344 words / 1.5 minute reading time

- Depending on how the coronavirus behaves in the upcoming weeks, sugar production could be affected.

- The good news is that the upcoming harvests are highly mechanised, so the mills should be able to find ways to continue operating.

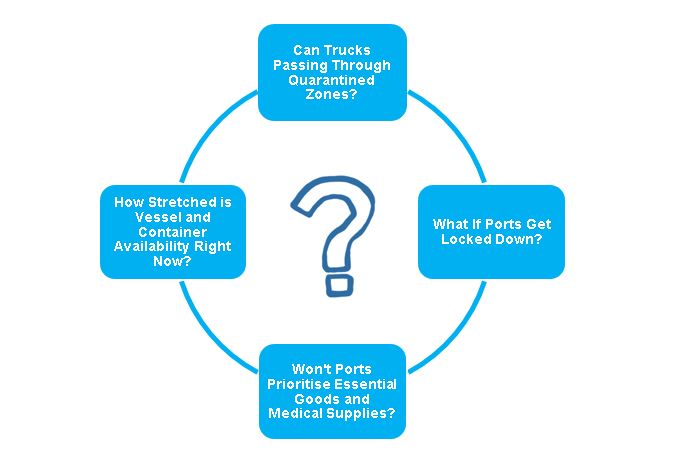

- We think there is more risk surrounding the movement of sugar and other food products.

Production Continues

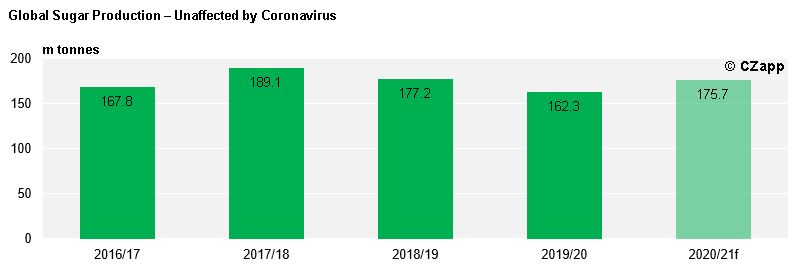

- Unlike with consumption, so far we have not made any changes to our sugar production estimates as a direct result of the coronavirus outbreak. This may change as the situation develops.

- Mills in Brazil have advised that they are taking preventive measures to ensure the safety of employees but there remains a risk of disruption.

- The start of the 2020/21 season has not been postponed but mills remain cautious as any surge in virus cases in the countryside could impact operations.

- Cane is a low-maintenance crop, meaning the upcoming Brazilian crop should continue to develop as usual.

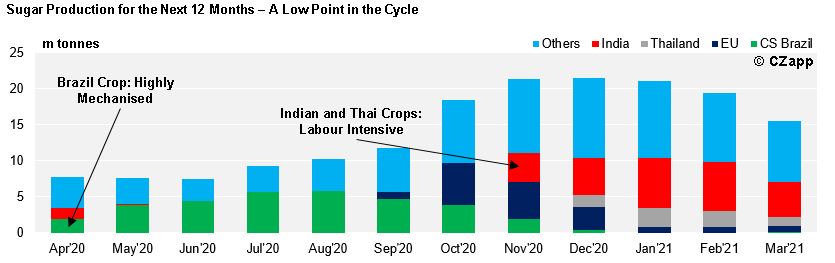

- Cane cutting can be labour intensive, especially in the Northern Hemisphere (India, Thailand), but these crops are just finishing and will not start up again for at least another six months.

- In CS Brazil and Australia, cane cutting is a highly mechanised process meaning mills should be able to minimise any disruption.

- The same applies to beet planting and harvesting which are also largely mechanised.

- This analysis follows for other soft commodities such as soybean or corn too.

- There is an indirect effect of the virus on sugar production:

- Low oil prices, partly associated with coronavirus, mean Brazilian mill ethanol returns have become negative.

- We will be increasing our 20/21 CS Brazil production number to account for an increased switch to sugar from ethanol.

Challenges Faced When Moving Sugar

- We have some concerns over the movement of cane and beet to mills and the sugar produced to ports…

- We will continue to monitor the situation and provide updates when we have more clarity.