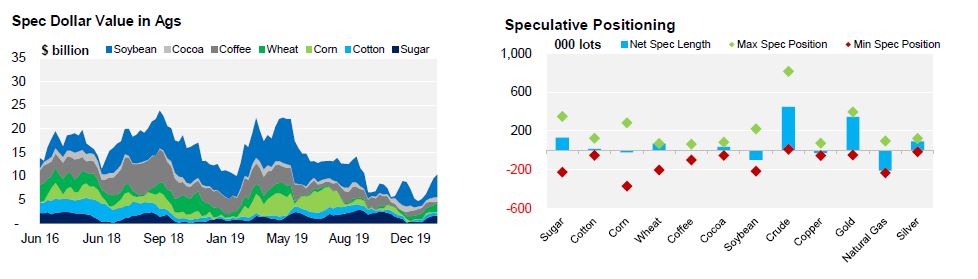

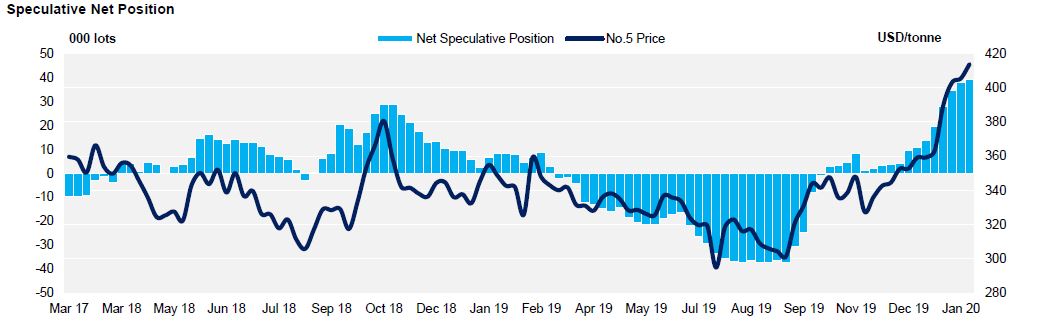

- Growth stalls in spec net long position for both No. 11 and No. 5 markets

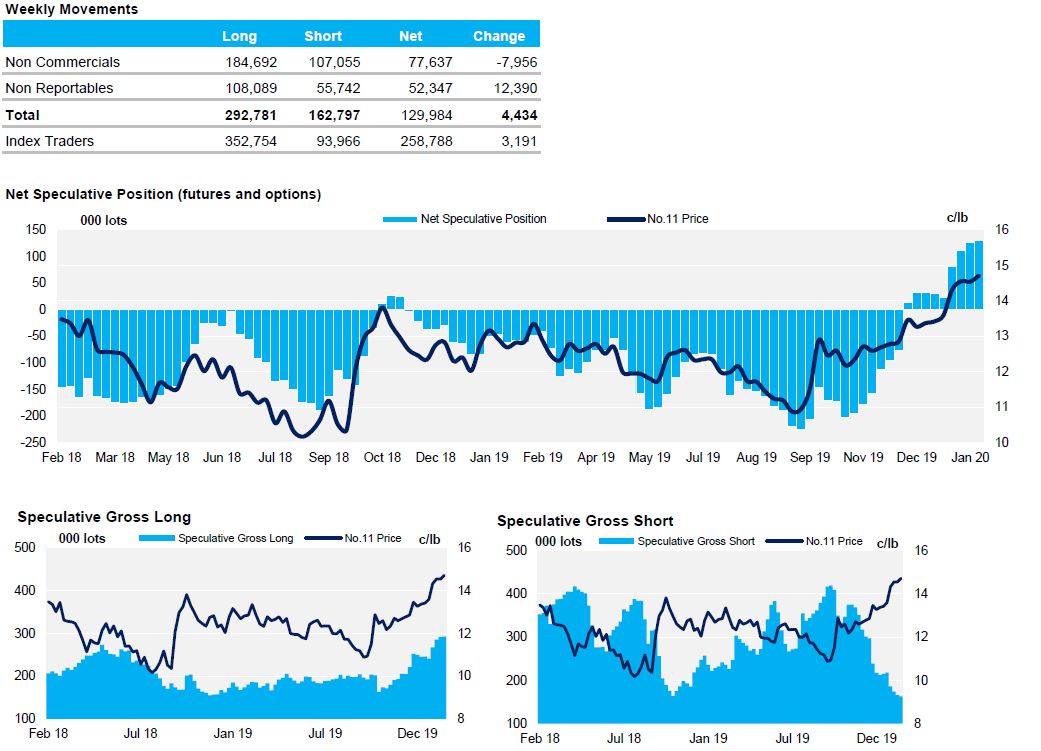

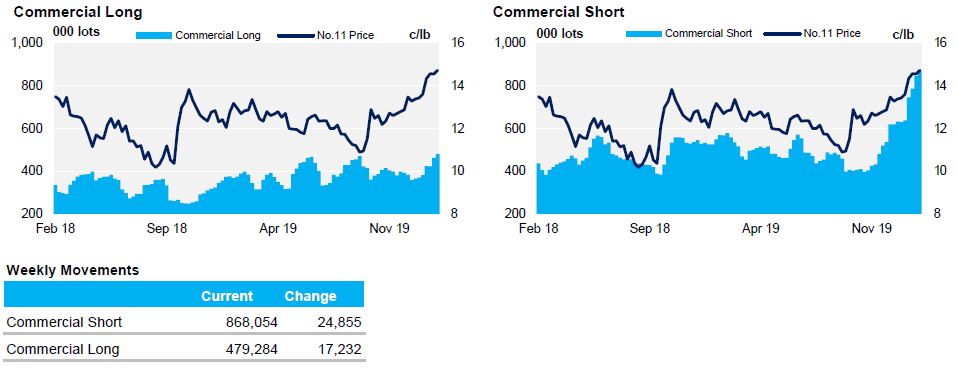

- In No. 11, commercials account for majority of both selling and buying for the second week running

