Insight Focus

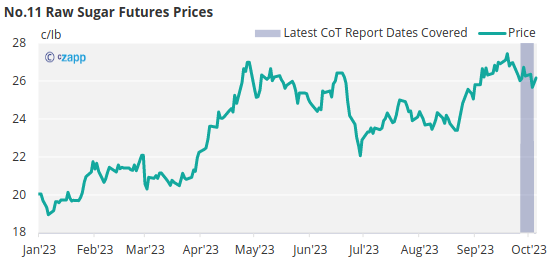

- The No.11 raw sugar futures continue to trade in their recent range.

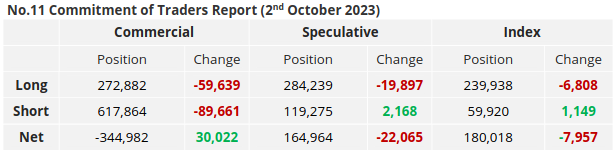

- Commercial participants closed a number of positions around the October expiry.

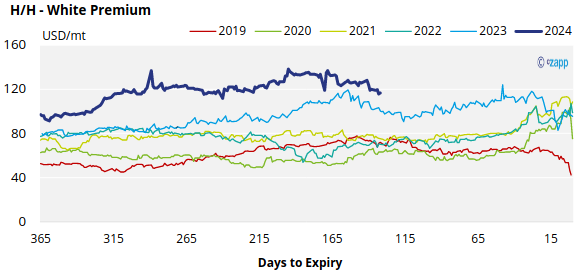

- The H/H white premium continues to weaken, now standing at 117 USD/mt.

New York No.11 Raw Sugar Futures

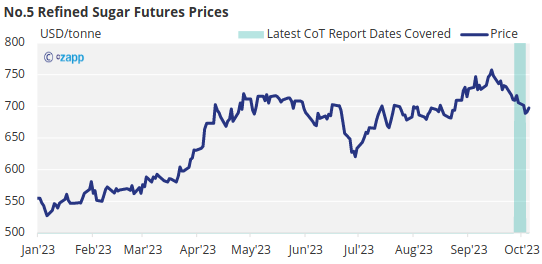

The No.11 raw sugar futures continue to trade between the 26-27c/Ib range.

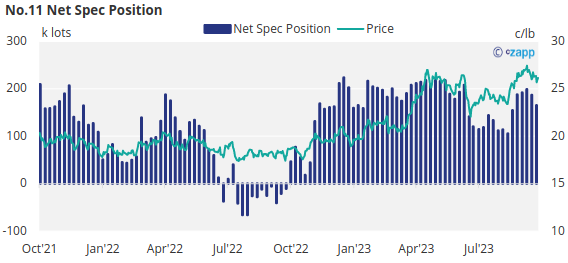

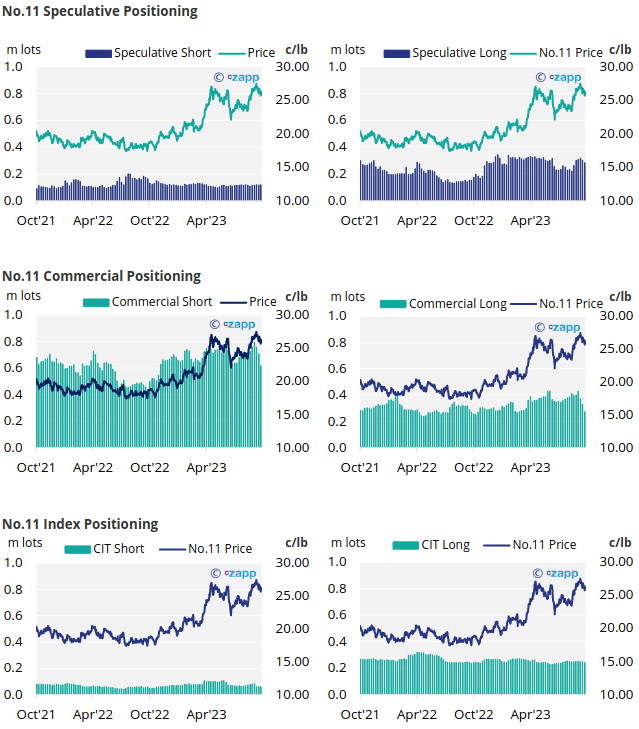

By the 2nd of October (latest CFTC CoT report), speculators of raw sugar closed out 19.8k lots of long positions.

With the addition of 2.1k lots of short positions, the overall net spec position has fallen by 22k lots to 164k.

