Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

A one-off deference to the spot continuation chart for NY Friday as it provisionally broke down from a nearby H&S pattern. No question this top highlights the fading of the post Jly-contract resurgence but since the Dollar has suffered a bit of a hiccup, the spot price series insists on watching the overall ’23 uptrend that is all but arm in arm with the lower Bollinger band (23.33/23.25). In other words, the cradle is rocking but do just give that trend a chance to intercept. If it cannot, the downturn would be a serious one and the next main weekly shelf at 20.50 would call.

LONDON WHITES #5 OCTOBER 2023

London seemed to finally tire of carrying the torch Friday and after another refusal in the low 700’s this week, ducked back towards the mid band (682.6). If that mid band and its rear guard at 677 both surrendered to this flinch, the Whites bubble would be prone to a sudden deflation during which it could peel away rapidly into the lower 600’s again unless the indicated stateside uptrend was meanwhile proving to be titanium clad. Must balance securely on 677 to otherwise signal less of a twitch and chances to yet unlock 705.

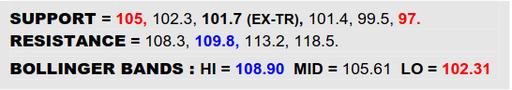

BLOOMBERG COMMODITY INDEX

Initially the B-Berg has grabbed on at the initial 105 outcrop but the situation still feels tenuous after the Dollars’ recent strong comeback from the 99’s. Looking to Crude Oil especially as a key pillar in propping up that 105 level to therein preserve the prior casting of the ’23 undulations as a rather ragged inverse H&S, ultimately seeking escape beyond 109.8 if commodities are to truly round the corner onto a sustained upside path. However, if the Dollar makes further gains and 105 gave way here, then beware a pocket of open air back to the ex-downtrend (101.7) before maybe getting one final chance to gather in and prevent a more enduring return to the downside.

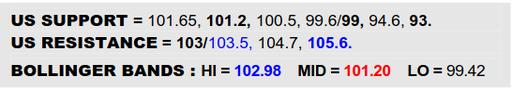

US DOLLAR INDEX

Some cooling of the Dollar Friday after a vigorous rebound from the mid-Jly dunk into the 99’s. The prior trough almost met a long term Fib retracement of the ‘21/’22 advance (99) and the manner in which values recovered across several hurdles has implied retrieving a false breakdown. In lately nearing the upper Bollinger band (103) however, perhaps a breather is required and the key prop during this will be the mid band (101.2). Hold safely clear of it and the previous false breakdown notion would be endorsed, keeping the upside path beckoning. A sharp twist back under the mid band though would instead argue the case of just an abrupt corrective bounce cresting to return focus to the 99’s.

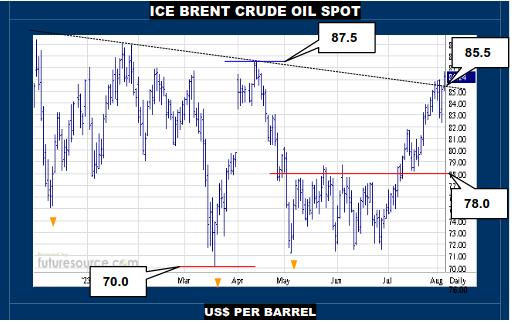

ICE BRENT CRUDE OIL SPOT

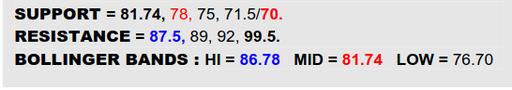

And here stands the Kings’ champion on whom rides the fate of the B-Bergs’ struggle with the evil warlord otherwise known as the Dollar. Even setting aside that huge responsibility, these are key moments for Brent (and WTI) as it seeks conquest of the 85.5 to 87.5 span to try to round out an 8-month inverse H&S base that would set the stage for a recovery into the 100’s. However, with the Dollar on a similar quest for a major upturn, the success of one is all but predicated on the failure of the other so the swords are drawn for a pivotal battle. If unable to pierce 87.5 to complete the base here, watch the oncoming mid band (81.74) as its demise would bode ominously for the B-Berg.

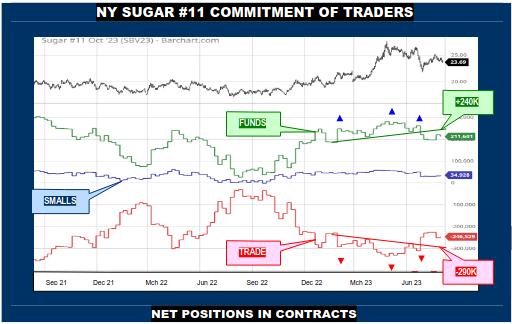

NY SUGAR #11 COMMITMENT OF TRADERS

AUG 1, 2023 OPEN INTEREST : 919,658

The COT shows some restoration of positions following the Jly contract washout but the net bounces of the Funds and Trade have both come up well shy of the prior +234K Funds and -278K Trade early Jun troughs that mark the underside of COT H&S patterns and sit just shy of the +240K and -290K actual necklines to those patterns. That leaves significant spec longs aboard but apparently not an avid appetite to restore to the same degree as before and thus implies dangerous potential selling fuel if the spot uptrend (23.25) fails to intercept the small price H&S just formed.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.