This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- American beet campaign proceeds normally.

- Beet producers are out of the market for 2022/23.

- Uncertainty over whether Mexico can fill its US export quota this year.

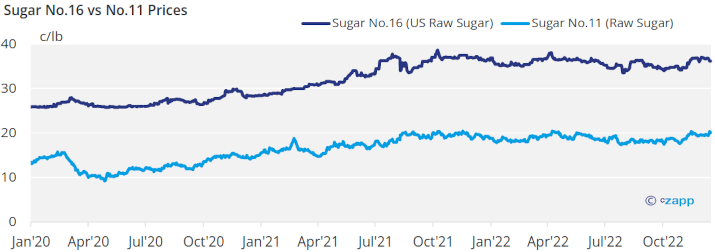

Tight supplies were the rule amid steady but firm prices in the US cash sugar market last week.

Beet processors were out of the market for the 2022-23 marketing year. Some cane refiners continued to offer sugar, but sources said their capacity for the rest of the marketing year also was highly booked and in some cases was sold out.

Beet sugar prices were nominally 59¢ to 60¢ a lb f.o.b. Midwest with supplies mainly available from distributors. One cane refiner offered spot sugar at 68¢ a lb f.o.b. through Dec. 31 and at 61¢ a lb f.o.b. for calendar 2023 at all locations. Sources indicated cane sugar supplies were becoming harder to find.

Beet facilities were running strong with no reports of major breakdowns or delays. Cold weather in northern areas was keeping outside piles sufficiently frozen. It appeared processors were on track with their beet slicing campaigns.

Deliveries of contracted sugar slowed, typical as some food manufacturers close for a time over the holidays. Some also attributed slower deliveries of bulk refined sugar to earlier double-booking in anticipation of a railroad workers strike (which was averted) and to year-end inventory management as buyers sought to keep supplies at a minimum for tax purposes. Some processors were allowing users to carry uncollected supplies into January-March.

Sales for 2023-24 were occurring, and some sellers were willing to put more sugar on the books, but most refiners and processors still were not quoting prices for the next marketing year. One seller said he thought most buyers asking for quotes but weren’t seriously looking to buy, hoping prices would decline in later months. Recent offers for 2023-24 were 51¢ a lb f.o.b. Midwest for beet sugar and 52.50¢ a lb f.o.b. Southeast for cane sugar.

The major concern for sugar users is the lack of supply on both the spot market and for the rest of 2022-23. Imports from Mexico are lacking as harvest there is just gearing up, and Mexico’s cane crop is expected to be smaller than last year due to adverse weather.

The US Department of Agriculture in its December World Agricultural Supply and Demand Estimates report lowered its forecast of 2022-23 US beet sugar production and raised cane sugar for a net decline of 47,000 tons in domestic sugar production. To maintain a 13.5% ending stocks-to-use ratio, the USDA added about 52,000 tons to Mexico’s import amount, resulting in a minor 6,000-ton increase in ending stocks. The lower beet and higher cane numbers were expected. There is some uncertainty as to whether Mexico will be able to fill its export quota this year as its exportable supply already is committed to the US market.

Contracting of corn sweeteners for 2023 mostly was completed from corn refiners’ perspectives, but a considerable amount of uncovered business remained with little hope of much spot supply in 2023.