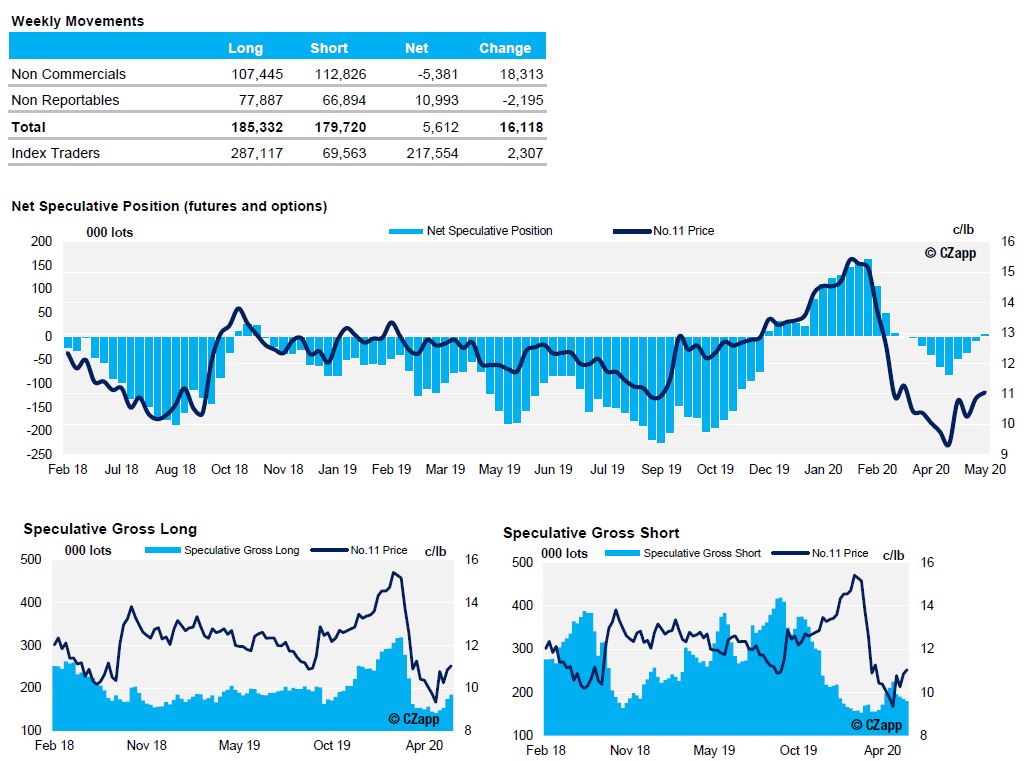

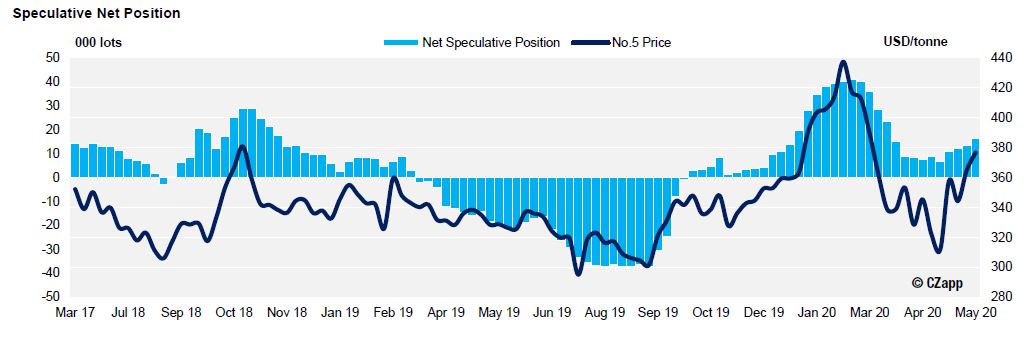

- Specs continue to appear bullish in raw sugar, now holding a modest net long position of 5k lots – moving in tandem with price as it surpassed 11c.

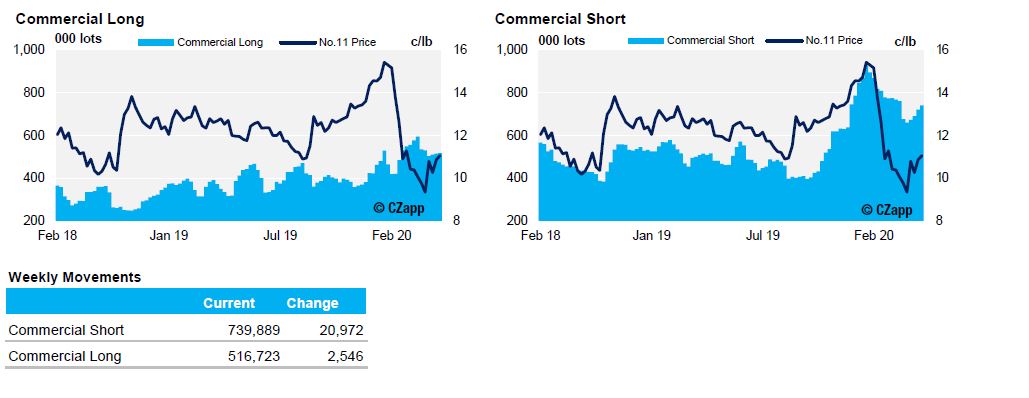

- This was driven both by specs opening new longs and closing shorts, and this buying was facilitated by raw sugar producers that were happy to hedge with the price strengthening.

