Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

Seems the Producer and Choreographer have decided that for maximum tension the battle between the uptrend (23.45) and H&S / mid band (24.00/24.18) needs to persist, the latter more the feature Thursday in keeping the lid on. NY must punch free of that mid band to shake off the top shape and so better carve a turn away from the recent trend interception and get back on the horse. Alas, meantime the B-Berg was having a moment and the Dollar was still proving resilient so don’t yet be too sure that the trendline isn’t going to have to pull on the gloves once more.

LONDON WHITES #5 OCTOBER 2023

Agincourt? Little Bighorn? Waterloo? The O.K. corral?!*? A tense standoff in London too as it huddles in the 677-705 range that seems to have become a pivotal battlefield to decide how things play out here. If it could make the escape across 705 on the heels of NY cleanly vaulting its mid band, there would be a sense of pulling out of a crisis and a scrappy new inverse H&S almost $100 in depth would then point on up towards 800. Alas, keenly aware how differently it could go with a tumble over 677,not much left thereafter to stem the tide until back at 600.

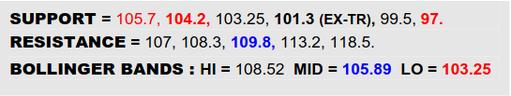

BLOOMBERG COMMODITY INDEX

It was looking briefly hopeful Wednesday as the B-Berg gapped higher and the Dollar posted a rather drab inside day but, no, Brent couldn’t secure a poke over $87.5 Thursday and the Dollar left mid 101’s support unscathed, keeping the roulette wheel spinning. The 108.3 to 109.8 country must ultimately still be crossed here on the commodity index to hone a prior downtrend escape and the inverse H&S base impression of ’23. To do that still seems to require the Dollar swatted back through the 101’s however. If instead the Dollar headed on into the 103’s, beware a delve back to the ex-downtrend (101.3) by the B-Berg, by which point the whole basing candidacy of ’23 would be ailing.

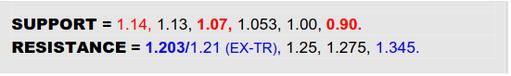

NY SUGAR #11 IN BRAZILIAN REAL

Notwithstanding the hopeful uptrend interception by ₵/lb., in Real pricing NY is still doing a tap dance between the 1.14 Q2 support rung and the 1.203 rim of a somewhat scrappy top that is made all the more focal by a downtrend / ex-trend intersection also going on there. Must bust clear of this merge to really hone recent catches that have been made and make a better case for swerving up out of a Fib retracement (1.07), thus calling an end to a corrective phase and resumption of the overall ‘20’s climb to mull scope beyond 1.345. By no means a done deal as yet however and keenly monitoring that 1.14 ledge meanwhile as the tripwire back down to 1.07, where a broader H&S could resolve instead.

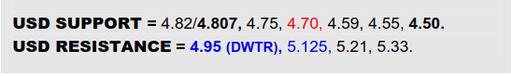

BRAZILIAN REAL / US DOLLAR SPOT

VALUE : 4.859

“No cigar.” While the Dollar shed the interim 4-month downtrend early in Aug, it was nonetheless blunted by the 4.95 resistance this week just as the broader ’23 downtrend arrives there. Can’t instantly call this a total fumble as the smaller ex-trend and mid band propose some nearby underpinning (4.82/4.807) so, if able to mop up there, do still keep a light in the window at 4.95 as a more important escape hatch on ahead to revisit the large pre-Q2 top border now at 5.125. On the other hand, if the greenback were swatted back out of the 4.80’s entirely, the latest 4.95 downtrend intercept would look a more emphatic one and the road on beneath 4.70 to the 4.50’s would beckon anew.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.