This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- The sugar cane and beet harvest continues but drought is severely compromising the quality of the crops.

- Both bulk refined and beet sugar prices were unchanged.

- There could be a slight dip in prices as at least one processor indicated they would return to the market with “significant volume”.

The sugar industry’s focus was on the advancing sugar beet harvest this week with progress varying by state. Bulk refined sugar prices were unchanged.

Sugar beets were an aggregate 50% harvested as of Oct. 15 in the four largest-producing states, up from 21% a week earlier, down from 62% a year ago, and about even with the 2018-22 average for the date, the US Department of Agriculture said in its Crop Progress report. Beet harvest in the Red River Valley was ahead of the five-year average pace but lagged levels seen in 2022.

Growers in Idaho were trying to catch up after being sidelined by recent storms and the harvest in Michigan had fully resumed after delays due to warm temperatures. Processors indicated sugar content for this phase of harvested beets was light in some areas, above average in others, but mostly average overall.

The sugar cane harvest was off to a slow start in Louisiana at 12% completed as of Oct. 15, down from the prior year’s and five year-average pace of 18%. In the Oct. 17 US Drought Monitor, the USDA said 100% of the state’s sugar cane crop remained in exceptional drought, the Monitor’s highest level. The crop was rated 23% good, 45% fair, 23% poor and 9% very poor, just slightly better than a week ago but well below last year’s rating of 74% good-to-excellent.

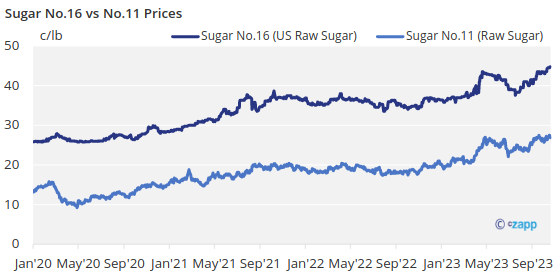

Bulk refined cane and beet sugar prices were unchanged. Adjustments may come in a few weeks as more is known about the cane and beet crops. Some processors continued to stay sidelined for 2024, but at least one processor said he was planning to re-enter the market in a couple weeks with significant volume. Additional anticipated beet sugar supplies on the market later this month may briefly affect prices, but it is yet to be determined whether or not the extra supply will be enough to offset losses in Louisiana. USDA forecasts of lower sugar supplies provided incentive to sellers to maintain current price levels.

Trade sources indicated demand was on track and deliveries, which had lagged throughout the summer and were showing mixed signals during the early part of autumn, were expected to resume more average levels by November.

The USDA in the Oct. 12 Crop Production report estimated 2023 US sugar beet production at 34.7 million tons (31.5 million tonnes), up nearly 7% from 2022. The average yield was forecast at 31.1 tons/acre (28.2 tonnes/acre), down slightly from September.

The USDA estimated 2023 US sugar cane production at 32.7 million tons (29.7 million tonnes), down about 6% from 2022 mainly due to the 1.9 million-ton (1.7 million tonne) year-over-year reduction in Louisiana.

The annual flat price contracting of corn sweeteners for 2024 remained slow. All refiners were in the market with initial offers said to be flat to slightly higher from 2023 contracted levels. Users, hoping for lower prices due to ample corn supplies and lower corn prices, were in no rush to buy.