Insight Focus

- The world will produce more sugar than it needs in 2022/23.

- Consumption is set to increase by more than population growth as countries move past Covid-19.

- Therefore, the surplus is smaller than in 2021/22.

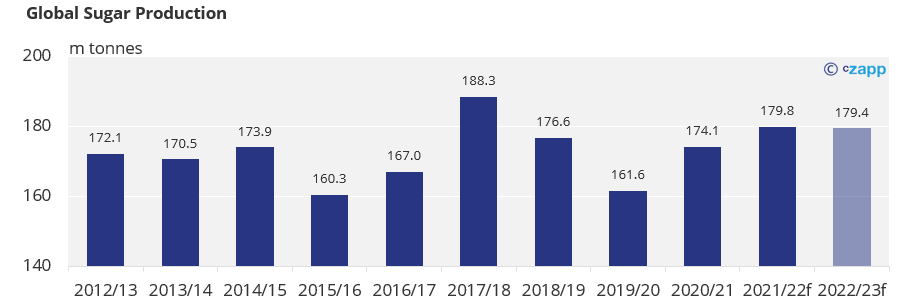

Global Production

The world will produce 179.4m tonnes of sugar in 2022/23, the third highest on record. This is over 3m higher than our forecast in the June Statshot and makes global production very similar to 2021/22.

We have increased our forecast for India following more cane planting on marginal land and good water availability, this is driving the higher global production figure.

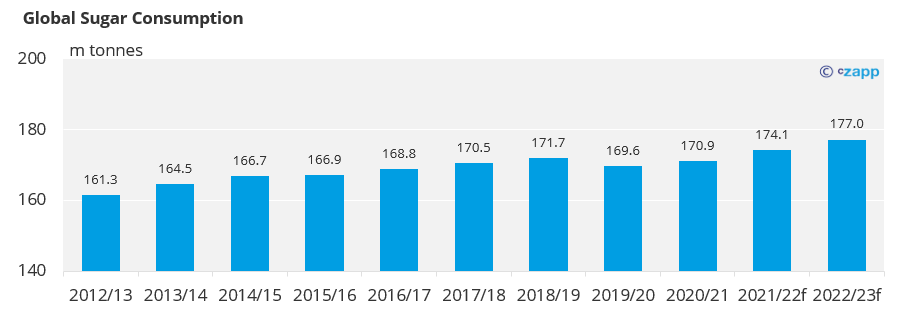

Global Consumption

In 2022/23 we will consume around 3m tonnes more sugar year-on-year than in 2021/22. This is in part due to more economies returning to pre-Covid consumption and through an increase in population.

This forecast is mostly unchanged since the last update.

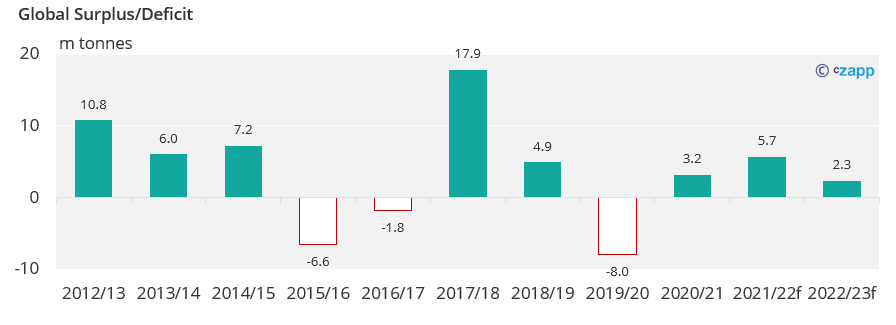

Small Production Surplus

Following the India crop forecast upgrade, we now expect a small surplus of 2.3m to form in 2022/23.

Growth in consumption means this is around half the size of the surplus observed in 2021/22, despite similar production.

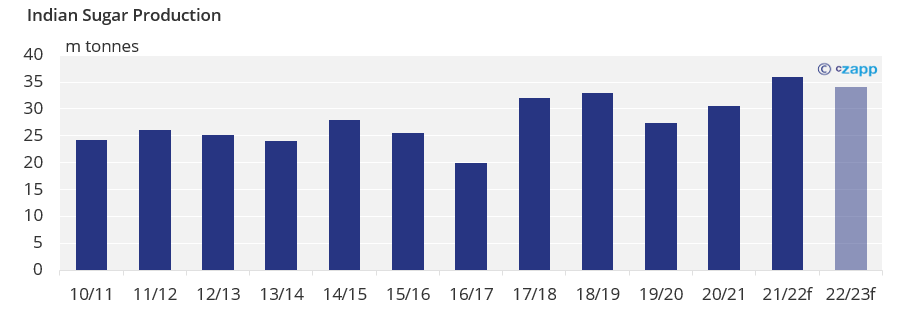

India Production Update

We think that India will produce 34m tonnes of sugar in 2022/23, this is around 2m tonnes less than the record breaking 2021/22 crop.

In order to meet their E20 ethanol blend mandate by 2025 an increase in the diversion of sugar cane for ethanol production is expected, this accounts for much of this year-on-year decrease in sucrose production.

The monsoon is currently progressing normally, and reservoirs for irrigation are at a good level. These are two key factors for cane development in India.

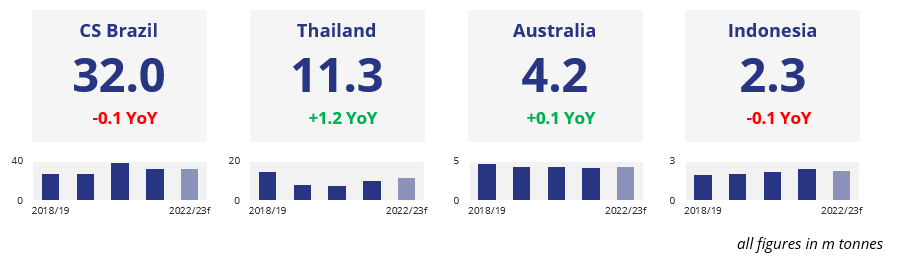

Other Producers at a Glance…

If you have any questions, please get in touch with us at Will@czapp.com

Other Insights That May be of Interest…

Why Demurrage is Bolstering Inflation

World Sugar Market 5 Year Forecast

Explainers That May be of Interest…