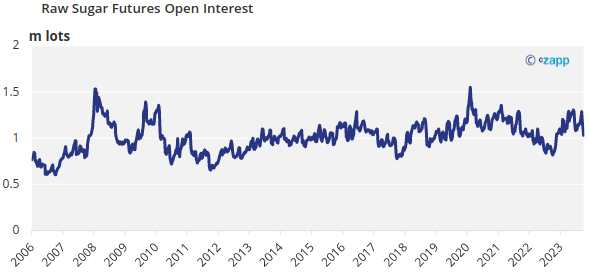

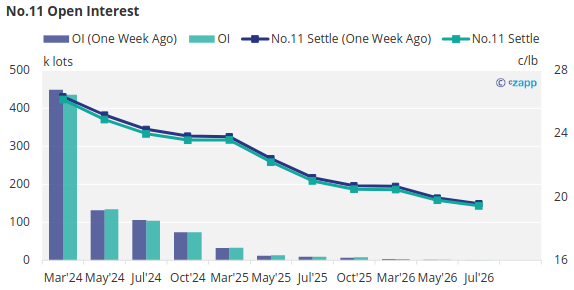

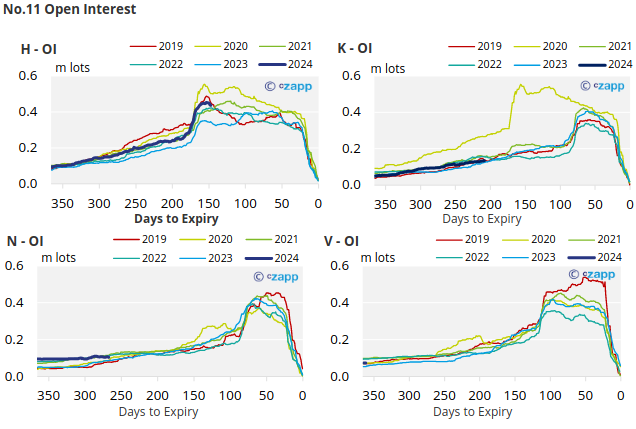

Looking over to the commercial participants, they too have been closing out a significant number of positions around the Oct’23 expiry. This has resulted in the market’s open interest falling to the lowest level in 11 months.

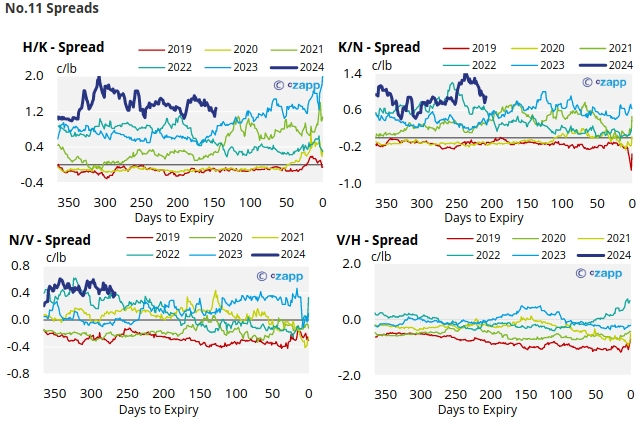

The No.11 forward curve remains inverted through to Mar’26.

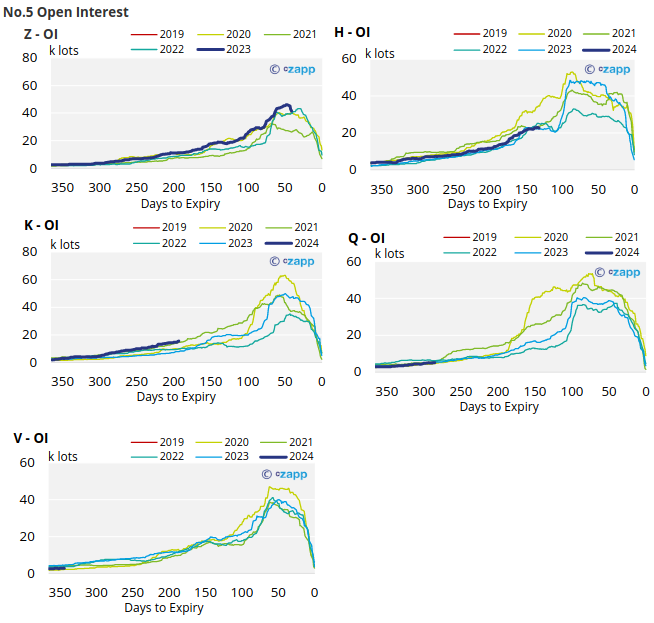

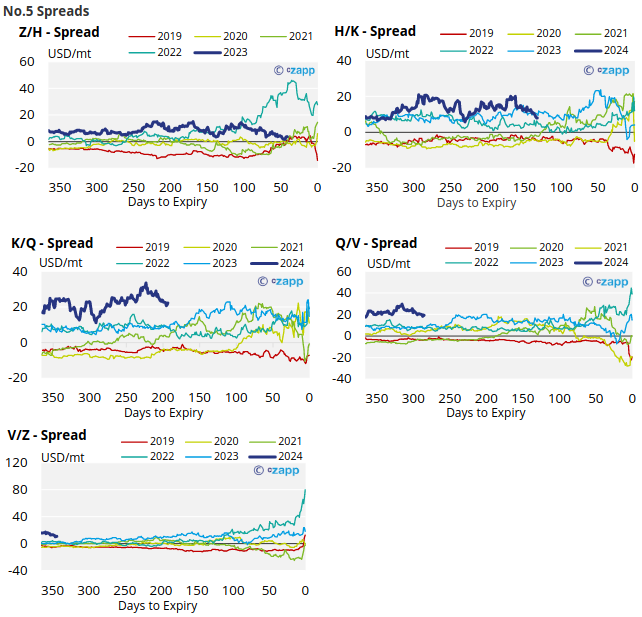

London No.5 Refined Sugar Futures

The No.5 refined sugar futures has continue to fall in recent weeks, closing at 691USD/mt last Friday.