- Interestingly over 90% of the spec buying was undertaken by small traders (non-reportables), rather than the large funds that have been heavily involved during the recent price rally

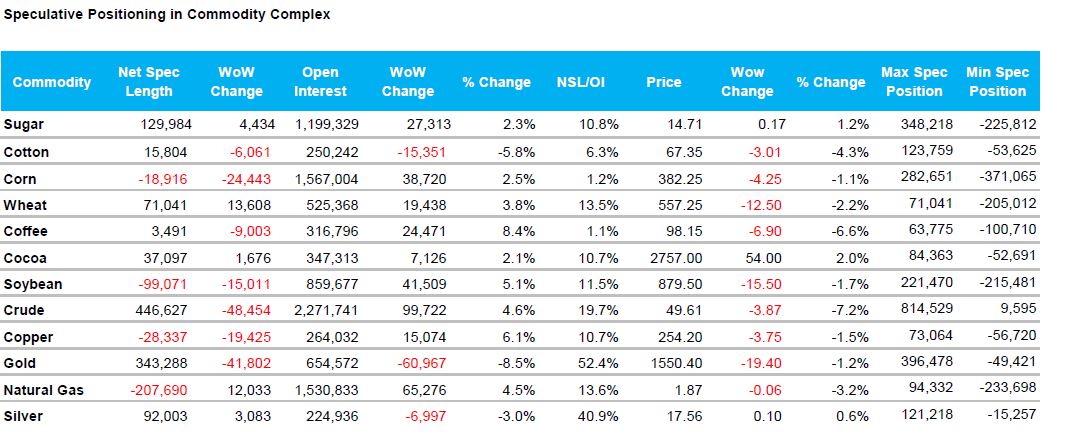

ICE No.11 Futures Speculative Positioning (values as of 4th February 2020)

ICE No.11 Futures Commerical Positioning (values as of 4th February 2020)

