Insight Focus

- Raw sugar hedging has slowed post-May futures expiry.

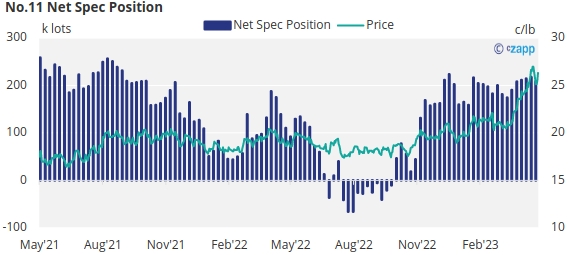

- The net speculative position has also fallen.

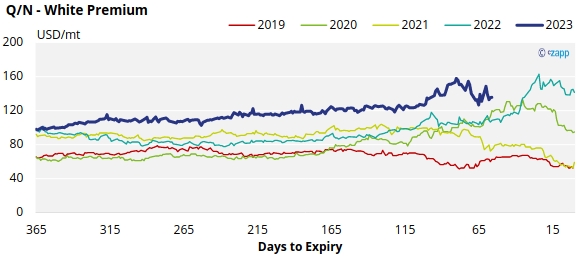

- Q/N sugar white premiums have strengthened, standing at 135USD/mt.

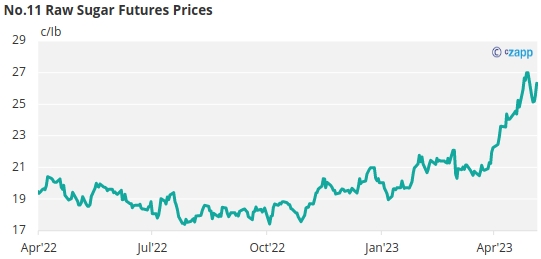

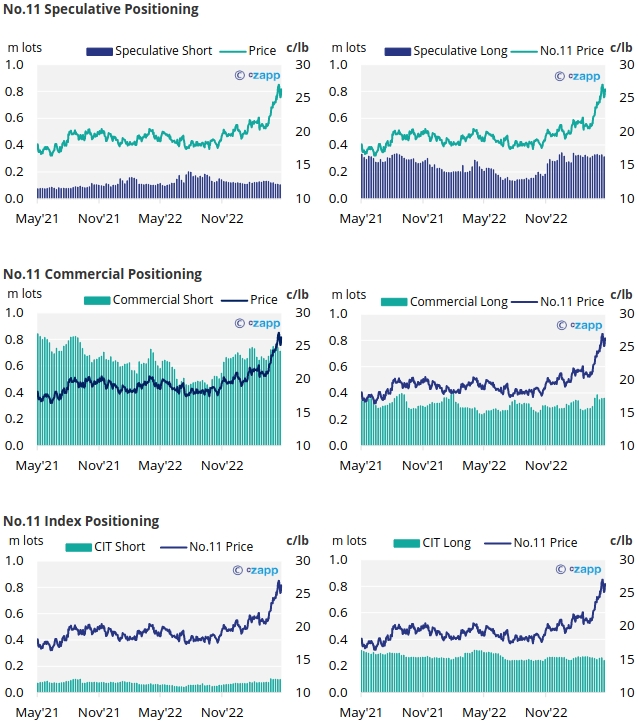

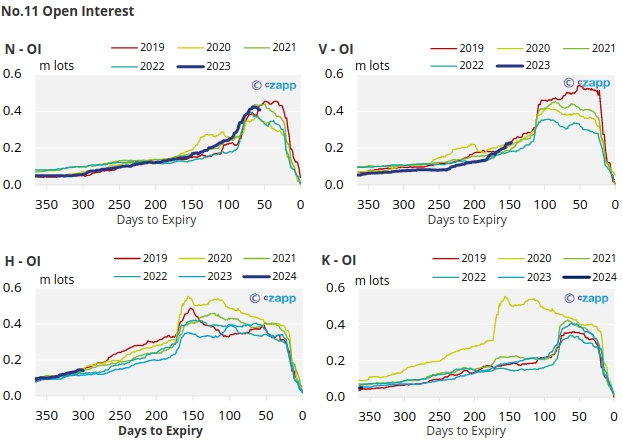

New York No.11 Raw Sugar Futures

Following the May’23 expiry, No.11 sugar futures prices fell slightly over the past week, reaching a low of 24.9c/Ib last Wednesday before recovering and closing at 26.32c/Ib on Friday.

