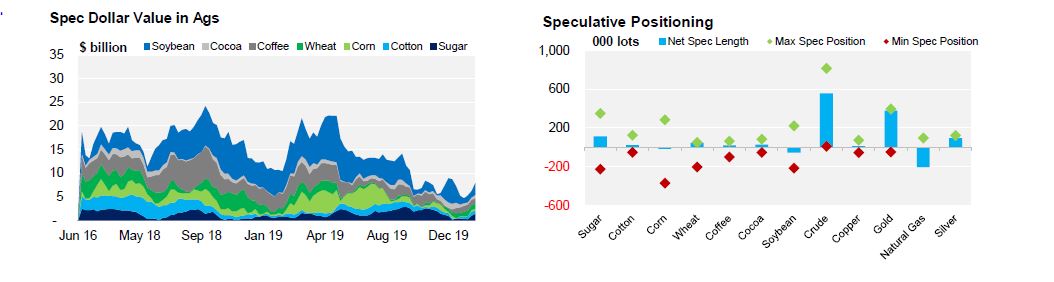

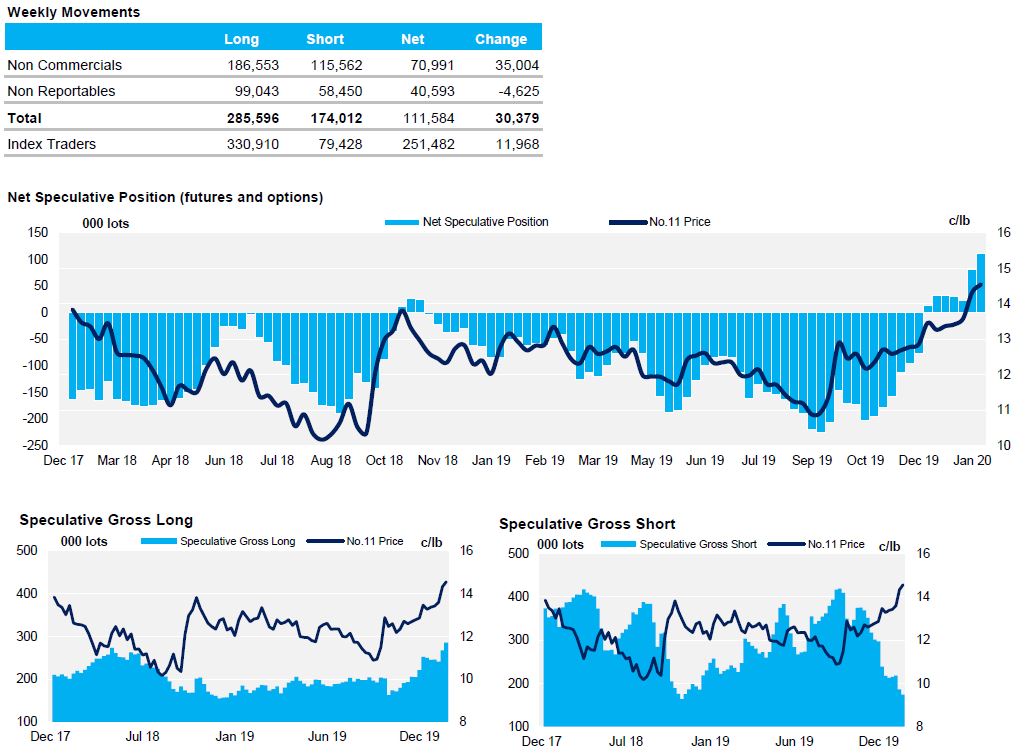

- The No.11 speculators have continued to increase their long position, currently sitting at 112k lots.

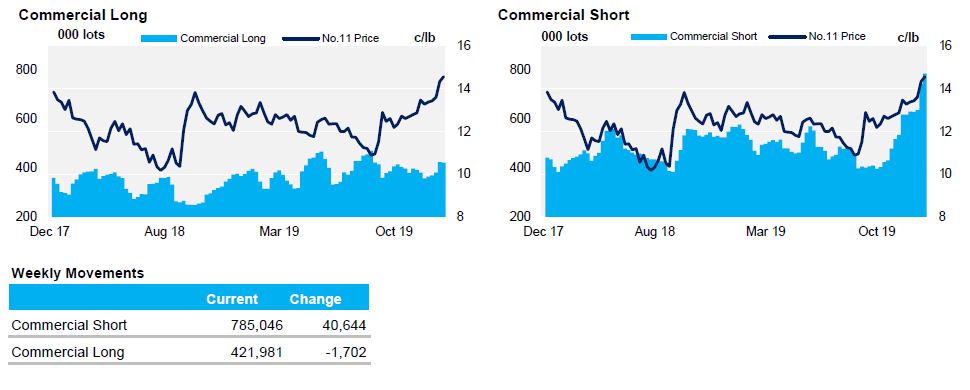

- Commercial shorts (producer pricing) accounted for 90% of the selling in the last week and their position has increased to levels not seen since Sept 2016 when prices were above 22c/lb.

