Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

Somebody was waving a ‘Trend is your friend’ sign this week as the continuation uptrend and its lower Bollinger band rear guard have managed to fend off a small H&S breakdown, NY punching back into the top and over the mid band Friday. This is making suggestion of a three-month correction being curtailed where ultimately the toppy shapes could fade away and May-Aug be cast in an inverse H&S type of light. Still wary of the Dollar raining on the parade though if it invades the 103’s so, in that event, do be prepared to veer back to the trendline (23.48) yet again.

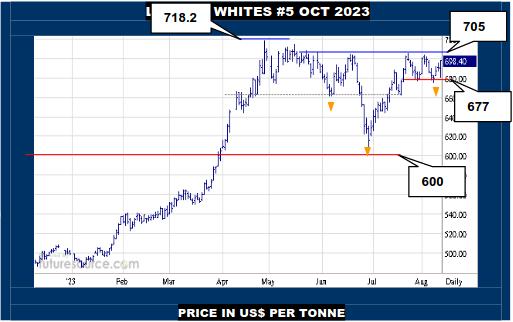

LONDON WHITES #5 OCTOBER 2023

Despite a brief dunk towards the 677 prop initially, London came around later on and chewed its way back up towards the 705 hurdle Friday. It has been a tense time balancing in the upper 600’s lately but if Raws can cement the H&S dispersal and coax Whites out across 705, the past three months would merge into an inverse H&S here that, while not textbook, would still propose ultimate success and the potential for a further substantial leg higher. Just that degree of currency caution demands keeping one eye on 677 nonetheless.

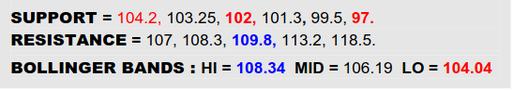

BLOOMBERG COMMODITY INDEX

A broader chart span just serves to emphasize the 109.8 divide even more as the key hurdle the B-Berg needs to overcome to really harness the turn already initiated in summer and secure ’23 as an inverse H&S. Success would then open the door to first the 118’s and in due course the mid 120’s. The problem of course is that now the Dollar has come back to life in the past month to hamper Crude in particular at a key time when it is on the verge of securing a big inverse H&S of its own. The resulting struggle is far from resolved but, due to several ex-downtrends here, would opt to watch the base neckline (102) as the critical defence that must endure to keep the commodity index propped up.

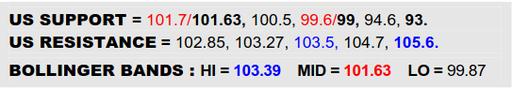

US DOLLAR INDEX

Briefly in Jly new Dollar lows seemed to offer the B-Berg the keys to the city but things changed rapidly as it narrowly missed a long term Fib retracement (99) and hustled back up, inferring a false breakdown instead. The Bollinger corridor is reacting by veering higher but, having shown poise in the 101’s lately, the greenback now needs to take its next step into the 103’s to start chasing the upper band and reaffirm its turn north with an eye to 105.6 as a next target in the recovery. If that occurs, it will spell trouble for the B-Berg. However, if denied a 103’s transition, mind the 101.7 ledge about to host the mid band as a vital pivot to undercut currency and offer the B-Berg those keys a second time.

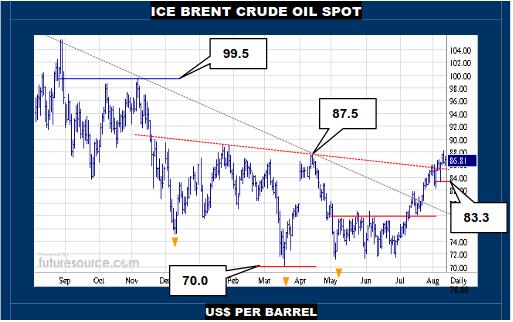

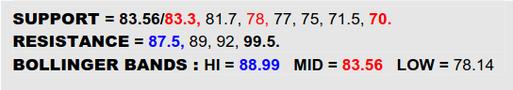

ICE BRENT CRUDE OIL SPOT

Brent has been applying the brakes since late ’22 and has edged through a 85.5 neckline to make preliminary suggestion of an impressive inverse H&S. Alas, with the livelier Dollar in recent weeks, it could really do with cleanly dispatching the preceding 87.5 April apex to reassure the Q3 rally and polarize the base, in so doing presenting a path to the doorstep of triple digits and giving the B-Berg a major tonic in its quest to reach and cross 109.8. Still quite cautious meanwhile though and watching the most recent 83.3 trough that is now hosting the mid band as a nearby stumbling block, a swerve back below threatening to trigger a delve to the May-Jun base rim at 78.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.