By the 2nd of May (latest CoT CFTC report) the spec long position fell by 13.5k lots, less than 4% of the total number of long positions held last week. With prices already at multi-year highs, speculators may be wary about adding to their long.

With some short positions also closed too, the net spec position has only fallen by 9k lots to 208k lots.

On the commercial side, raw sugar producers closed over 25k lots of short positions, whilst consumers were able to add around 1.8k lots of new hedges.

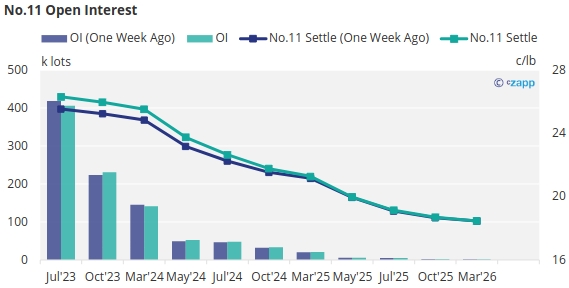

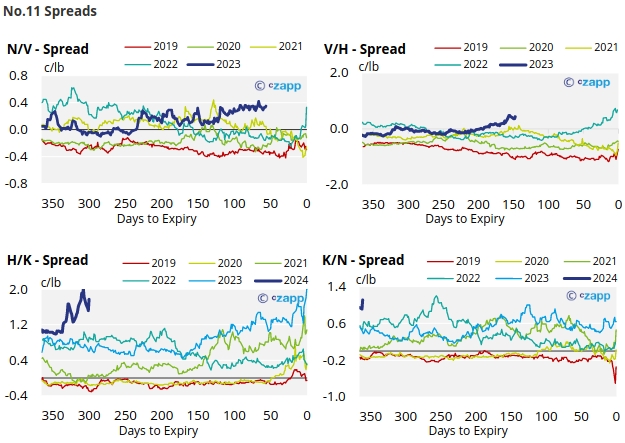

Following the May’23 expiry, the No.11 forward curve remains inverted through to March 2026.

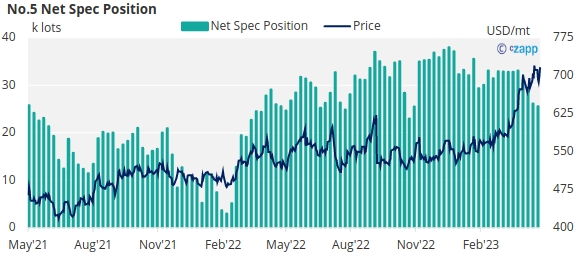

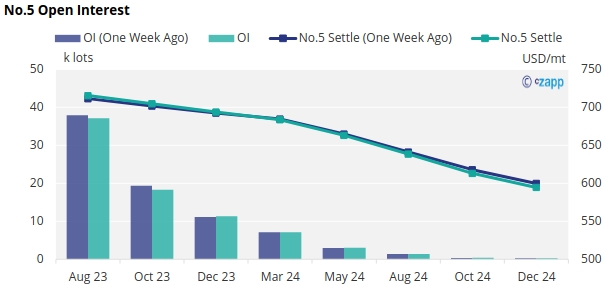

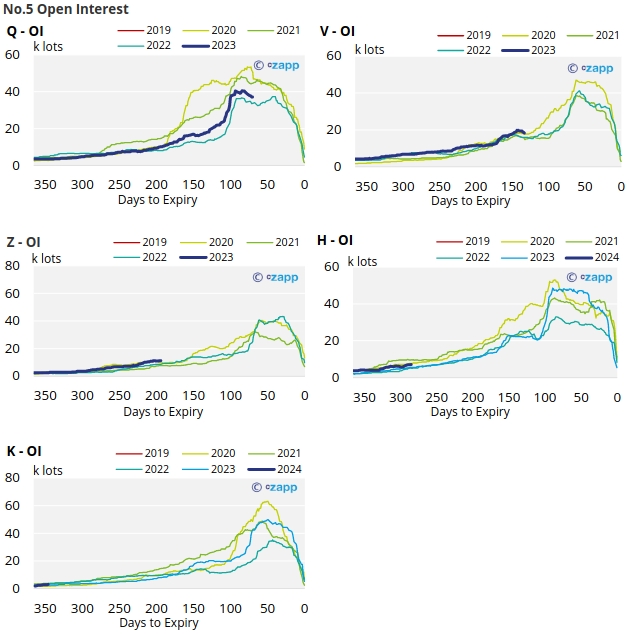

London No.5 Refined Sugar Futures

The No.5 refined sugar futures also traded sideways last week, before strengthening again on Friday and closing at 715USD/mt.