- In white sugar the net long position continued its steady growth, in line with the tightness in the refined market – illustrated by the Q/N and V/V white premiums both standing above $100.

ICE No.11 Futures Commerical Positioning (values as of 26th May 2020)

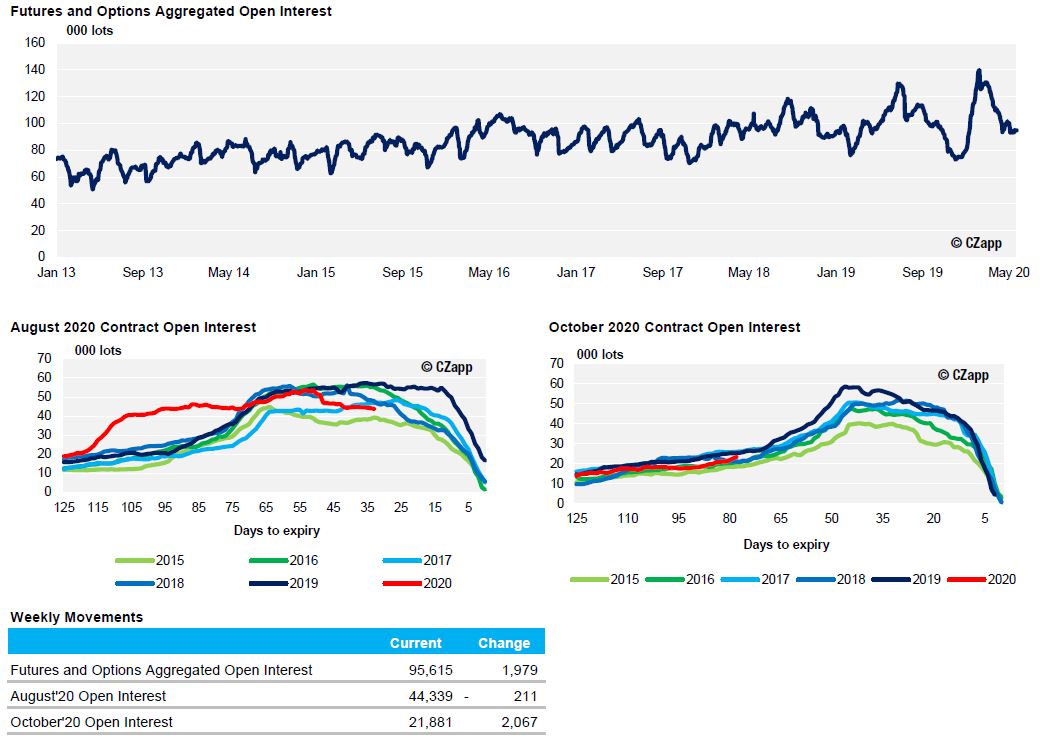

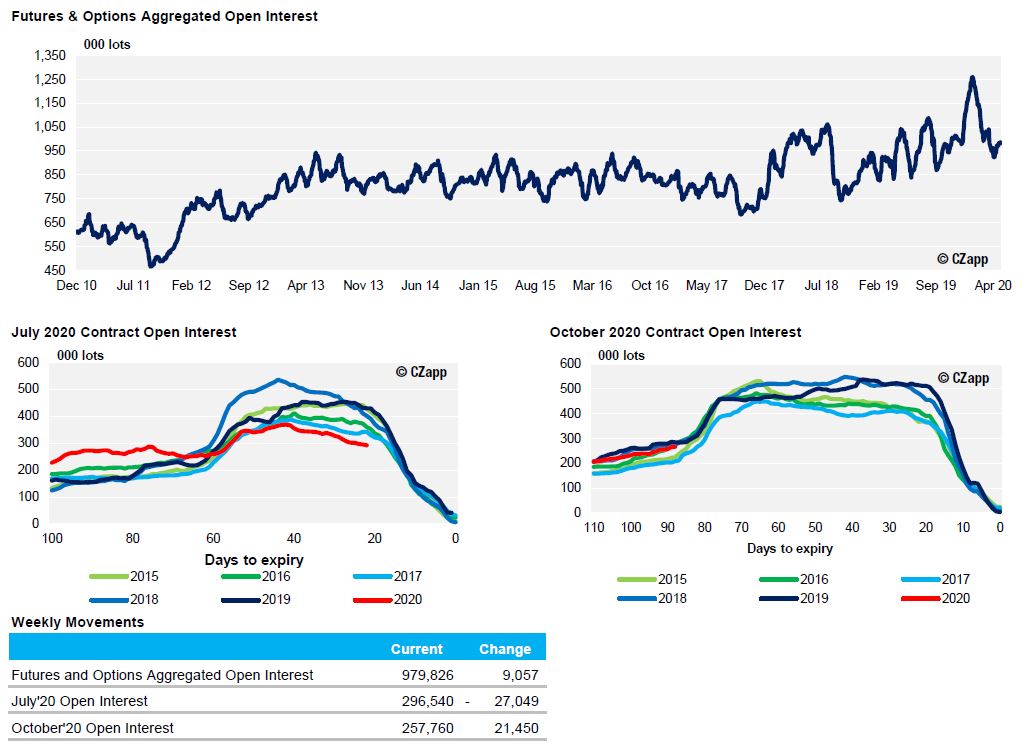

ICE No.11 Futures Open Interest (values as of 26th May 2020)

ICE Futures Europe (No.5) Speculative Positioning (values as of 26th May 2020)

ICE Futures Europe Open Interest (values as of 26th May 2020)