This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

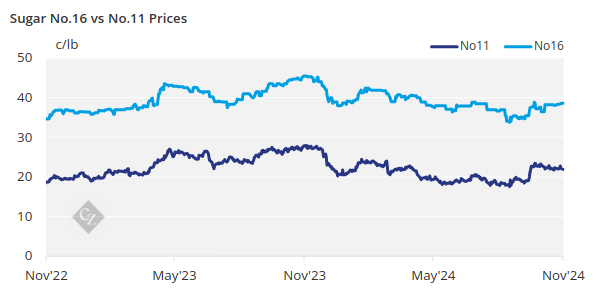

US Sugar prices remain stable amid strong harvests. Weather-related issues in Michigan have hampered harvest progress. Limited sales and buyer hesitancy reflect ample supplies.

The cash sugar market was quiet during the week ending November 1, with prices unchanged. Negotiations for 2025 corn sweetener contracts continued, though progress remained slow.

New refined sugar sales for 2025 also saw limited activity. Some sellers suggested that there might not be as much uncovered business as previously thought, particularly among small and mid-size buyers.

Buyers with unmet needs appeared in no rush to secure supply, likely due to limited upward pressure on sugar prices from ample supplies. Additionally, food manufacturers faced uncertainty regarding demand, preferring to wait and see if sales exceed forecasts before contracting more sugar.

Signals for 2025 prices were mixed. One beet processor indicated it might soon raise prices to limit sales, citing concerns about its 2024-25 supply.

Meanwhile, other processors leaned toward slightly lower prices due to strong sugar beet harvests with high sugar content, assuming favourable winter conditions to preserve beet piles into spring. Forward prices were unchanged for the week.

Progress for Sugar Beet and Cane Harvests

As of October 27, the USDA reported sugar beet harvest at 83% complete across the four largest producing states, up from 71% the prior week and above both last year’s 81% and the 2019-23 average of 78%. The harvest was nearing completion in the Red River Valley, with Minnesota at 98% and North Dakota at 95%.

A small portion of beets will remain unharvested in the region to avoid exceeding processing capacity given the large crop. Meanwhile, Michigan has faced challenging conditions, with the harvest only 38% complete—well below the 2019-23 average of 47%.

This slow progress is due to a late start caused by hot, dry weather, compounded by additional delays from ongoing high temperatures. The harvest was expected to resume over the past weekend, but both tonnage and sugar content have been declining in the state.

The sugar cane harvest progressed in Florida and Louisiana, with the latter at 38% complete as of October 27, ahead of 22% a year ago and the 2019-23 average of 26%.

Spot Prices Hold Firm

Spot sugar prices remained steady. Sugar deliveries contracted for 2024 also held firm. Bulk refined sugar deliveries were slow for some processors, though retail demand was strong due to the seasonal baking and holiday demand, while foodservice shipments were generally sluggish.

Preliminary discussions for 2025-26 and calendar 2026 sugar contracts have begun, though no specific prices have emerged yet.

Corn sweetener contracting for 2025 is underway and likely to extend into December. Corn refiners seek stable or firmer pricing on select products, while buyers may push for flat to lower rates compared with 2024.