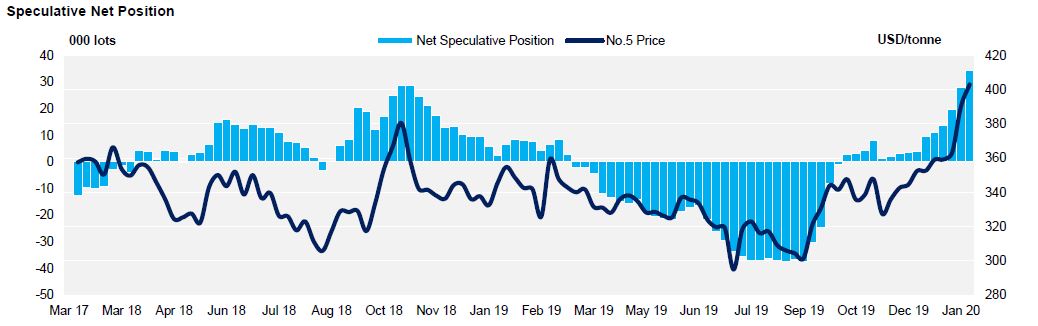

- The No.5 speculative position is currently at a record long of 34k lots long, having been a record short in H2’19.

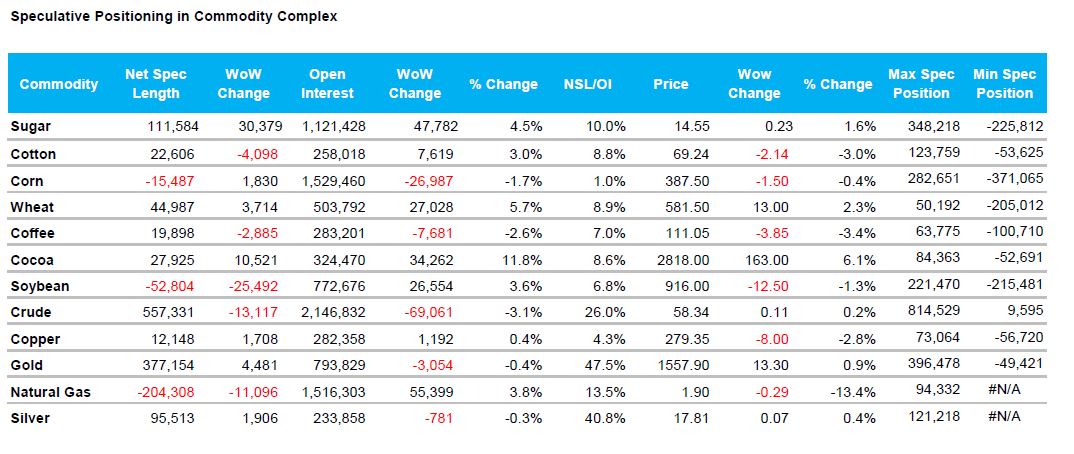

ICE No.11 Futures Speculative Positioning (values as of 21st January 2020)

ICE No.11 Futures Commerical Positioning (values as of 21st January 2020)

