Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

NY took Thursdays’ inside day in its stride and trumped it with an outside day higher again to finish the week still pecking at the ex-uptrend (23.76). Nevertheless, the main challenge still lies just overhead in the niche between the 24.01 double top rim and the mid band drooping towards it (24.31). If the market could deliver a swashbuckling thrust across there to essentially disperse the top formation, it would be back in business after the Jly delivery and the 26.43 high could be targeted. Alas, if foiled in the low 24’s, watch 23.10 as the tripwire back down to the 21’s.

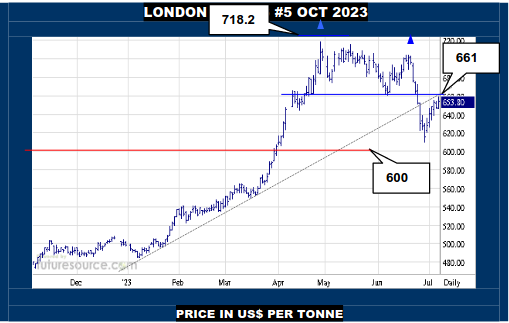

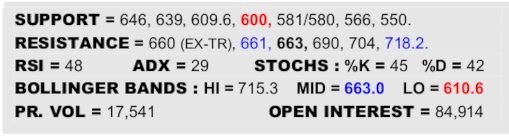

LONDON WHITES #5 OCTOBER 2023

London similarly sidestepped a preceding inside day but still appeared to tip its cap to the ex-uptrend (660) and lurking 661 double top frontier Friday. If it could summon up a decisive lunge through those features and the closely located mid band (663) early next week while Raws made a substantive impact on the 24’s, there would again be that suggestion of all’s well in the aftermath of Jly NY retiring. It is looking a close run thing meantime though so keep an eye on 646 meanwhile, any twist back through starting to tilt the balance back down again.

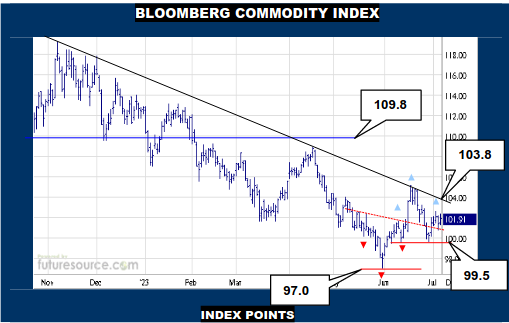

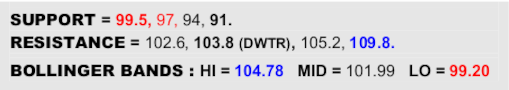

BLOOMBERG COMMODITY INDEX

Consistent with some rather non-committal flailing action in the Dollar, the B-Berg has also been nipping and tucking in the past fortnight after a mid-Jun stab at 105 simply served to confirm the presence of a broader downtrend. That trend has pressed on in the meantime and still presents a pivotal escape hatch not too far overhead (103.8) if the Dollar seriously fumbles its own rather lukewarm rebellion, then able to set sights on 109.8 as the next hurdle to a major overall shift in the macro balance. Must stay mindful of the 99.5 support meanwhile though if the Dollar somehow found a way out over 103.4 as a break there would form a new upright H&S aimed down through 97 to the 94 area.

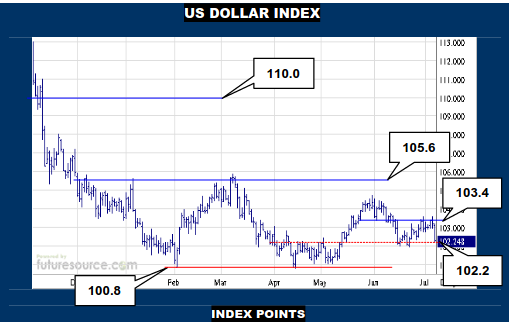

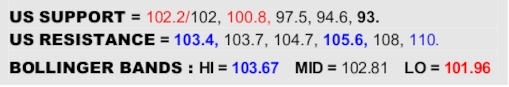

US DOLLAR INDEX

Renewed Fed rate hike expectations had nudged the Dollar up to prod the small top above 103.4 lately but it failed to make any lasting impression and fell back through its mid band Friday, leaving the recent swell looking ostensibly corrective. Admittedly, a burst free of the mid 103’s could liven things up later on and inject new verve to reach towards the broader base exit that remains 105.6. Meantime though, the past fortnight is looking toppier in its nature so keep a watch over the 102 figure now, its demise nullifying the recent murmurs of new life and warning of a potentially decisive third test of 100.8 where a next weekly step lower to the 93’s could be triggered.

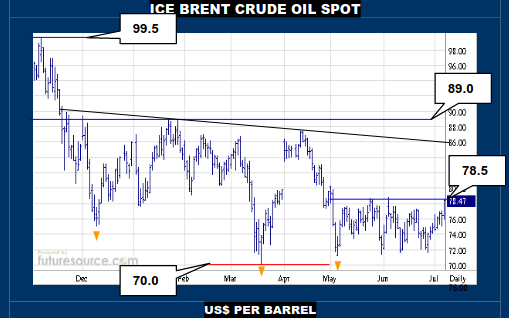

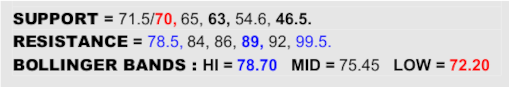

ICE BRENT CRUDE OIL SPOT

Well, we’ve done this before, in fact this is about the fourth time of Brent scrambling back up the hill away from 70 to the 78’s in the past two months. Generally there can be no doubt that ’23 has taken the sting out of ‘22’s big decline from near $140 but the market must cleanly dispatch the 78.5 resistance to give the latest two-month stage of the rebellion much sharper definition, rigging a new base platform that could instill more zest to rally into the 86-89 terrain. Cautious of the repeated rebukes meanwhile and an actual break down through the 70 figure would instead threaten a further step lower to a long term Fib retracement at 63 before potentially renewing the bid to turn.

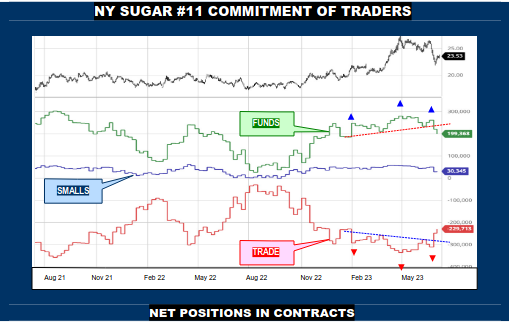

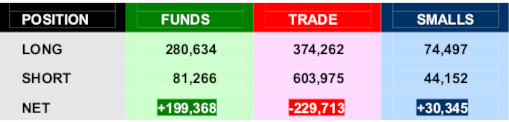

NY SUGAR #11 COMMITMENT OF TRADERS

JULY 3, 2023 OPEN INTEREST : 863,843

Worth a glance at the COT as the July contract liquidation shake out brought steep retreats in all net holdings and this has molded quite clear H&S patterns for the Funds and the Trade (if inverse for the latter) from the ’23 period. To change the course of these apparent topping outs would demand Oct at least hack its way back across that 24.01 to 24.30’s span and grip beyond so as to prompt a subsequent bolster back over +234K for the Funds and -278K for the Trade. If foiled at 24₵, expect resumed price decay and further net position trimming here.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.