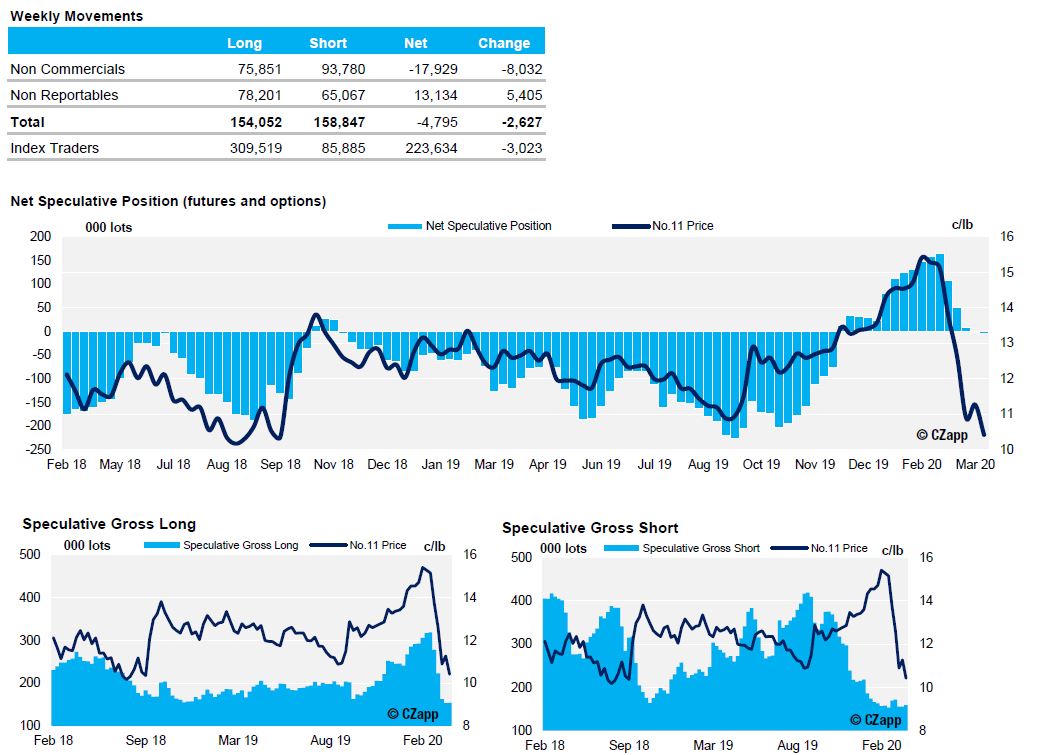

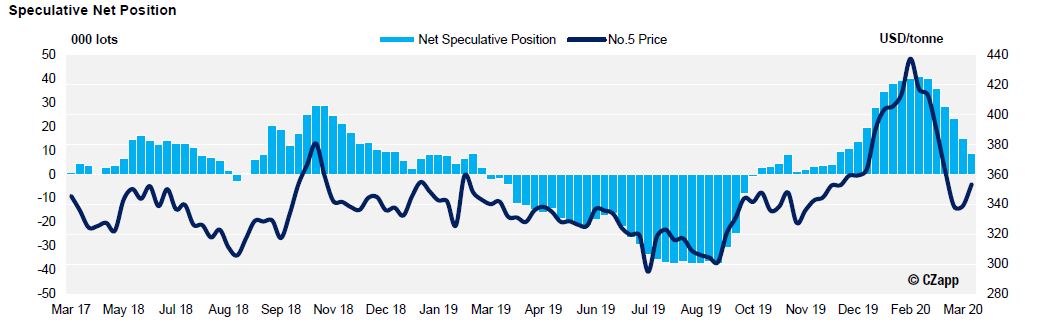

- Specs continue to lack direction in sugar – with the net spec position in whites continuing to decrease to match the already neutral position In raws.

- In the No. 11 it was a remarkably stable week, with the gross spec long and gross spec short positions only increasing by 806 and 3,433 lots, respectively.

- This inactivity was mirrored by the commercials, meaning that the total volume of buying and selling by specs and commercials has been the lowest of any week of 2020.

ICE No.11 Futures Speculative Positioning (values as of 31st March 2020)

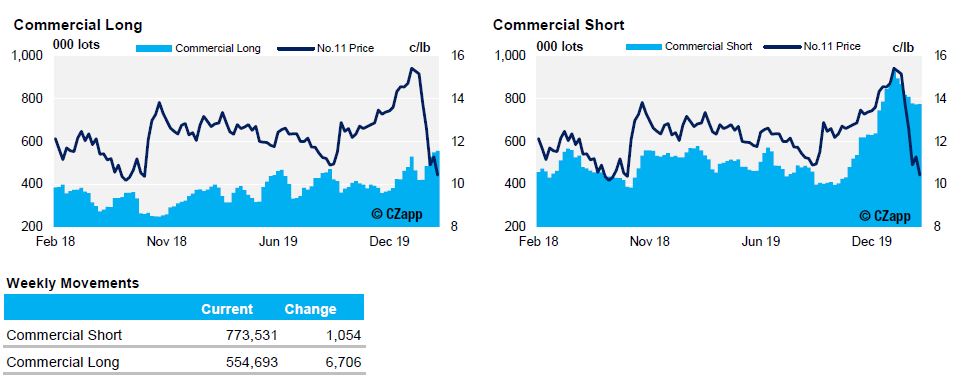

ICE No.11 Futures Commerical Positioning (values as of 31st March 2020)

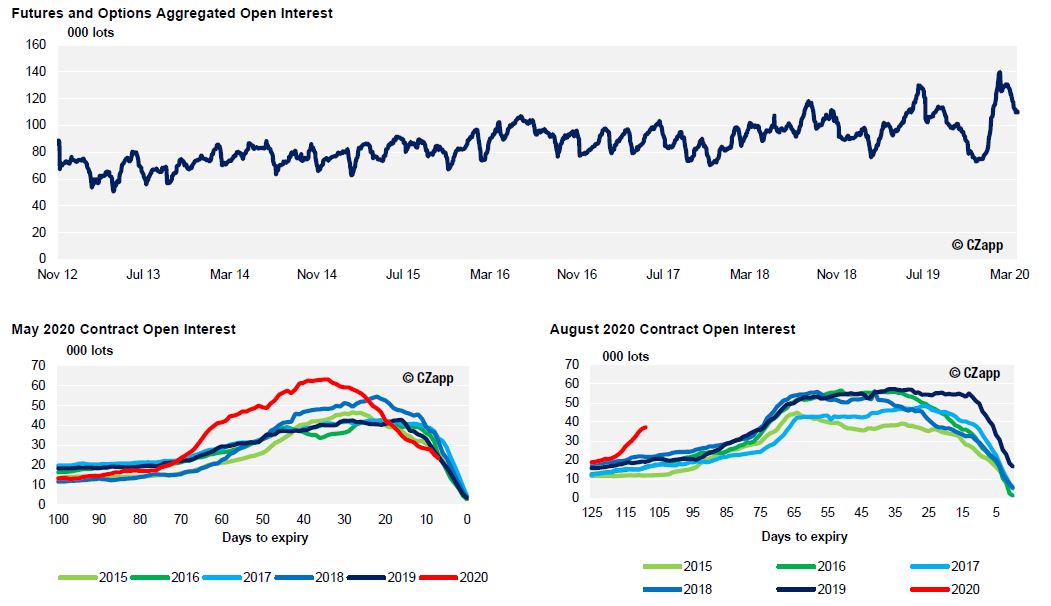

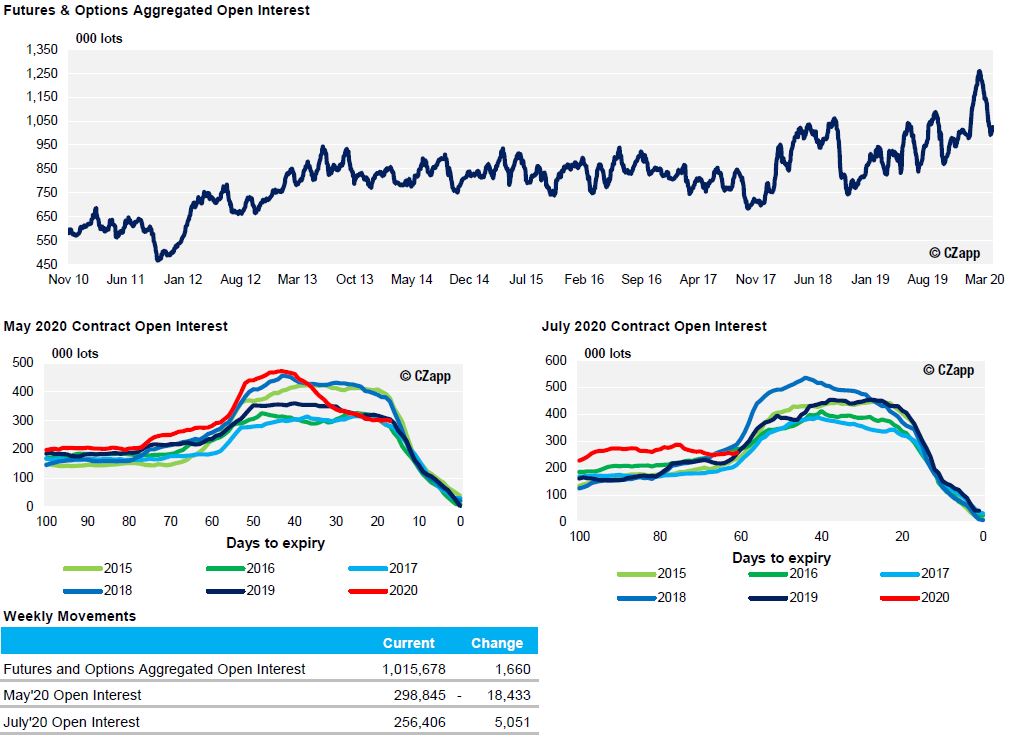

ICE No.11 Futures Open Interest (values as of 31st March 2020)

ICE Futures Europe (No.5) Speculative Positioning (values as of 31st March 2020)

ICE Futures Europe Open Interest (values as of 31st March 2020)