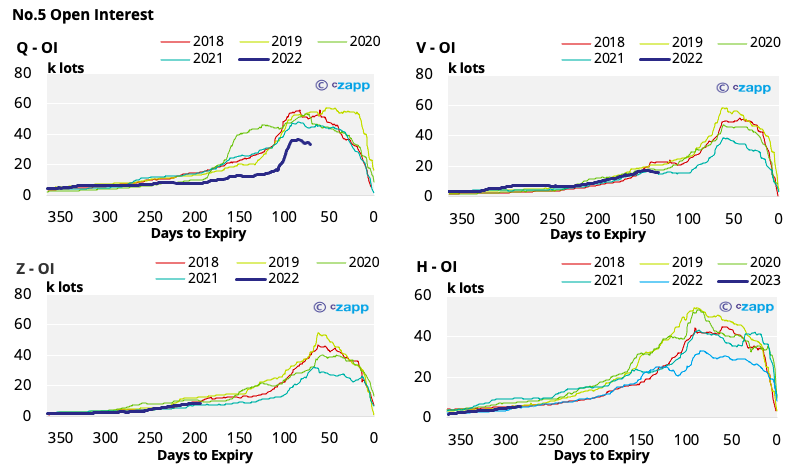

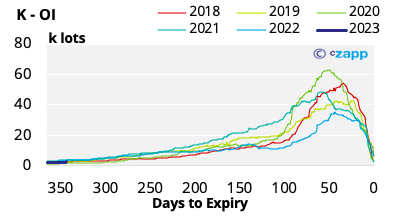

- Open interest in the Q’22 contract continues to be lower at this stage than in previous years.

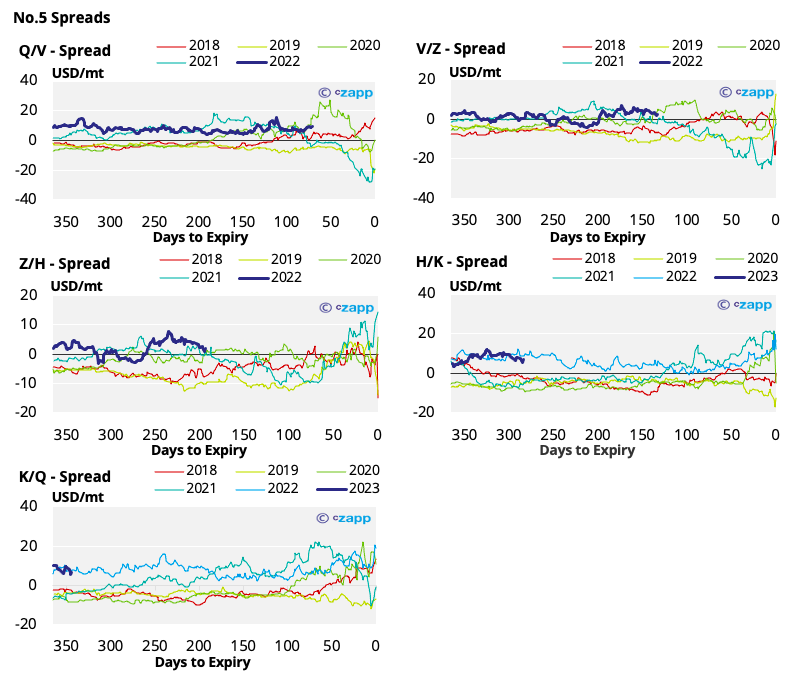

- The futures curve is still backwardated across 2022 and 2023.

White Premium (Arbitrage)

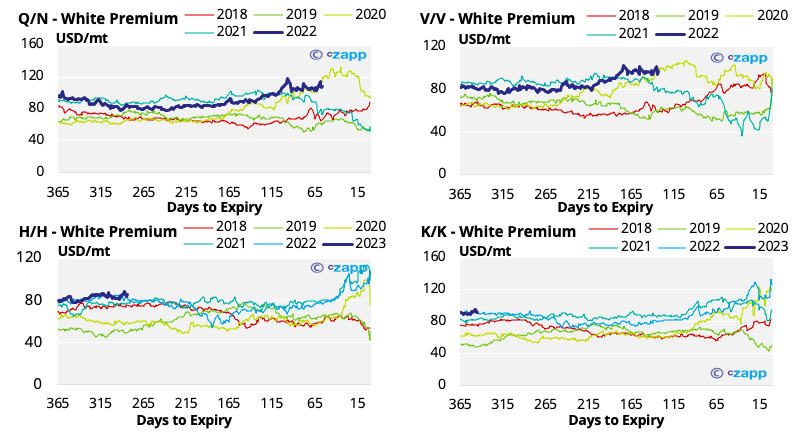

- The Q/N 2022 white premium has kept above 100USD and now sits at 106USD/mt.

- This is close to the highest level seen for the Q/N arbitrage by this stage in the year for the last 5 years.

- Despite this, we think re-export refiners may struggle to operate profitably at this level.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…