- Being overweight appears to increase the risk of having severe COVID symptoms.

- Governments around the world may therefore increase the size and scope of their sugar taxes.

- Ensuring food is affordable during the pandemic is more important than sugar taxation, but priorities may soon change.

Weight Emerges as a COVID Risk Factor

- When COVID first emerged in early 2020, a major symptom was a cough/breathlessness, sometimes leading to pneumonia or acute respiratory distress syndrome.

- Doctors assumed COVID was a respiratory disease and the treatment of critically ill patients focussed on increasing blood oxygen levels, often through ventilation.

- It now seems that COVID can also lead to increased risk of strokes, organ damage (notably heart, liver and kidneys as well as lungs), excessive clotting, and septic shock.

- People with underlying health conditions seem to have worse COVID outcomes than those without.

- One such underlying condition is being overweight.

- Public Health England has carried out a review of existing COVID studies and concluded that being overweight increases the risk of serious illness and death.

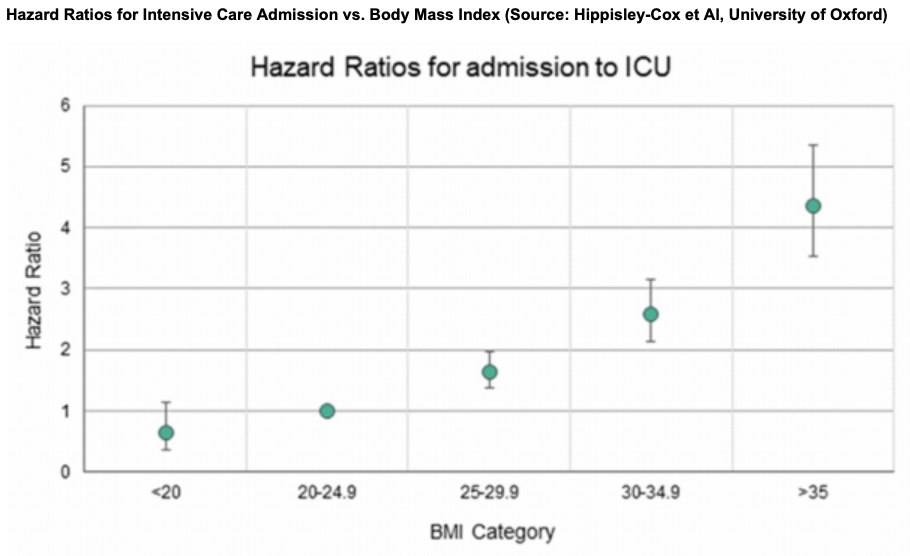

- UK government statistics show that nearly 8% of critically ill patients in intensive care units with the virus are morbidly obese, compared with 2.9% of the general population.

- The World Obesity Federation are also concerned that obese patients are harder to treat effectively:

- They are more difficult to intubate;

- It can be more challenging to obtain diagnostic imaging as there are weight limits on imaging machines;

- Patients are more difficult to position and transport for nursing staff.

- We think governments around the world will seek new ways to improve the health of their populations.

- This means the battle against sugar and fat in food and drinks will intensify.

The Squeeze on Sugar Continues

- We are already seeing the first tentative steps being taken in the United Kingdom.

- David Cameron’s government had commissioned a study on how to reduce obesity in 2016.

- But he abruptly left office after the UK voted to leave the European Union and Theresa May’s government did not carry out many of the recommendations made by the study.

- Boris Johnson’s government has revisited the study in July 2020, perhaps influenced by Johnson’s own treatment in intensive care for COVID.

- New measures are now being proposed:

- A ban on TV and online adverts for food high in fat, sugar, and salt before 9pm.

- Limits on in-store promotions for unhealthy foods.

- Calorie labelling on restaurant menus and alcoholic drinks.

