Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

Thrust, parry, stab; NY continues to battle it out in the narrowing niche between the still determined uptrend (23.60) and the recent 24.42 apex that now looks like an exit from a small inverse H&S riding aboard that trend. Since Wednesday was also a marginal outside day back upwards, the market deserves its chance to bust free of 24.42 and so better hone the trend catch and maybe build the past three months into a bigger inverse H&S. No macro help to be found though so if kept hemmed in by 24.42 still, stay wary of quite a cavern looming beneath the trend.

LONDON WHITES #5 OCTOBER 2023

The cheerleaders were chanting and doing cartwheels in London as it also pulled off an outside day to close in the 700’s and really apply the heat to the 705 resistance. If it could make that vault while NY at least popped 24.42, a tense scrummage over recent weeks would seem to open up and the summer action could be hailed as a nigh on $100 inverse H&S base, therein projecting up to the 800 vicinity. Opportunity knocks then but the growling Dollar warns to always know where the parachute pack and emergency exit are (677).

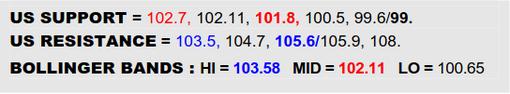

US DOLLAR INDEX

The Dollar has pushed ahead out of an early Aug flag but isn’t initially fizzing with verve as a result. Would accordingly be looking for a proving escape across 103.5 to put more weight behind this latest step up and thereby take aim at the next longer term divide at 105.6, defeat of that in sync with the B-Berg being pressed back beneath its inverse H&S neckline (101.8) making for a major tilt of the macro balance detrimental to commodities. Only if the wheels kept spinning in the shadow of 103.5 and the Dollar veered back under 102.7 would that former flag claim be cast into doubt, therein shifting focus back onto key 102.1 mid band support and a pivotal 101.8 ledge not far behind.

#5 / #11 WHITE PREMIUM OCT 2023

VALUE : $168

After a searing Jly rally from the 120’s to $170, the White Premium briefly exhaled in early Aug but didn’t surrender much ground before it making renewed overtures towards resuming its advance. Thus, while mindful the big flag-like shape of Q2 proposed a goal of $174, it would also be noted that meanwhile any stretch over $170 would form a new small Aug flag which, with a minimum flagpole height of $30 (and max $49), would tend to supersede with targets between $190 and $209 technically. Only if remaining in check at $170 and diverted back under $160 would the new flag possibility fade and a return to the $145 base rim be implied.

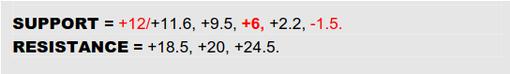

LONDON WHITES #5 OCT / DEC 2023 SWITCH

VALUE : +$18

Oct/Dec Whites have gathered up a couple of innocuous dips in the first half of Aug to keep the impressive Q3 recovery on the front foot and now starting to inch out to new highs over a prior April peak of +$17.1. If this getaway attempt can soon be secured and Oct flat price adjacently broke clear of 705, would duly be inclined to read the entire mid-year phase of sweeping undulations as a broad if scrappy inverse H&S that would project on up to about +$24.5. Only another flat price flinch at 705 and a backlash through the immediate +$12 trough here as it imminently hosts the mid band (+$11.6) would otherwise undercut the rally and err towards more of a dual top landscape instead.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.