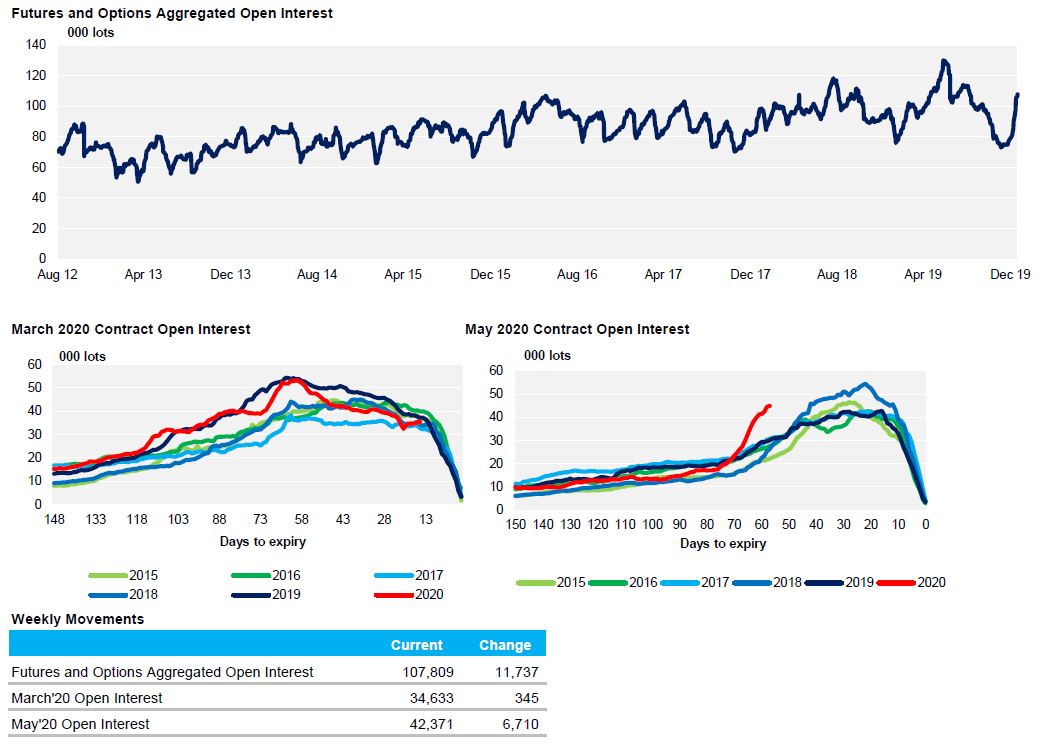

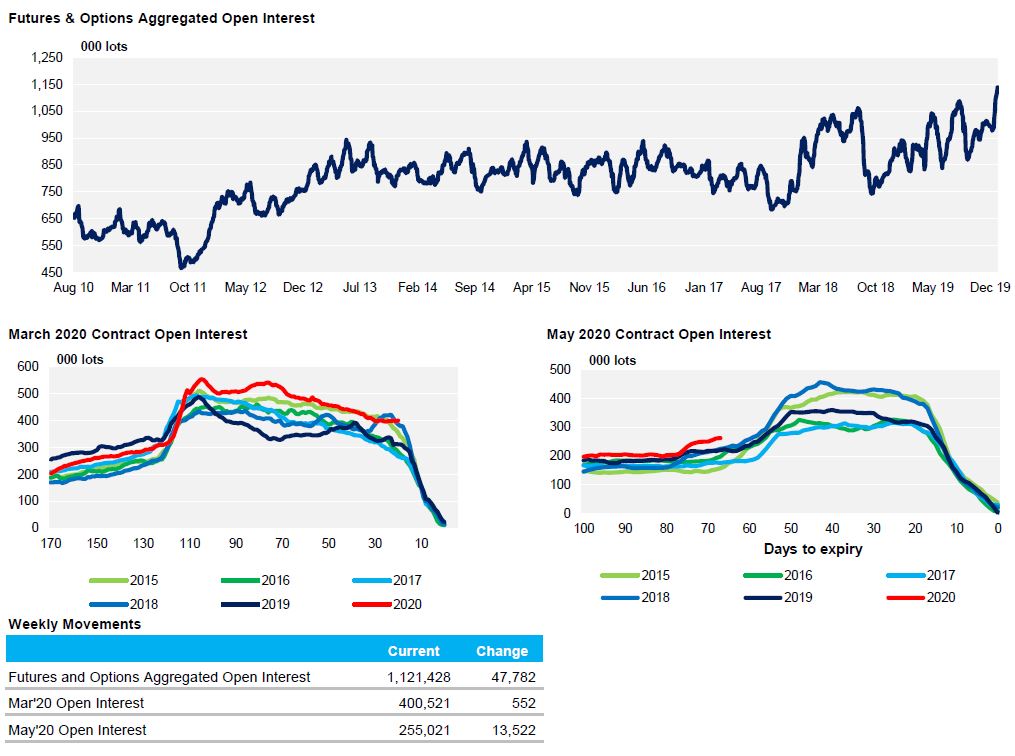

ICE No.11 Futures Open Interest (values as of 21st January 2020)

ICE Futures Europe (No.5) Speculative Positioning (values as of 21st January 2020)

ICE Futures Europe Open Interest (values as of 21st January 2020)