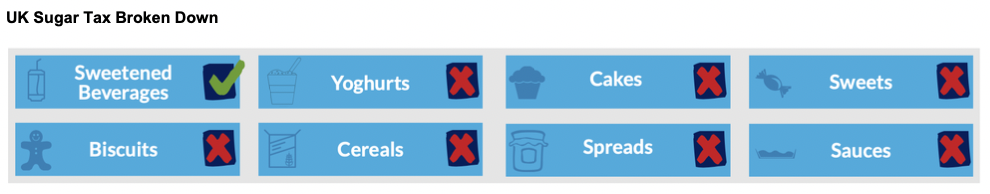

- At this stage, the UK government is not making changes to its existing sugar tax, which is applied only to sugar-sweetened beverages.

- But we fear this might change in the coming months.

Sugar Taxes: More Countries?

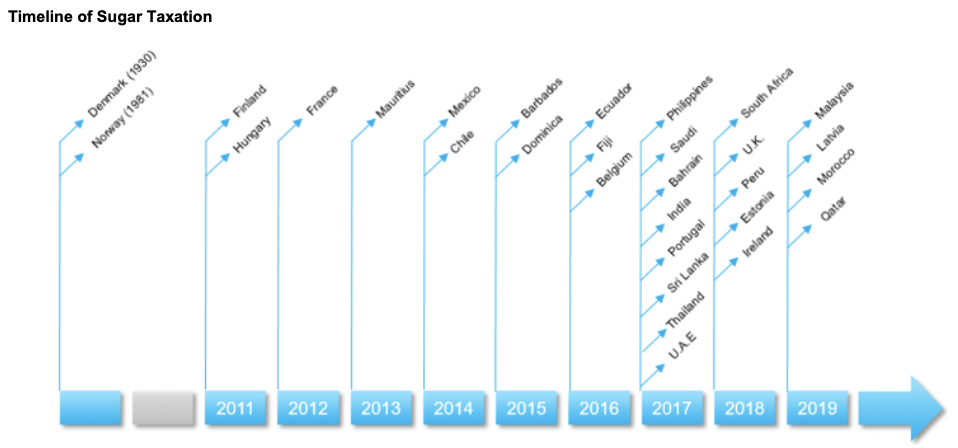

- Even before coronavirus arrived, sugar taxes had been increasing in popularity.

- Since 2014, at least 24 countries have introduced some form of sugar tax.

- The aim had been to improve population health, and with COVID this becomes even more urgent.

- We therefore expect more countries to apply taxes on sugary foods in the coming months.

Sugar Taxes: Increased Scope?

- We also expect countries that have sugar taxes in place to widen their scope.

- For example, in the UK, the tax only applies to sugar-sweetened beverages but may be expanded to cover baked goods and confectionery.

- This may pose problems for major food and beverage companies.

- Sugar doesn’t just provide sweetness; it also has other uses which make it a valuable ingredient.

- For example, it acts as a preservative, provides bulk and an attractive texture, and caramelises when heated.

- It’s not going to be easy for companies to reformulate their food products to avoid sugar taxes in the way they could for sugar-sweetened beverages.

Sugar Taxes: Increased Size?

- We also think the taxes may be increased in size.

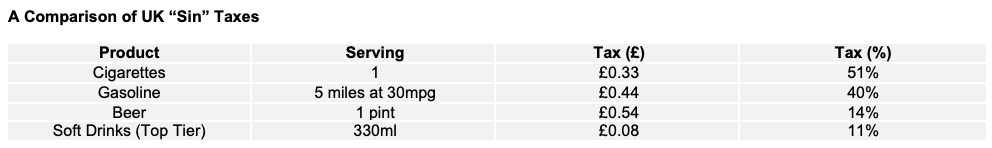

- Currently, the UK sugar tax is much lower than other comparative sin taxes.

- But many governments around the world have spent heavily to keep economies afloat during COVID-induced lockdowns in 2020.

- At its peak, around 25% of the British workforce was furloughed and so receiving 80% of their normal wage from the government rather than their employers.

- These governments have been able to take advantage of near-zero interest rates to fund their expenditure, but increased taxation also seems likely in the future.

Sugar Taxes: When?

- We don’t expect these changes to happen quickly.

- Governments are extremely sensitive to the cost of food given the economic damage inflicted by the response to COVID, including widespread job losses.

- We therefore don’t expect major changes to sugar taxation in the short-term.

- There will be plenty of time for the debate around sugar taxes to intensify as we move into 2021 and beyond.