By the 2nd of May (latest CoT data), refined sugar speculators reduced their net long positions by 0.6k lots, though does represent a reasonable drop for the second week in a row, the refined sugar speculators are now at similar position to this time last year.

The No.11 forward curve continues remains inverted until December 2024.

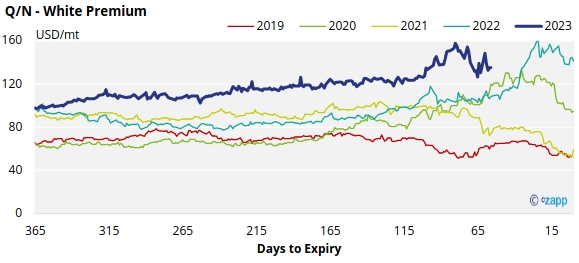

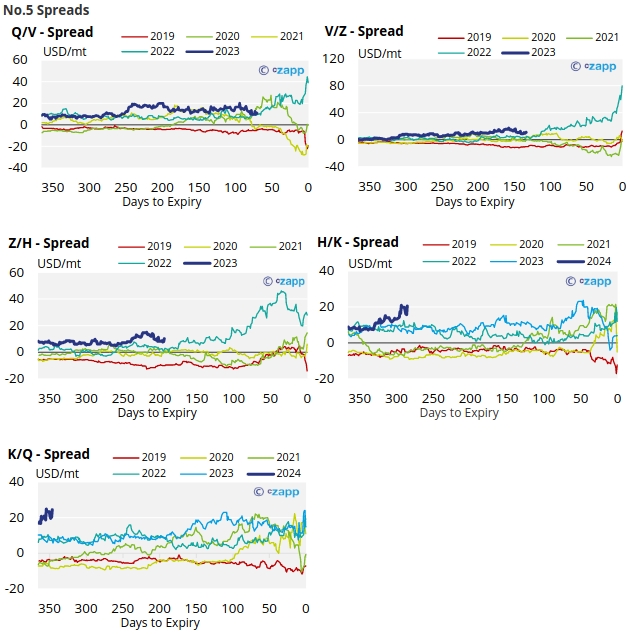

White Premium (Arbitrage)

The Q/N sugar white premium has strengthened slightly over the past week, now trading at 135USD/mt.

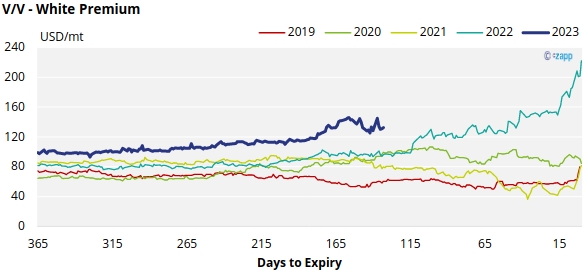

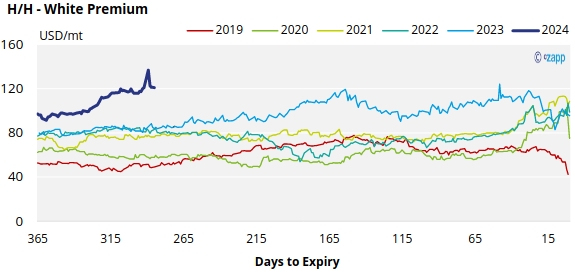

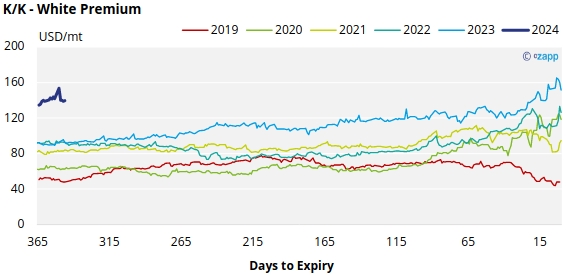

The refined sugar market is expected to be slightly undersupplied for the majority of 2023, as evidenced by comparatively strong V/V and H/H white premiums, which have also been rising and now approach 133USD/mt and 121UD/mt, respectively.

With global energy prices falling, we believe re-exports refiners require around 130-145 USD/mt above the No.11 to produce refined sugar profitably.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix