Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

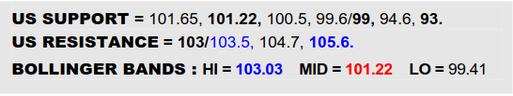

NEW YORK SUGAR #11 OCTOBER 2023

Sticking with the spot continuation chart of NY currently as, sure enough, the combo of lower Bollinger band and ’23 uptrend (23.42/23.36) came to the rescue initially to temper Fridays’ drop out of a small new H&S. Not a full scale repair in one session though as the market stayed hemmed in under the top so this is very much a work in progress. Would really need a rebound over the mid band (24.20) to dispel the new top and so give the nod of approval to the trend for intervening. Meantime, if that trend were to in fact succumb, beware serious downside reach to 20.50.

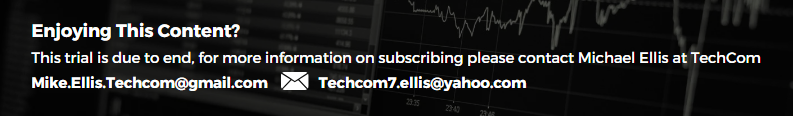

LONDON WHITES #5 OCTOBER 2023

Meantime, after chasing the White Premium to $170, London has lost its former drive and ducked back through its mid band Monday to loom ominously close to the preceding 677 ledge. If it tipped off that ledge while Raws derailed from the ’23 spot uptrend, there would be a unified snapping sound that would warn of longs taking cover in both markets, which could turn ugly and would bring the broader weekly defenses at 600 back into the frame. Must balance on 677 and pierce 705 to survive this wobble and breakout topside after all.

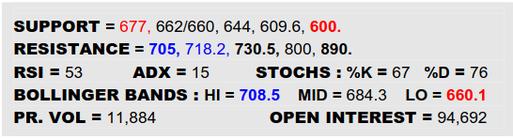

US DOLLAR INDEX

After a three-point rally out of the 99’s, the Dollar twitched as last week ended and seemed in a quieter consolidation frame of mind Monday. Nonetheless, this produced an inside day, which hints of already trying to rein in the nearby dip. So if the US currency can generally contain dips in the higher 101’s or even get straight back on the horse to start chasing the upper Bollinger band across 103.5, the prior hold clear of a 99 Fib retracement would keep Jly looking like a false breakdown and a positive Dollar would be ominous for commodities. Must otherwise gouge back through the mid band (101.22) to seriously undermine the recovery here and help get the B-Berg back on course.

NY SUGAR #11 OCT 23 / MCH 24 SWITCH

VALUE : -23

Though lacking much thump when it initially broke through the -15 support in Jly, the Oct/Mch switch remained confined beneath and arrival of the mid band and steep summer downtrend on the scene lately have prompted further whittling south Monday. This warns to keep one eye on the previous -26/-27 lows from last year as their collapse would then merit a delayed acknowledgment of Jly action being another bear flaggish phase that would measure on through to -45. Only pivoting back from -27 to defeat -15 would alternatively signal a new trough and a corrective aperture opening back up towards level-money.

NY SUGAR #11 OCT 23 INTRADAY SNAPSHOT

Though the oncoming daily continuation uptrend seemed to intercept early Monday, the intraday chart does still emphasize the three week H&S obstructing the resulting comeback at 24₵. Indeed, since there are further mini H&S patterns contained within that nearby top, it makes sense to want to see a crossing of the daily mid band (24.20) to make a truly decisive impact heading back upwards where the top(s) could be considered dispelled and a firmer footing restored. Alternatively, just tailing off in the face of 24₵ currently just reiterates the new topping out and insists the main daily uptrend (23.36) might yet be in jeopardy, its subsequent collapse then opening the way to an actual top projection down to 22.35.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.