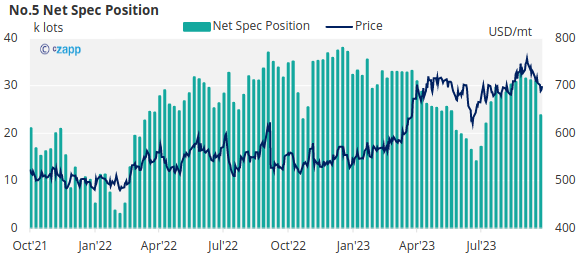

As prices have fallen away, so has the net spec position, which has decreased by 7k tonnes to 23.8k lots.

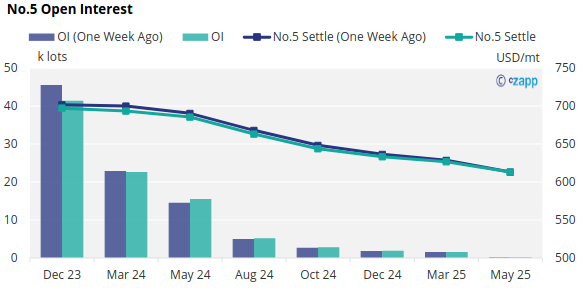

Having said that, the No.5 forwards curve has remained relatively unchanged since last week and remains inverted through Mary’25.

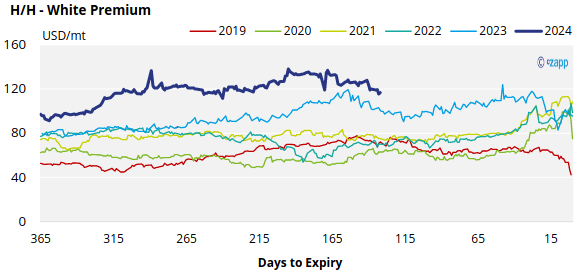

White Premium (Arbitrage)

With the No.11 and No.5 sugar futures making similar moves, the H/H white premium has weakened slightly to 117USD/mt.

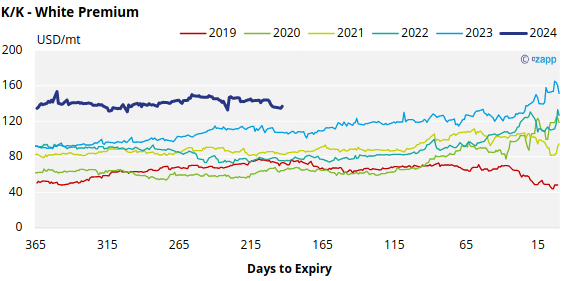

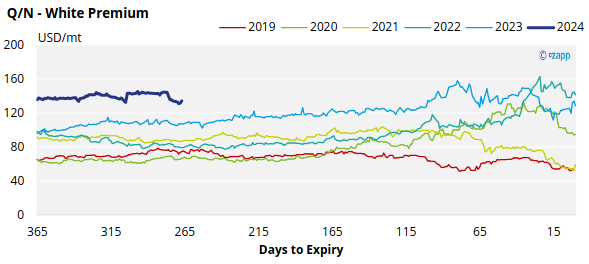

The refined sugar market is expected to be undersupplied for the rest of 2023 and the majority of 2024, as evidenced by a strong K/K and Q/N white premiums, both of which are trading around 135USD/mt.

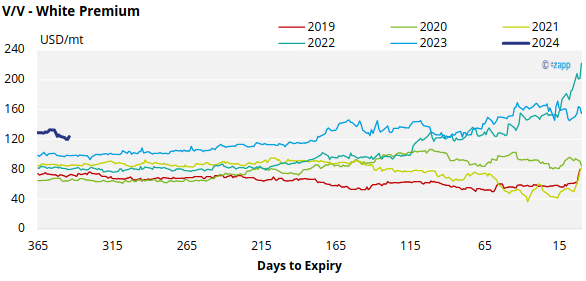

We believe that many re-export refiners require at least 90-105USD/tonne over the No.11 to be profitable, which means that the spot white premium provides comfortably enough for these refiners to maximize their throughput.

At this level, higher-cost or discretionary refiners may begin to consider re-exporting in addition to serving their domestic markets.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix