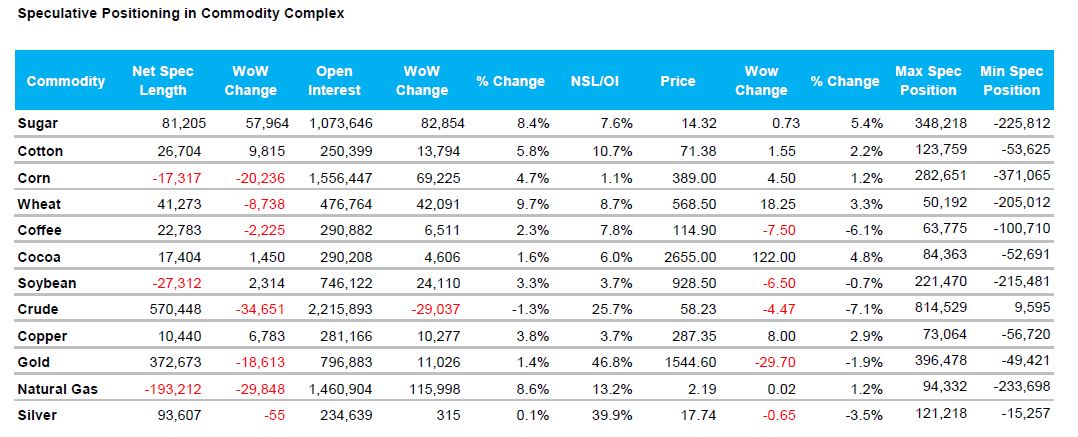

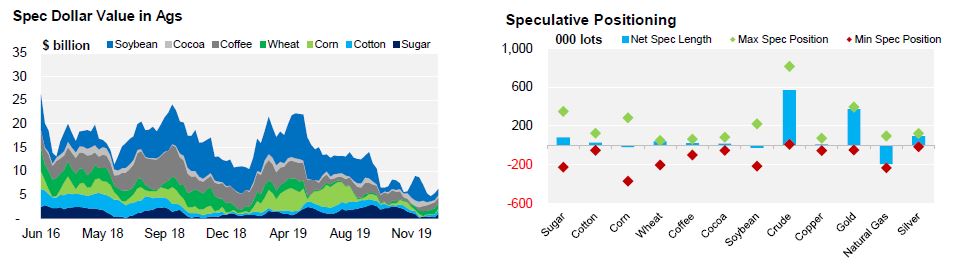

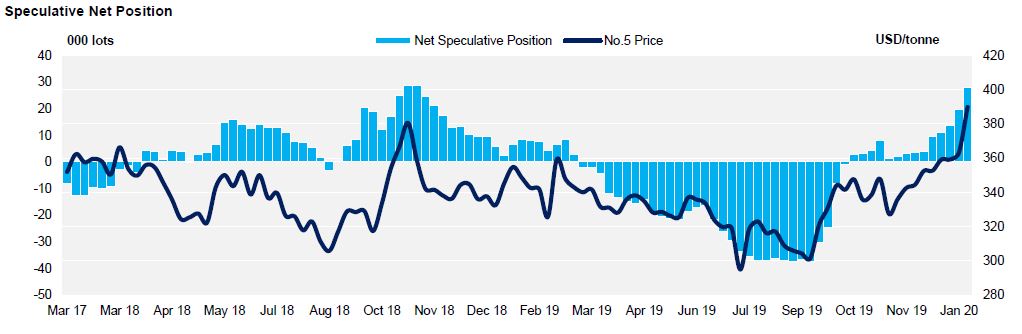

- Large wave of spec buying in No.11 leads to 81k lot net long, the largest since March 2017.

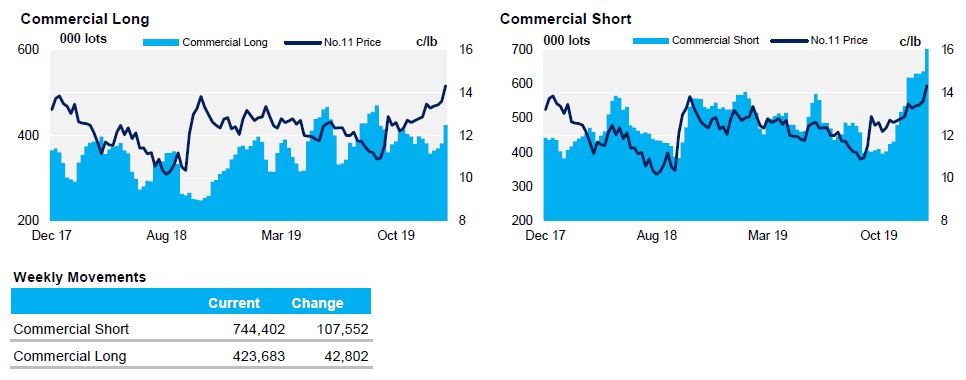

- Speculators have continued to buy back shorts and add to longs, but have run into heavy producer hedging near 14.50c/lb.

