Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

NY’s weekend stab at the nearby H&S top has unraveled again early this week as the Dollar bids to take a next step up and the B-Berg is ailing as Crude (Brent) dices with its $84.2 mid band. Ergo the uptrend is feeling the spotlight once more (23.52) here and still looks an essential prop to try to maintain the attempt to shrug off a summer correction and get back on the broader ‘20’s upside track. Alas, if it failed to endure, beware a heftier retreat to a prior weekly shelf at 20.50. Must otherwise grip again and pop 24.42 to form a small inverse H&S to counteract the upright one.

LONDON WHITES #5 OCTOBER 2023

The low 700’s were again proving slippery Tuesday and a slightly wider range than Monday became an outside day for London. Since outsiders normally herald a change of direction, this one is a concern as it implies a stumble in the face of the 705 resistance and suggests the key 677 ledge could be facing further scrutiny pretty soon. Needless to say, loss of 677 and NY’s uptrend would spell trouble. Alternatively the market must weather this latest twitch and still blow the hatch at 705 to build a much more fortifying base.

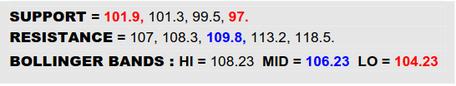

BLOOMBERG COMMODITY INDEX

Shifting sands in Crude as Brent couldn’t secure a glimpse over its $87.5 base escape hatch and has slipped back to threaten its mid band ($84.2), undercutting the B-Berg to tip it over last weeks’ 104.2 trough. This is exposing passage back to the neckline of the ’23 inverse H&S (101.9) and the threat of actually challenging it would intensify if Brent were to meanwhile break its mid band while the Dollar made a more persuasive impression into the 103’s by popping 103.5. At that point, there would be a tangible negative tilt in the macro but, for the moment, if able to curb the greenback at 103.5 and therein skirt clear of the neckline here, so this might yet be a retrievable (corrective) state of affairs.

NY SUGAR #11 IN THAI BAHT

Baht priced Raws have jabbed the prior Q2 double top above 8.50 a couple of times now in Q3 but without making any substantive impact and slid back again Tuesday. Generally this wheelspin in the shadow of a preceding top is unnerving so the uptrend (8.20) is on alert as a possible tripwire towards 7.25. Must reach the 8.60’s to dispel the top.

NY SUGAR #11 IN INDONESIAN RUPIAH

Admittedly making a tad more impression than Baht Raws but still that same overall feel in Rupiah NY of grinding against former Q2 top clutter. Must duly mind a nearby 3570 ledge as a potential trigger for a small new top shoehorned in under the previous one, which could trip off an uptrend attack (3475) where more enduring harm could occur.

NY SUGAR #11 IN CHINESE YUAN

Similar to Rupiah Raws in Yuan NY where some pokes at the Q2 top (1.74+) haven’t shown any staying power and that sense of wheelspin has resumed again this week. The same old uptrend lookout then (1.68). Survive aboard it and perhaps the top can be chiseled away. Break the trend though and there is plenty of space down to 1.465.

NY SUGAR #11 IN INDIAN RUPEE

Rupee Raws managed a quick prod into the Q2 top over 20.15 in Jly but haven’t been able to repeat since and Q3 action duly retains a toppy vibe, watching 19.50 as the immediate tripwire to involve the uptrend (19.10) where more enduring damage could be inflicted. Must punch beyond 20.50 to genuinely dispel the toppier landscape.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.