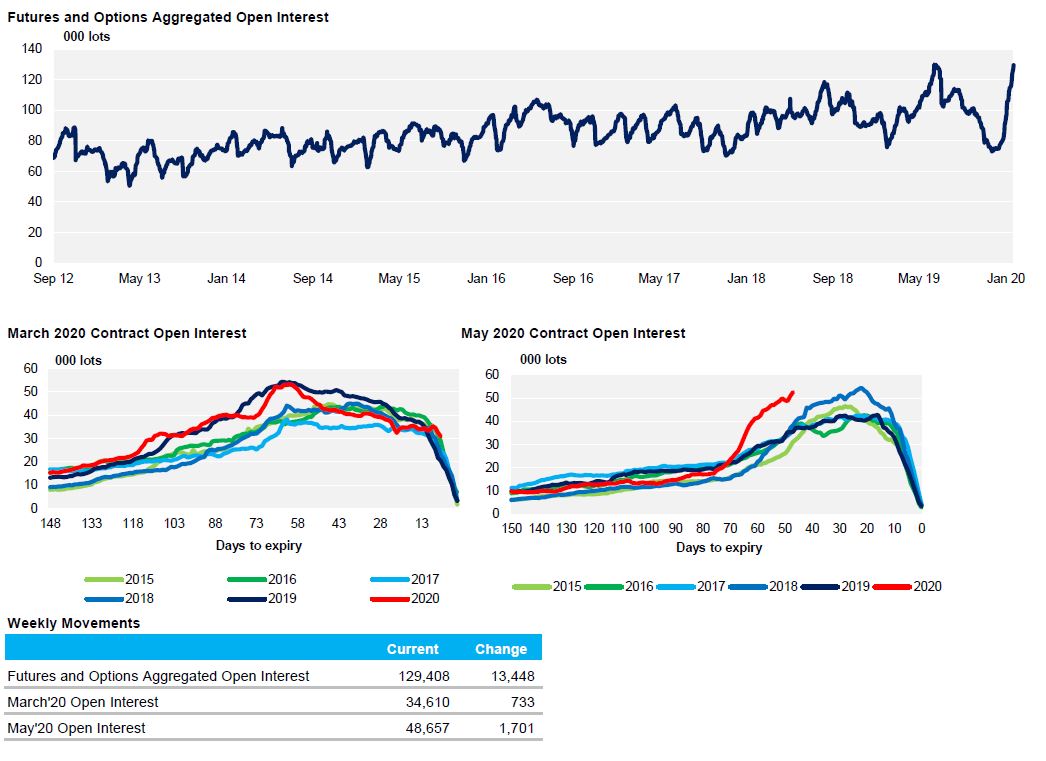

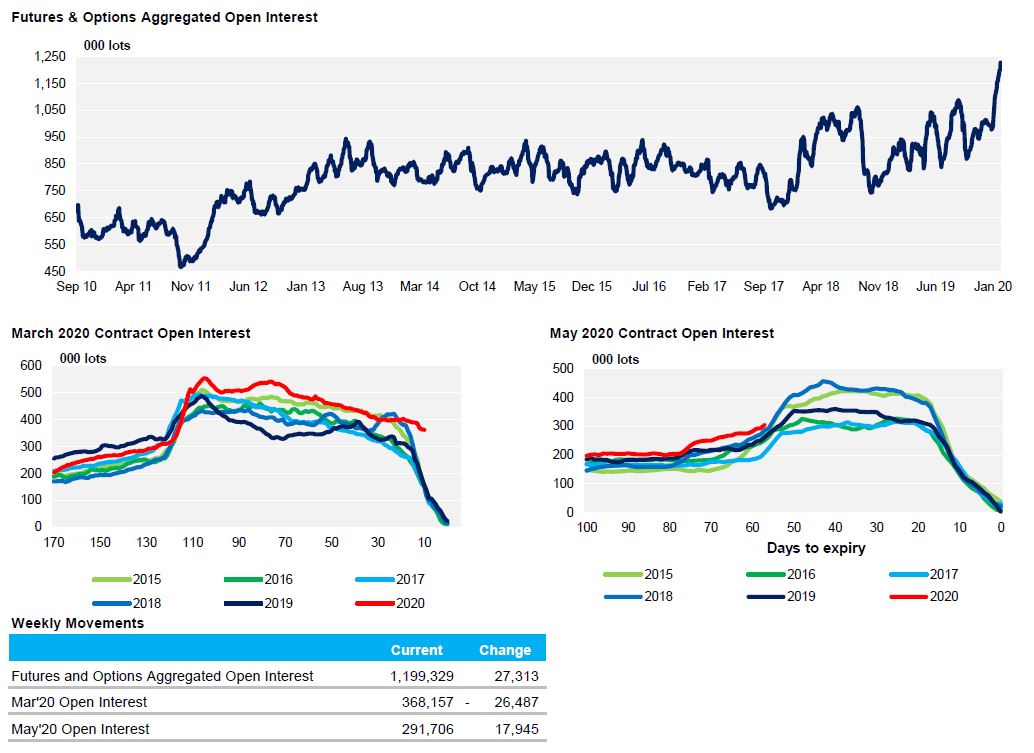

ICE No.11 Futures Open Interest (values as of 4th February 2020)

ICE Futures Europe (No.5) Speculative Positioning (values as of 4th February 2020)

ICE Futures Europe Open Interest (values as of 4th February 2020)