Insight Focus

- Sugar consumption will exceed production in 2022/23.

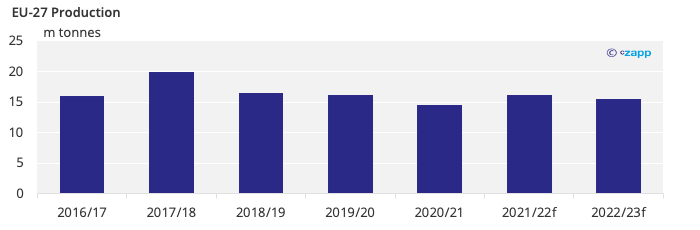

- Sugar production remains in line with previous years.

- Consumption continues to increase in line with population growth.

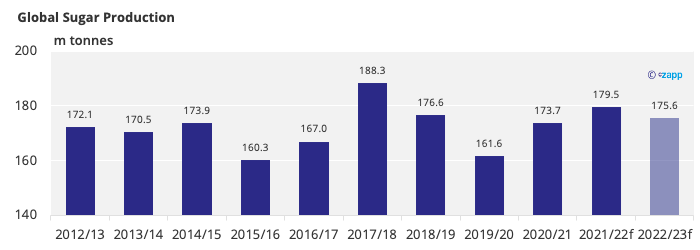

Global Production in 2022/23

In 2022/23 the world will produce over 175.6m tonnes of sugar. This is around 4m tonnes less than in 2021/22 but still the fourth highest on record. One reason for the decrease is that we don’t expect India to match its record-breaking crop next year.

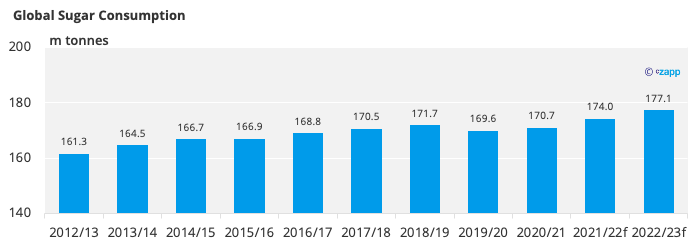

Global Sugar Consumption in 2022/23

In 2022/23 we will consume around 3m tonnes more sugar year-on-year than in 2021/22. This is in part due to more economies returning to pre-Covid consumption and through an increase in population.

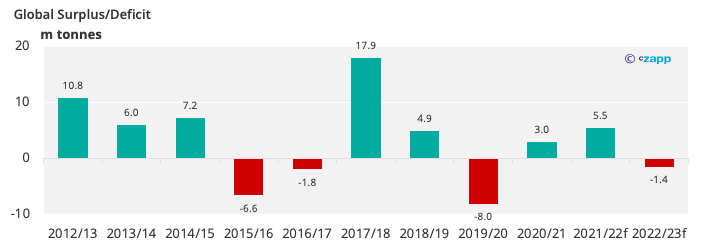

Small Production Deficit in 2022/23

In 2022/23 there will be a small production deficit of 1.4m tonnes. This is after noting a small surplus in the previous update.

An 800k downgrade to the crop in CS Brazil following low rainfall affecting yields, a very poor crop in Cuba, and upgrades to consumption in a few countries are behind this deficit forming.

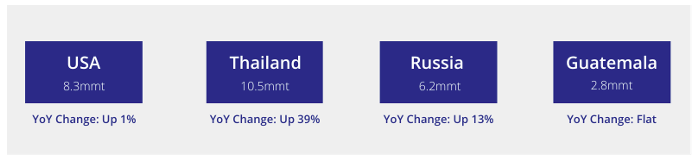

Regional Production

Regional Updates

We forecast sugar production in the EU-27 to fall around 700k tonnes on the year to 15.5m tonnes in 2022/23.

This downturn comes from increased agricultural input costs like fertilizer, an increase in processing costs through higher gas prices, and increased competition from other crops with stronger returns such as wheat.

As a result, the region will continue it’s decline from a major supplier of refined sugar to the world market.

If you have any questions, please get in touch with us at Will@czapp.com

Other Insights That May Be of Interest…

Global Milk Production Overview

Fertilizer Industry at a Crossroads

Explainers That May Be of Interest…