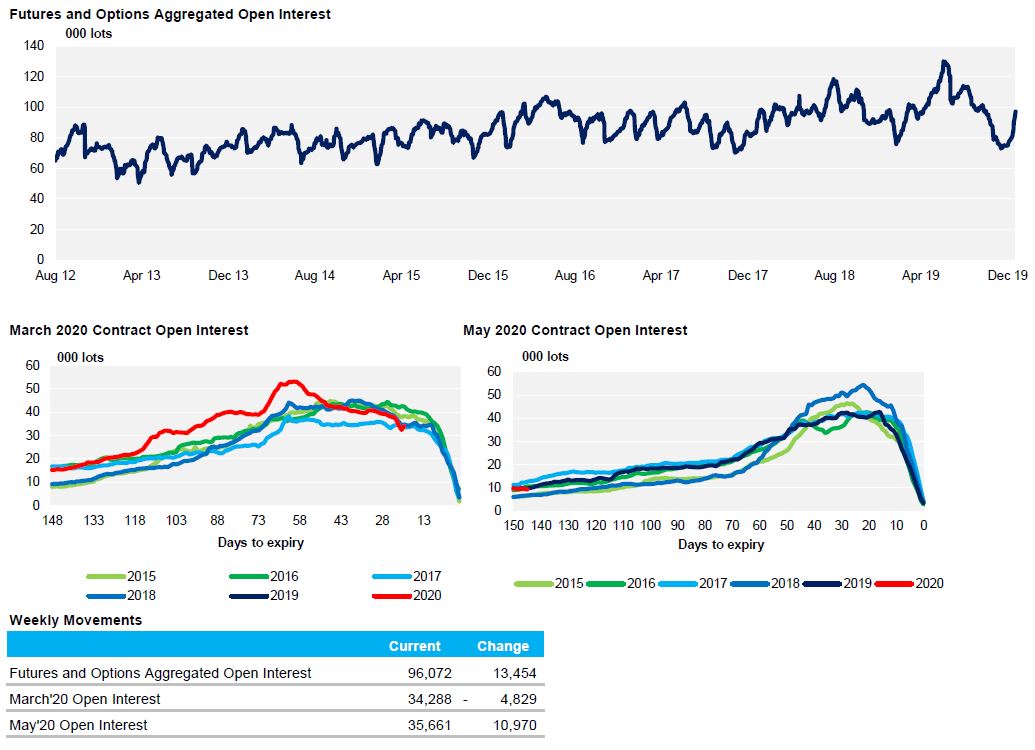

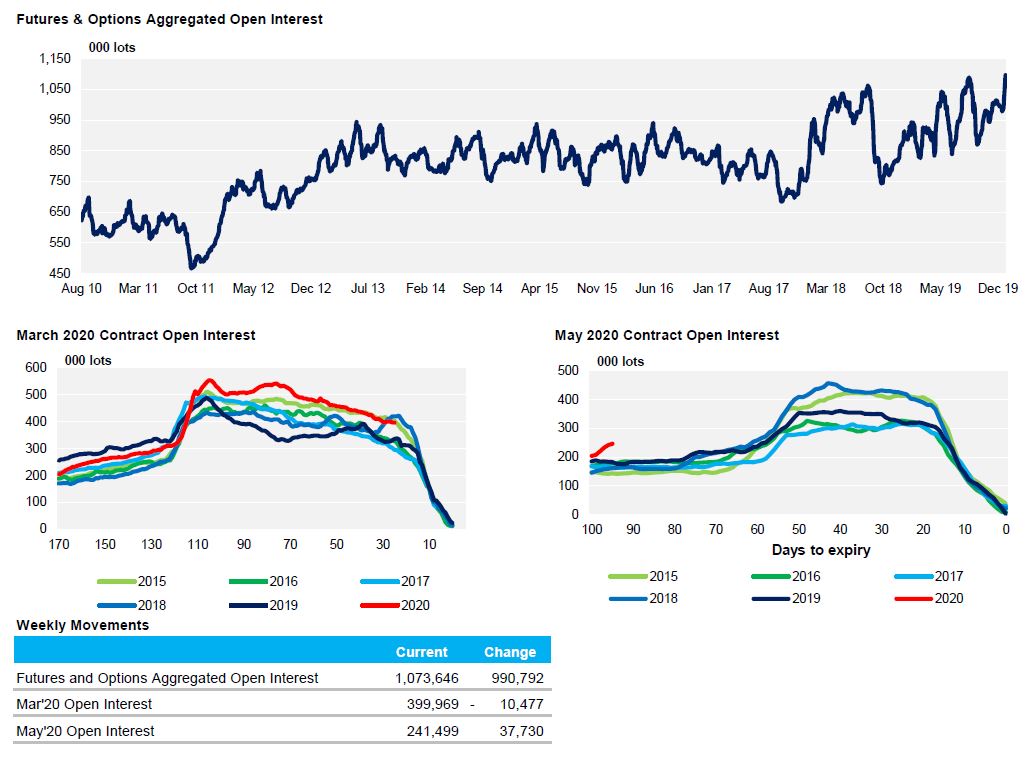

- Open Interest in raw sugar is close to record levels, with producers using the price strength to sell across all 2020 positions.

ICE No.11 Futures Speculative Positioning (values as of 14th January 2020)

ICE No.11 Futures Commerical Positioning (values as of 14th January 2020)

ICE No.11 Futures Open Interest (values as of 14th January 2020)

ICE Futures Europe (No.5) Speculative Positioning (values as of 14th January 2020)

ICE Futures Europe Open Interest (values as of 14th January 2020)