Insight Focus

- Global sugar production is expected to be the second highest on record in 2023/24.

- Yet growing consumption will mean a production deficit for the second season in a row.

- Production in Thailand, a top 5 producer, is expected to be the worst in a decade in 2023/24.

2023/24 at a Glance…

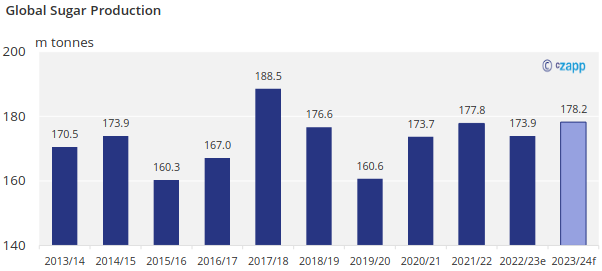

Global Sugar Production

We think the world will produce 178.2m tonnes of sugar in 2023/24. This will be the second largest output on record after the enormous 2017/18 season.

Our forecast has decreased by 0.1m tonnes since the July report, owing to a slight reduction in our Egypt estimate.

Whilst monsoon rains in India have so far been just about adequate and we haven’t reduced our forecast there is still downside risk present for the remainder of the growing season.

In CS Brazil crushing continues to run smoothly, this and a particularly high sugar mix achieved means there is possibly room for our forecast to be pushed higher in a future statshot.

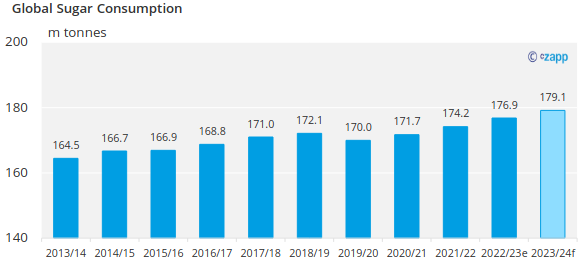

Global Sugar Consumption

The world will consume a record amount of sugar in 2023/24, we think to just over 179m tonnes. This is mostly driven by population growth which amounts to roughly 2m tonnes of extra sugar required per season.

We haven’t made any changes to our 2023/24 consumption forecast since the July update.

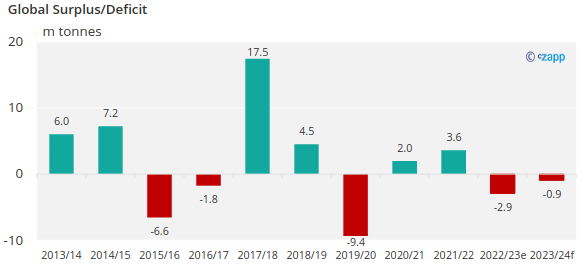

Small Production Deficit

We don’t think the world will produce enough sugar to meet consumption again in 2023/24. At the moment we expect a shortfall of around 0.9m tonnes.

Northern hemisphere producers such as India and Thailand had poorer-than-expected crops in 2022/23, and are expected to have similarly sized crops in 2023/24 too (worse in the case of Thailand).

The deficit is expected to be smaller than in 2022/23 mostly down to a particularly large crop in CS Brazil.

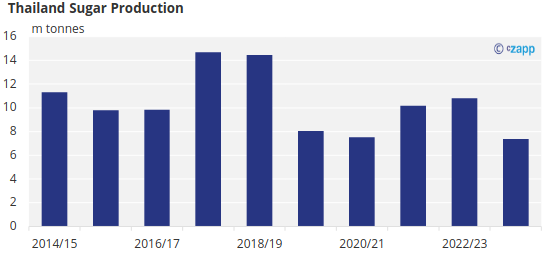

Thailand Production Update

The 2023/24 Thai season is set to start toward the end of November, start of December. Sugar production is expected to be a fairly large downturn from the 2022/23 season, from 10.8m tonnes to just 7.4m tonnes.

This would make 2023/24 the worst season for sugar production in Thailand in a decade.

This is driven by a combination of hot, dry, weather hindering cane development, and a large move by smaller farmers to planting cassava instead of sugar cane.

Both crops are liked by farmers due to their good tolerance to drought, however this season returns for farmers for growing cassava heavily outweigh the returns for sugar cane.

There are also still ongoing problems attracting labour, a problem which emerged during the previous season.

Other Sugar Producers at a Glance…

If you have any questions, please get in touch with us at Will@czapp.com.